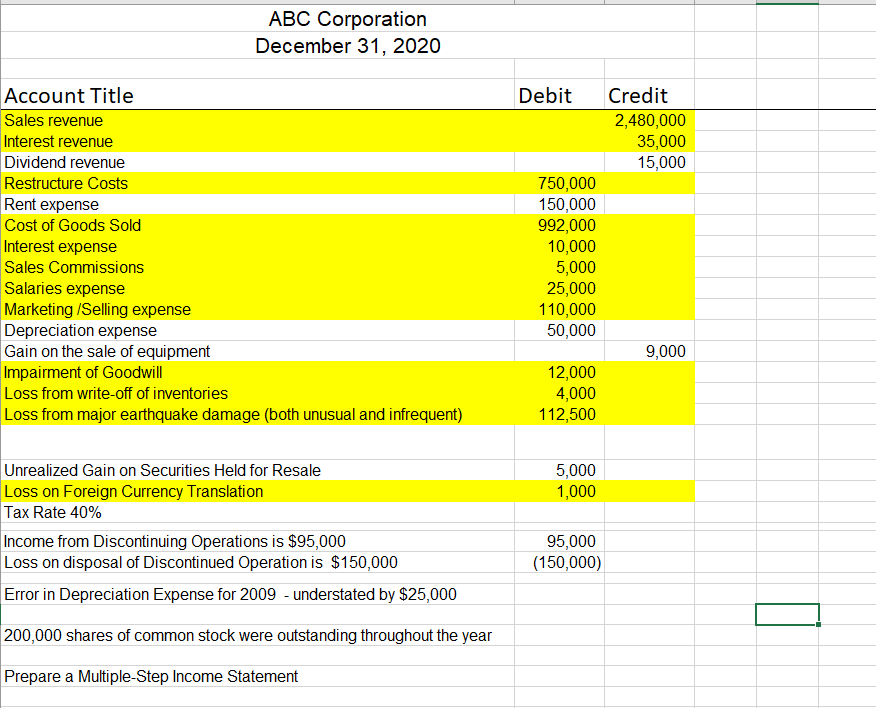

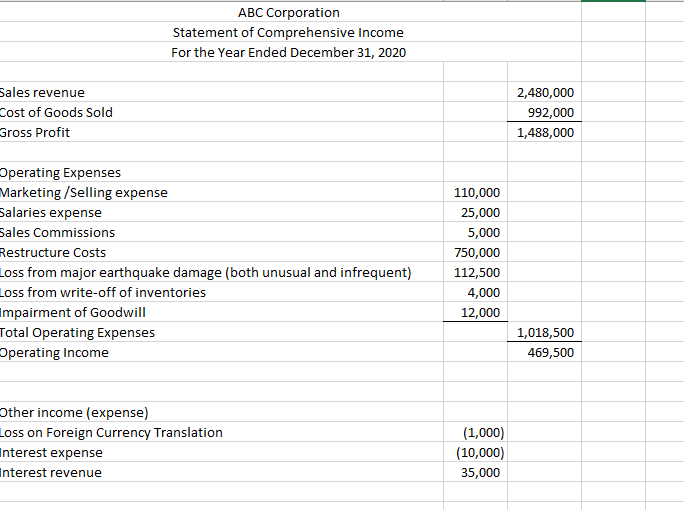

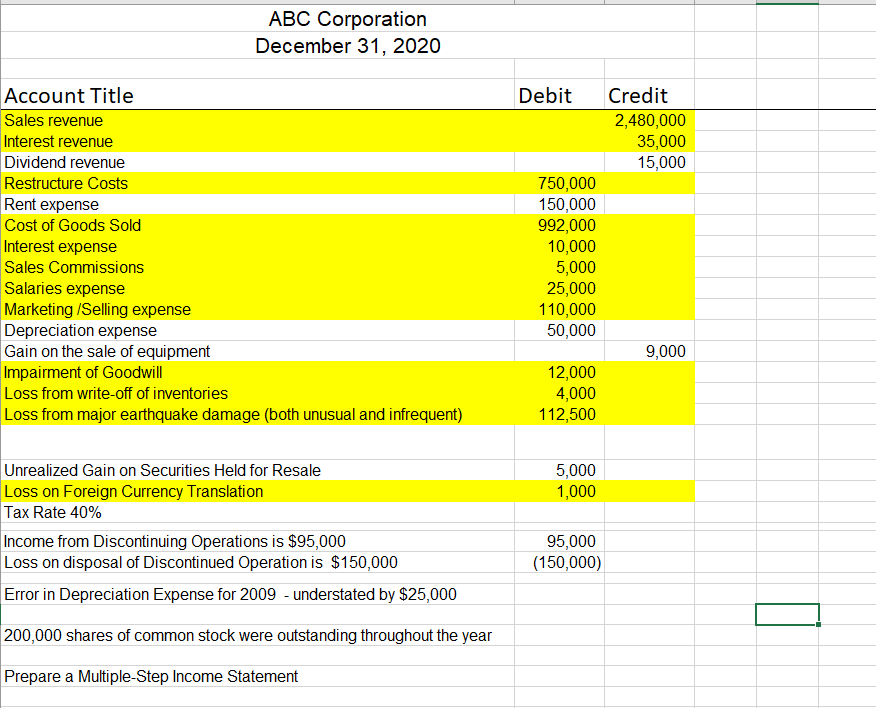

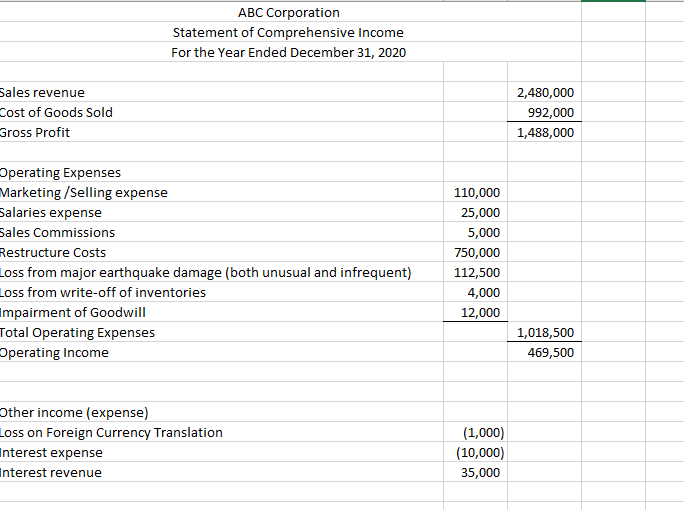

Complete two Statements of Comprehensive Income using the below amounts. Include captions and amounts for Income from Continuing Operations, Discontinued Operations and Other Comprehensive Income. Show EPS for appropriate captions. Use the single, continuous statement approach when preparing Statements of Comprehensive Income.

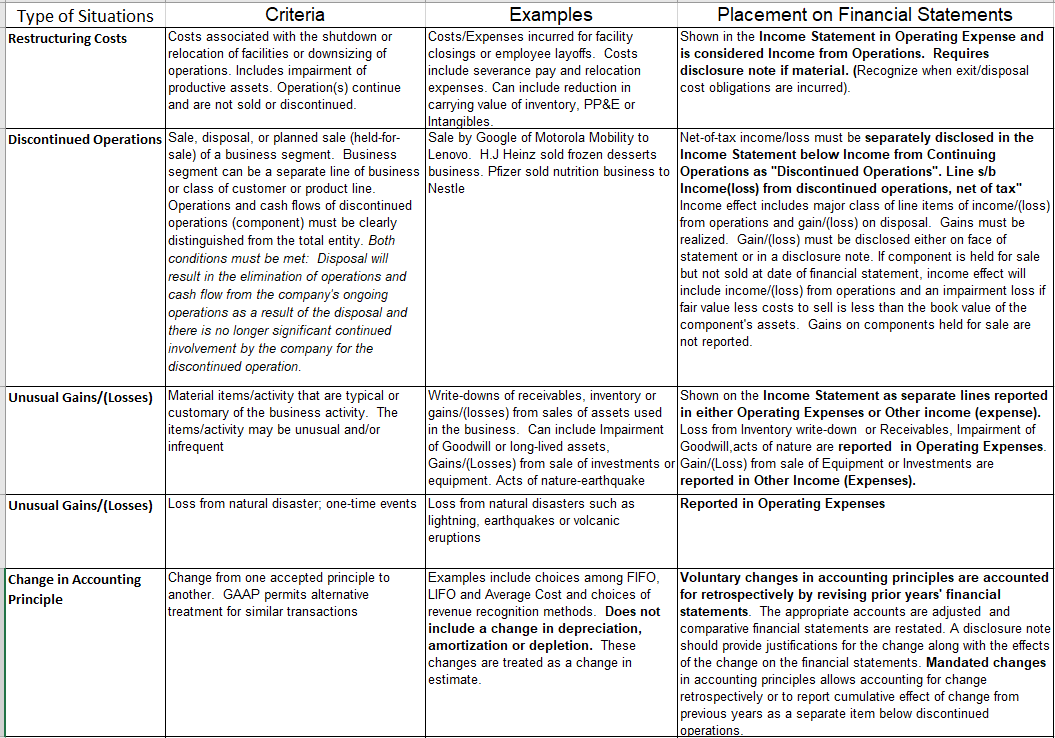

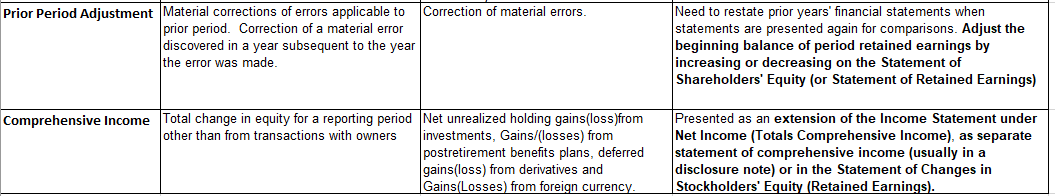

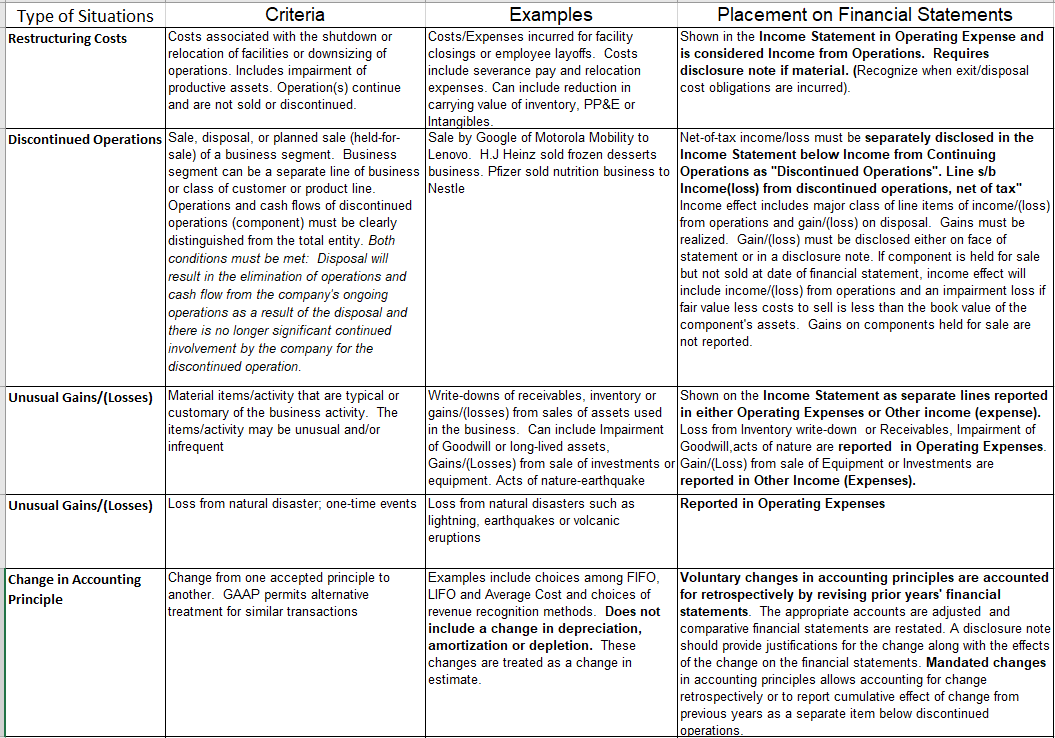

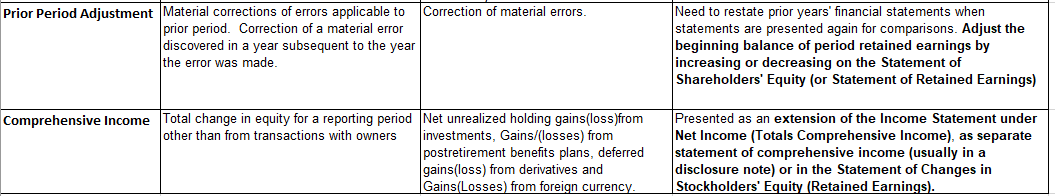

ABC Corporation December 31, 2020 Debit Credit 2,480,000 35,000 15,000 Account Title Sales revenue Interest revenue Dividend revenue Restructure Costs Rent expense Cost of Goods Sold Interest expense Sales Commissions Salaries expense Marketing /Selling expense Depreciation expense Gain on the sale of equipment Impairment of Goodwill Loss from write-off of inventories Loss from major earthquake damage (both unusual and infrequent) 750,000 150,000 992,000 10,000 5,000 25,000 110,000 50,000 9,000 12,000 4,000 112,500 5,000 1,000 Unrealized Gain on Securities Held for Resale Loss on Foreign Currency Translation Tax Rate 40% Income from Discontinuing Operations is $95,000 Loss on disposal of Discontinued Operation is $150,000 Error in Depreciation Expense for 2009 - understated by $25,000 95,000 (150,000) 200,000 shares of common stock were outstanding throughout the year Prepare a Multiple-Step Income Statement ABC Corporation Statement of Comprehensive Income For the Year Ended December 31, 2020 Sales revenue Cost of Goods Sold Gross Profit 2,480,000 992,000 1,488,000 Operating Expenses Marketing/Selling expense Salaries expense Sales Commissions Restructure Costs Loss from major earthquake damage (both unusual and infrequent) Loss from write-off of inventories Impairment of Goodwill Total Operating Expenses Operating Income 110,000 25,000 5,000 750,000 112,500 4,000 12,000 1,018,500 469,500 Other income (expense) Loss on Foreign Currency Translation Interest expense Interest revenue (1,000) (10,000) 35,000 Type of Situations Criteria Examples Placement on Financial