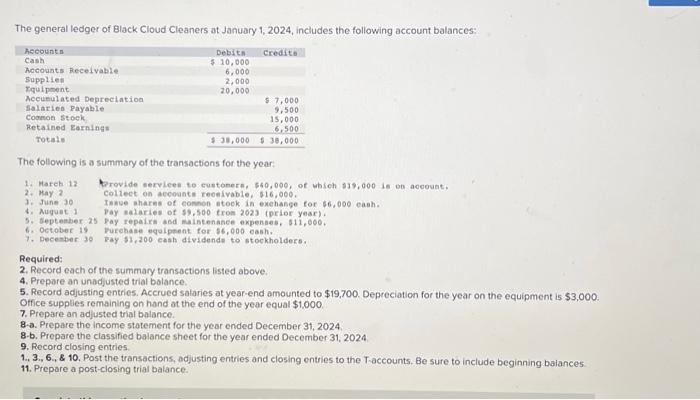

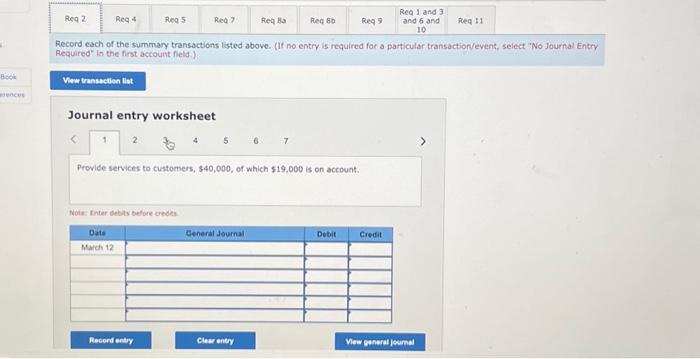

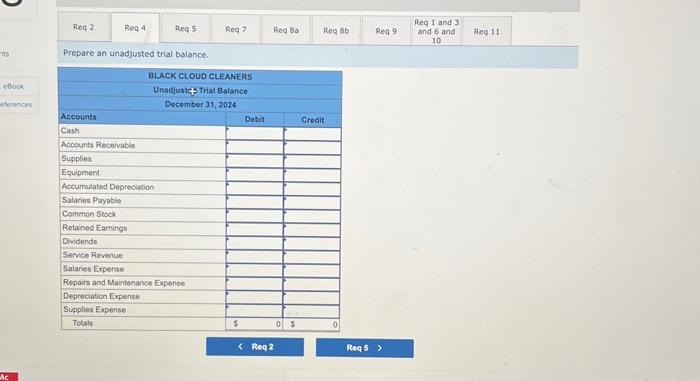

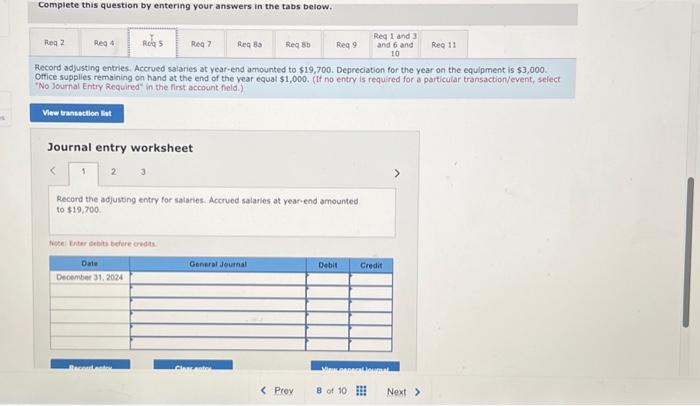

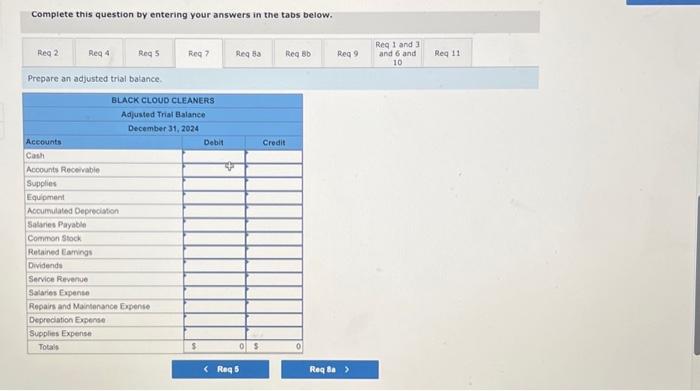

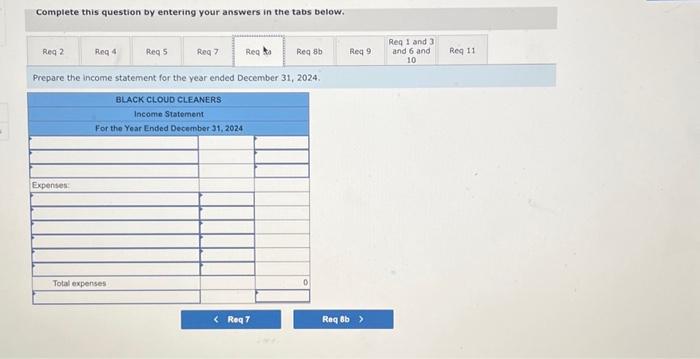

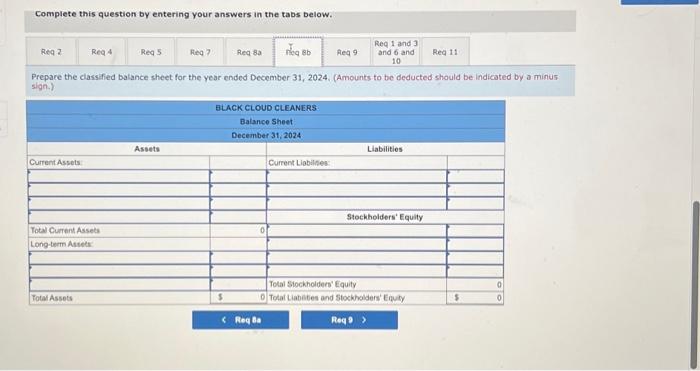

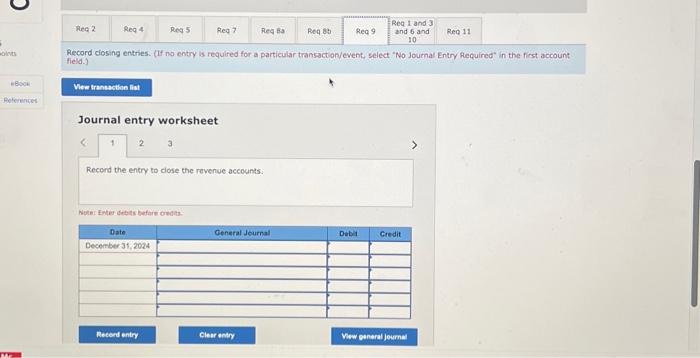

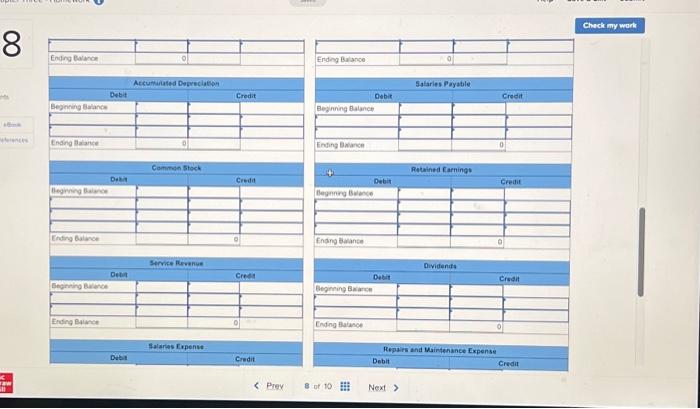

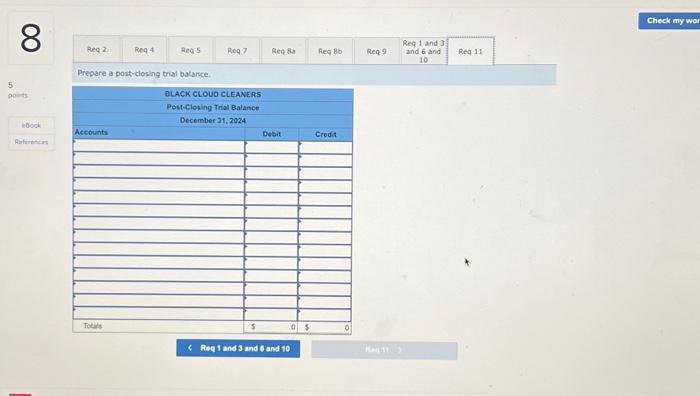

Complete this question by entering your answers in the tabs below. Prepare the classified balance sheet for the year ended December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) Complete this question by entering your answers in the tabs below. Prepare the income statement for the year ended December 31,2024. Prepare a post-closing trat balance 8 Complete this question by entering your answers in the tabs below. Record adjusting entries. Accrued salaries at year-end amounted to $19,700. Depreciation for the year on the equipment is $3,000. Otfice supplies remaining on hand at the end of the vear equal $1,000. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account fleld.) Journal entry worksheet Record the adjusting entry for salaries. Accrued salarles at year-end amounted to $19,700. hoce: Enter tebitu behere crndas. Record closing entries. (If no enty is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry to dose the revenue accounts. Woter Enter Gebits befare ondits. lecord each of the summary transactions listed above. (If no entry is required for a particular