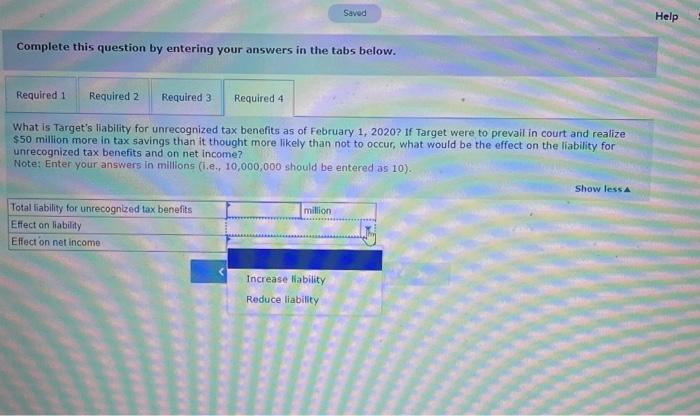

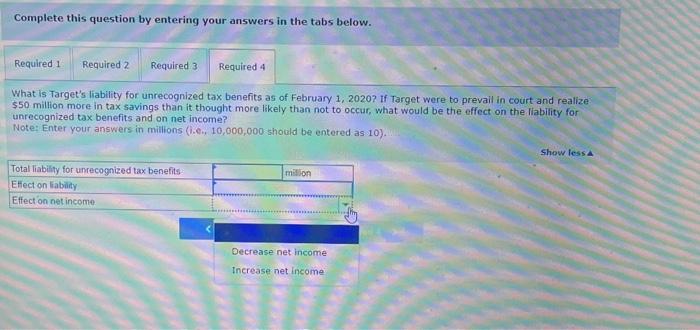

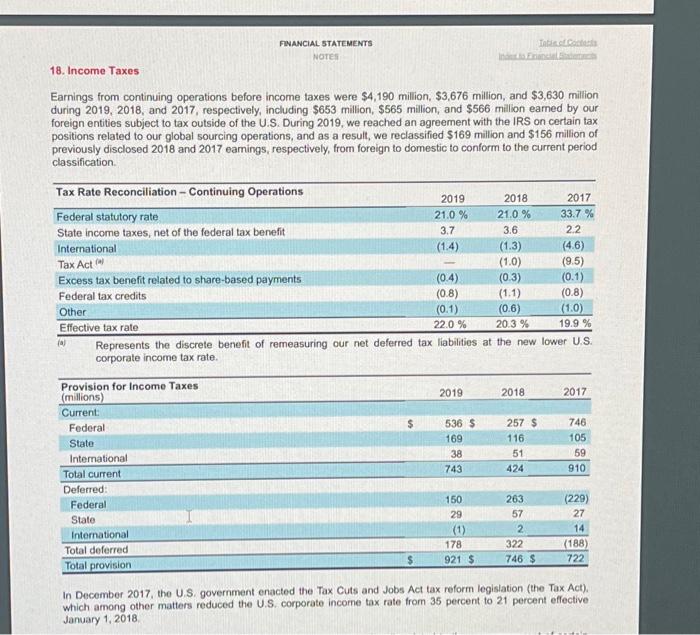

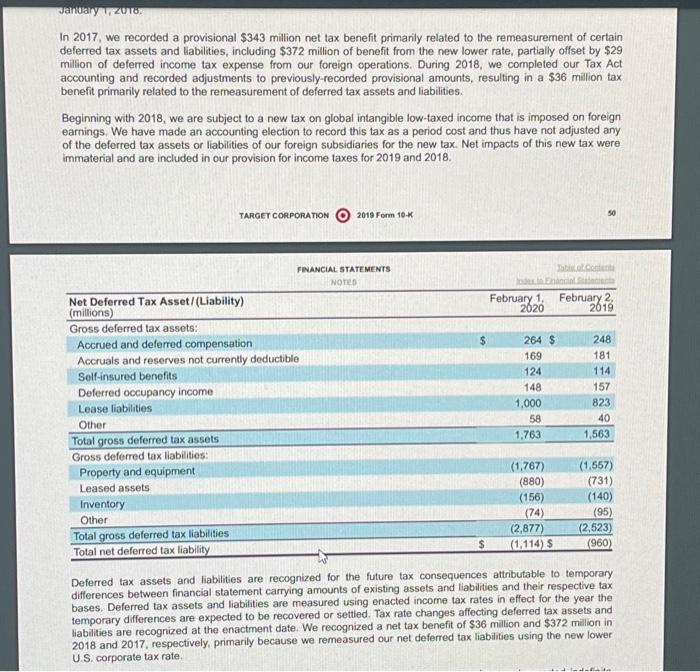

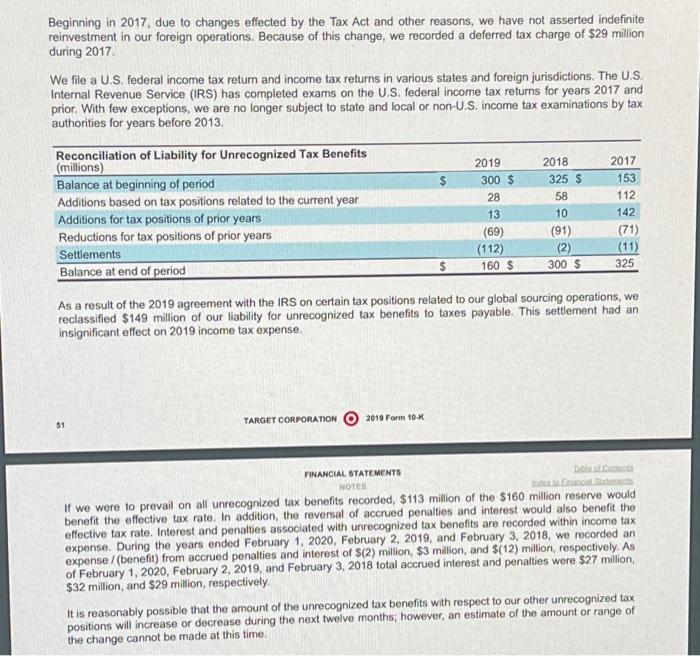

Complete this question by entering your answers in the tabs below. What is Target's liability for unrecognized tax benefits as of February 1, 2020? If Target were to prevail in court and realize $50 million more in tax savings than it thought more likely than not to occur, what would be the effect on the liability for unrecognized tax benefits and on net income? Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Earnings from continuing operations before income taxes were $4,190 million, $3,676 million, and $3,630 million during 2019,2018, and 2017, respectively, including $653 million, $565 million, and $566 million eamed by our foreign entities subject to tax outside of the U.S. During 2019, we reached an agreement with the IRS on certain tax positions related to our global sourcing operations, and as a result, we reclassified $169 million and $156 million of previously disclosed 2018 and 2017 earnings, respectively, from foreign to domestic to conform to the current period classification. (a) Represents the discrete benefit of remeasuring our net deferred tax liabilities at the new lower U.S. corporate income tax rate. In December 2017, the U.S. government enacted the Tax Cuts and Jobs Act tax reform legislation (the Tax Act). which among other matters reduced the U.S. corporate incorne tax rate from 35 percent to 21 percent effective January 1,2018 Complete this question by entering your answers in the tabs below. What is Target's liability for unrecognized tax benefits as of February 1,2020? If Target were to prevail in court and realize $50 million more in tax savings than it thought more likely than not to occur, what would be the effect on the liability for unrecognized tax benefits and on net income? Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Beginning in 2017, due to changes effected by the Tax Act and other reasons, we have not asserted indefinite reinvestment in our foreign operations. Because of this change, we recorded a deferred tax charge of $29 million during 2017. We file a U.S. federal income tax return and income tax returns in various states and foreign jurisdictions. The U.S Internal Revenue Service (IRS) has completed exams on the U.S. federal income tax returns for years 2017 and prior. With few exceptions, we are no longer subject to state and local or non-U.S. income tax examinations by tax authorities for years before 2013. As a result of the 2019 agreement with the IRS on certain tax positions related to our global sourcing operations, we reclassified $149 million of our liability for unrecognized tax benefits to taxes payable. This settlement had an insignificant effect on 2019 income tax expense. 