Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete this whole work Jimmy's Painting Jimmy's Painting is an owner-operator run sole proprietorship that operates in Galloway, BC. Jimmy Davis started the company in

complete this whole work

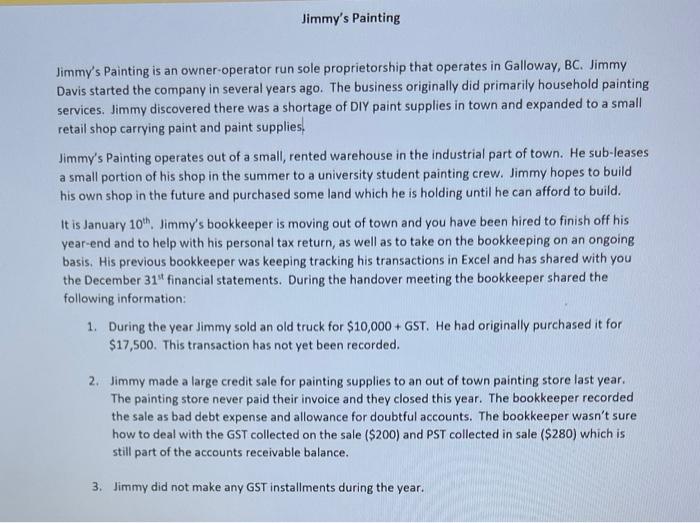

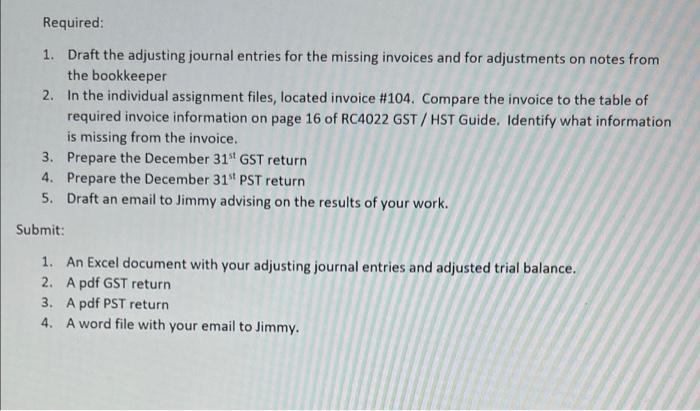

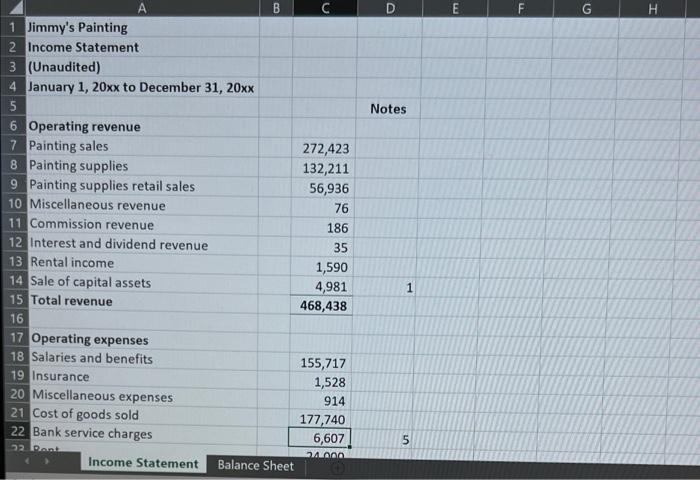

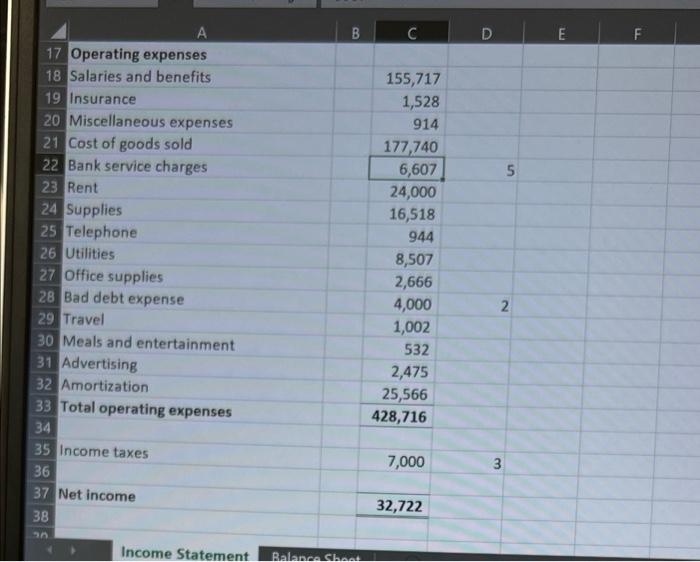

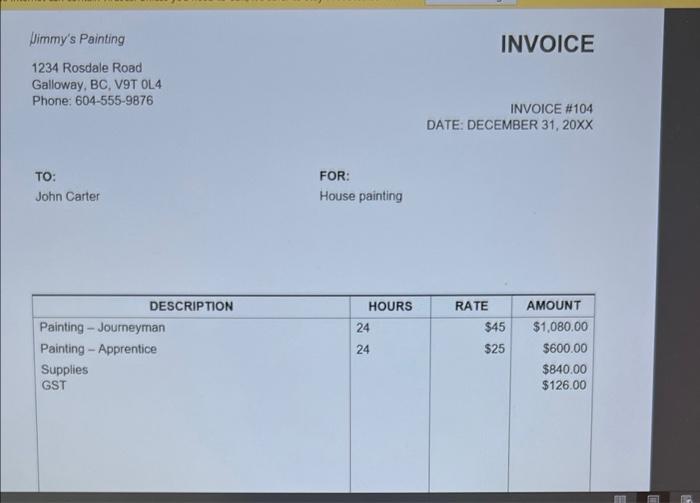

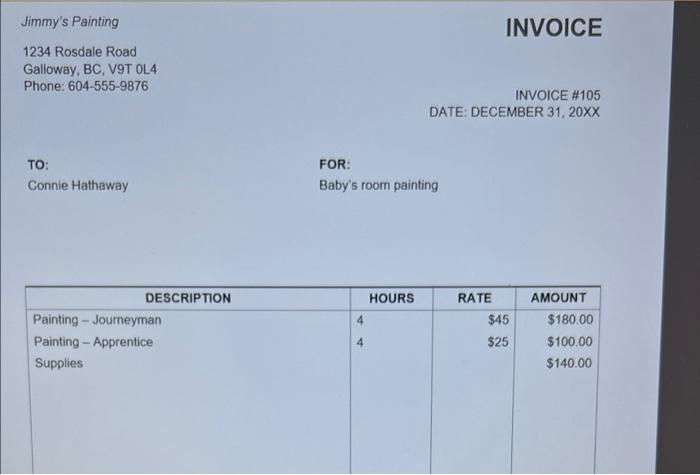

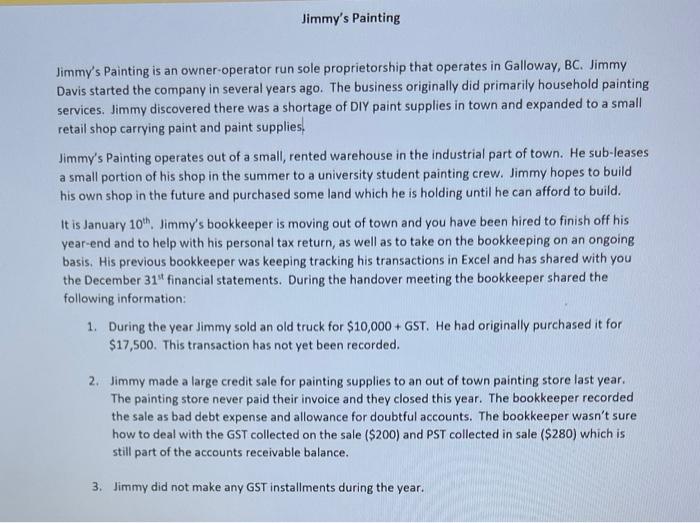

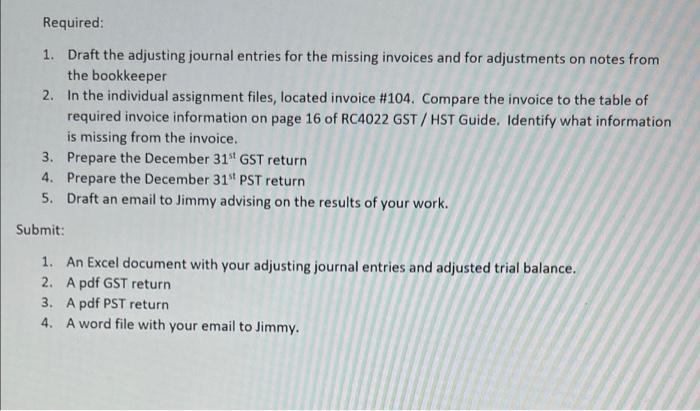

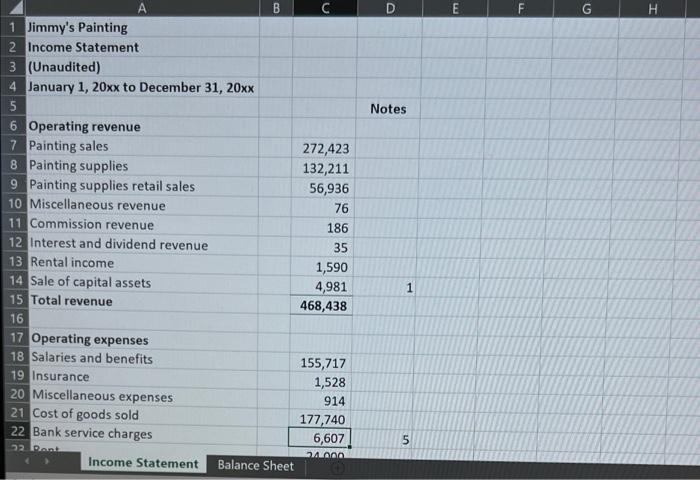

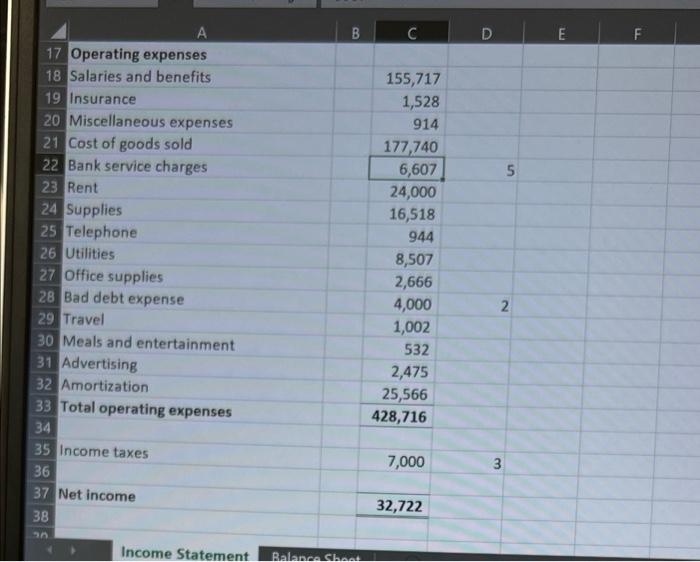

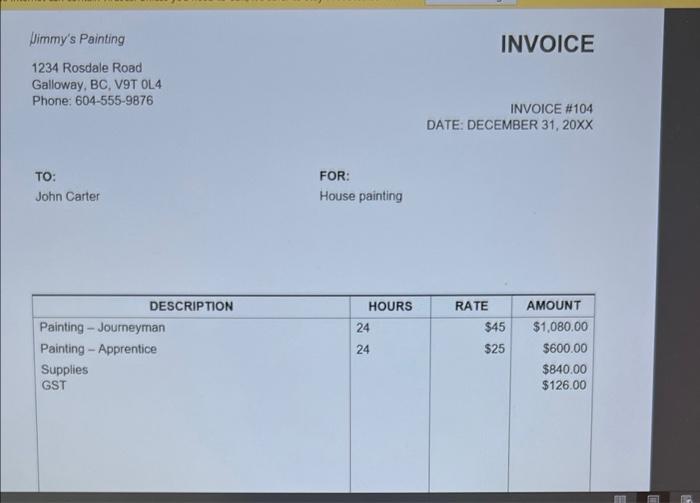

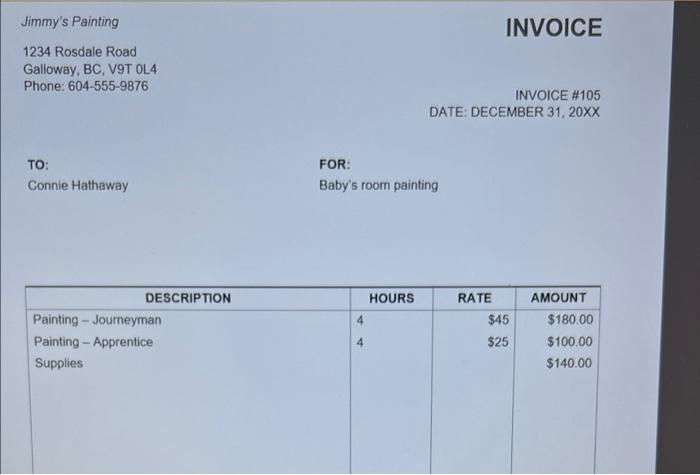

Jimmy's Painting Jimmy's Painting is an owner-operator run sole proprietorship that operates in Galloway, BC. Jimmy Davis started the company in several years ago. The business originally did primarily household painting services. Jimmy discovered there was a shortage of DIY paint supplies in town and expanded to a small retail shop carrying paint and paint supplies Jimmy's Painting operates out of a small, rented warehouse in the industrial part of town. He sub-leases a small portion of his shop in the summer to a university student painting crew. Jimmy hopes to build his own shop in the future and purchased some land which he is holding until he can afford to build. It is January 10th, Jimmy's bookkeeper is moving out of town and you have been hired to finish off his year-end and to help with his personal tax return, as well as to take on the bookkeeping on an ongoing basis. His previous bookkeeper was keeping tracking his transactions in Excel and has shared with you the December 31" financial statements. During the handover meeting the bookkeeper shared the following information: 1. During the year Jimmy sold an old truck for $10,000 + GST. He had originally purchased it for $17,500. This transaction has not yet been recorded. 