Complete the Statement of financial position work sheet

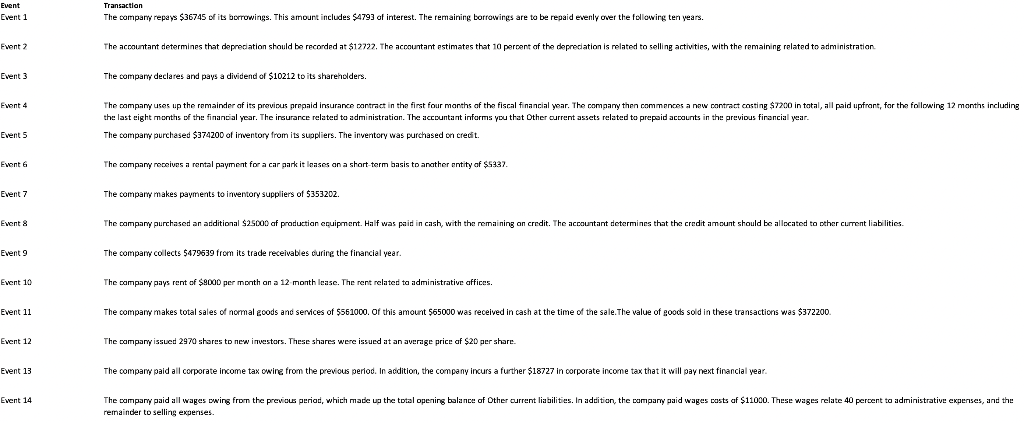

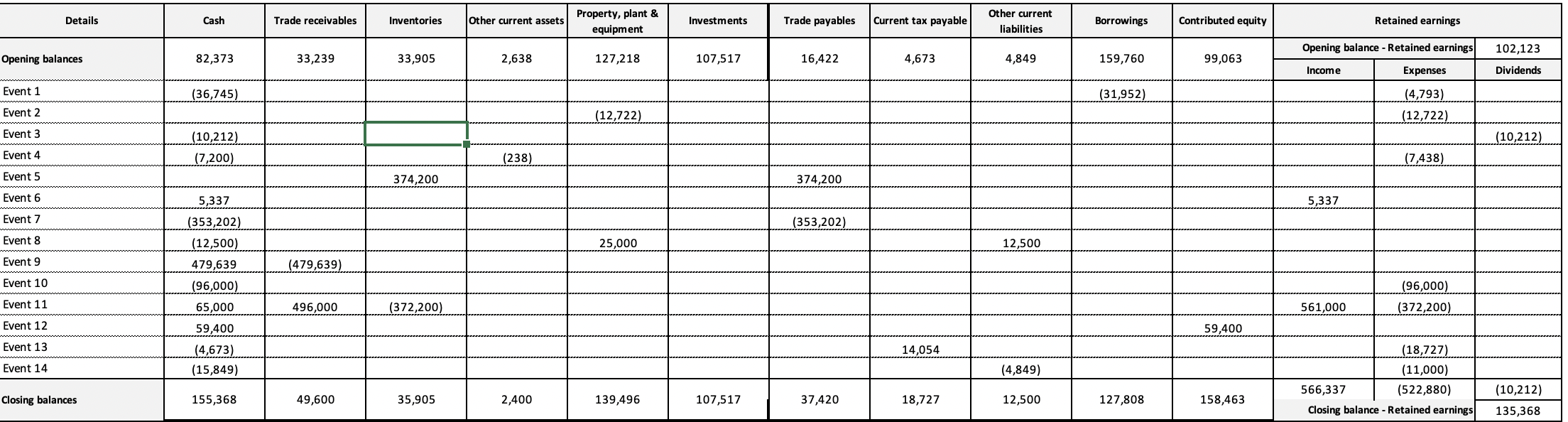

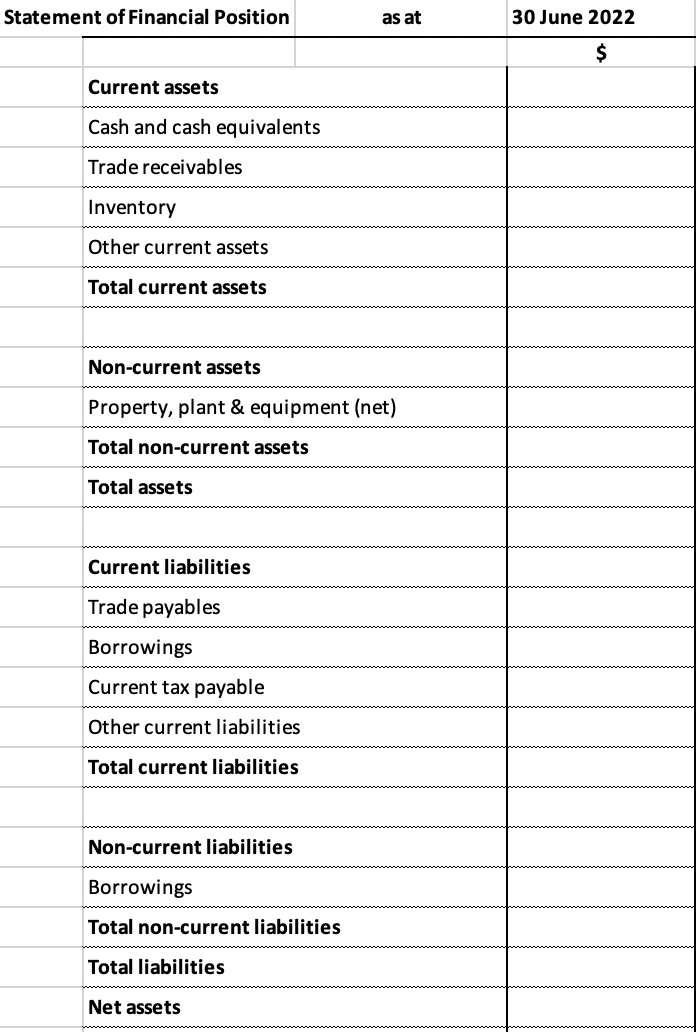

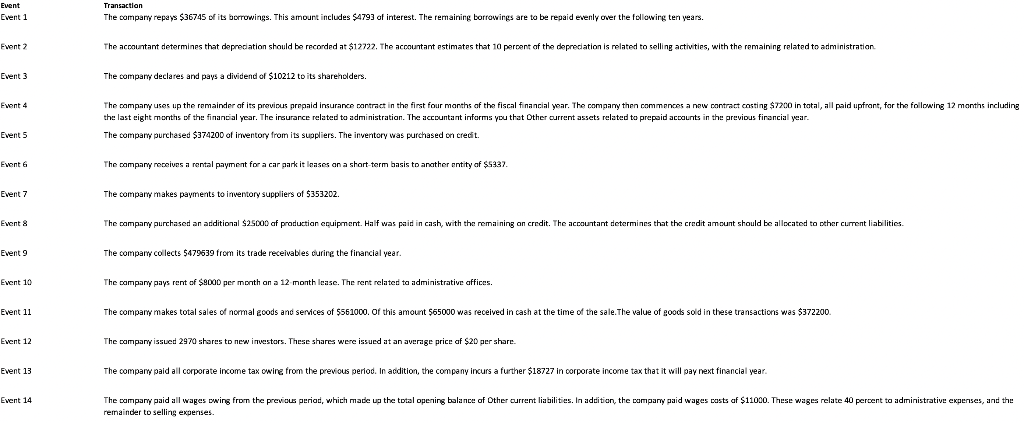

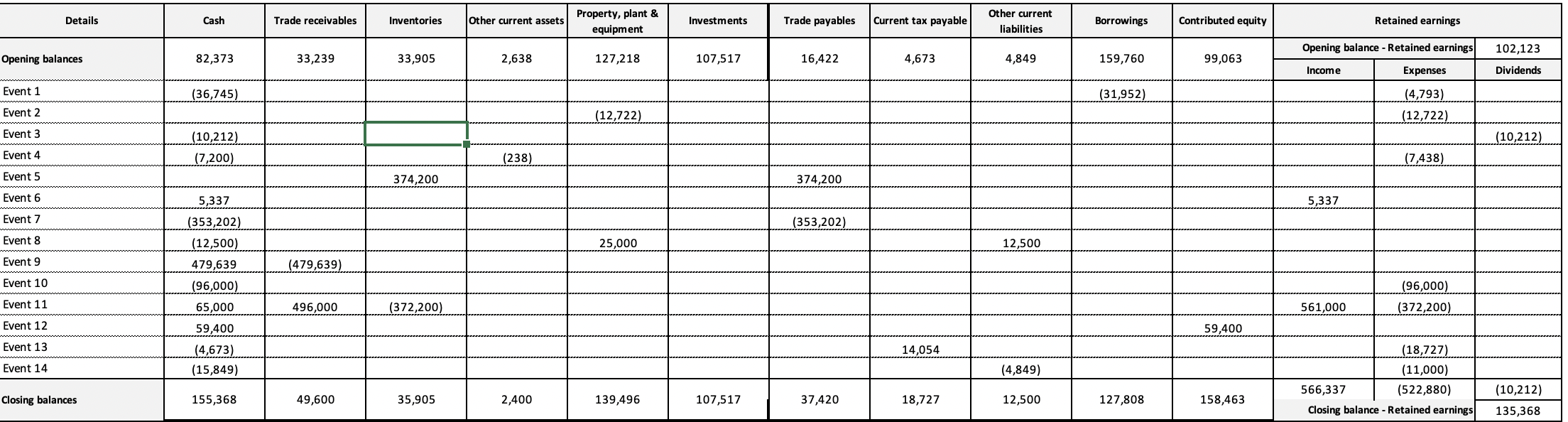

Event Event 1 Transaction The company repays $36745 of its borrowings. This amount includes $4793 of interest. The remaining borrowings are to be repaid evenly over the following ten years. Fvent 2 The accountant determines that depreciation should be recorded at $12722. The accountant estimates that 10 percent of the depreciation is related to selling activities, with the remaining related to administration Event 3 The company declares and pays a dividend of $10212 to its shareholders. Fvent 4 The company uses up the remainder of its previous prepaid insurance contract in the first four manths of the fiscal financial year. The company then commences a new contract casting $7200 in total, all paid upfront, for the following 12 months including the last eight months of the financial year. The insurance related to administration. The accountant informs you that other current assets related to prepaid accounts in the previous financial year. The company purchased $374200 of inventory from its suppliers. The inventory was purchased on credit. Events Event 6 The company receives a rental payment for a car park it