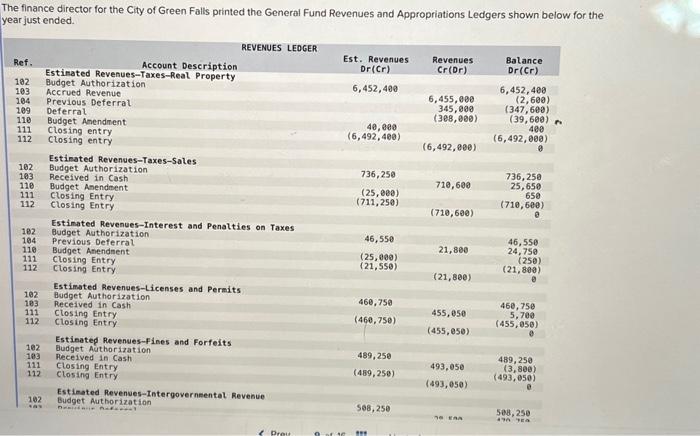

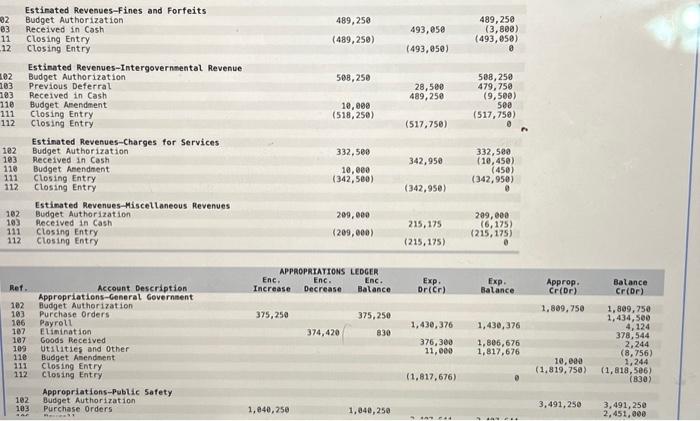

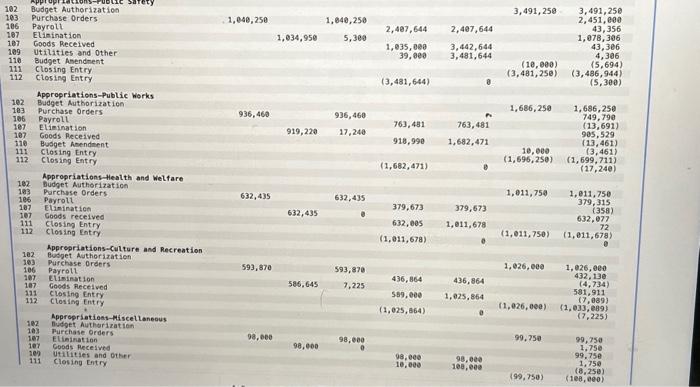

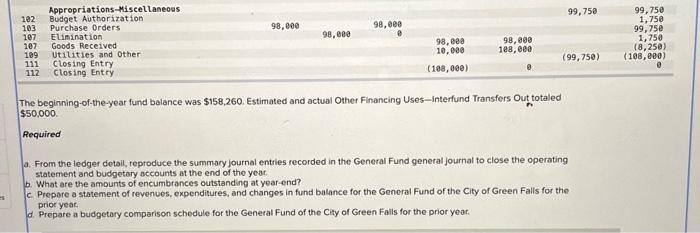

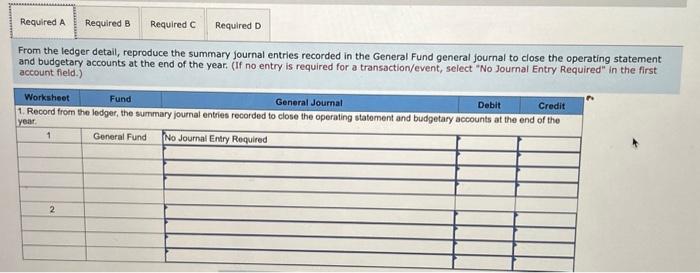

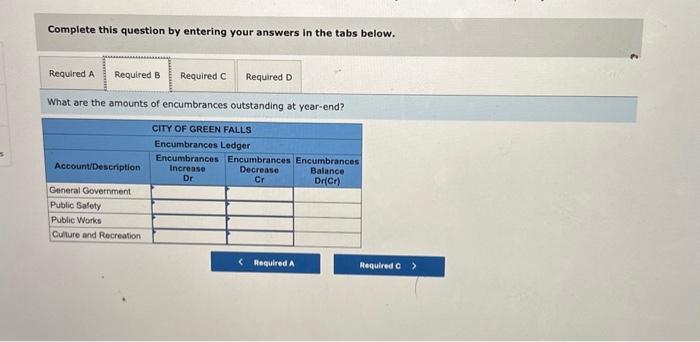

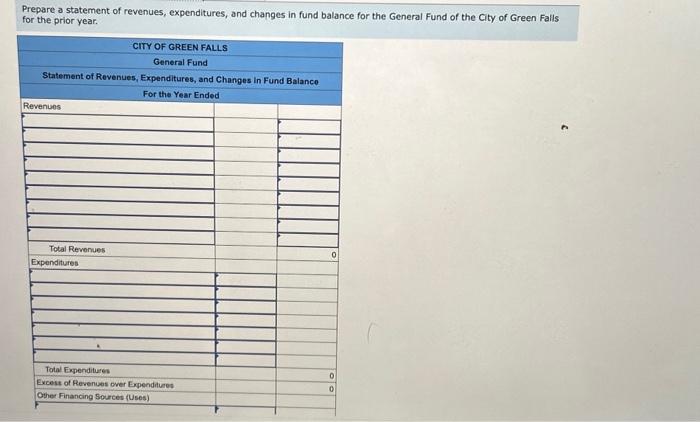

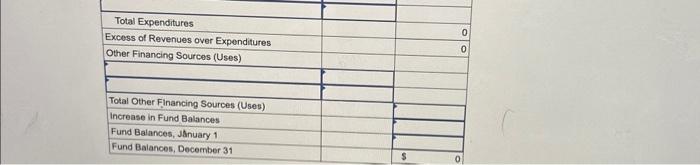

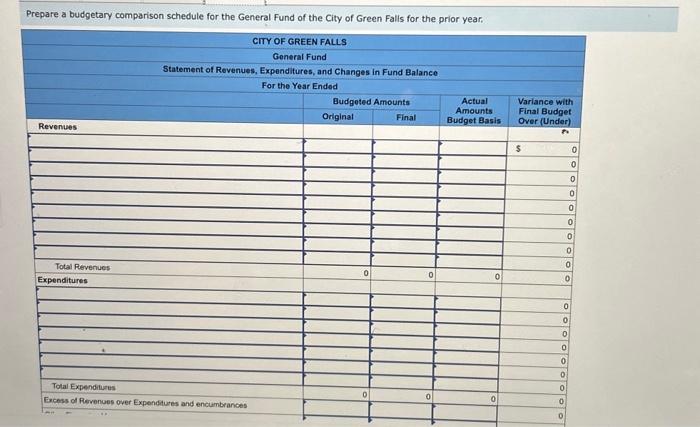

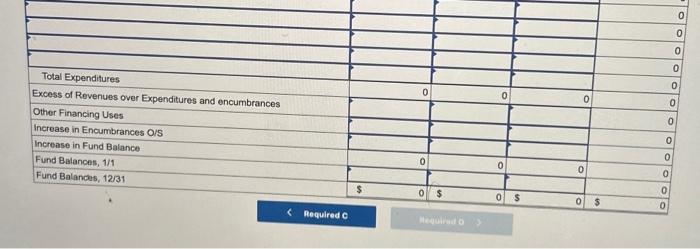

Complete this question by entering your answers in the tabs below. What are the amounts of encumbrances outstanding at year-end? \begin{tabular}{|c|c|} \hline Total Expenditures & 0 \\ \hline Excess of Revenues over Expenditures & 0 \\ \hline Other Financing Sources (Uses) & \\ \hline & \\ \hline & \\ \hline Total Other Flnancing Sources (Uses) & \\ \hline Increase in Fund Balances & \\ \hline Fund Balances, JAnuary 1 & \\ \hline Fund Baiances, December 31 & $ \\ \hline \end{tabular} The beginning-of-the-year fund balance was $158,260. Estimated and actual Other Financing Uses-Interfund Transfers Out totaled $50.000. Required a. From the ledger detail, reproduce the summary journal entries recorded in the General Fund general journal to close the operating statement and budgetary accounts at the end of the year. b. What are the amounts of encumbrances outstanding at year-end? c. Prepare a statement of revenues, expenditures, and changes in fund balance for the General Fund of the City of Green Falls for the prior year. d. Prepare a budgetary comparison schedule for the General Fund of the City of Green Falls for the prior year. Prepare a statement of revenues, expenditures, and changes in fund