2. Jimmy made a large credit sale for painting supplies to an out of town painting store last year. The painting store never paid their invoice and they closed this year. The bookkeeper recorded the sale as bad debt expense and allowance for doubtful accounts. The bookkeeper wasn't sure how to deal with the GST collected on the sale ($200) and PST collected in sale ($280) which is still part of the accounts receivable balance. 3. Jimmy did not make any GST installments during the year. Required: 1. Draft the adjusting journal entries for the missing invoices and for adjustments on notes from the bookkeeper 2. In the individual assignment files, located invoice #104. Compare the invoice to the table of required invoice information on page 16 of RC4022 GST/HST Guide. Identify what information is missing from the invoice. 3. Prepare the December 31st GST return 4. Prepare the December 31" PST return 5. Draft an email to Jimmy advising on the results of your work. Submit: 1. An Excel document with your adjusting journal entries and adjusted trial balance. 2. A pdf GST return 3. A pdf PST return 4. A word file with your email to Jimmy. B F G H Notes 1 Jimmy's Painting 2 Income Statement 3 (Unaudited) 4 January 1, 20xx to December 31, 20xx 5 6 Operating revenue 7 Painting sales 272,423 8 Painting supplies 132,211 9 Painting supplies retail sales 56,936 10 Miscellaneous revenue 76 11 Commission revenue 186 12 Interest and dividend revenue 35 13 Rental income 1,590 14 Sale of capital assets 4,981 15 Total revenue 468,438 16 17 Operating expenses 18 Salaries and benefits 155,717 19 