Answered step by step

Verified Expert Solution

Question

1 Approved Answer

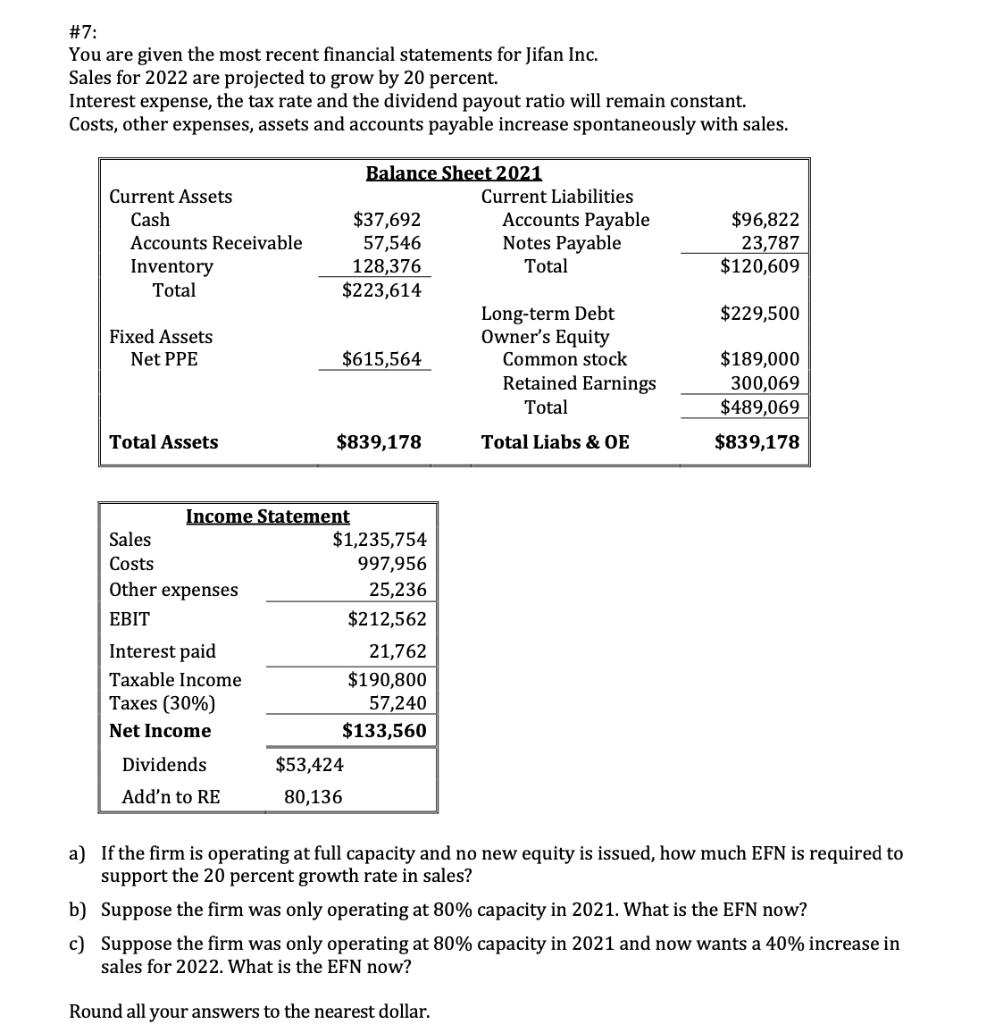

#7: You are given the most recent financial statements for Jifan Inc. Sales for 2022 are projected to grow by 20 percent. Interest expense,

#7: You are given the most recent financial statements for Jifan Inc. Sales for 2022 are projected to grow by 20 percent. Interest expense, the tax rate and the dividend payout ratio will remain constant. Costs, other expenses, assets and accounts payable increase spontaneously with sales. Current Assets Cash Accounts Receivable Inventory Total Fixed Assets Net PPE Total Assets Sales Costs Other expenses EBIT Interest paid Taxable Income Taxes (30%) Net Income Dividends Add'n to RE $37,692 57,546 128,376 $223,614 Income Statement Balance Sheet 2021 $615,564 $839,178 $1,235,754 997,956 25,236 $212,562 21,762 $190,800 57,240 $133,560 $53,424 80,136 Current Liabilities Accounts Payable Notes Payable Total Long-term Debt Owner's Equity Common stock Retained Earnings Total Total Liabs & OE $96,822 23,787 $120,609 $229,500 $189,000 300,069 $489,069 $839,178 a) If the firm is operating at full capacity and no new equity is issued, how much EFN is required to support the 20 percent growth rate in sales? b) Suppose the firm was only operating at 80% capacity in 2021. What is the EFN now? c) Suppose the firm was only operating at 80% capacity in 2021 and now wants a 40% increase in sales for 2022. What is the EFN now? Round all your answers to the nearest dollar.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the External Financing Needed EFN in each scenario we need to determine the additional funds required to support the projected sales grow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started