Statements Restructuring Costs Costs associated with the shutdown or Costs/Expenses incurred for facility Shown in the Income Statement in Operating Expense and relocation of facilities or downsizing of closings or employee layoffs. Costs is considered Income from Operations. Requires operations. Includes impairment of include severance pay and relocation disclosure note if material. (Recognize when exit/disposal productive assets. Operation(s) continue expenses. Can include reduction in cost obligations are incurred). and are not sold or discontinued. carrying value of inventory, PP&E or Intangibles. Discontinued Operations Sale, disposal, or planned sale (held-for- Sale by Google of Motorola Mobility to Net-of-tax income/loss must be separately disclosed in the sale) of a business segment. Business Lenovo. H.J Heinz sold frozen desserts Income Statement below Income from Continuing segment can be a separate line of business business. Pfizer sold nutrition business to Operations as "Discontinued Operations". Line s/b or class of customer or product line. Nestle Income(loss) from discontinued operations, net of tax" Operations and cash flows of discontinued Income effect includes major class of line items of income/(loss) operations (component) must be clearly from operations and gain/(loss) on disposal. Gains must be distinguished from the total entity. Both realized. Gain/(loss) must be disclosed either on face of conditions must be met: Disposal will statement or in a disclosure note. If component is held for sale result in the elimination of operations and but not sold at date of financial statement, income effect will cash flow from the company's ongoing include income/loss) from operations and an impairment loss if operations as a result of the disposal and fair value less costs to sell is less than the book value of the there is no longer significant continued component's assets. Gains on components held for sale are involvement by the company for the not reported. discontinued operation. Unusual Gains/(Losses) Material items/activity that are typical or Write-downs of receivables, inventory or Shown on the Income Statement as separate lines reported customary of the business activity. The gains/(losses) from