Answered step by step

Verified Expert Solution

Question

1 Approved Answer

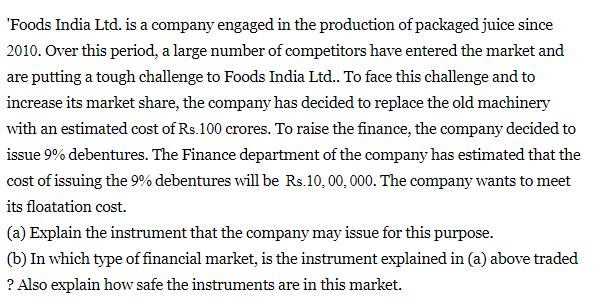

'Foods India Ltd. is a company engaged in the production of packaged juice since 2010. Over this period, a large number of competitors have

'Foods India Ltd. is a company engaged in the production of packaged juice since 2010. Over this period, a large number of competitors have entered the market and are putting a tough challenge to Foods India Ltd.. To face this challenge and to increase its market share, the company has decided to replace the old machinery with an estimated cost of Rs.100 crores. To raise the finance, the company decided to issue 9% debentures. The Finance department of the company has estimated that the cost of issuing the 9% debentures will be Rs.10, 00, 000. The company wants to meet its floatation cost. (a) Explain the instrument that the company may issue for this purpose. (b) In which type of financial market, is the instrument explained in (a) above traded ? Also explain how safe the instruments are in this market.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a A deb enture is a loan that is not backed by any collateral The company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dfdfb80bf5_180564.pdf

180 KBs PDF File

635dfdfb80bf5_180564.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started