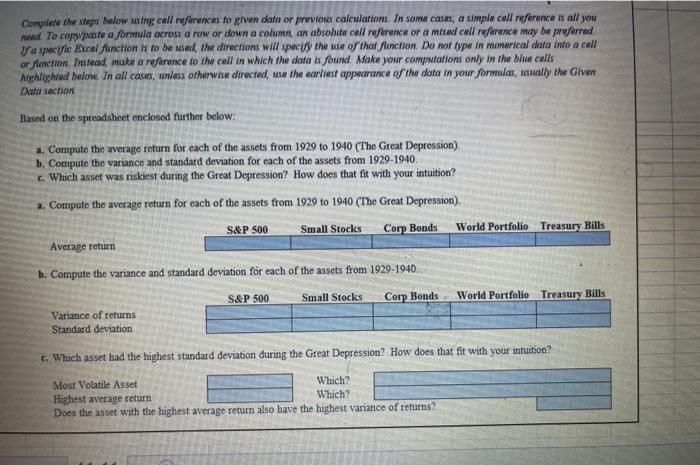

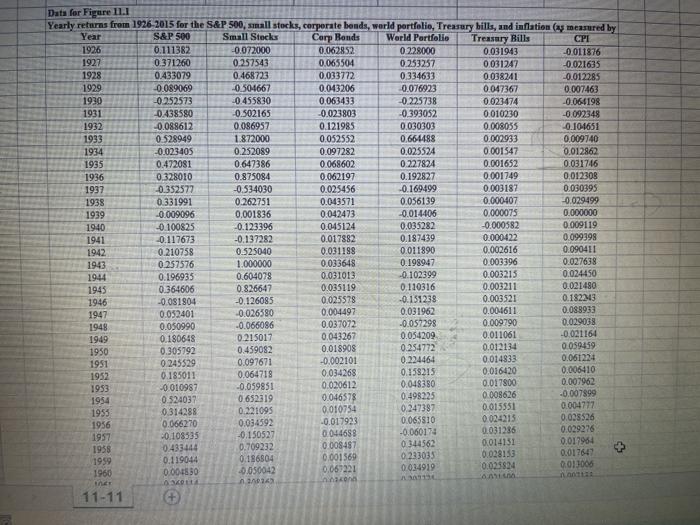

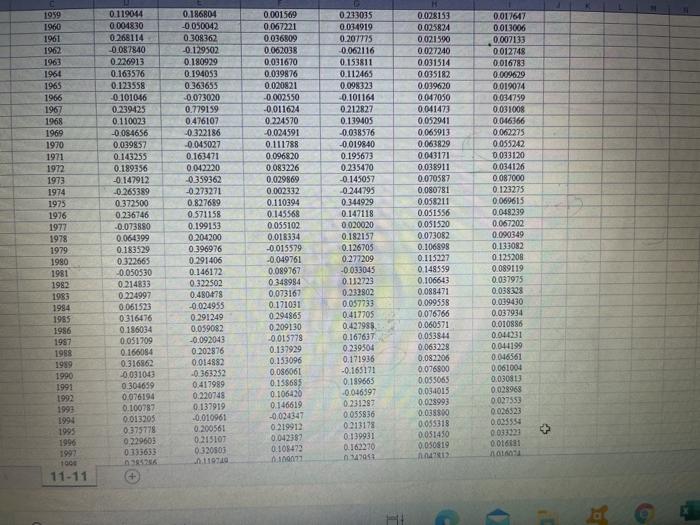

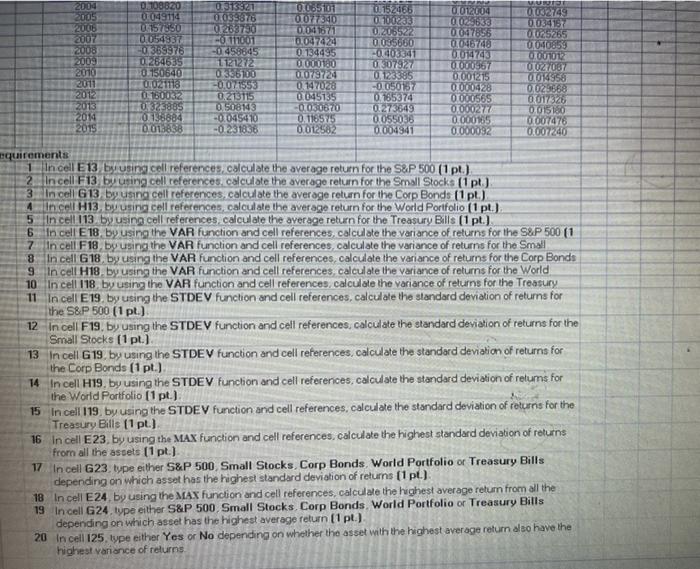

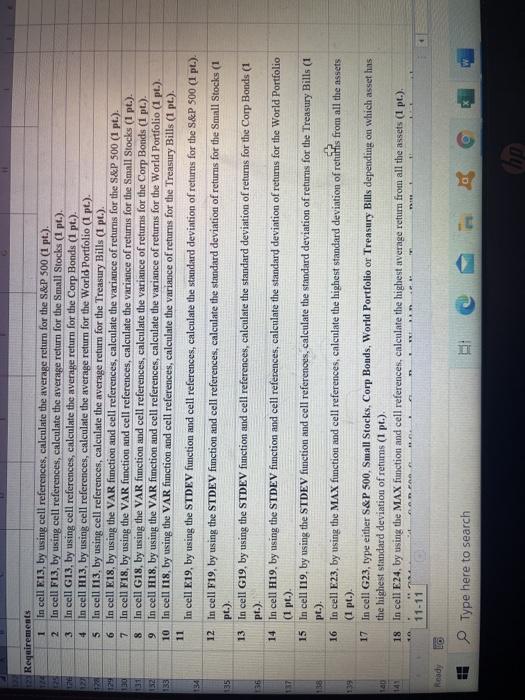

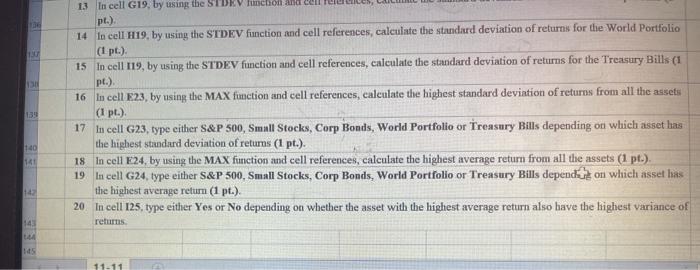

Complete the steps below wing call references to given data or previous calculations. In some cases, a simple call reference is all you need. To copy paste a formula across a row or down a column, an absolute cell refrence or a mhad cell refrance may be preferred Va specific coal finction is to be used, the directions will spect the use of that flinction. Do not type in numerical data into a call or function. Instead, make a reference to the call in which the data is found Make your computations only in the blue calls highlighted low. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, wally the Given Dato section Based on the spreadsheet enclosed further below: a. Compute the average return for each of the assets from 1929 to 1940 (The Great Depression) b. Compute the variance and standard deviation for each of the assets from 1929-1940 c. Which asset was riskiest during the Great Depression? How does that fit with your intuition? a. Compute the average return for each of the assets from 1929 to 1940 (The Great Depression) S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills Average return b. Compute the variance and standard deviation for each of the assets from 1929-1940. S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills Variance of returns Standard deviation c. Which asset had the highest standard deviation during the Great Depression? How does that fit with your intuition? Most Volatile Asset Which? Highest average return Which? Does the asset with the highest average return also have the highest variance of returns? Data for Figure 11.1 Yearly returns from 1926 2015 for the S&P 500, small stocks, corporate bonds, world portfolio, Treasury bills, and inflation ( measured by Year S&P 500 Small Stacks Corp Bonds World Portfolio Treasury Bills CPI 1926 0.111382 -0.072000 0.062852 0228000 0031943 -0.011876 1927 0.371260 0.257543 0.065504 0.253257 0.031247 -0.021635 1928 0.433079 0.468723 0.033772 0334633 0.038241 -0.012285 1929 -0.089069 0.504667 0.043206 0.076923 0047367 0.007463 1930 -0252573 -0.455830 0.063433 -0.225738 0.023474 -0.064198 1931 -0.438580 -0.502165 -0.023803 0.393052 0.010230 -0.092348 1932 -0.088612 0.086957 0.121985 0.030303 0.008035 -0.101651 1933 0.528949 1.872000 0.052552 0,664488 0.002933 0.009740 1934 -0.023405 0.252089 0.097282 0.025524 0.001547 0.012862 1935 0.472081 0647386 0.068602 0.227824 0.001652 0.031746 1936 0.328010 0.875084 0.062197 0.192827 0.001749 0.012303 1937 -0.352577 -0.534030 0.025456 -0.169499 0.003187 0.030395 1938 0.331991 0.262751 0.043571 0.056139 0.000407 -0.029499 1939 -0.009096 0.001836 0.042473 -0.014406 0.000075 0.000000 1940 -0.100825 -0.123396 0.045124 0.035282 -0.000582 0.009119 1941 -0.117673 -0.137282 0.017882 0.187439 0.000422 0.099398 1942 0.210758 0.525040 0.031188 0.011890 0.002616 0.090411 1943 0.257576 1.000000 0.033648 0.198947 0.003396 0.027638 1944 0.196935 0.604078 0.031013 -0.102399 0.003215 0.024450 1945 0.364606 0.826647 0.035119 0.110316 0.003211 0.021480 1946 -0 081804 -0.126085 0.025578 -0.151238 0.003521 0.18223 0.052401 0.026380 0.004497 0.031962 0.004611 0.083933 1948 0.050990 -0.066086 0.037072 -0.057298 0.009790 0.029038 1949 0.180648 0.215017 0.043267 0.054209 0.011061 -0.021164 1950 0.305792 0.459082 0.018908 0.254772 0.012134 0.059459 1951 0.245529 0.097671 -0.002101 0.224464 0.014833 0.061224 1952 0.185011 0.064718 0.034268 0.158215 0.016420 0.006410 1953 40010987 -0.059851 0.020612 0.048380 0.017800 0.007962 1954 0.524037 0.652319 0.046578 0.498225 0.008626 -0.007899 1955 0.314288 0.221095 0.010754 0.247387 0.015551 0.004777 1956 0.066270 0.034592 -0.017923 0.063810 0024213 0.038 526 -0.108335 -0.150527 0.044698 -0.060174 0.031286 0.029276 1958 0.433444 0.709232 0.008487 0.014131 0344562 0.017954 1959 0.119044 0.017647 0.186804 0.001569 0233035 0.028153 0034919 -0.050042 1960 0,069221 0.025824 0.01.2006 0.001830 24 11-11 + 1947 WOYEU 1959 1960 1961 1962 1963 1960 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1957 1988 1989 1990 1991 1992 1993 1994 1995 1996 1992 1000 11-11 0.119044 0.004830 0.268114 -0.087840 0.226913 0.163576 0.123558 -0.101046 0.239425 0.110023 -0.084656 0.039857 0.143255 0.189356 -0.147912 -0.265389 0.372500 0.236746 -0.073880 0.064399 0.183529 0.322665 -0.050530 0214833 0224997 0.061523 0316476 0.186034 0.051709 0.166084 0.316862 -0.031043 0.304659 0.076194 0.100787 0.013205 0.375778 0.229603 0333633 26 0.186804 -0 050042 0308362 -0.129502 0.180929 0.194053 0.363655 -0.073020 0.779159 0.476107 -0.322186 -0,045027 0.163471 0.042220 0.359362 -0.273271 0.827689 0.571158 0.199153 0.204200 0.396976 0.291406 0.146172 0.322502 0.480678 -0.024955 0.291249 0.059082 -0.092043 0.202876 0.014882 -0.363252 0.417989 0.220748 0.137919 -0.010961 0.20056! 0.215107 0320803 0.001569 0.067221 0.036809 0.062038 0.031670 0.039876 0.020821 -0.002550 0011624 0.224570 -0.024591 0.111788 0.096820 0.083226 0.029869 0.002332 0.110394 0.145568 0.055102 0.018334 -0.015579 -0.049761 0.089767 0348984 0.073161 0.171031 0.294865 0.209130 -0.015778 0.137929 0.153096 0.086061 0.158685 0.106420 0.146619 -0.024347 0.219912 0.042382 0.108472 0.233035 0.034919 0.207775 0.062116 0.153811 0.112465 0.098323 -0.101164 0.212827 0.139405 -0.038576 -0.019840 0.195673 0.235470 -0.145057 0.244795 0.344929 0.147118 0.020020 0.182157 0.126705 0.277209 -0.033045 0.112723 0.232802 0.057733 0.417705 0.427985 0.167637 0.239504 0.171936 -0.165171 0.199663 -0.046397 0.231287 0.055836 0213178 0139931 0.162270 0.028152 0.025824 0.02.1500 0.027240 0031514 0.035182 0.039620 0.047050 0.041473 0.052941 0.065913 0.063829 0.043171 0.038911 0.070587 0.080781 0.058211 0.051556 0.051520 0.073082 