Insurance 1,528 20 Miscellaneous expenses 914 21 Cost of goods sold 177,740 22 Bank service charges 6,607 52 Ron 240 Income Statement Balance Sheet 1 5 B D E F 5 A 17 Operating expenses 18 Salaries and benefits 19 Insurance 20 Miscellaneous expenses 21 Cost of goods sold 22 Bank service charges 23 Rent 24 Supplies 25 Telephone 26 Utilities 27 Office supplies 28 Bad debt expense 29 Travel 30 Meals and entertainment 31 Advertising 32 Amortization 33 Total operating expenses 34 35 Income taxes 36 37 Net income 38 90 Income Statement 155,717 1,528 914 177,740 6,607 24,000 16,518 944 8,507 2,666 4,000 1,002 532 2,475 25,566 428,716 N 7,000 3 3 32,722 Balance Sheet Jimmy's Painting INVOICE 1234 Rosdale Road Galloway, BC, V9T OL4 Phone: 604-555-9876 INVOICE #104 DATE: DECEMBER 31, 20XX TO: John Carter FOR: House painting RATE DESCRIPTION Painting - Journeyman Painting - Apprentice Supplies GST HOURS 24 24 $45 $25 AMOUNT $1,080.00 $600.00 $840.00 $126.00 INVOICE Jimmy's Painting 1234 Rosdale Road Galloway, BC, VYT OL4 Phone: 604-555-9876 INVOICE #105 DATE: DECEMBER 31, 20XX TO: Connie Hathaway FOR: Baby's room painting HOURS 4 DESCRIPTION Painting - Journeyman Painting - Apprentice Supplies RATE $45 $25 AMOUNT $180.00 $100.00 $140.00 Jimmy's Painting Jimmy's Painting is an owner-operator run sole proprietorship that operates in Galloway, BC. Jimmy Davis started the company in several years ago. The business originally did primarily household painting services. Jimmy discovered there was a shortage of DIY paint supplies in town and expanded to a small retail shop carrying paint and paint supplies Jimmy's Painting operates out of a small, rented warehouse in the industrial part of town. He sub-leases a small portion of his shop in the summer to a university student painting