51 TARGET CORPORATION 2010 Form 10K RINANCLAL STATEMENTS Tabuetconiunta work: If we were to prevail on all unrecognized tax benefits recorded, $113 million of the $160 million reserve would benefit the effoctive tax rate. In addition, the reversal of accrued penalties and interest would also benefit the effective tax rate. Interest and penalties associated with unrecognized tax benefits are recorded within income tax expense. During the years ended February 1, 2020, February 2, 2019, and February 3, 2018, we recorded an expense / (benefit) from accrued penalties and interest of \$(2) million, \$3 million, and \$(12) miltion, respectively. As of February 1, 2020, February 2, 2019, and February 3, 2018 total accrued interest and penalties were $27 million, $32 million, and $29 million, respectively. It is reasonably possible that the amount of the unrecognized tax benefits with respect to our other unrecognized tax positions will increase or decrease during the next twelve months; however, an estimate of the amount or range of the change cannot be made at this time. In 2017, we recorded a provisional $343 million net tax benefit primarily related to the remeasurement of certain deferred tax assets and liabilities, including $372 million of benefit from the new lower rate, partially offset by $29 million of deferred income tax expense from our foreign operations. During 2018, we completed our Tax Act accounting and recorded adjustments to previously-recorded provisional amounts, resulting in a $36 million tax benefit primarily related to the remeasurement of deferred tax assets and liabilities. Beginning with 2018, we are subject to a new tax on global intangible low-taxed income that is imposed on foreign earnings. We have made an accounting election to record this tax as a period cost and thus have not adjusted any of the deferred tax assets or liabilities of our foreign subsidiaries for the new tax. Net impacts of this new tax were immaterial and are included in our provision for income taxes for 2019 and 2018. TARGET CORPORATION 2019 Form 10K 50 Deferred tax assets and liabilities are recognized for the future tax consequences attributable to temporary differences between financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted income tax rates in effect for the year the temporary differences are expected to be recovered or settled. Tax rate changes affecting deferred tax assets and liabilities are recognized at the enactment date. We recognized a net tax benefit of $36 million and $372 million in 2018 and 2017, respectively, primarily because we remeasured our net deferred tax liabilities using the new lower U.S. corporate tax rate