Question

Complete the W-3 Form for Shipbuilders of New England (employer identification #33-3333333). The company (located at 2 Hickory Trail, Pawtucket, RI 02860) does not use

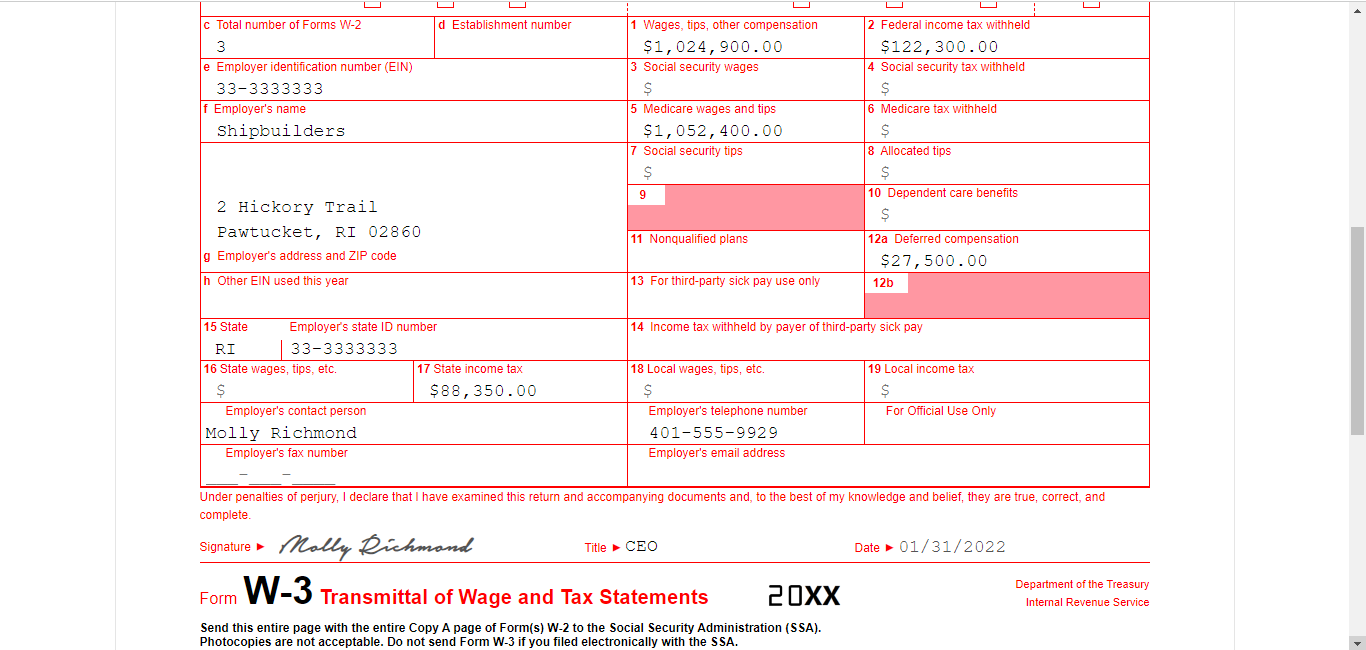

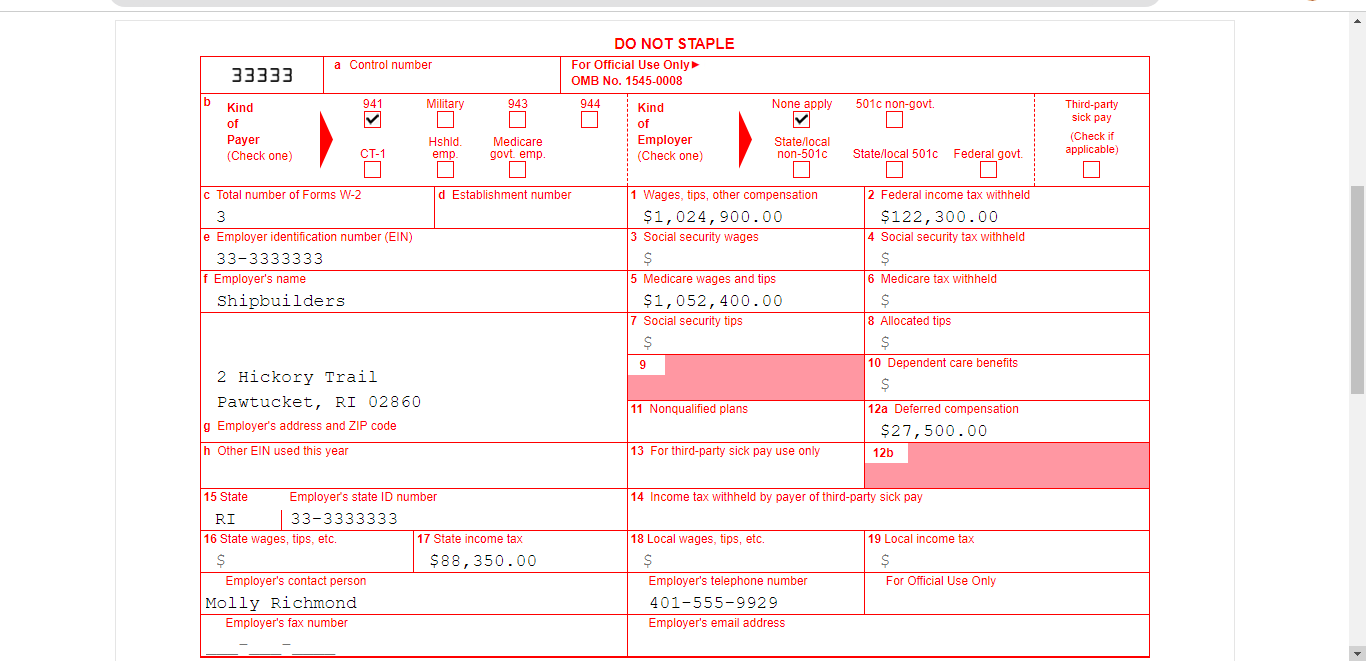

Complete the W-3 Form for Shipbuilders of New England (employer identification #33-3333333). The company (located at 2 Hickory Trail, Pawtucket, RI 02860) does not use control numbers. Total employee compensation (gross pay) for the year was $1,052,400, and annual retirement plan contributions totaled $27,500. Federal income tax withholding totaled $122,300 for the year. Only three of the nine employees have earnings subject to Social Security tax less than $142,800(these employees earnings were $98,400, $31,200 , and $13,600, respectively). Rhode Island state earnings subject to income tax withholding were the same as those subject to federal income tax withholding. State income tax withholding totaled $88,350, with no local taxes withheld. The employer's Rhode Island state ID number is the same as its federal identification number. The form is signed by the CFO of the company, Molly Richmond (telephone #401-555-9929), and is submitted on the due date for paper filings. The company files Form 941 during the year and selects "none apply" in the Kind of Employer section.

Notes: There are no rounding differences for Social Security tax or Medicare tax between withheld amounts and those that can be calculated by using the total taxable earnings for the year, and no employee was subject to Additional Medicare Tax during the year. For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

c Total number of Forms W-2 3 e Employer identification number (EIN) 33-3333333 f Employer's name Shipbuilders d Establishment number 1 Wages, tips, other compensation $1,024,900.00 3 Social security wages $ 5 Medicare wages and tips $1,052,400.00 7 Social security tips $ 9 2 Federal income tax withheld $122,300.00 4 Social security tax withheld $ 6 Medicare tax withheld $ 8 Allocated tips $ 10 Dependent care benefits $ 12a Deferred compensation $27,500.00 2 Hickory Trail Pawtucket, RI 02860 g Employer's address and ZIP code h Other EIN used this year 15 State RI Employer's state ID number |33-3333333 11 Nonqualified plans 13 For third-party sick pay use only 12b 14 Income tax withheld by payer of third-party sick pay 16 State wages, tips, etc. $ Employer's contact person Molly Richmond Employer's fax number 17 State income tax 18 Local wages, tips, etc. $88,350.00 $ Employer's telephone number 401-555-9929 Employer's email address 19 Local income tax $ For Official Use Only Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete. Signature Molly Richmond Title CEO Form W-3 Transmittal of Wage and Tax Statements Date 01/31/2022 20XX Department of the Treasury Internal Revenue Service Send this entire page with the entire Copy A page of Form(s) W-2 to the Social Security Administration (SSA). Photocopies are not acceptable. Do not send Form W-3 if you filed electronically with the SSA.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started