sales of assets used in either Operating Expenses or Other income (expense). items/activity may be unusual and/or in the business. Can include Impairment Loss from Inventory write-down or Receivables, Impairment of infrequent of Goodwill or long-lived assets, Goodwill, acts of nature are reported in Operating Expenses. Gains/(Losses) from sale of investments or Gain/(Loss) from sale of Equipment or Investments are equipment. Acts of nature-earthquake reported in Other Income (Expenses). Unusual Gains/(Losses) Loss from natural disaster, one-time events Loss from natural disasters such as Reported in Operating Expenses lightning, earthquakes or volcanic eruptions Change in Accounting Principle Change from one accepted principle to another. GAAP permits alternative treatment for similar transactions Examples include choices among FIFO, LIFO and Average Cost and choices of revenue recognition methods. Does not include a change in depreciation, amortization or depletion. These changes are treated as a change in estimate Voluntary changes in accounting principles are accounted for retrospectively by revising prior years' financial statements. The appropriate accounts are adjusted and comparative financial statements are restated. A disclosure note should provide justifications for the change along with the effects of the change on the financial statements. Mandated changes in accounting principles allows accounting for change retrospectively or to report cumulative effect of change from previous years as a separate item below discontinued operations. Prior Period Adjustment Material corrections of errors applicable to Correction of material errors. prior period. Correction of a material error discovered in a year subsequent to the year the error was made. Need to restate prior years' financial statements when statements are presented again for comparisons. Adjust the beginning balance of period retained earnings by increasing or decreasing on the Statement of Shareholders' Equity (or Statement of Retained Earnings) Comprehensive Income Total change in equity for a reporting period Net unrealized holding gains(loss from other than from transactions with owners investments, Gains/(losses) from postretirement benefits