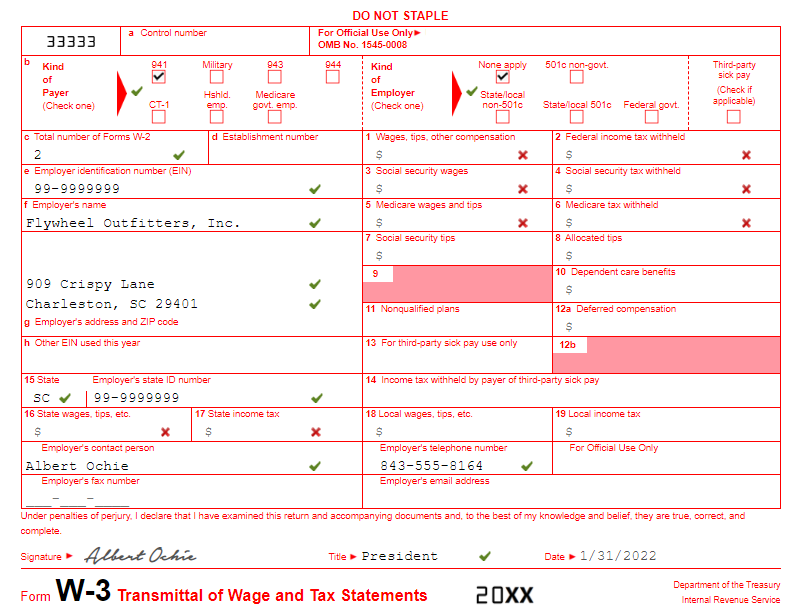

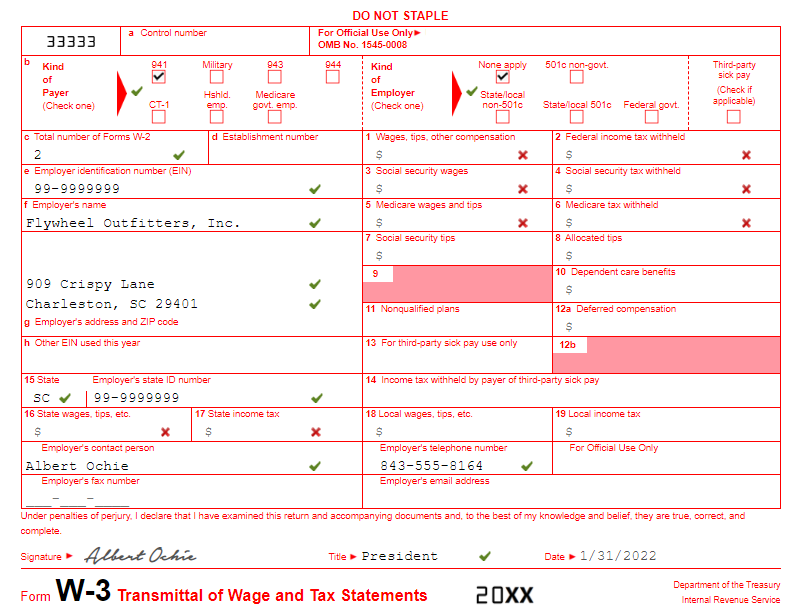

Complete the W-3 Form for Flywheel Outfitters, Inc. (employer identification \#99-9999999), based on the employee information listed below. The company is located at 909 Crispy Lane, Charleston, SC 29401 . and its South Carolina State ID number is the same as the federal identification number. The form is signed by the president of the company. Albert Ochie (telephone \#: 843-555-8164), and is submitted on the due date for e-filing. The company files Form 941 during the year, and selects 'none apply' in the Kind of Employer section. - Employee \#1: Julio Estevez is an employee of Flywheel Outfitters, Inc. Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were S82,476. 05 for the year, wiile these taxes were $8,645,$5,113.52, and $1,195.90, respectively. Annual union dues were $625. South Carolina income tax withholding was $5,773.32 (based on the same gross earnings amount as above), with no local taxes withheld. - Employee \#2: Albert Ochie is an employee of Flywheel Outitters, Inc. Gross eamings for federal income tax withholding, Social Security tax, and Medicare tax were $163,501.80 for the year, while these taxes were $15,270,$8,853.60, and $2,370.78 respectively. Annual union dues were $625, while Albert elects to have charitable contributions of $300 withheld. South Carolina income tax with $. $7,944.03 (based on the above gross earnings for federal income tax), with no local taxes withheld. Notes: - For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. DO NOT STAPLE Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete. Signature H Whert Oehie Tite President Date 1/31/2022 Form = Transmittal of Wage and Tax Statements Trapartment of the Treasury Complete the W-3 Form for Flywheel Outfitters, Inc. (employer identification \#99-9999999), based on the employee information listed below. The company is located at 909 Crispy Lane, Charleston, SC 29401 . and its South Carolina State ID number is the same as the federal identification number. The form is signed by the president of the company. Albert Ochie (telephone \#: 843-555-8164), and is submitted on the due date for e-filing. The company files Form 941 during the year, and selects 'none apply' in the Kind of Employer section. - Employee \#1: Julio Estevez is an employee of Flywheel Outfitters, Inc. Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were S82,476. 05 for the year, wiile these taxes were $8,645,$5,113.52, and $1,195.90, respectively. Annual union dues were $625. South Carolina income tax withholding was $5,773.32 (based on the same gross earnings amount as above), with no local taxes withheld. - Employee \#2: Albert Ochie is an employee of Flywheel Outitters, Inc. Gross eamings for federal income tax withholding, Social Security tax, and Medicare tax were $163,501.80 for the year, while these taxes were $15,270,$8,853.60, and $2,370.78 respectively. Annual union dues were $625, while Albert elects to have charitable contributions of $300 withheld. South Carolina income tax with $. $7,944.03 (based on the above gross earnings for federal income tax), with no local taxes withheld. Notes: - For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. DO NOT STAPLE Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete. Signature H Whert Oehie Tite President Date 1/31/2022 Form = Transmittal of Wage and Tax Statements Trapartment of the Treasury