Complete Valuation using the FCFE and Relative methods using the information from the following case.

STANDARD CHARTERED BANK: VALUATION AND CAPITAL STRUCTURE

VALUATION

On the London Stock Exchange,20 SCBs adjusted closing share price stood at $13.0821 on March 1, 2006, around the time of Temaseks initial purchase. It hit a peak of $24.35 on March 14, 2013, and was on a downward trend thereafter. The share closed at $14.71 on February 16, 2015. The decline of SCBs share price raised concerns that it might in fact be oversold and under-priced. However, it was obvious that bearish sentiments regarding the share remained.

As far back as October 2011, there were some signals that Temasek might move away from its SCB stake when it raised $502 million by selling a zero-coupon bond that could be exchanged for SCB shares if the bank shares rose beyond the requisite 27 per cent premium to the then share price of $21.98.22 The poor record in 2014 re- ignited speculation that Temasek might offload its stake.

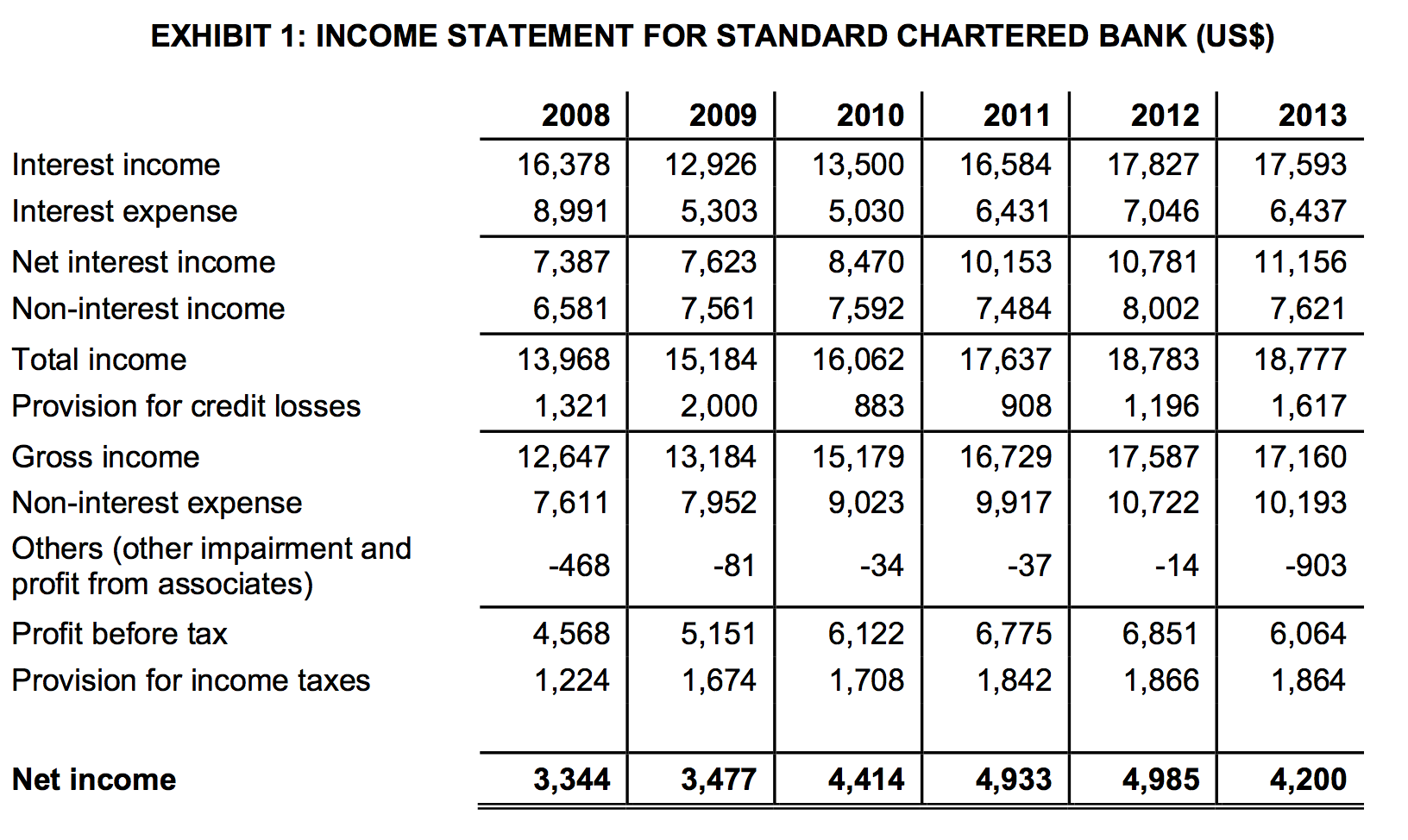