plans, deferred gains(loss) from derivatives and Gains(Losses) from foreign currency. Presented as an extension of the Income Statement under Net Income (Totals Comprehensive Income), as separate statement of comprehensive income (usually in a disclosure note) or in the Statement of Changes in Stockholders' Equity (Retained Earnings). ABC Corporation December 31, 2020 Debit Credit 2,480,000 35,000 15,000 Account Title Sales revenue Interest revenue Dividend revenue Restructure Costs Rent expense Cost of Goods Sold Interest expense Sales Commissions Salaries expense Marketing /Selling expense Depreciation expense Gain on the sale of equipment Impairment of Goodwill Loss from write-off of inventories Loss from major earthquake damage (both unusual and infrequent) 750,000 150,000 992,000 10,000 5,000 25,000 110,000 50,000 9,000 12,000 4,000 112,500 5,000 1,000 Unrealized Gain on Securities Held for Resale Loss on Foreign Currency Translation Tax Rate 40% Income from Discontinuing Operations is $95,000 Loss on disposal of Discontinued Operation is $150,000 Error in Depreciation Expense for 2009 - understated by $25,000 95,000 (150,000) 200,000 shares of common stock were outstanding throughout the year Prepare a Multiple-Step Income Statement ABC Corporation Statement of Comprehensive Income For the Year Ended December 31, 2020 Sales revenue Cost of Goods Sold Gross Profit 2,480,000 992,000 1,488,000 Operating Expenses Marketing/Selling expense Salaries expense Sales Commissions Restructure Costs Loss from major earthquake damage (both unusual and infrequent) Loss from write-off of inventories Impairment of Goodwill Total Operating Expenses Operating Income 110,000 25,000 5,000 750,000 112,500 4,000 12,000 1,018,500 469,500 Other income (expense) Loss on Foreign Currency Translation Interest expense Interest revenue (1,000) (10,000) 35,000 Type of Situations Criteria Examples Placement on Financial Statements Restructuring Costs Costs associated with the shutdown or Costs/Expenses incurred for facility Shown in the Income Statement in Operating Expense and relocation of facilities or downsizing of closings or employee layoffs. Costs is considered Income from Operations. Requires operations. Includes impairment of include