crew. Jimmy hopes to build his own shop in the future and purchased some land which he is holding until he can afford to build. It is January 10th, Jimmy's bookkeeper is moving out of town and you have been hired to finish off his year-end and to help with his personal tax return, as well as to take on the bookkeeping on an ongoing basis. His previous bookkeeper was keeping tracking his transactions in Excel and has shared with you the December 31" financial statements. During the handover meeting the bookkeeper shared the following information: 1. During the year Jimmy sold an old truck for $10,000 + GST. He had originally purchased it for $17,500. This transaction has not yet been recorded. 2. Jimmy made a large credit sale for painting supplies to an out of town painting store last year. The painting store never paid their invoice and they closed this year. The bookkeeper recorded the sale as bad debt expense and allowance for doubtful accounts. The bookkeeper wasn't sure how to deal with the GST collected on the sale ($200) and PST collected in sale ($280) which is still part of the accounts receivable balance. 3. Jimmy did not make any GST installments during the year. Required: 1. Draft the adjusting journal entries for the missing invoices and for adjustments on notes from the bookkeeper 2. In the individual assignment files, located invoice #104. Compare the invoice to the table of required invoice information on page 16 of RC4022 GST/HST Guide. Identify what information is missing from the invoice. 3. Prepare the December 31st GST return 4. Prepare the December 31" PST return 5. Draft an email to Jimmy advising on the results of your work. Submit: 1. An Excel document with your adjusting journal entries and adjusted trial balance. 