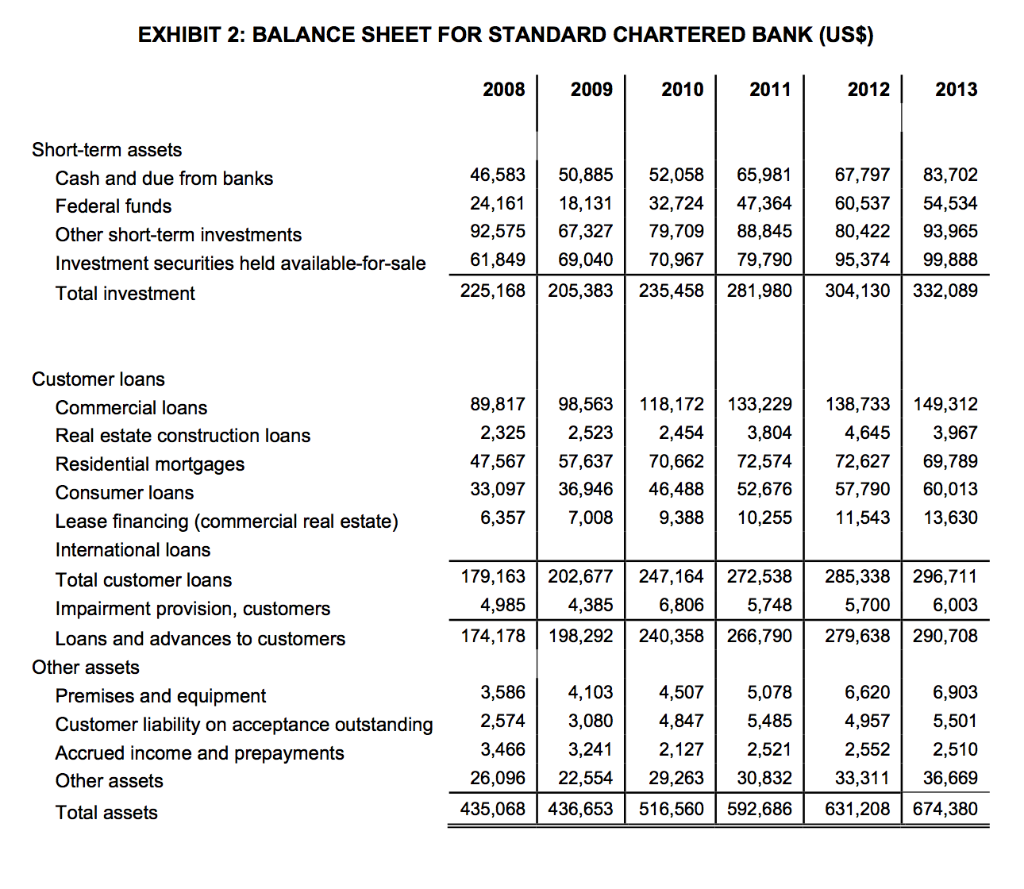

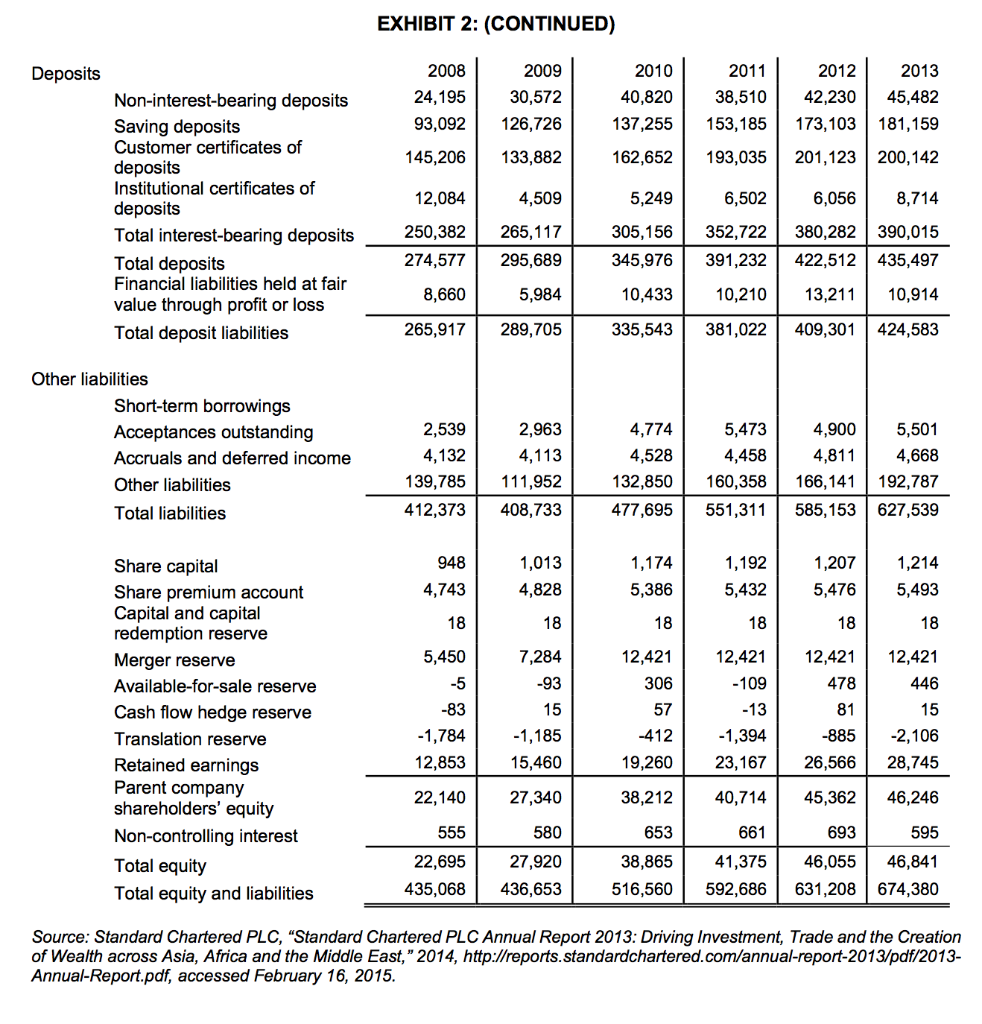

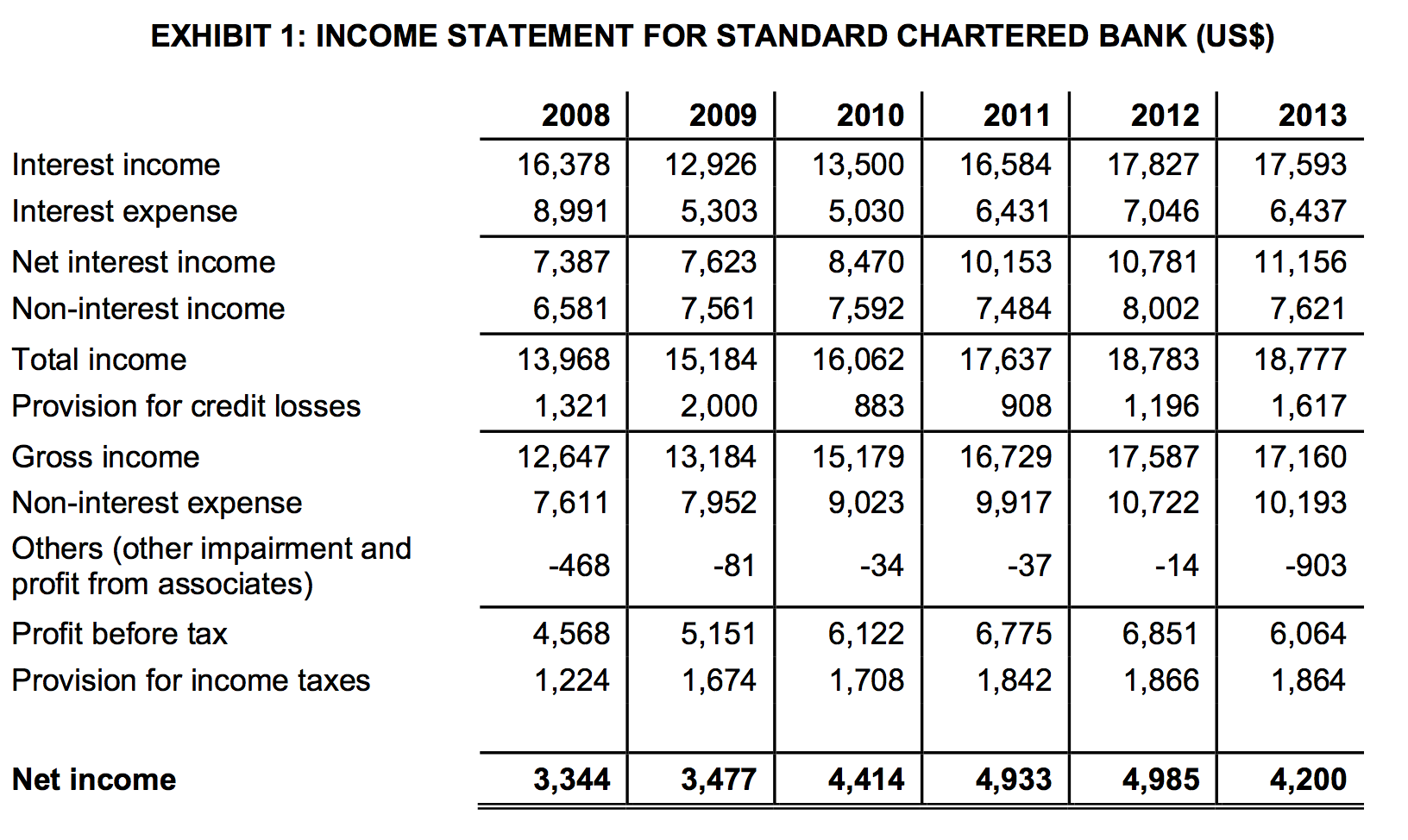

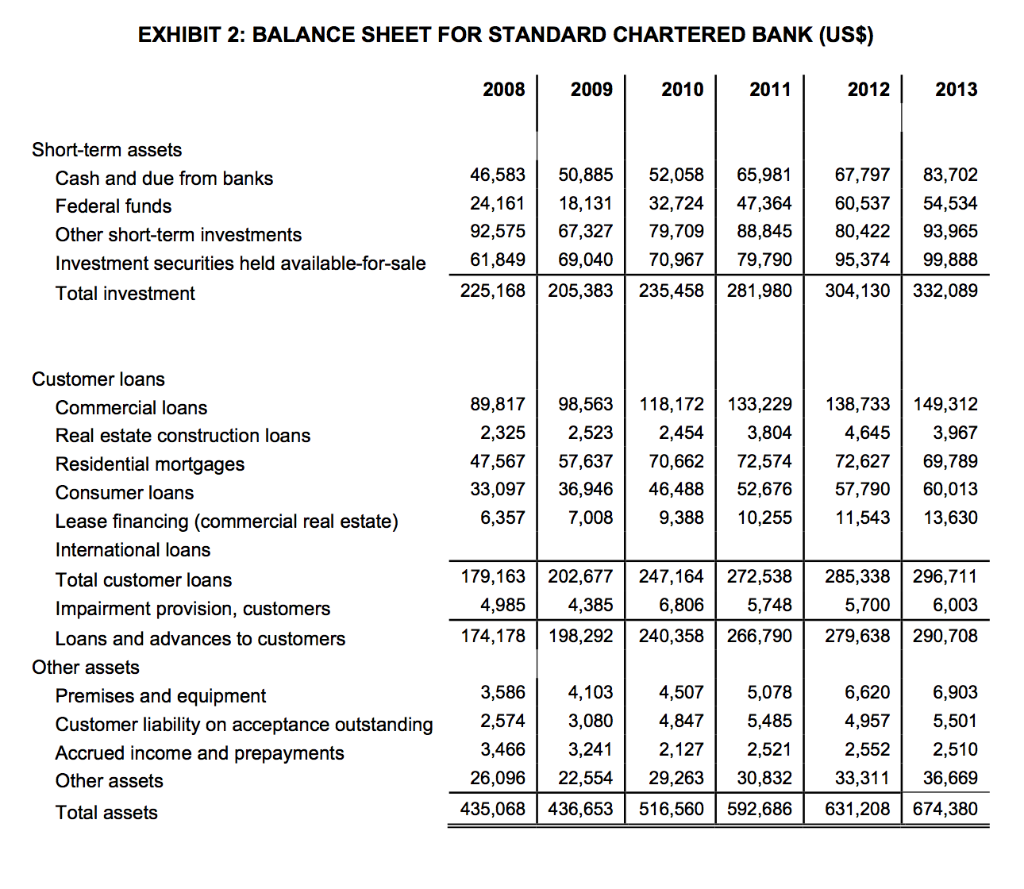

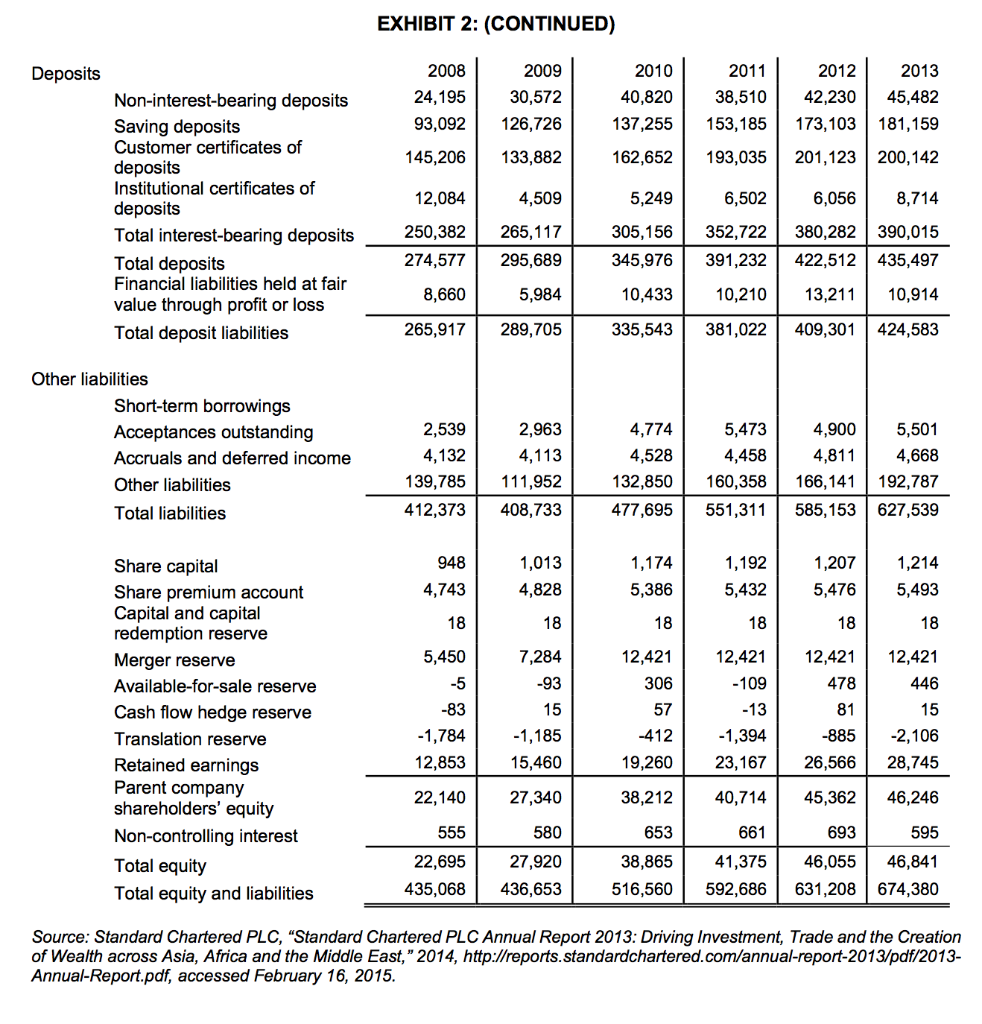

If Temasek decided to sell a part of, or all of, its stake in SCB on February 16, 2015, what would be a reasonable valuation for SCBs shares based on its past financial performance and other relevant market information? Summaries of the historical financial statements are provided in Exhibits 1 and 2.