severance pay and relocation disclosure note if material. (Recognize when exit/disposal productive assets. Operation(s) continue expenses. Can include reduction in cost obligations are incurred). and are not sold or discontinued. carrying value of inventory, PP&E or Intangibles. Discontinued Operations Sale, disposal, or planned sale (held-for- Sale by Google of Motorola Mobility to Net-of-tax income/loss must be separately disclosed in the sale) of a business segment. Business Lenovo. H.J Heinz sold frozen desserts Income Statement below Income from Continuing segment can be a separate line of business business. Pfizer sold nutrition business to Operations as "Discontinued Operations". Line s/b or class of customer or product line. Nestle Income(loss) from discontinued operations, net of tax" Operations and cash flows of discontinued Income effect includes major class of line items of income/(loss) operations (component) must be clearly from operations and gain/(loss) on disposal. Gains must be distinguished from the total entity. Both realized. Gain/(loss) must be disclosed either on face of conditions must be met: Disposal will statement or in a disclosure note. If component is held for sale result in the elimination of operations and but not sold at date of financial statement, income effect will cash flow from the company's ongoing include income/loss) from operations and an impairment loss if operations as a result of the disposal and fair value less costs to sell is less than the book value of the there is no longer significant continued component's assets. Gains on components held for sale are involvement by the company for the not reported. discontinued operation. Unusual Gains/(Losses) Material items/activity that are typical or Write-downs of receivables, inventory or Shown on the Income Statement as separate lines reported customary of the business activity. The gains/(losses) from sales of assets used in either Operating Expenses or Other income (expense). items/activity may be unusual and/or in the business. Can include Impairment Loss from Inventory write-down or Receivables, Impairment of infrequent of Goodwill or long-lived assets, Goodwill, acts of nature are reported in Operating Expenses. Gains/(Losses) from