0.106898 0.115227 0.148559 0.106643 0.088471 0.099558 0.076766 0.060571 0.053844 0.063228 0.082206 0.076500 0.055065 0.034015 0.028993 0.038809 0.055318 0.051450 0.050819 2 0.017647 0.013006 0.007133 0012748 0.016783 0.009629 0.019074 0:034759 0.031008 0.016366 0.062275 0.055242 0.033120 0.034126 0.087000 0.123275 0.069615 0.048239 0.067202 0.090349 0.133082 0.125208 0.089119 0.037975 0.038328 0.009430 0.037934 0.010886 0.04031 0.044199 0.016561 0.061004 0.030813 0.028968 0.027553 0.026323 0.035550 00332 0.01611 + a 6 2004 VUIT 0.108620 0.313327 0.085101 0.152166 0.012004 01032145 2005 0049114 0.039876 07077340 0100233 009630 0.034157 2006 0157050 0263730 0.041672 0.206522 00047836 OS265 2007 0.054937 O111001 10.047424 0.035680 COM640 0040859 2008 -0.369978 -07458845 0 134495 -0.003341 0.014743 O 001012 2009 01264639 1121272 0000100 0/307924 OTO00967 0.150640 2010 0021087 0336100 0.079724 0123385 0.001215 0014958 2011 07021118 -0.071553 0.147028 -0.050157 0000428 0029668 2012 0 150032 0.213115 0.045139 0.165374 0000565 0017320 2013 0.323805 0508143 -0.030670 0.273649 0.000277 0.015100 2014 0.138884 -0.045410 0.116575 0.055036 0.000165 0.007476 2015 0013838 -0.231836 0.012582 0.004941 0.000032 0.007240 equirements 1 In cell E13 by using cell references, calculate the average return for the S&P 500 (1 pt.) 2 In cell F13 by using cell references calculate the average return for the Small Stocks (1 pt) 3 In cell G13 by using cell references, calculate the average return for the Corp Bonds (1 p.) 4 In cell H13, by using cell references, calculate the average return for the World Portfolio (1 p.) 5 In cell 113 by using cell references calculate the average return for the Treasury Bills (1 pt.) In cell E18 by using the VAR function and cell references calculate the variance of returns for the S&P 500 (1 7 In cell F18 by using the VAR function and cell references, calculate the variance of returns for the Small 8. In cell G18 by using the VAR function and coll references calculate the variance of returns for the Corp Bonds 9 In cell H18. By using the VAR function and cell references, calculate the variance of returns for the World 10 In cell 118 by using the VAR function and cell references, calculate the variance of returns for the Treasury 11 In cell E 19 by using the STDEV function and cell references, calculate the standard deviation of returns for the S&P 500 (1 pt.) 12 In cell F19, by using the STDEV function and cell references, calculate the standard deviation of returns for the Small Stocks (1 pt.) 13 In cell G19 by using the STDEV function and cell references, calculate the standard deviation of returns for the Corp Bonds (1 pt.) 14 In cell H19. by using the STDEV function and cell references, calculate the standard deviation of retums for the World Portfolio (1 pt.) 15 In cell 119 by using the STDEV function and cell references, calculate the standard deviation of returns for the Treasury Bills (1 pt.) 16 In cell E23, by using the MAX function and cell references, calculate the highest standard deviation of returns from all the assets (1 pt.) 17 In cell G23 type either S&P 500 Small Stocks, Corp Bonds World Portfolio of Treasury Bills depending on which asset has the highest standard deviation of returns (1 p.) 18 In cell E24, by using the MAX function and cell references, calculate the highest average return from all the 19 In cell G24 type either S&P 500. Small Stocks Corp Bonds World Portfolio or Treasury Bills depending on which asset has the highest average return (1 pt.) 20 In cell 125 type either Yes or No depending on whether the asset with the highest average return also have the highest variance of returns 4 12 6 129 30 135 134 135 Requirements In cell E13, by using cell references, calculate the average return for the S&P 500 (1 pt.). 225 2 In cell F13, by using cell references, calculate the average return for the Small Stocks (1 pr.). PE 3 In cell G13, by using cell references, calculate the average return for the Corp Bonds (1 pt.). In cell H13, by using cell references, calculate the average return for the World Portfolio (1 pt.). 5 In cell 113. by using cell references, calculate the average return for the Treasury Bills (1 pt.). In cell E18, by using the VAR function and cell references, calculate the variance of returns for the S&P 500 (1 pt.). 7 In cell F18, by using the VAR function and cell references, calculate the variance of returns for the Small Stocks (1 pt.). In cell G18, by using the VAR function and cell references, calculate the variance of returns for the Corp Bonds (1 pt.). 9 In cell H18, by using the VAR function and cell references, calculate the variance of returns for the World Portfolio (1 pt.). 10 In cell 118, by using the VAR function and cell references, calculate the variance of returns for the Treasury Bills (1 pt.). 11 In cell E19, by using the STDEV function and cell references, calculate the standard deviation of returns for the S&P 500 (1 pt.). 12 In cell F19, by using the STDEV function and cell references, calculate the standard deviation of returns for the Small Stocks (1 pt.) 13 In cell G19, by using the STDEV function and cell references, calculate the standard deviation of returns for the Corp Bonds (1 36 pr.) 14 In cell H19, by nsing the STDEV function and cell references, calculate the standard deviation of returns for the World Portfolio (1 pr.) 15 In cell 119. by using the STDEV function and cell references, calculate the standard deviation of returns for the Treasury Bills (1 pt.). 16 In cell E23. by using the MAX function and cell references, calculate the highest standard deviation of retultis from all the assets 139 (1 pt.) 17 In cell G23, type either S&P 500, Small Stocks, Corp Bonds, World Portfolio or Treasury Bills depending on which asset has the highest standard deviation of retums (1 pr.). 18 In cell E24. by using the MAX function and cell references, calculate the highest average return from all the assets (1 pr.). - 11-11 140 141 ## Ready o Type here to search Complete the steps below wing call references to given data or previous calculations. In some cases, a simple call reference is all you need. To copy paste a formula across a row or down a column, an absolute cell refrence or a mhad cell refrance may be preferred Va specific coal finction is to be used, the directions will spect the use of that flinction. Do not type in numerical data into a call or function. Instead, make a reference to the call in which the data is found Make your computations only in the blue calls highlighted low. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, wally the Given Dato section Based on the spreadsheet enclosed further below: a. Compute the average return for each of the assets from 1929 to 1940 (The Great Depression) b. Compute the variance and standard deviation for each of the assets from 1929-1940 c. Which asset was riskiest during the Great Depression? How does that fit with your intuition? a. Compute the average return for each of the assets from 1929 to 1940 (The Great Depression) S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills Average return b. Compute the variance and standard deviation for each of the assets from 1929-1940. S&P 500 Small Stocks Corp Bonds World Portfolio Treasury Bills Variance of returns Standard deviation c. Which asset had the highest standard deviation during the Great Depression? How does that fit with your intuition? Most Volatile Asset Which? Highest average return Which? Does the asset with the highest average return also have the highest variance of returns? Data for Figure 11.1 Yearly returns from 1926 2015 for the S&P 500, small stocks, corporate bonds, world portfolio, Treasury bills, and inflation ( measured by Year S&P 500 Small Stacks Corp Bonds World Portfolio Treasury Bills CPI 1926 0.111382 -0.072000 0.062852 0228000 0031943 -0.011876 1927 0.371260 0.257543 0.065504 0.253257 0.031247 -0.021635 1928 0.433079 0.468723 0.033772 0334633 0.038241 -0.012285 1929 -0.089069 0.504667 0.043206 0.076923 0047367 0.007463 1930 -0252573 -0.455830 0.063433 -0.225738 0.023474 -0.064198 1931 -0.438580 -0.502165 -0.023803 0.393052 0.010230 -0.092348 1932 -0.088612 0.086957 0.121985 0.030303 0.008035 -0.101651 1933 0.528949 1.872000 0.052552 0,664488 0.002933 0.009740 1934 -0.023405 0.252089 0.097282 0.025524 0.001547 0.012862 1935 0.472081 0647386 0.068602 0.227824 0.001652 0.031746 1936 0.328010 0.875084 0.062197 0.192827 0.001749 0.012303 1937 -0.352577 -0.534030 0.025456 -0.169499 0.003187 0.030395 1938 0.331991 0.262751 0.043571 0.056139 0.000407 -0.029499 1939 -0.009096 0.001836 0.042473 -0.014406 0.000075 0.000000 1940 -0.100825 -0.123396 0.045124 0.035282 -0.000582 0.009119 1941 -0.117673 -0.137282 0.017882 0.187439 0.000422 0.099398 1942 0.210758 0.525040 0.031188 0.011890 0.002616 0.090411 1943 0.257576 1.000000 0.033648 0.198947 0.003396 0.027638 1944 0.196935 0.604078 0.031013 -0.102399 0.003215 0.024450 1945 0.364606 0.826647 0.035119 0.110316 0.003211 0.021480 1946 -0 081804 -0.126085 0.025578 -0.151238 0.003521 0.18223 0.052401 0.026380 0.004497 0.031962 0.004611 0.083933 1948 0.050990 -0.066086 0.037072 -0.057298 0.009790 0.029038 1949 0.180648 0.215017 0.043267 0.054209 0.011061 -0.021164 1950 0.305792 0.459082 0.018908 0.254772 0.012134 0.059459 1951 0.245529 0.097671 -0.002101 0.224464 0.014833 0.061224 1952 0.185011 0.064718 0.034268 0.158215 0.016420 0.006410 1953 40010987 -0.059851 0.020612 0.048380 0.017800 0.007962 1954 0.524037 0.652319 0.046578 0.498225 0.008626 -0.007899 1955 0.314288 0.221095 0.010754 0.247387 0.015551 0.004777 1956 0.066270 0.034592 -0.017923 0.063810 0024213 0.038 526 -0.108335 -0.150527 0.044698 -0.060174 0.031286 0.029276 1958 0.433444 0.709232 0.008487 0.014131 0344562 0.017954 1959 0.119044 0.017647 0.186804 0.001569 0233035 0.028153 0034919 -0.050042 1960 0,069221 0.025824 0.01.2006 0.001830 24 11-11 + 1947 WOYEU 1959 1960 1961 1962 1963 1960 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1957 1988 1989 1990 1991 1992 1993 1994 1995 1996 1992 1000 11-11 0.119044 0.004830 0.268114 -0.087840 0.226913 0.163576 0.123558 -0.101046 0.239425 0.110023 -0.084656 0.039857 0.143255 0.189356 -0.147912 -0.265389 0.372500 0.236746 -0.073880 0.064399 0.183529 0.322665 -0.050530 0214833 0224997 0.061523 0316476 0.186034 0.051709 0.166084 0.316862 -0.031043 0.304659 0.076194 0.100787 0.013205 0.375778 0.229603 0333633 26 0.186804 -0 050042 0308362 -0.129502 0.180929 0.194053 0.363655 -0.073020 0.779159 0.476107 -0.322186 -0,045027 0.163471 0.042220 0.359362 -0.273271 0.827689 0.571158 0.199153 0.204200 0.396976 0.291406 0.146172 0.322502 0.480678 -0.024955 0.291249 0.059082 -0.092043 0.202876 0.014882 -0.363252 0.417989 0.220748 0.137919 -0.010961 0.20056! 0.215107 0320803 0.001569 0.067221 0.036809 0.062038 0.031670 0.039876 0.020821 -0.002550 0011624 0.224570 -0.024591 0.111788 0.096820 0.083226 0.029869 0.002332 0.110394 0.145568 0.055102 0.018334 -0.015579 -0.049761 0.089767 0348984 0.073161 0.171031 0.294865 0.209130 -0.015778 0.137929 0.153096 0.086061 0.158685 0.106420 0.146619 -0.024347 0.219912 0.042382 0.108472 0.233035 0.034919 0.207775 0.062116 0.153811 0.112465 0.098323 -0.101164 0.212827 0.139405 -0.038576 -0.019840 0.195673 0.235470 -0.145057 0.244795 0.344929 0.147118 0.020020 0.182157 0.126705 0.277209 -0.033045 0.112723 0.232802 0.057733 0.417705 0.427985 0.167637 0.239504 0.171936 -0.165171 0.199663 -0.046397 0.231287 0.055836 0213178 0139931 0.162270 0.028152 0.025824 0.02.1500 0.027240 0031514 0.035182 0.039620 0.047050 0.041473 0.052941 0.065913 0.063829 0.043171 0.038911 0.070587 0.080781 0.058211 0.051556 0.051520 0.073082 0.106898 0.115227 0.148559 0.106643 0.088471 0.099558 0.076766 0.060571 0.053844 0.063228 0.082206 0.076500 0.055065 0.034015 0.028993 0.038809 0.055318 0.051450 0.050819 2 0.017647 0.013006 0.007133 0012748 0.016783 0.009629 0.019074 0:034759 0.031008 0.016366 0.062275 0.055242 0.033120 0.034126 0.087000 0.123275 0.069615 0.048239 0.067202 0.090349 0.133082 0.125208 0.089119 0.037975 0.038328 0.009430 0.037934 0.010886 0.04031 0.044199 0.016561 0.061004 0.030813 0.028968 0.027553 0.026323 0.035550 00332 0.01611 + a 6 2004 VUIT 0.108620 0.313327 0.085101 0.152166 0.012004 01032145 2005 0049114 0.039876 07077340 0100233 009630 0.034157 2006 0157050 0263730 0.041672 0.206522 00047836 OS265 2007 0.054937 O111001 10.047424 0.035680 COM640 0040859 2008 -0.369978 -07458845 0 134495 -0.003341 0.014743 O 001012 2009 01264639 1121272 0000100 0/307924 OTO00967 0.150640 2010 0021087 0336100 0.079724 0123385 0.001215 0014958 2011 07021118 -0.071553 0.147028 -0.050157 0000428 0029668 2012 0 150032 0.213115 0.045139 0.165374 0000565 0017320 2013 0.323805 0508143 -0.030670 0.273649 0.000277 0.015100 2014 0.138884 -0.045410 0.116575 0.055036 0.000165 0.007476 2015 0013838 -0.231836 0.012582 0.004941 0.000032 0.007240 equirements 1 In cell E13 by using cell references, calculate the average return for the S&P 500 (1 pt.) 2 In cell F13 by using cell references calculate the average return for the Small Stocks (1 pt) 3 In cell G13 by using cell references, calculate the average return for the Corp Bonds (1 p.) 4 In cell H13, by using cell references, calculate the average return for the World Portfolio (1 p.) 5 In cell 113 by using cell references calculate the average return for the Treasury Bills (1 pt.) In cell E18 by using the VAR function and cell references calculate the variance of returns for the S&P 500 (1 7 In cell F18 by using the VAR function and cell references, calculate the variance of returns for the Small 8. In cell G18 by using the VAR function and coll references calculate the variance of returns for the Corp Bonds 9 In cell H18. By using the VAR function and cell references, calculate the variance of returns for the World 10 In cell 118 by using the VAR function and cell references, calculate the variance of returns for the Treasury 11 In cell E 19 by using the STDEV function and cell references, calculate the standard deviation of returns for the S&P 500 (1 pt.) 12 In cell F19, by using the STDEV function and cell references, calculate the standard deviation of returns for the Small Stocks (1 pt.) 13 In cell G19 by using the STDEV function and cell references, calculate the standard deviation of returns for the Corp Bonds (1 pt.) 14 In cell H19. by using the STDEV function and cell references, calculate the standard deviation of retums for the World Portfolio (1 pt.) 15 In cell 119 by using the STDEV function and cell references, calculate the standard deviation of returns for the Treasury Bills (1 pt.) 16 In cell E23, by using the MAX function and cell references, calculate the highest standard deviation of returns from all the assets (1 pt.) 17 In cell G23 type either S&P 500 Small Stocks, Corp Bonds World Portfolio of Treasury Bills depending on which asset has the highest standard deviation of returns (1 p.) 18 In cell E24, by using the MAX function and cell references, calculate the highest average return from all the 19 In cell G24 type either S&P 500. Small Stocks Corp Bonds World Portfolio or Treasury Bills depending on which asset has the highest average return (1 pt.) 20 In cell 125 type either Yes or No depending on whether the asset with the highest average return also have the highest variance of returns 4 12 6 129 30 135 134 135 Requirements In cell E13, by using cell references, calculate the average return for the S&P 500 (1 pt.). 225 2 In cell F13, by using cell references, calculate the average return for the Small Stocks (1 pr.). PE 3 In cell G13, by using cell references, calculate the average return for the Corp Bonds (1 pt.). In cell H13, by using cell references, calculate the average return for the World Portfolio (1 pt.). 5 In cell 113. by using cell references, calculate the average return for the Treasury Bills (1 pt.). In cell E18, by using the VAR function and cell references, calculate the variance of returns for the S&P 500 (1 pt.). 7 In cell F18, by using the VAR function and cell references, calculate the variance of returns for the Small Stocks (1 pt.). In cell G18, by using the VAR function and cell references, calculate the variance of returns for the Corp Bonds (1 pt.). 9 In cell H18, by using the VAR function and cell references, calculate the variance of returns for the World Portfolio (1 pt.). 10 In cell 118, by using the VAR function and cell references, calculate the variance of returns for the Treasury Bills (1 pt.). 11 In cell E19, by using the STDEV function and cell references, calculate the standard deviation of returns for the S&P 500 (1 pt.). 12 In cell F19, by using the STDEV function and cell references, calculate the standard deviation of returns for the Small Stocks (1 pt.) 13 In cell G19, by using the STDEV function and cell references, calculate the standard deviation of returns for the Corp Bonds (1 36 pr.) 14 In cell H19, by nsing the STDEV function and cell references, calculate the standard deviation of returns for the World Portfolio (1 pr.) 15 In cell 119. by using the STDEV function and cell references, calculate the standard deviation of returns for the Treasury Bills (1 pt.). 16 In cell E23. by using the MAX function and cell references, calculate the highest standard deviation of retultis from all the assets 139 (1 pt.) 17 In cell G23, type either S&P 500, Small Stocks, Corp Bonds, World Portfolio or Treasury Bills depending on which asset has the highest standard deviation of retums (1 pr.). 18 In cell E24. by using the MAX function and cell references, calculate the highest average return from all the assets (1 pr.). - 11-11 140 141 ## Ready o Type here to search