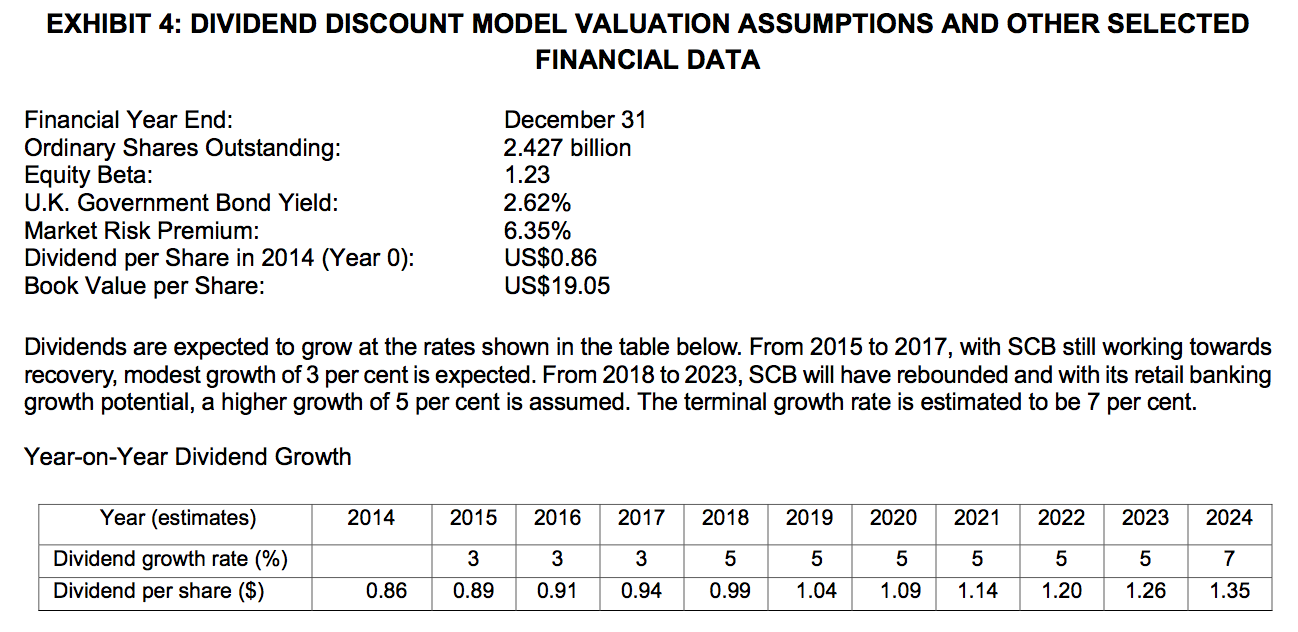

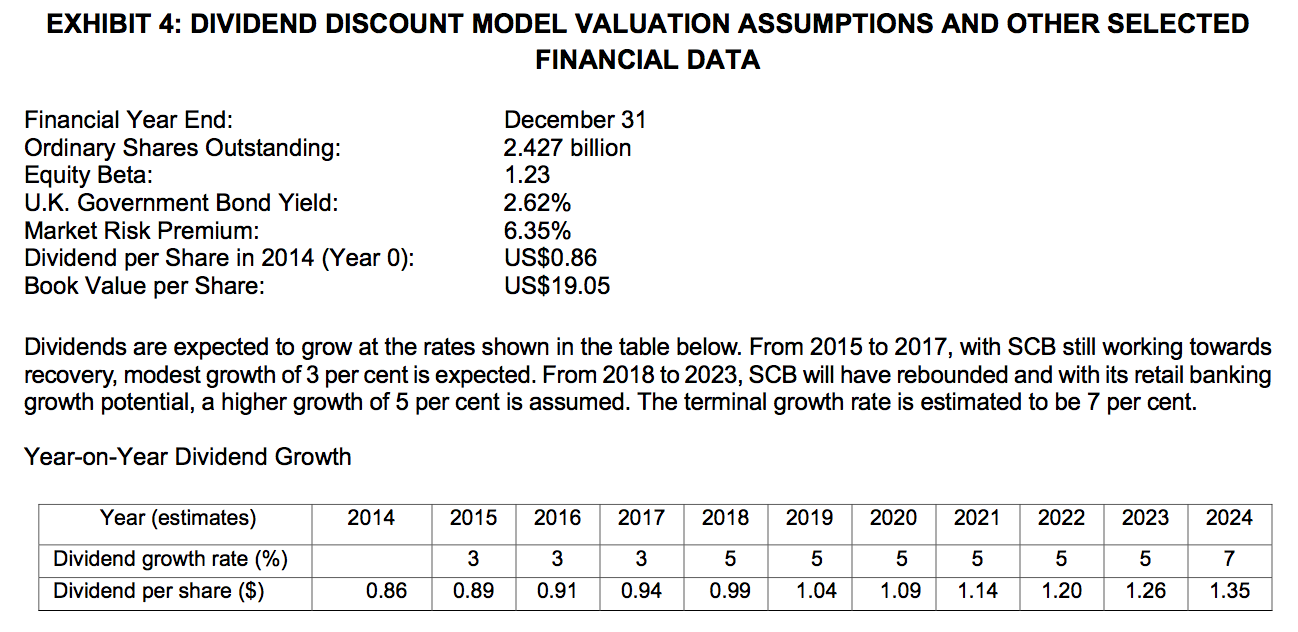

Some assumptions and projections of the free cash flow to equity for 2014 through to 2024 and beyond are available in Exhibit 3. Corresponding projections with attendant assumptions that would be useful for a dividend discount model valuation are presented in Exhibit 4. This includes information on the required return on equity, and the estimated dividends from 2014 through to 2024 and beyond.

