Question

Complete the tax return for Dr. Warner Scenario: Dr. Susan Warner is a divorced taxpayer who maintains the cost of a home for herself and

Complete the tax return for Dr. Warner

Scenario: Dr. Susan Warner is a divorced taxpayer who maintains the cost of a home for herself and her two adopted daughters Gabby (15) and Lillie (10). She works hard to support her family all year. She has provided you with the following information and would like you to prepare her 2019 Tax Return.

- In December of 2018, Dr. Warner sold her home. She purchased the home for $300,000 and sold the home for $400,000. She has lived in the home since she purchased it in 2010.

- New address: 65 Township Road 1199, Chesapeake, Ohio 45659. Her SSN# is 111-11-1111. Gabby's SSN# is 222-22-2222 and Lillie's SSN# is 222-22-2222.

- Dr. Warner received life insurance proceeds of $125,000 when her mother passed away September of 2019.

- Dr. Warner is self-employed and owner of Warner's Pediatrics. Her gross profit from the business was $320,000 for 2019.

- Dr. Warner incurred the following expenses in connection with her business.

o Paid her nurses $150,000

o Rent on her office space $30,000

o Medical supplies of $15,000

o Penalties on late tax payments of$2,500

o New X-ray machine - made Section 179 Election - $10,000

o Business meals of $5,000

o Travel to a conference $2,500

- Dr. Warner also worked part-time as a physician at a clinic. The clinic sent her a W-2 that showed wages of $30,000, federal withholding of $12,000, Social Security tax of $3,500, Medicare tax of $1,500, and state withholding of $2,500.

- Dr. Warner personally owns some rental property. She had gross rental income of $50,000.

- Dr. Warner incurred the following expenses associated with her rental:

o Depreciation of $15,000

o Mortgage interest of $10,500

o Property taxes of $5,500

o Repairs of $12,750

o Pest control of $3,000

o Maintenance of $3,000

- She has a CD at the local bank which paid her interest of $4,500. She also received $6,000 worth of interest from a municipal bond.

- She paid $15,500 of mortgage interest (acquisition indebtedness) on her personal home.

- She made charitable contributions of $14,500.

- She paid property taxes on her personal home of $4,500.

- She sold a jet ski she used personally at a loss of $2,000. She had owned the jet ski for 3 years.

- Dr. Warner paid her former spouse alimony of $15,500. The divorce occurred prior to tax reform.

- She made federal estimated tax payments of $12,600.

- Dr. Warner sold some AT&T stock she had held for six years at a gain of $10,400. (Ignore preferential rates)

- She had unreimbursed medical expenses of $25,500.

- She has gambling winnings of $5,000 and no losses.

- Assume she qualifies for the Child Tax Credit. (Ignore AGI Phase Outs)

- She wants you to calculate her SE Tax

1.) 2019 Form 1040

2.) 2019 Form 1040 - Schedule 1

3.) 2019 Form 1040 - Schedule A Please do not complete Schedule C, page 2 or Schedule E, page 2.