sale of investments or Gain/(Loss) from sale of Equipment or Investments are equipment. Acts of nature-earthquake reported in Other Income (Expenses). Unusual Gains/(Losses) Loss from natural disaster, one-time events Loss from natural disasters such as Reported in Operating Expenses lightning, earthquakes or volcanic eruptions Change in Accounting Principle Change from one accepted principle to another. GAAP permits alternative treatment for similar transactions Examples include choices among FIFO, LIFO and Average Cost and choices of revenue recognition methods. Does not include a change in depreciation, amortization or depletion. These changes are treated as a change in estimate Voluntary changes in accounting principles are accounted for retrospectively by revising prior years' financial statements. The appropriate accounts are adjusted and comparative financial statements are restated. A disclosure note should provide justifications for the change along with the effects of the change on the financial statements. Mandated changes in accounting principles allows accounting for change retrospectively or to report cumulative effect of change from previous years as a separate item below discontinued operations. Prior Period Adjustment Material corrections of errors applicable to Correction of material errors. prior period. Correction of a material error discovered in a year subsequent to the year the error was made. Need to restate prior years' financial statements when statements are presented again for comparisons. Adjust the beginning balance of period retained earnings by increasing or decreasing on the Statement of Shareholders' Equity (or Statement of Retained Earnings) Comprehensive Income Total change in equity for a reporting period Net unrealized holding gains(loss from other than from transactions with owners investments, Gains/(losses) from postretirement benefits plans, deferred gains(loss) from derivatives and Gains(Losses) from foreign currency. Presented as an extension of the Income Statement under Net Income (Totals Comprehensive Income), as separate statement of comprehensive income (usually in a disclosure note) or in the Statement of Changes in Stockholders' Equity (Retained Earnings)