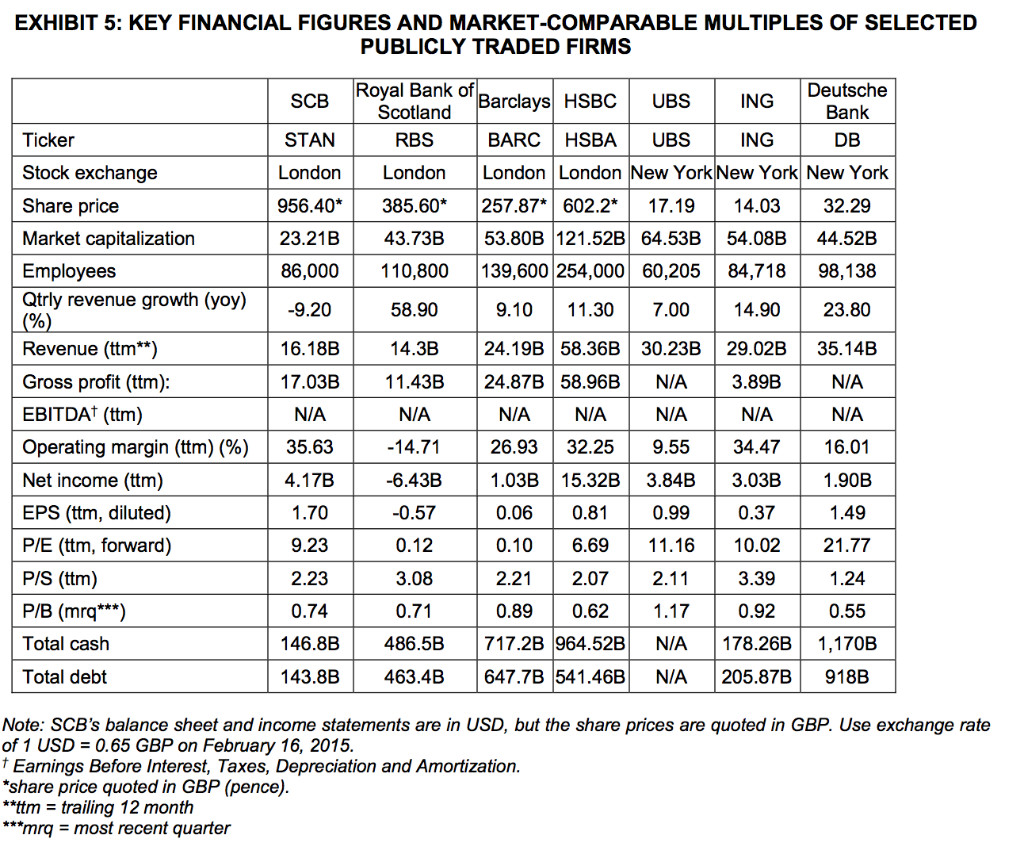

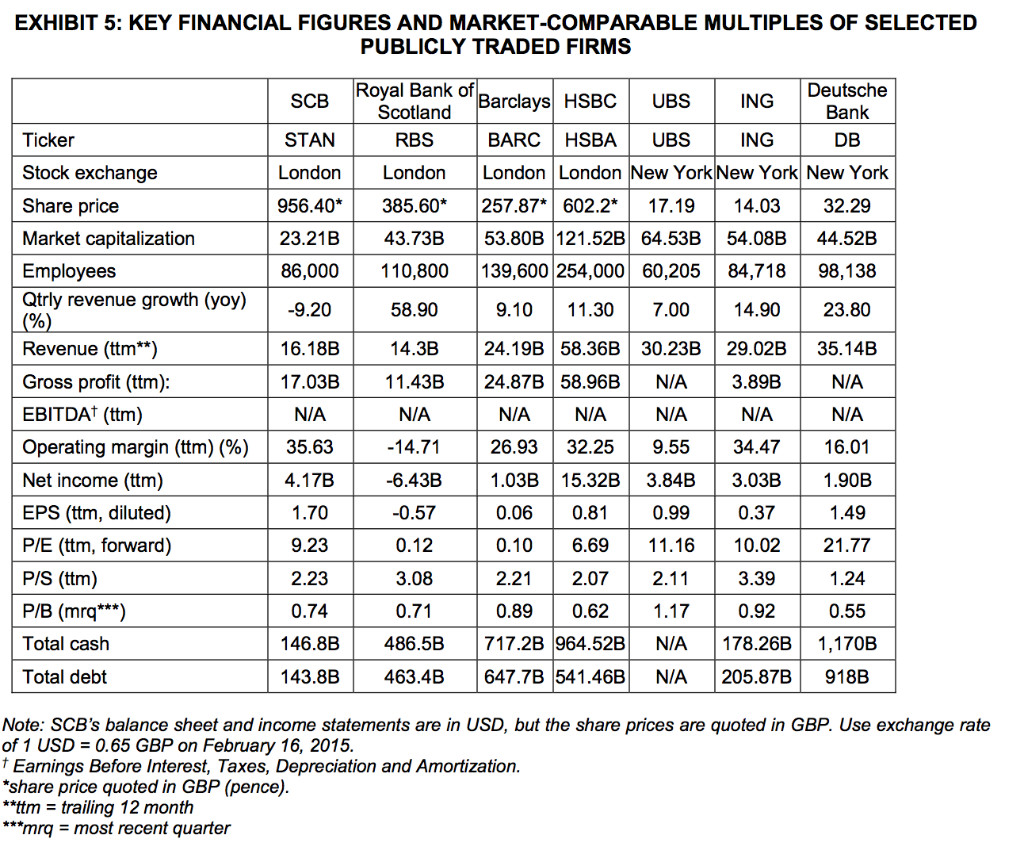

For a relative valuation analysis using a peer comparison, data had been collected, but a suitable peer group had yet to be identified (see Exhibit 5). Stock charts that show the price performance of SCB relative to its competitors are offered in Exhibits 6 and 7.

EXHIBIT 1: INCOME STATEMENT FOR STANDARD CHARTERED BANK (US$)

EXHIBIT 2: BALANCE SHEET FOR STANDARD CHARTERED BANK (US$) 2008 2009 2010 2011 2012

-

EXHIBIT 3: DISCOUNTED CASH FLOW VALUATION ASSUMPTIONS

EXHIBIT 3: DISCOUNTED CASH FLOW VALUATION ASSUMPTIONS

-

Interest income is expected to grow at the rates shown in the table below. From 2014 to 2016, with SCBs downturn, modest growth using the average growth rate from 2008 to 2013 of 2.48 per cent is projected. From 2017 to 2023, SCB will enter a higher growth phase and a 4.5 per cent growth is assumed. Beyond that, the terminal growth rate is estimated to be 5 per cent. The base interest income at Year -1 (FY2013) is $17,593. Year 0 is FY2014. Discount the free cash flows starting from 2015.

-

Other items are assumed to grow proportionately with interest income. Interest expense, non-interest income, provision for credit losses, and non-interest expense are estimated to be 41.35 per cent, 48.04 per cent, 8.58 per cent and 58.47 per cent of interest income, respectively. Tax is applied at 28.714 per cent on taxable income.

-

As SCBs interest expense is considered a cost of goods sold due to the nature of the banking business, the free cash flows are calculated after deducting interest expense and therefore are essentially cash flows to equity.

-

The valuation assumes that capital spending and net operating working capital are negligible.

-

No adjustments for outstanding warrants and share options are made in calculating value per share.

Year-on-Year Interest Income Growth

Source: Created by the authors based on assumptions stated above.