balance for the General Fund of the City of Green Falls for the prior year. he finance director for the City of Green Falls printed the General Fund Revenues and Appropriations Ledgers shown below for the ear just ended. From the ledger detail, reproduce the summary journal entries recorded in the General Fund general journal to close the operating statement and budgetary accounts at the end of the year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Estinated Revenues-Fines and Forfeits Budget Authorization Received in Cosh Closing Entry Closing Entry 489,256 (489,250) 493, ese 489,250 (3,800) (493,050) (493,65e) Estinated Revenues-Intergovernmental Revenue Budget Authorization Previous Deferral. Received in Cash Budget Amendment Closing Entry Closing Entry 508,250 Estinated Revenues-Charges for Services Budget Authorization Received in Cash Budget Anendnent 28,500 489,250 508,250 Closing Entry 10,000 479,758 (9,500) (518,250) (517,750) Closing Entry 332,500 (517,750) 0 . 122103110111112BudgetAutInCReceivedinBudgetAnendnClosingEntryClosingEntry 10,000 342,950 332,5e0 (342,500) (10,450) Estinated Revenues-Miscellaneous Revenues Budget Authorization Aeceived in Cash 209,000 Closing Entry (209,000) (342,950) (342,950) Closing Entry (215,175) 209, eee 103 Peceived in Cash 111 Closing Entry 112 Closing Entry (215,175) \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline Ref. & \begin{tabular}{l} Account Description \\ Appropriations-General Governnent \end{tabular} & \begin{tabular}{c} APP \\ Enc. \\ Increase \end{tabular} & \begin{tabular}{l} opriatrons \\ Enc. \\ Decrease \end{tabular} & \begin{tabular}{l} LEDGER \\ EnC. \\ Balance \end{tabular} & \begin{tabular}{c} Exp. \\ Dr(Cr) \end{tabular} & \begin{tabular}{l} Exp. \\ Balance \end{tabular} & \begin{tabular}{l} Approp: \\ Cr(Dr) \end{tabular} & \begin{tabular}{l} Balance \\ Cr(Dr) \end{tabular} \\ \hline 182 & \begin{tabular}{l} Appropriations-General Governent \\ Budget Authorization \end{tabular} & & & & & & 1,809,750 & \\ \hline 103 & Purchase orders & 375,250 & & 375,250 & & & 1,869,750 & \begin{tabular}{l} 1,809,750 \\ 1,434,500 \end{tabular} \\ \hline 186 & Peyroli & & & & 1,430,376 & 1,430,376 & & 4,124 \\ \hline 107 & Elinination & & 374,420 & 830 & & & & 378,544 \\ \hline 107 & Goods Received & & & & 376,300 & 1,806,676 & & 2,244 \\ \hline \begin{tabular}{l} 109 \\ 110 \end{tabular} & \begin{tabular}{l} Utilities and other \\ Budget Amendinent. \end{tabular} & & & & 11,000 & 1,817,676 & & (8,756) \\ \hline \begin{tabular}{l} 110 \\ 111 \end{tabular} & \begin{tabular}{l} Budget Amendinent \\ Closing Entry \end{tabular} & & & & & & 10, eas & 1,244 \\ \hline 112 & \begin{tabular}{l} Closing Entry \\ Closing Entry \end{tabular} & & & & (1,817,676) & & (1,819,750) & \begin{tabular}{r} (1,818,5e6) \\ (830) \end{tabular} \\ \hline & \begin{tabular}{l} Appropriations-Public safety \\ Budget Authorization \end{tabular} & & & & & & & \\ \hline 103 & \begin{tabular}{l} Oudget Authorization \\ Purchase Orders \end{tabular} & 1,840,250 & & 1,34a,250 & & & 3,491,250 & \begin{tabular}{l} 3,491,250 \\ 2,451,000 \end{tabular} \\ \hline \end{tabular} Prepare a budgetary comparison schedule for the General Fund of the City of Green Falls for the prior year