leases on a short-term basis to another entity of $5337. Event 7 The company makes payments to inventory suppliers of $353202, Event & The company purchased an additional $25000 af production cquipment. Half was paid in cash, with the remaining an credit. The accountant determines that the credit amount should be allocated to other current liabilities. Event 9 The company collects $479639 from its trade receivables during the financial year. Event 10 The company pays rent of $9000 per month on a 12 month case. The rent related to administrative affices. Event 11 The company makes total sales of normal goods and services of $561000. of this amount $65000 was received in cash at the time of the sale. The value of goods sold in these transactions was $372200 Event 12 The company issued 2970 shares to new investors. These shares were issued at an average price of $20 per share. Event 13 The company paid all corporate income tax owing from the previous period. In addition, the company incurs a further $18727 in corporate income tax that it will pay next financial year. Event 14 The company paid all wages owing from the previous period, which made up the total opening balance of other current liabilities. In addition, the company paid wages costs of $11000. These wages relate 40 percent to administrative expenses, and the remainder to selling expenses Details Cash Trade receivables Inventories Other current assets Property, plant & equipment Investments Trade payables Current tax payable Other current liabilities Borrowings Contributed equity Retained earnings Opening balance - Retained earnings 102,123 Opening balances 82,373 33,239 33,905 2,638 127,218 107,517 16,422 4,673 4,849 159,760 99,063 Income Expenses Dividends Event 1 (36,745) (31,952) (4,793) (12,722) Event 2 (12,722) Event 3 (10,212) (10,212) (7,200) Event 4 (238) (7,438) Event 5 374,200 374,200 Event 6 5,337 5,337 Event 7 (353,202) Event 8 (353,202) (12,500) 479,639 25,000 12,500 Event 9 (479,639) Event 10 (96,000) (372,200) Event 11 496,000 (372,200) 561,000 Event 12 (96,000) 65,000 59,400 (4,673) (15,849) 59,400 Event 13 14,054 Event 14 (4,849) (18,727) (11,000) 566,337 (522,880) Closing balance - Retained earnings (10,212) Closing balances 155,368 49,600 35,905 2,400 139,496 107,517 37,420 18,727 12,500 127,808 158,463 135,368 Statement of Financial Position as at 30 June 2022 $ Current assets Cash and cash equivalents Trade receivables Inventory Other current assets Total current assets Non-current assets Property, plant & equipment (net) Total non-current assets Total assets Current liabilities Trade payables Borrowings Current tax payable Other current liabilities Total current liabilities Non-current liabilities Borrowings Total non-current liabilities Total liabilities Net assets