EXHIBIT 4: DIVIDEND DISCOUNT MODEL VALUATION ASSUMPTIONS AND OTHER SELECTED FINANCIAL DATA

EXHIBIT 1: INCOME STATEMENT FOR STANDARD CHARTERED BANK (US$) 2008 2009 2010 2012 2013 Interest income Interest expense 16,378 8,991 7,387 6,581 olla Net interest income Non-interest income 12,926 5,303 7,623 7,561 15,184 2,000 13,184 7,952 13,500 5,030 8,470 7,592 16,062 883 15,179 9,023 2011 16,584 6,431 10,153 7,484 17,637 908 17,827 7,046 10,781 8,002 18,783 1,196 17,587 10,722 17,593 6,437 11,156 7,621 18,777 1,617 17,160 10,193 Total income Provision for credit losses 13,968 1,321 12,647 7,611 11 16,729 9,917 Gross income Non-interest expense Others (other impairment and profit from associates) Profit before tax Provision for income taxes -468 -81 -34 -37 -14 -903 4,568 1,224 5,151 1,674 6,122 1,708 6,775 1,842 6,851 1,866 6,064 1,864 Net income 3,344 3,477 4,414 4,933 4,985 4,200 EXHIBIT 2: BALANCE SHEET FOR STANDARD CHARTERED BANK (US$) 2008 2009 2010 2011 2012 2013 Short-term assets Cash and due from banks Federal funds Other short-term investments Investment securities held available-for-sale Total investment 46,583 50,885 24,161 18,131 92,575 67,327 61,849 69,040 225,168 205,383 52,058 32,724 79,709 70,967 235,458 65,981 47,364 88,845 79,790 67,797 83,702 60,537 54,534 80,422 93,965 95,374 99,888 304,130 332,089 281,980 89,817 2,325 47,567 33,097 6,357 98,563 2,523 57,637 36,946 7,008 118,172 133,229 2,454 3,804 70,662 72,574 46,488 52,676 9,388 10,255 138,733 149,312 4,645 3,967 72,627 69,789 57,790 60,013 11,543 13,630 Customer loans Commercial loans Real estate construction loans Residential mortgages Consumer loans Lease financing (commercial real estate) International loans Total customer loans Impairment provision, customers Loans and advances to customers Other assets Premises and equipment Customer liability on acceptance outstanding Accrued income and prepayments Other assets 179,163 202,677 4,985 4,385 174,178 198,292 247,164 272,538 6,806 5,748 240,358 266,790 285,338 296,711 5,700 6,003 279,638 290,708 3,586 4,103 2,574 3,080 3,466 3,241 26,096 22,554 435,068 436,653 4,507 4,847 2,127 29,263 516,560 5,078 5,485 2,521 30,832 592,686 6,620 6,903 4,957 5,501 2,552 2,510 33,311 36,669 631,208 674,380 Total assets EXHIBIT 2: (CONTINUED) Deposits 2008 24,195 93,092 2009 30,572 126,726 2010 40,820 137,255 2011 38,510 153,185 2012 42.230 173,103 2013 45,482 181,159 145,206 133,882 162,652 193,035 201,123 200, 142 12,084 4,509 5,249 6,502 6,056 8,714 Non-interest-bearing deposits Saving deposits Customer certificates of deposits Institutional certificates of deposits Total interest-bearing deposits Total deposits Financial liabilities held at fair value through profit or loss Total deposit liabilities 250,382 274,577 265,117 295,689 305,156 345,976 352,722 391,232 380,282 390,015 422,512 435,497 8,660 5,984 10,433 10,210 13,211 10,914 265,917 289,705 335,543 381,022 409,301 424,583 Other liabilities Short-term borrowings Acceptances outstanding Accruals and deferred income Other liabilities Total liabilities 2,539 4,132 139,785 412,373 2,963 4,113 111,952 408,733 4,774 4,528 132,850 477,695 5,473 4,458 160,358 551,311 4,900 5,501 4,811 4,668 166,141 192,787 585,153 627,539 948 1,013 4,828 1,174 5,386 1,192 5,432 1,207 5,476 1,214 5,493 4,743 18 18 18 18 18 18 5,450 12,421 -5 -109 Share capital Share premium account Capital and capital redemption reserve Merger reserve Available-for-sale reserve Cash flow hedge reserve Translation reserve Retained earnings Parent company shareholders' equity Non-controlling interest Total equity Total equity and liabilities 7,284 -93 15 -1,185 15,460 12,421 306 57 -412 -13 -83 -1,784 12,853 12,421 478 81 -885 26,566 12,421 446 15 -2,106 28,745 -1,394 23,167 19,260 22,140 27,340 38,212 40,714 45,362 46,246 555 580 653 661 22,695 435,068 27,920 436,653 38,865 516,560 41,375 592,686 693 595 46,055 46,841 631,208 674,380 Source: Standard Chartered PLC, "Standard Chartered PLC Annual Report 2013: Driving Investment, Trade and the Creation of Wealth across Asia, Africa and the Middle East," 2014, http://reports.standardchartered.com/annual-report-2013/pdf/2013- Annual-Report.pdf, accessed February 16, 2015. EXHIBIT 4: DIVIDEND DISCOUNT MODEL VALUATION ASSUMPTIONS AND OTHER SELECTED FINANCIAL DATA Financial Year End: Ordinary Shares Outstanding: Equity Beta: U.K. Government