4.) 2019 Form 1040 - Schedule C

5.) 2019 Form 1040 - Schedule E

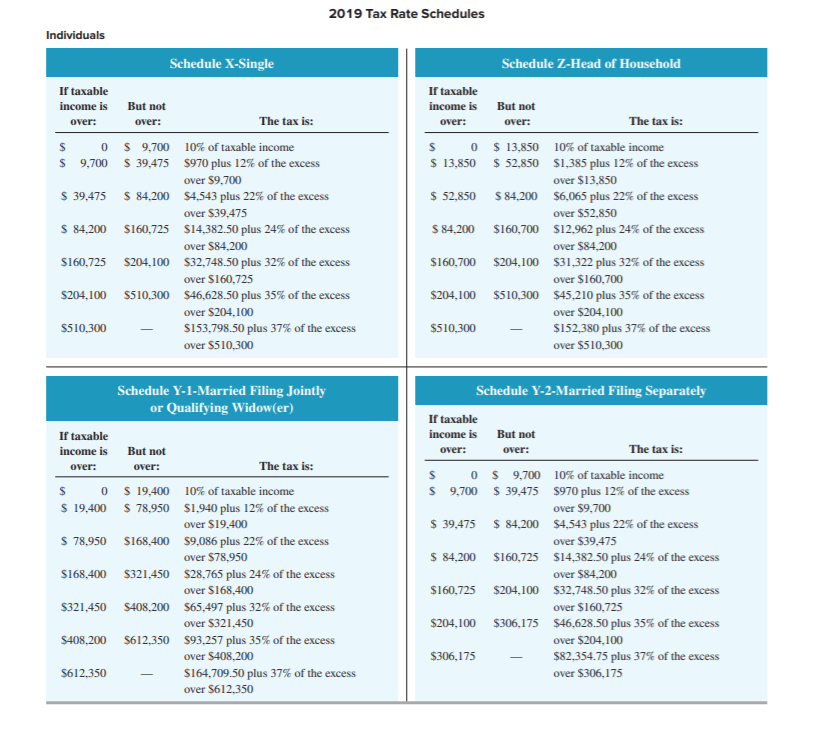

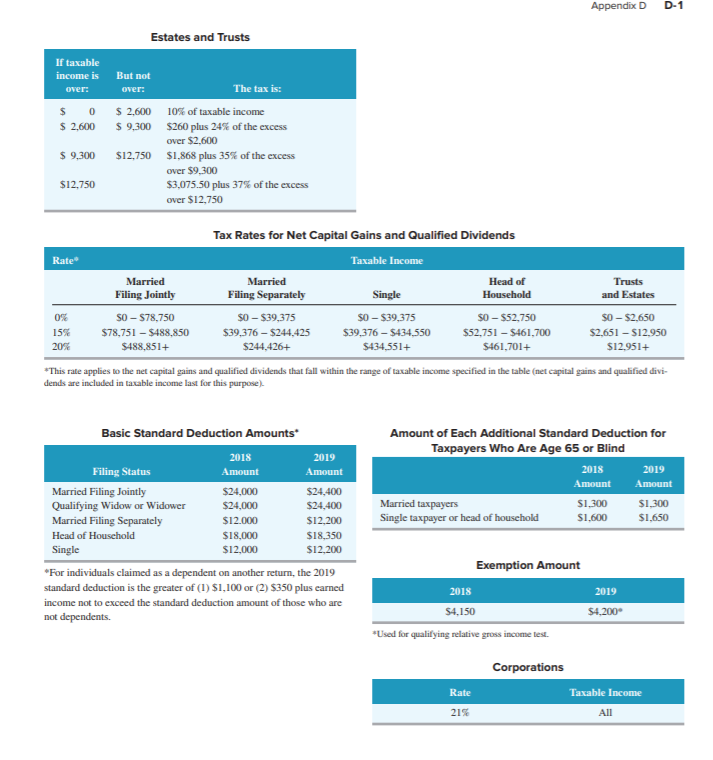

6.) Tax Rates:

2019 Tax Rate Schedules Individuals Schedule X-Single Schedule Z-Head of Household If taxable income is over: But not over: If taxable income is over: But not over: The tax is: The tax is: $ $ 0 9,700 $ 9,700 S 39,475 $ 0 $ 13,850 $ 13,850 $ 52,850 $ 39,475 $ 84,200 $ 84,200 $160,725 $ 84,200 $160,700 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84.200 $32.748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798.50 plus 37% of the excess over $510,300 10% of taxable income $1,385 plus 12% of the excess over $13,850 $6,065 plus 22% of the excess over $52.850 $12.962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 $160,725 $204,100 $160,700 $204,100 $204,100 $510,300 $204,100 $510,300 S510,300 - $510,300 - Schedule Y-2-Married Filing Separately Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is If taxable income is over: But not over: The tax is: But not over: The tax is: $ $ 0 9,700 $ 9,700 $ 39,475 $ 0 $ 19,400 $ 19.400 $ 78,950 $ 39,475 $ 84,200 $ 78,950 $168,400 $ 84,200 $160,725 $168,400 $321,450 10% of taxable income $1.940 plus 12% of the excess over $19,400 $9,086 plus 22% of the excess over $78,950 $28,765 plus 24% of the excess over $168.400 $65,497 plus 32% of the excess over $321,450 $93.257 plus 35% of the excess over $408.200 $164,709.50 plus 37% of the excess over $612,350 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46.628.50 plus 35% of the excess over $204,100 $82.354.75 plus 37% of the excess over $306,175 $160,725 $204,100 $321,450 $408,200 $204,100 $306,175 $408,200 $612,350 $306,175 $612,350 - Appendix D D-1 Estates and Trusts If taxable income is over: But not over: The tax is: $ 0 $ 2,600 $2,600 $9,300 $ 9,300 $12,750 10% of taxable income $260 plus 24% of the excess over $2,600 $1,868 plus 35% of the excess over $9,300 $3,075.50 plus 37% of the excess over $12,750 $12.750 Tax Rates for Net Capital Gains and Qualified Dividends Rate Taxable income Married Filing Jointly Married Filing Separately Head of Household Trusts and Estates Single 0% 15% 20% SO - $78,750 $78,751 - $488,850 $488,851+ $0 - $39,375 $39,376 - $244,425 $244.426+ $0-$39,375 $39,376 - $434,550 $434,551+ $0 - $52,750 $52,751 - 5461,700 $461,701+ $0-$2.650 $2,651 - $12.950 $12.951+ *This rate applies to the nel capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified divi- dends are included in taxable income last for this purpose) Basic Standard Deduction Amounts Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2019 Amount Filing Status 2019 Amount Married Filing Jointly Qualifying Widow or Widower Married Filing Separately Head of Household Single 2018 Amount $24,000 $24,000 $12.000 $18,000 $12,000 $24,400 $24,400 S12.200 $18,350 $12,200 2018 Amount S1.300 $1,600 Married taxpayers Single taxpayer or head of household $1,300 $1,650 Exemption Amount For individuals claimed as a dependent on another return, the 2019 standard deduction is the greater of (1) $1,100 or (2) $350 plus earned income not to exceed the standard deduction amount of those who are not dependents. 2018 2019 $4,150 $4,200 *Used for qualifying relative gross income test. Corporations Taxable income Rate 21% 2019 Tax Rate Schedules Individuals Schedule X-Single Schedule Z-Head of Household If taxable income is over: But not over: If taxable income is over: But not over: The tax is: The tax is: $ $ 0 9,700 $ 9,700 S 39,475 $ 0 $ 13,850 $ 13,850 $ 52,850 $ 39,475 $ 84,200 $ 84,200 $160,725 $ 84,200 $160,700 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84.200 $32.748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798.50 plus 37% of the excess over $510,300 10% of taxable income $1,385 plus 12% of the excess over $13,850 $6,065 plus 22% of the excess over $52.850 $12.962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 $160,725 $204,100 $160,700 $204,100 $204,100 $510,300 $204,100 $510,300 S510,300 - $510,300 - Schedule Y-2-Married Filing Separately Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is If taxable income is over: But not over: The tax is: But not over: The tax is: $ $ 0 9,700 $ 9,700 $ 39,475 $ 0 $ 19,400 $ 19.400 $ 78,950 $ 39,475 $ 84,200 $ 78,950 $168,400 $ 84,200 $160,725 $168,400 $321,450 10% of taxable income $1.940 plus 12% of the excess over $19,400 $9,086 plus 22% of the excess over $78,950 $28,765 plus 24% of the excess over $168.400 $65,497 plus 32% of the excess over $321,450 $93.257 plus 35% of the excess over $408.200 $164,709.50 plus 37% of the excess over $612,350 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46.628.50 plus 35% of the excess over $204,100 $82.354.75 plus 37% of the excess over $306,175 $160,725 $204,100 $321,450 $408,200 $204,100 $306,175 $408,200 $612,350 $306,175 $612,350 - Appendix D D-1 Estates and Trusts If taxable income is over: But not over: The tax is: $ 0 $ 2,600 $2,600 $9,300 $ 9,300 $12,750 10% of taxable income $260 plus 24% of the excess over $2,600 $1,868 plus 35% of the excess over $9,300 $3,075.50 plus 37% of the excess over $12,750 $12.750 Tax Rates for Net Capital Gains and Qualified Dividends Rate Taxable income Married Filing Jointly Married Filing Separately Head of Household Trusts and Estates Single 0% 15% 20% SO - $78,750 $78,751 - $488,850 $488,851+ $0 - $39,375 $39,376 - $244,425 $244.426+ $0-$39,375 $39,376 - $434,550 $434,551+ $0 - $52,750 $52,751 - 5461,700 $461,701+ $0-$2.650 $2,651 - $12.950 $12.951+ *This rate applies to the nel capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified divi- dends are included in taxable income last for this purpose) Basic Standard Deduction Amounts Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2019 Amount Filing Status 2019 Amount Married Filing Jointly Qualifying Widow or Widower Married Filing Separately Head of Household Single 2018 Amount $24,000 $24,000 $12.000 $18,000 $12,000 $24,400 $24,400 S12.200 $18,350 $12,200 2018 Amount S1.300 $1,600 Married taxpayers Single taxpayer or head of household $1,300 $1,650 Exemption Amount For individuals claimed as a dependent on another return, the 2019 standard deduction is the greater of (1) $1,100 or (2) $350 plus earned income not to exceed the standard deduction amount of those who are not dependents. 2018 2019 $4,150 $4,200 *Used for qualifying relative gross income test. Corporations Taxable income Rate 21%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started