2. A pdf GST return 3. A pdf PST return 4. A word file with your email to Jimmy. B F G H Notes 1 Jimmy's Painting 2 Income Statement 3 (Unaudited) 4 January 1, 20xx to December 31, 20xx 5 6 Operating revenue 7 Painting sales 272,423 8 Painting supplies 132,211 9 Painting supplies retail sales 56,936 10 Miscellaneous revenue 76 11 Commission revenue 186 12 Interest and dividend revenue 35 13 Rental income 1,590 14 Sale of capital assets 4,981 15 Total revenue 468,438 16 17 Operating expenses 18 Salaries and benefits 155,717 19 Insurance 1,528 20 Miscellaneous expenses 914 21 Cost of goods sold 177,740 22 Bank service charges 6,607 52 Ron 240 Income Statement Balance Sheet 1 5 B D E F 5 A 17 Operating expenses 18 Salaries and benefits 19 Insurance 20 Miscellaneous expenses 21 Cost of goods sold 22 Bank service charges 23 Rent 24 Supplies 25 Telephone 26 Utilities 27 Office supplies 28 Bad debt expense 29 Travel 30 Meals and entertainment 31 Advertising 32 Amortization 33 Total operating expenses 34 35 Income taxes 36 37 Net income 38 90 Income Statement 155,717 1,528 914 177,740 6,607 24,000 16,518 944 8,507 2,666 4,000 1,002 532 2,475 25,566 428,716 N 7,000 3 3 32,722 Balance Sheet Jimmy's Painting INVOICE 1234 Rosdale Road Galloway, BC, V9T OL4 Phone: 604-555-9876 INVOICE #104 DATE: DECEMBER 31, 20XX TO: John Carter FOR: House painting RATE DESCRIPTION Painting - Journeyman Painting - Apprentice Supplies GST HOURS 24 24 $45 $25 AMOUNT $1,080.00 $600.00 $840.00 $126.00 INVOICE Jimmy's Painting 1234 Rosdale Road Galloway, BC, VYT OL4 Phone: 604-555-9876 INVOICE #105 DATE: DECEMBER 31, 20XX TO: Connie Hathaway FOR: Baby's room painting HOURS 4 DESCRIPTION Painting - Journeyman Painting - Apprentice Supplies RATE $45 $25 AMOUNT $180.00 $100.00 $140.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started