Bond Yield: Market Risk Premium: Dividend per Share in 2014 (Year 0): Book Value per Share: December 31 2.427 billion 1.23 2.62% 6.35% US$0.86 US$19.05 Dividends are expected to grow at the rates shown in the table below. From 2015 to 2017, with SCB still working towards recovery, modest growth of 3 per cent is expected. From 2018 to 2023, SCB will have rebounded and with its retail banking growth potential, a higher growth of 5 per cent is assumed. The terminal growth rate is estimated to be 7 per cent. Year-on-Year Dividend Growth 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Year (estimates) Dividend growth rate (%) Dividend per share ($) 3 3 3 5 5 5 5 5 5 7 0.86 0.89 0.91 0.94 0.99 1.04 1.09 1.14 1.20 1.26 1.35 EXHIBIT 5: KEY FINANCIAL FIGURES AND MARKET-COMPARABLE MULTIPLES OF SELECTED PUBLICLY TRADED FIRMS SCB UBS ING Royal Bank of Scotland Barclays HSBC RBS BARC HSBA Deutsche Bank DB STAN UBS ING London London 956.40* 385.60* London London New York New York New York 257.87* 602.2* 17.19 14.03 32.29 53.80B 121.52B 64.53B 54.08B 44.52B 139,600 254,000 60,205 84,718 98,138 23.21B 43.73B 86,000 110,800 -9.20 58.90 9.10 11.30 7.00 14.90 23.80 16.18B 14.3B 24.19B 58.36B 30.23B 29.02B 35.14B 17.03B 11.43B 24.87B 58.96B N/A Ticker Stock exchange Share price Market capitalization Employees Qtrly revenue growth (yoy) (%) Revenue (ttm**) Gross profit (ttm): EBITDA (ttm) Operating margin (ttm) (%) Net income (ttm) EPS (ttm, diluted) P/E (ttm, forward) P/S (ttm) P/B (mrq***) Total cash 3.89B N/A N/A N/A N/A 35.63 -14.71 26.93 32.25 9.55 34.47 16.01 4.17B -6.43B 1.03B 15.32B 3.84B 3.03B 1.90B 1.70 -0.57 0.06 0.81 0.37 1.49 0.99 11.16 9.23 0.12 0.10 6.69 10.02 21.77 2.23 3.08 2.21 2.07 2.11 3.39 1.24 0.74 0.71 0.89 0.62 1.17 0.92 0.55 146.8B 486.5B N/A 178.26B 717.2B 964.52B 647.7B 541.46B 1,170B 918B Total debt 143.8B 463.4B N/A 205.87B Note: SCB's balance sheet and income statements are in USD, but the share prices are quoted in GBP. Use exchange rate of 1 USD = 0.65 GBP on February 16, 2015. + Earnings Before Interest, Taxes, Depreciation and Amortization. *share price quoted in GBP (pence). **ttm = trailing 12 month ***mrq = most recent quarter EXHIBIT 1: INCOME STATEMENT FOR STANDARD CHARTERED BANK (US$) 2008 2009 2010 2012 2013 Interest income Interest expense 16,378 8,991 7,387 6,581 olla Net interest income Non-interest income 12,926 5,303 7,623 7,561 15,184 2,000 13,184 7,952 13,500 5,030 8,470 7,592 16,062 883 15,179 9,023 2011 16,584 6,431 10,153 7,484 17,637 908 17,827 7,046 10,781 8,002 18,783 1,196 17,587 10,722 17,593 6,437 11,156 7,621 18,777 1,617 17,160 10,193 Total income Provision for credit losses 13,968 1,321 12,647 7,611 11 16,729 9,917 Gross income Non-interest expense Others (other impairment and profit from associates) Profit before tax Provision for income taxes -468 -81 -34 -37 -14 -903 4,568 1,224 5,151 1,674 6,122 1,708 6,775 1,842 6,851 1,866 6,064 1,864 Net income 3,344 3,477 4,414 4,933 4,985 4,200 EXHIBIT 2: BALANCE SHEET FOR STANDARD CHARTERED BANK (US$) 2008 2009 2010 2011 2012 2013 Short-term assets Cash and due from banks Federal funds Other short-term investments Investment securities held available-for-sale Total investment 46,583 50,885 24,161 18,131 92,575 67,327 61,849 69,040 225,168 205,383 52,058 32,724 79,709 70,967 235,458 65,981 47,364 88,845 79,790 67,797 83,702 60,537 54,534 80,422 93,965 95,374 99,888 304,130 332,089 281,980 89,817 2,325 47,567 33,097 6,357 98,563 2,523 57,637 36,946 7,008 118,172 133,229 2,454 3,804 70,662 72,574 46,488 52,676 9,388 10,255 138,733 149,312 4,645 3,967 72,627 69,789 57,790 60,013 11,543 13,630 Customer loans Commercial loans Real estate construction loans Residential mortgages Consumer loans Lease financing (commercial real estate) International loans Total customer loans Impairment provision, customers Loans and advances to customers Other assets Premises and equipment Customer liability on acceptance outstanding Accrued income and prepayments Other assets 179,163 202,677 4,985 4,385 174,178 198,292 247,164 272,538 6,806 5,748 240,358 266,790 285,338 296,711 5,700 6,003 279,638 290,708 3,586 4,103 2,574 3,080 3,466 3,241 26,096 22,554 435,068 436,653 4,507 4,847 2,127 29,263 516,560 5,078 5,485 2,521 30,832 592,686 6,620 6,903 4,957 5,501 2,552 2,510 33,311 36,669 631,208 674,380 Total assets EXHIBIT 2: (CONTINUED) Deposits 