transactionvevent, select "No Journal Entry tequired" in the first account field.) Journal entry worksheet 234567 Provide services to customers, $40,000, of which $19,000 is on account. Nots: Enter debts before credes. The general ledger of Black Cloud Cleaners at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. Hareb 12 2. May ? 3. June 30 4. Auguet 1 5. Septenber 2 6. Oetober is 7. Decenber 38 brovide servicen to customern, 540,000 , of which $39,000 is ob acooust. Collect on accounts reosivable, $16,000. Isnue sharns of comon stoek in exehasge for $6,000 eash. vay salaries of $9,500 tron 2023 (prier year). pay repairs asd maistenahe expenses, $11,000, Furchase equiptent for 56,000 cash. pay $1,200 eash dividends to stockholders. Required: 2. Record each of the summary transoctions listed above. 4. Prepare an unadjusted trial bolance. 5. Record adjusting entries. Accrued salaries at year-end amounted to $19,700. Depreciation for the year on the equipment is $3,000. Office supplies remaining on hand at the end of the year equal $1,000. 7. Prepare an adjusted trial balance. 8-a. Prepare the income statement for the year ended December 31, 2024 8-b. Prepare the classified balance sheet for the year ended December 31,2024 9. Record closing entries. 1., 3., 6, \& 10. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning baiances. 11. Prepare a post-closing trial balance. Prepare an unadjusted trial balance. Complete this question by entering your answers in the tabs below. Prepare an adjusted trial batance