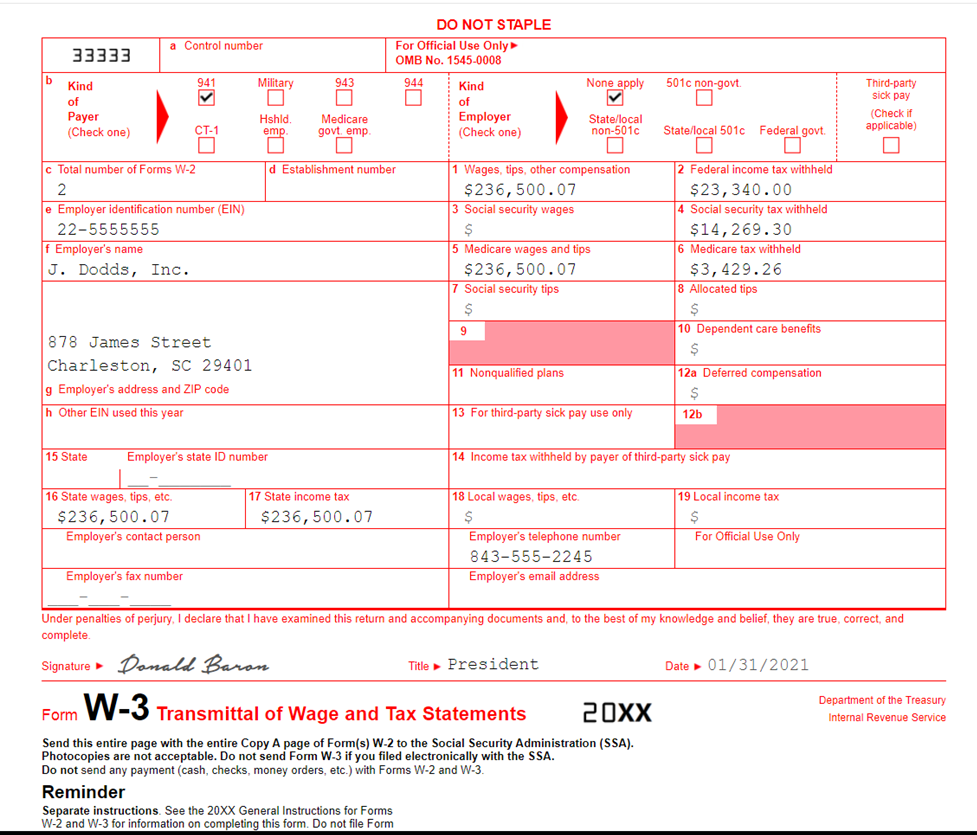

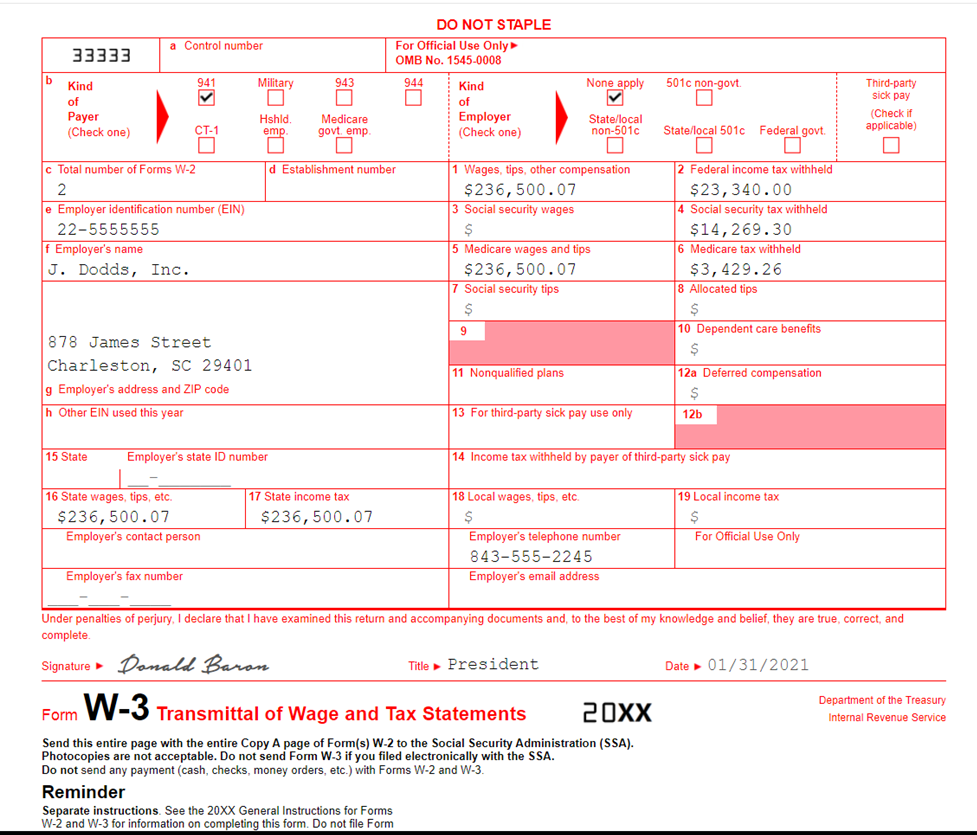

Complete the W-3 Form for J. Dodds, Inc. (employer identification #22-5555555), based on the employee information listed below. The company is located at 876 James Street, Charleston, SC 29401, and its South Carolina State ID number is the same as its federal identification number. The form is signed by the President of the company, Donald Baron (telephone #843-555-2245), and is submitted on the due date for e-filing. The company files Form 941 during the year and selects none apply in the Kind of Employer section.

