Answered step by step

Verified Expert Solution

Question

1 Approved Answer

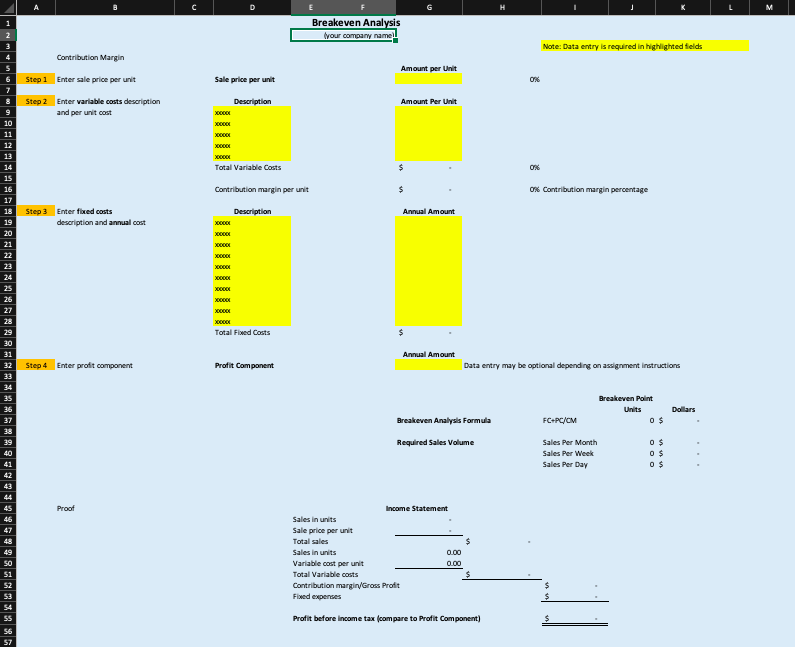

complete this breakeven analysis based on this information. Business Description Nate's Creative Woodworking is a small business that specializes in crafting custom wood furniture and

complete this breakeven analysis based on this information.

Business Description

Nate's Creative Woodworking is a small business that specializes in crafting custom wood furniture and dcor items. The business is based in a small workshop in the owner's backyard, and it operates as a parttime venture alongside the owner's fulltime job. Nate's Creative Woodworking caters to a local clientele, primarily individuals and businesses seeking unique and personalized pieces.

Fixed Costs

Rent: Nate's Creative Woodworking does not incur any rent expenses as the workshop is located in the owner's backyard.

Owner Salary: As a parttime venture, Nate does not draw a regular salary from the business. However, the owner's time and effort are considered a fixed cost for the purpose of breakeven analysis.

Owner Taxes: Owner's taxes are estimated at of the owner's assumed annual salary of $ resulting in an annual fixed cost of $

Advertising: Nate's Creative Woodworking primarily relies on wordofmouth marketing and social media presence, incurring minimal advertising expenses.

Equipment Lease: Nate has invested in essential woodworking tools, such as power saws, sanders, and drills. The annual equipment lease cost is approximately $

Miscellaneous: Miscellaneous fixed costs include items such as business licenses, insurance, and utilities, amounting to approximately $ per year.

Profit Component

The desired profit component for Nate's Creative Woodworking is set at $ per year. This amount represents a fair compensation for the owner's time and effort while ensuring the business remains sustainable.

Summarizing Findings

Based on the breakeven analysis, Nate's Creative Woodworking needs to sell approximately pieces of custom furniture or dcor items per year to break even. This translates to selling an average of units per month or units per week. The analysis also indicates that the business has the potential to generate a profit of $ per year if it can reach its sales target.

Optimize pricing strategies: Evaluate pricing strategies to ensure they align with the value of the products and remain competitive within the local market.

Monitor expenses: Regularly review expenses and identify opportunities to reduce costs without compromising quality or customer satisfaction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started