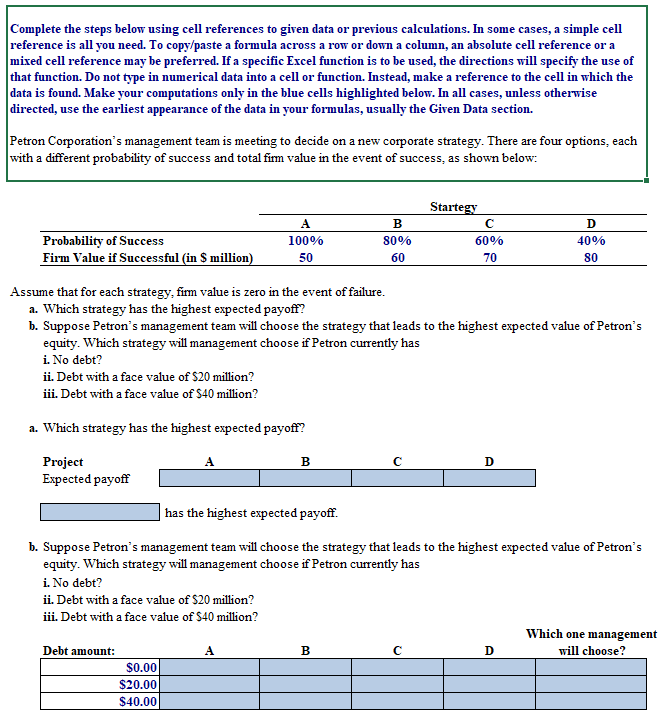

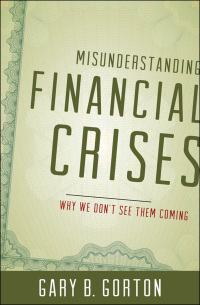

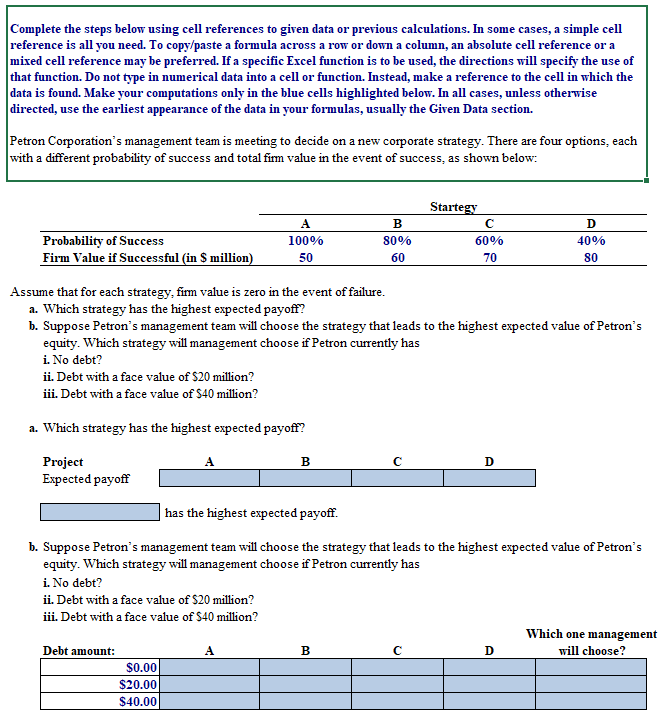

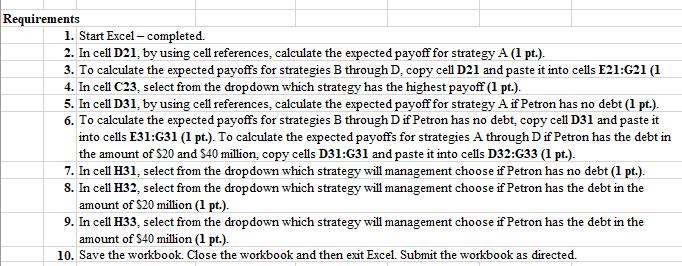

Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Petron Corporation's management team is meeting to decide on a new corporate strategy. There are four options, each with a different probability of success and total firm value in the event of success, as shown below: Probability of Success Firm Value if Successful (in $ million) A 100% 50 B 80% 60 Startegy 60% 70 D 40% 80 Assume that for each strategy, firm value is zero in the event of failure. a. Which strategy has the highest expected payoff? b. Suppose Petron's management team will choose the strategy that leads to the highest expected value of Petron's equity. Which strategy will management choose if Petron currently has i. No debt? ii. Debt with a face value of $20 million? iii. Debt with a face value of 540 million? a. Which strategy has the highest expected payoff? A B D Project Expected payoff has the highest expected payoff. b. Suppose Petron's management team will choose the strategy that leads to the highest expected value of Petron's equity. Which strategy will management choose if Petron currently has i. No debt? ii. Debt with a face value of $20 million? iii. Debt with a face value of $40 million? Which one management Debt amount: B D will choose? $0.00 $20.00 $40.00 A Requirements 1. Start Excel - completed. 2. In cell D21, by using cell references, calculate the expected payoff for strategy A (1 pt.). 3. To calculate the expected payoffs for strategies B through D. copy cell D21 and paste it into cells E21:G21 (1 4. In cell C23, select from the dropdown which strategy has the highest payoff (1 pt.). 5. In cell D31, by using cell references, calculate the expected payoff for strategy A if Petron has no debt (1 pt.). 6. To calculate the expected payoffs for strategies B through Dif Petron has no debt copy cell D31 and paste it into cells E31:G31 (1 pt.). To calculate the expected payoffs for strategies A through Dif Petron has the debt in the amount of $20 and $40 million copy cells D31:G31 and paste it into cells D32:G33 (1 pt.). 7. In cell H31, select from the dropdown which strategy will management choose if Petron has no debt (1 pt.). 8. In cell H32, select from the dropdown which strategy will management choose if Petron has the debt in the amount of $20 million (1 pt.). 9. In cell H33, select from the dropdown which strategy will management choose if Petron has the debt in the amount of $40 million (1 pt.). 10. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed