Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount

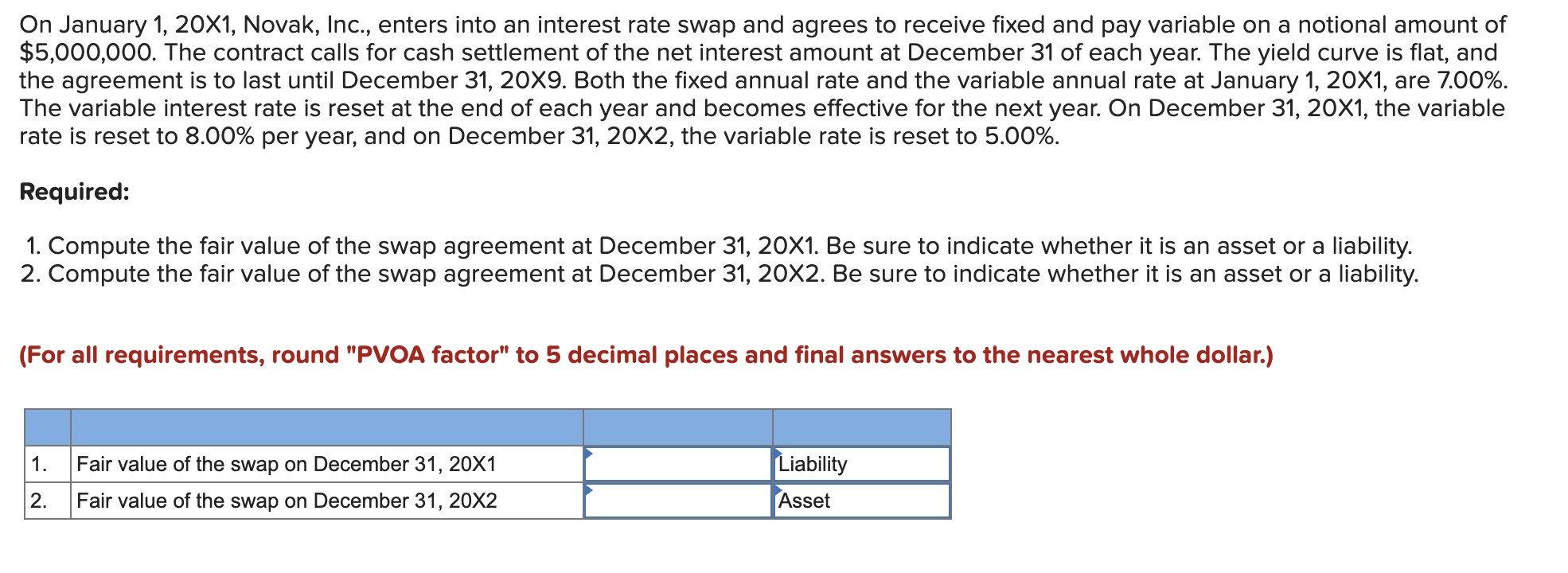

On January 1, 20X1, Novak, Inc., enters into an interest rate swap and agrees to receive fixed and pay variable on a notional amount of $5,000,000. The contract calls for cash settlement of the net interest amount at December 31 of each year. The yield curve is flat, and the agreement is to last until December 31, 20X9. Both the fixed annual rate and the variable annual rate at January 1, 20X1, are 7.00%. The variable interest rate is reset at the end of each year and becomes effective for the next year. On December 31, 20X1, the variable rate is reset to 8.00% per year, and on December 31, 20X2, the variable rate is reset to 5.00%. Required: 1. Compute the fair value of the swap agreement at December 31, 20X1. Be sure to indicate whether it is an asset or a liability. 2. Compute the fair value of the swap agreement at December 31, 20X2. Be sure to indicate whether it is an asset or a liability. (For all requirements, round "PVOA factor" to 5 decimal places and final answers to the nearest whole dollar.) 1. Fair value of the swap on December 31, 20X1 2. Fair value of the swap on December 31, 20X2 Liability Asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the fair value of the swap agreement we need to determine the net cash flows generated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started