Answered step by step

Verified Expert Solution

Question

1 Approved Answer

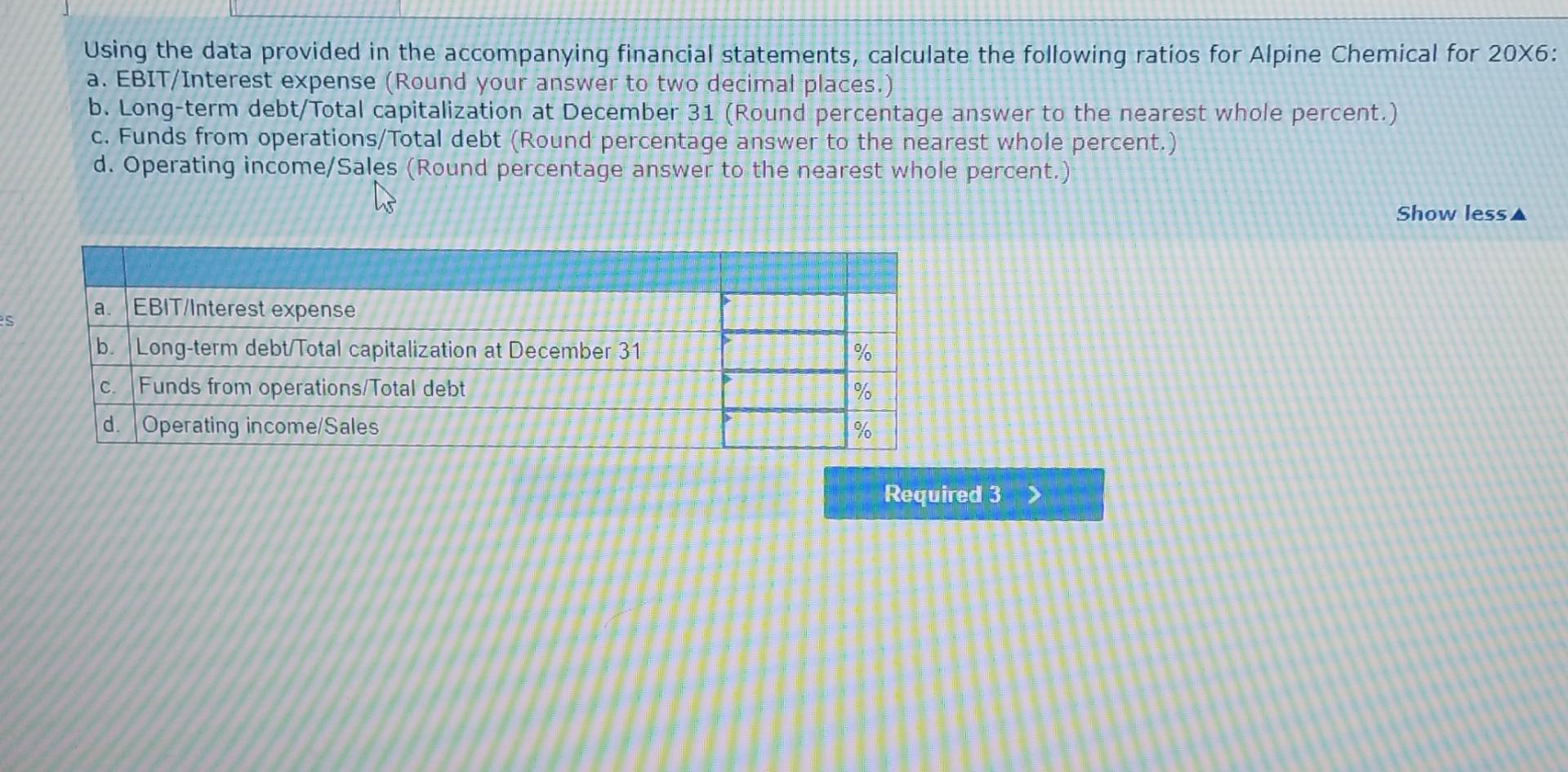

Complete this question by entering your answers in the tabs below. Using the data provided in the accompanying financial statements, calculate the following ratios for