2008 24,195 93,092 2009 30,572 126,726 2010 40,820 137,255 2011 38,510 153,185 2012 42.230 173,103 2013 45,482 181,159 145,206 133,882 162,652 193,035 201,123 200, 142 12,084 4,509 5,249 6,502 6,056 8,714 Non-interest-bearing deposits Saving deposits Customer certificates of deposits Institutional certificates of deposits Total interest-bearing deposits Total deposits Financial liabilities held at fair value through profit or loss Total deposit liabilities 250,382 274,577 265,117 295,689 305,156 345,976 352,722 391,232 380,282 390,015 422,512 435,497 8,660 5,984 10,433 10,210 13,211 10,914 265,917 289,705 335,543 381,022 409,301 424,583 Other liabilities Short-term borrowings Acceptances outstanding Accruals and deferred income Other liabilities Total liabilities 2,539 4,132 139,785 412,373 2,963 4,113 111,952 408,733 4,774 4,528 132,850 477,695 5,473 4,458 160,358 551,311 4,900 5,501 4,811 4,668 166,141 192,787 585,153 627,539 948 1,013 4,828 1,174 5,386 1,192 5,432 1,207 5,476 1,214 5,493 4,743 18 18 18 18 18 18 5,450 12,421 -5 -109 Share capital Share premium account Capital and capital redemption reserve Merger reserve Available-for-sale reserve Cash flow hedge reserve Translation reserve Retained earnings Parent company shareholders' equity Non-controlling interest Total equity Total equity and liabilities 7,284 -93 15 -1,185 15,460 12,421 306 57 -412 -13 -83 -1,784 12,853 12,421 478 81 -885 26,566 12,421 446 15 -2,106 28,745 -1,394 23,167 19,260 22,140 27,340 38,212 40,714 45,362 46,246 555 580 653 661 22,695 435,068 27,920 436,653 38,865 516,560 41,375 592,686 693 595 46,055 46,841 631,208 674,380 Source: Standard Chartered PLC, "Standard Chartered PLC Annual Report 2013: Driving Investment, Trade and the Creation of Wealth across Asia, Africa and the Middle East," 2014, http://reports.standardchartered.com/annual-report-2013/pdf/2013- Annual-Report.pdf, accessed February 16, 2015. EXHIBIT 4: DIVIDEND DISCOUNT MODEL VALUATION ASSUMPTIONS AND OTHER SELECTED FINANCIAL DATA Financial Year End: Ordinary Shares Outstanding: Equity Beta: U.K. Government Bond Yield: Market Risk Premium: Dividend per Share in 2014 (Year 0): Book Value per Share: December 31 2.427 billion 1.23 2.62% 6.35% US$0.86 US$19.05 Dividends are expected to grow at the rates shown in the table below. From 2015 to 2017, with SCB still working towards recovery, modest growth of 3 per cent is expected. From 2018 to 2023, SCB will have rebounded and with its retail banking growth potential, a higher growth of 5 per cent is assumed. The terminal growth rate is estimated to be 7 per cent. Year-on-Year Dividend Growth 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Year (estimates) Dividend growth rate (%) Dividend per share ($) 3 3 3 5 5 5 5 5 5 7 0.86 0.89 0.91 0.94 0.99 1.04 1.09 1.14 1.20 1.26 1.35 EXHIBIT 5: KEY FINANCIAL FIGURES AND MARKET-COMPARABLE MULTIPLES OF SELECTED PUBLICLY TRADED FIRMS SCB UBS ING Royal Bank of Scotland Barclays HSBC RBS BARC HSBA Deutsche Bank DB STAN UBS ING London London 956.40* 385.60* London London New York New York New York 257.87* 602.2* 17.19 14.03 32.29 53.80B 121.52B 64.53B 54.08B 44.52B 139,600 254,000 60,205 84,718 98,138 23.21B 43.73B 86,000 110,800 -9.20 58.90 9.10 11.30 7.00 14.90 23.80 16.18B 14.3B 24.19B 58.36B 30.23B 29.02B 35.14B 17.03B 11.43B 24.87B 58.96B N/A Ticker Stock exchange Share price Market capitalization Employees Qtrly revenue growth (yoy) (%) Revenue (ttm**) Gross profit (ttm): EBITDA (ttm) Operating margin (ttm) (%) Net income (ttm) EPS (ttm, diluted) P/E (ttm, forward) P/S (ttm) P/B (mrq***) Total cash 3.89B N/A N/A N/A N/A 35.63 -14.71 26.93 32.25 9.55 34.47 16.01 4.17B -6.43B 1.03B 15.32B 3.84B 3.03B 1.90B 1.70 -0.57 0.06 0.81 0.37 1.49 0.99 11.16 9.23 0.12 0.10 6.69 10.02 21.77 2.23 3.08 2.21 2.07 2.11 3.39 1.24 0.74 0.71 0.89 0.62 1.17 0.92 0.55 146.8B 486.5B N/A 178.26B 717.2B 964.52B 647.7B 541.46B 1,170B 918B Total debt 143.8B 463.4B N/A 205.87B Note: SCB's balance sheet and income statements are in USD, but the share prices are quoted in GBP. Use exchange rate of 1 USD = 0.65 GBP on February 16, 2015. + Earnings Before Interest, Taxes, Depreciation and Amortization. *share price quoted in GBP (pence). **ttm = trailing 12 month ***mrq = most recent quarter

EXHIBIT 3: DISCOUNTED CASH FLOW VALUATION ASSUMPTIONS

EXHIBIT 3: DISCOUNTED CASH FLOW VALUATION ASSUMPTIONS