Complete the worksheet for Garner Management Service. You will need to complete columns (G, I, O, Q, S & U). Use tab Worksheet. Prepare the

-

Complete the worksheet for Garner Management Service. You will need to complete columns (G, I, O, Q, S & U). Use tab Worksheet.

-

Prepare the end-of-year adjusting journal entries using the adjusted trial-balance as the base. Use tab Adjusting Entries.

-

Using the completed worksheet from step #1, prepare the following financial statements:

-

Income Statement. Use tab Income Statement.

-

Statement of retained earnings (the beginning balance was $42,000). Use tab

Retained earning.

-

A classified Balance Sheet. (Note: $25,000 of the mortgage payable is due for payment next year). Use tab Balance Sheet.

-

-

Journalize the closing entries. Use tab Closing Entries.

-

Prepare the post-closing trial balance. Use tab Post Closing Trial Balance.

-

Prepare the following rations ratios: (Use tab Ratios).

-

Current Ratio

-

Working Capital

-

Debt Ratio

-

Accounts Receivable Turnover

-

Deb Equity

-

Return on total assets

-

Additional information:

-

The ending balance for the total assets for 2013 was $375,950.

-

During 2014 only service revenue was 100% on credit and rent revenue was on cash.

-

The ending balance for accounts receivable for 2013 was $50,500.

Need help with 4,5,6 thanks!

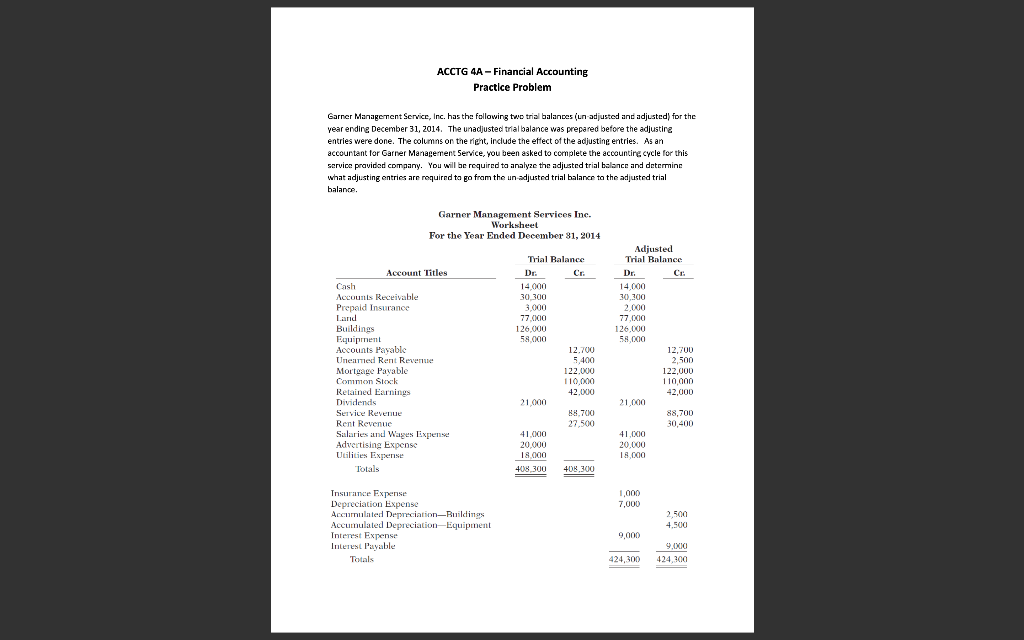

ACCTG 4A - Financial Accounting Practice Problem Garner Management Service, Inc. has the following two trial balances (un-adjusted and adjusted for the year ending December 31, 2014. The unadjusted trial balance was prepared before the adjustire entries were done. The columns on the rient, include the effect of the adjusting entries. As an accountant for Garner Management Service, you been asked to complete the accounting cycle for this service provided company. You will be required to analyze the adjusted trial balance and determine what adjusting entries are roquired to go from the un-adjusted trial balance to the adjusted trial balance Garner Management Services Inc. Worksheet For the Year Ended December 81, 2014 Account Titles Cash Accounts Receivable Prepeld Insurance Larid Buildings Equipment Accounts Payable Uneamed Rent Revenue Mortgage Payable Common Stock Retained Earnings Dividends Service Revente Rent Revenue Salaries and Wages lixpense Advertising Expense Utilities Expense Totals Trial Balance Dr. CG 14.000 30,300 3,000 77.XIC 126,000 58.XIO 12.700 5,400 122.000 110,000 42.000 21000 8.700 27.500 41.00 20,000 18.000 408 300 408.300 Adjusted Trial Balance Dr. CE 14,000 30,300 2.000 77.xia 126,000 58.000 12,700 2,500 122,000 110,000 42,000 21.000 88,700 30,400 41. (XIO 20.000 19.000 1,000 7,000 Insurance Expense Depreciation Expense Accumulated Depreciation-Buildings Accumulated Depreciation Equipment Interest Expense Interest Payable Totals 2.500 4.500 9,000 9.XX 424,300 424,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started