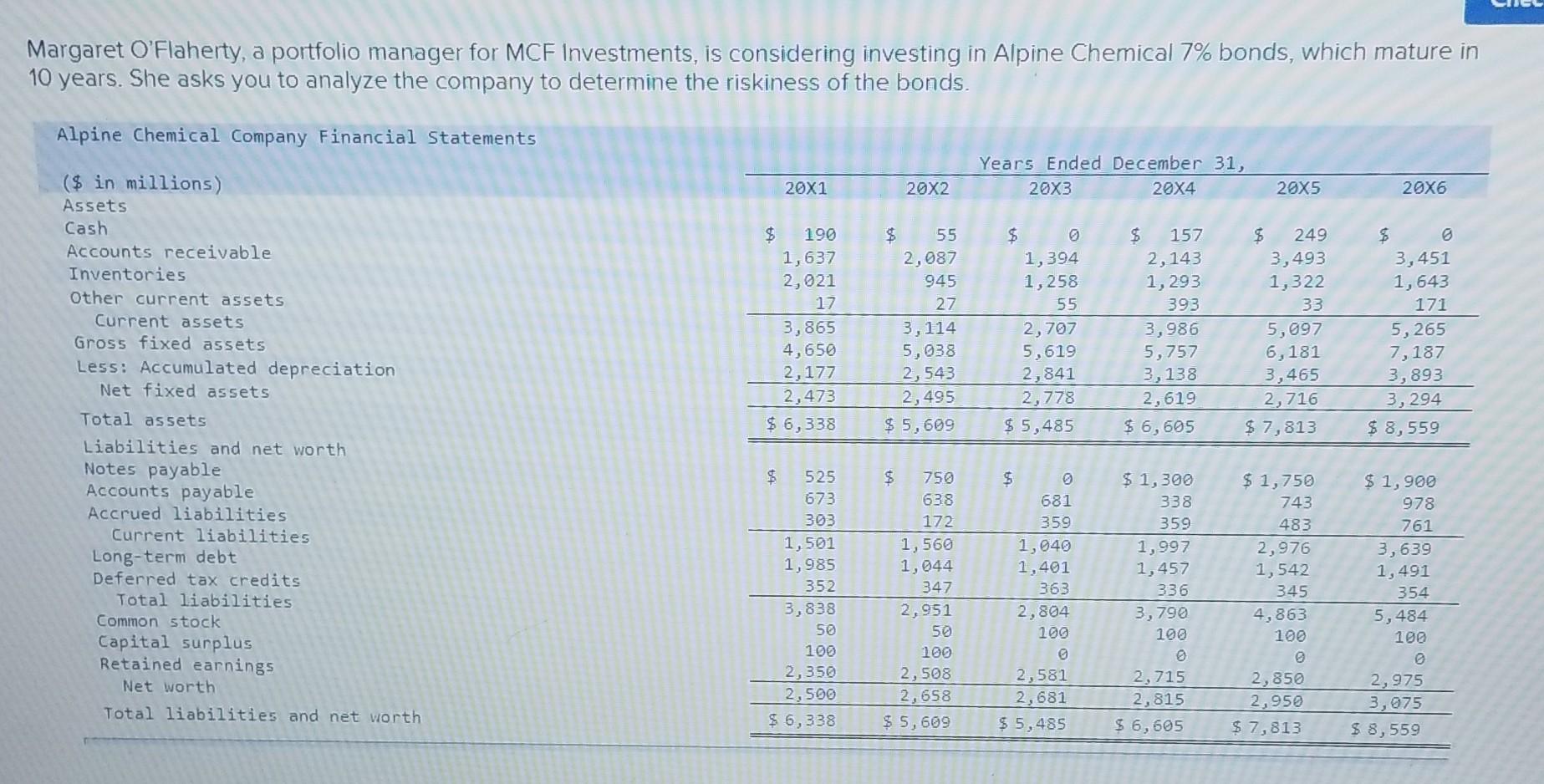

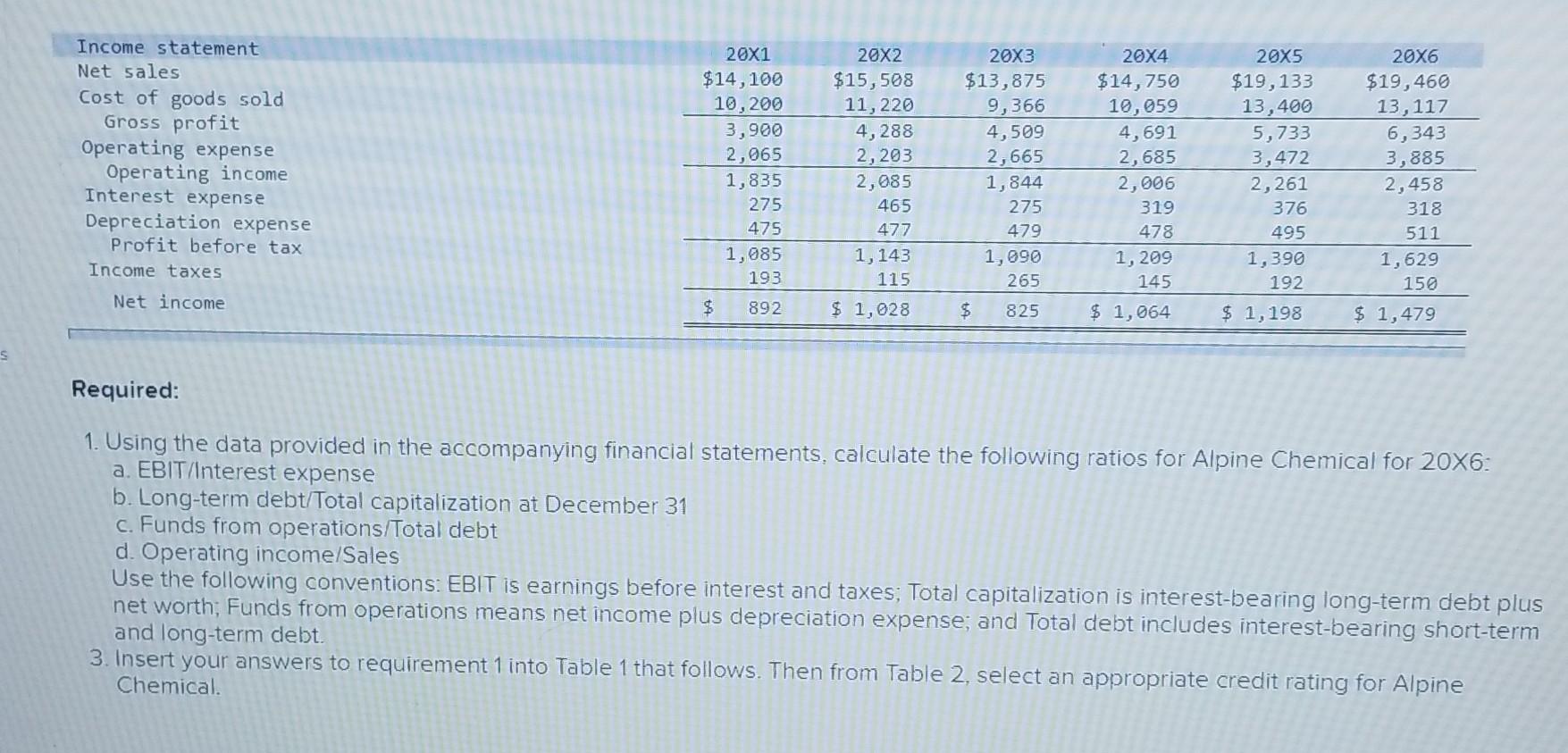

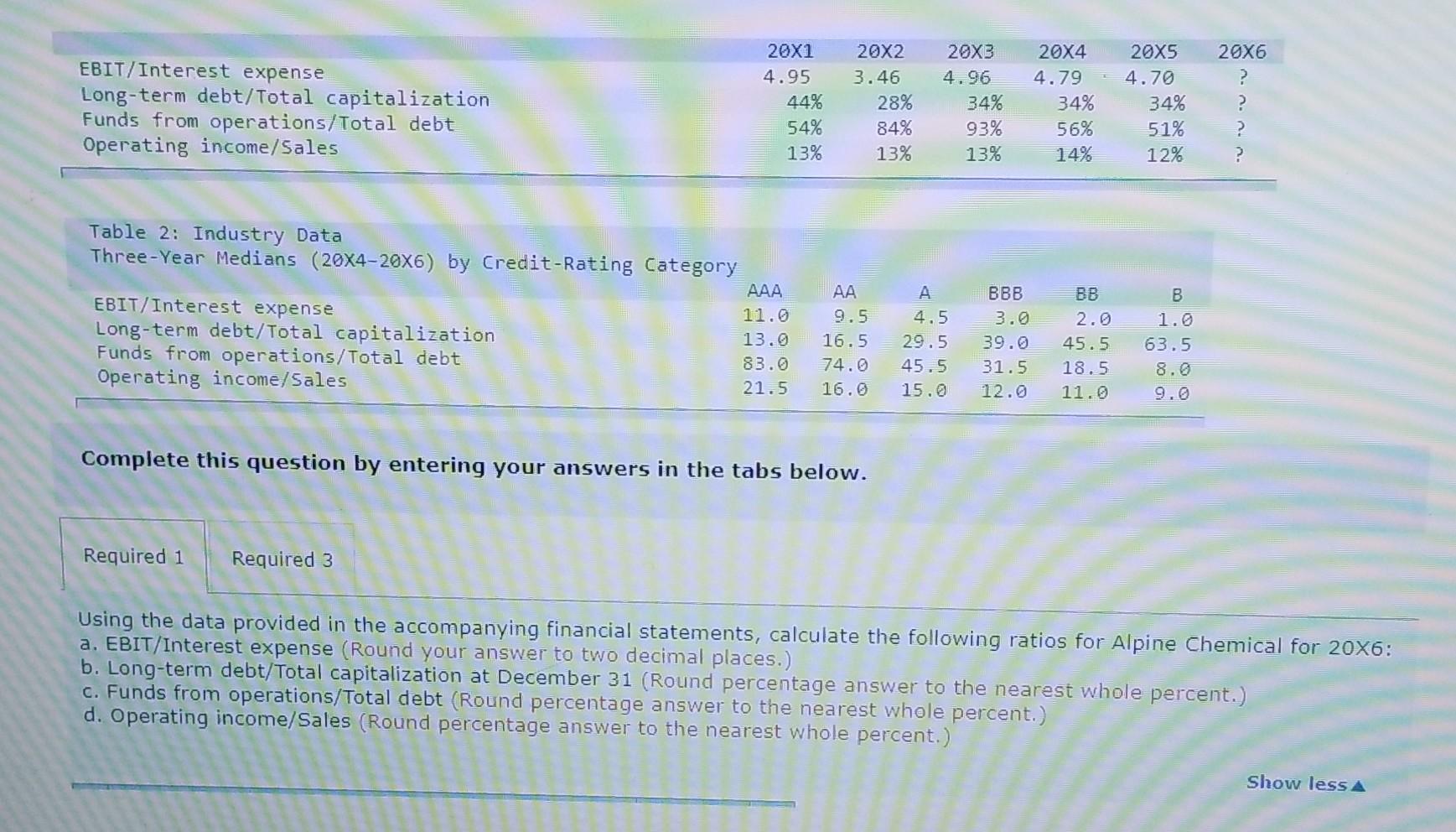

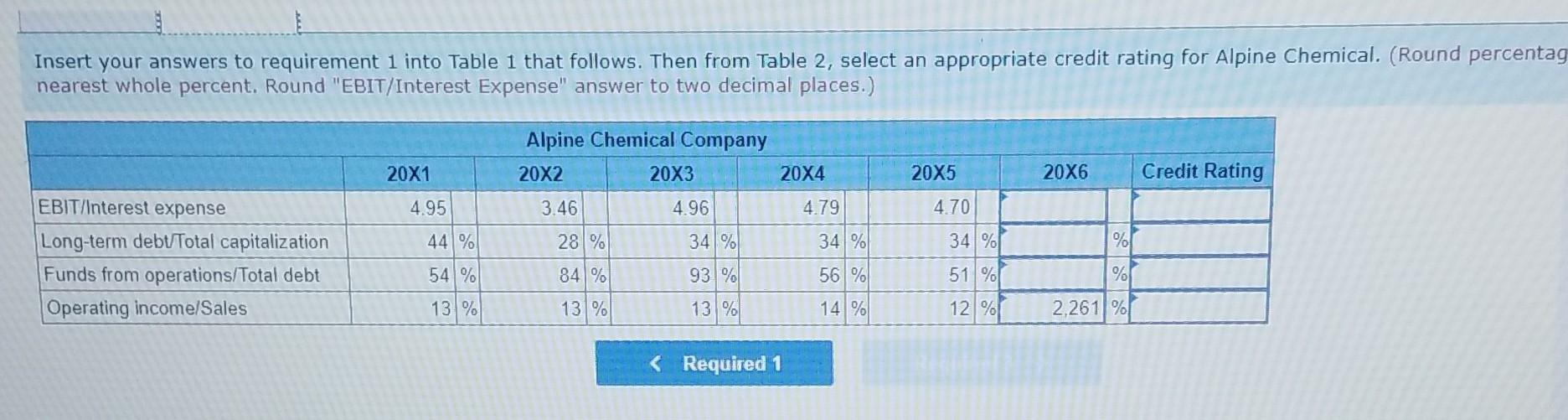

Complete this question by entering your answers in the tabs below. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 20X6: a. EBIT/Interest expense (Round your answer to two decimal places.) b. Long-term debt/Total capitalization at December 31 (Round percentage answer to the nearest whole percent.) c. Funds from operations/Total debt (Round percentage answer to the nearest whole percent.) d. Operating income/Sales (Round percentage answer to the nearest whole percent.) 1. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 206 : a. EBIT/Interest expense b. Long-term debt/Total capitalization at December 31 c. Funds from operations/Total debt d. Operating income/Sales Use the following conventions: EBIT is earnings before interest and taxes; Total capitalization is interest-bearing long-term debt plu net worth; Funds from operations means net income plus depreciation expense; and Total debt includes interest-bearing short-term and long-term debt. 3. Insert your answers to requirement 1 into Table 1 that follows. Then from Table 2, select an appropriate credit rating for Alpine Chemical. Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in 10 years. She asks you to analyze the company to determine the riskiness of the bonds. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 206 : a. EBIT/Interest expense (Round your answer to two decimal places.) b. Long-term debt/Total capitalization at December 31 (Round percentage answer to the nearest whole percent.) c. Funds from operations/Total debt (Round percentage answer to the nearest whole percent.) d. Operating income/Sales (Round percentage answer to the nearest whole percent.) Insert your answers to requirement 1 into Table 1 that follows. Then from Table 2, select an appropriate credit rating for Alpine Ch nearest whole percent. Round "EBIT/Interest Expense" answer to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started