- Employee #1: Donald Baron is an employee of J. Dodds, Inc. Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $92,450.05 for the year, while these taxes were $9,180, $5,731.90, and $1,340.53, respectively. Charitable contributions totaled $5,890 for the year, while the annual union dues were $750. South Carolina income tax withholding was $5,994 (based on the above gross earnings for federal income tax), with no local taxes withheld.

- Employee #2: Damian South is an employee of J. Dodds, Inc. Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $144,050.02 for the year, while these taxes were $14,160, $8,537.40, and $2,088.73, respectively. Annual union dues were $750, and Damian elects to have charitable contributions of $250 withheld. South Carolina income tax withholding was $9,134 (based on the above gross earnings for federal income tax), with no local taxes withheld.

Notes:

- For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Social Security need not exceed 137,700. Box 3 help.

a Control number DO NOT STAPLE For Official Use Only OMB No. 1545-0008 33333 941 Military 943 944 None apply 501c non-govt Kind of Payer (Check one) | Kind of Employer (Check one) Third-party sick pay (Check if applicable) CT-1 Hshid emp Medicare govt emp State/local non-501C State/local 501c Federal govt. d Establishment number c Total number of Forms W-2 2 e Employer identification number (EIN) 22-5555555 Employer's name J. Dodds, Inc. 1 Wages, tips, other compensation $236,500.07 Social security wages $ 5 Medicare wages and tips $236,500.07 7 Social security tips S 2 Federal income tax withheld $23, 340.00 4 Social security tax withheld $14,269.30 Medicare tax withheld $3,429.26 8 Allocated tips $ 10 Dependent care benefits $ 878 James Street Charleston, SC 29401 g Employer's address and ZIP code h Other EIN used this year 11 Nonqualified plans 12a Deferred compensation $ 13 For third-party sick pay use only 12b 15 State Employer's state ID number 14 Income tax withheld by payer of third-party sick pay 17 State income tax 16 State wages, tips, etc. $236,500.07 Employer's contact person $236,500.07 18 Local wages, tips, etc. $ Employer's telephone number 843-555-2245 Employer's email address 19 Local income tax $ For Official Use Only Employer's fax number Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete Signature Donald Baran Title President Date 01/31/2021 Department of the Treasury Internal Revenue Service Form W-3 Transmittal of Wage and Tax Statements 20XX Send this entire page with the entire Copy A page of Form(s) W-2 to the Social Security Administration (SSA). Photocopies are not acceptable. Do not send Form W-3 if you filed electronically with the SSA. Do not send any payment (cash, checks, money orders, etc.) with Forms W-2 and W-3 Reminder Separate instructions. See the 20XX General Instructions for Forms W-2 and W-3 for information on completing this form. Do not file Form a Control number DO NOT STAPLE For Official Use Only OMB No. 1545-0008 33333 941 Military 943 944 None apply 501c non-govt Kind of Payer (Check one) | Kind of Employer (Check one) Third-party sick pay (Check if applicable) CT-1 Hshid emp Medicare govt emp State/local non-501C State/local 501c Federal govt. d Establishment number c Total number of Forms W-2 2 e Employer identification number (EIN) 22-5555555 Employer's name J. Dodds, Inc. 1 Wages, tips, other compensation $236,500.07 Social security wages $ 5 Medicare wages and tips $236,500.07 7 Social security tips S 2 Federal income tax withheld $23, 340.00 4 Social security tax withheld $14,269.30 Medicare tax withheld $3,429.26 8 Allocated tips $ 10 Dependent care benefits $ 878 James Street Charleston, SC 29401 g Employer's address and ZIP code h Other EIN used this year 11 Nonqualified plans 12a Deferred compensation $ 13 For third-party sick pay use only 12b 15 State Employer's state ID number 14 Income tax withheld by payer of third-party sick pay 17 State income tax 16 State wages, tips, etc. $236,500.07 Employer's contact person $236,500.07 18 Local wages, tips, etc. $ Employer's telephone number 843-555-2245 Employer's email address 19 Local income tax $ For Official Use Only Employer's fax number Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete Signature Donald Baran Title President Date 01/31/2021 Department of the Treasury Internal Revenue Service Form W-3 Transmittal of Wage and Tax Statements 20XX Send this entire page with the entire Copy A page of Form(s) W-2 to the Social Security Administration (SSA). Photocopies are not acceptable. Do not send Form W-3 if you filed electronically with the SSA. Do not send any payment (cash, checks, money orders, etc.) with Forms W-2 and W-3 Reminder Separate instructions. See the 20XX General Instructions for Forms W-2 and W-3 for information on completing this form. Do not file Form