Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete whole question Hurte-Paroxysm Products, Inc, (B). Hurte-Paroxysm Products, Inc. (HP) of the United Stales, experts computer printers to Brazl whose cumency, the reas (BFL)

complete whole question

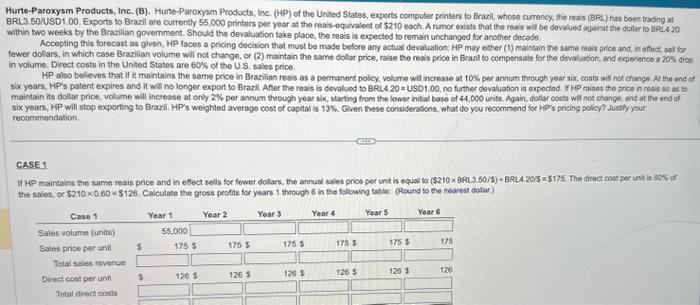

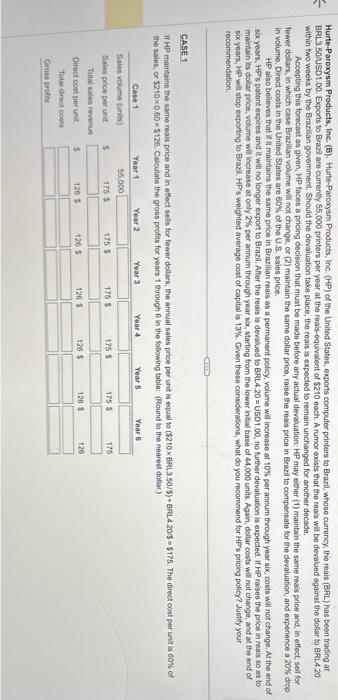

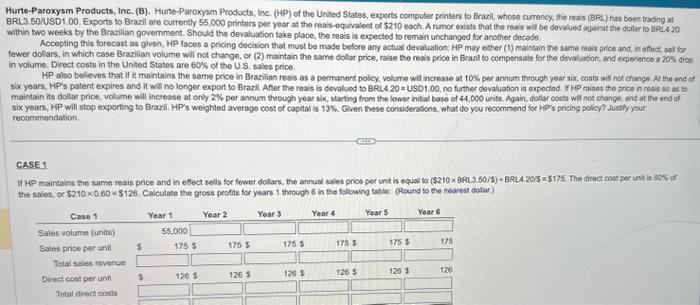

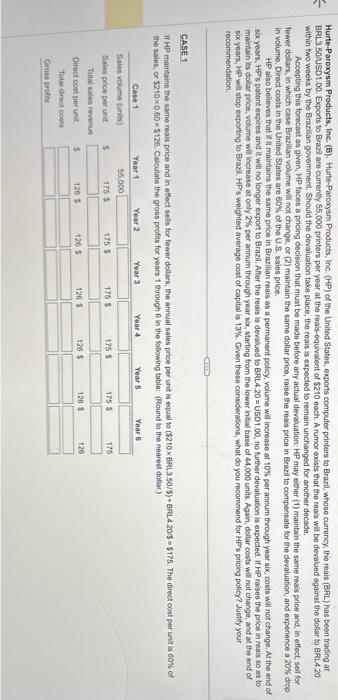

Hurte-Paroxysm Products, Inc, (B). Hurte-Paroxysm Products, Inc. (HP) of the United Stales, experts computer printers to Brazl whose cumency, the reas (BFL) Fras been trading at BRL 3.50USD 1.00. Exports to Brazil are currenily 55,000 printers per year at the reais-equivalent of \$210 each. A rumor exists that the roais wil be devalued aganst the doltar to B.PL4 ia within two weeks by the Brazilian government. Should the devaluation take place, the reals is expected to remain unchanged for ancther decedo. Aocopting this forecast as given, MP laces a pricing decision that must be made before any actual devaluation: HP may eicher (1) maintain the same reais price and, in affect selfor. fewer dolars, in which case Brazilian volume wili not change, or (2) maintain the same dollar price, raise the reais price in Bradil to compensalo for the devalotion, and experince a 20s droe in volume. Direct costs in the Unted States are 60% of the U.S, sales price. HP also belioves that if il maintains the same price in Brazilian roais as a permanent policy, volume wil increase at 10s per annum theugh year six, costa atll hot change Ae the ond of six years, HP's patent expires and it will no longer export to Brazil After the reais is dovalued to BRLL. 20= USD1.00, no further devaluation is oxpoctad. if HP raises the grice in reai so at to maintain its dollar price, volume will increase at only 2% per annum through yoar six, starthg from the lower inital base of 44,000 units. Again, dollar cost will nct change, and at the and of six yoars. HP will stog exporting to Brazi. HP's weighted average cost of capital is 13%. Given these considerasons, what do you reoomrond foc HP's preing policy? Justly your recomvendation. CASE 1 the sales, or $2100.60 - $126. Calculate the gross peofits for years 1 through 6 in the following table: (Round to the cearest dolar.) Hurte-Paroxysm Products, Inc. (B). Hurte-Paroxysm Products, Inc. (HP) of the United States, exports computer printers to Brazil, whose currency, the reais (BRL) has been trading at BRL3.50 USD 1.00, Exports to Brazi are currently 55,000 printers per year at the reals-equivalent of $210 each. A rumor exists that the reais will be devalued against the dollar to BRL4 20within two weeks by the Brazilan govemment. Should the devaluation take place, the reais is expected to remain unchanged for another decade. Accepting this forecest as given, HP faces a pricing decision that must be made before any actual devaluation: HP may ether (1) maintain the same reais price and, in effect, seli for fener dollars, in which case Brazilian volume will not change, or (2) maintain the same dollar price, faise the reais price in Brazil to compensate for the devaluation, and experience a 20\%s drop in volume. Direct costs in the United States are 60% of the U.S. sales price. HP aiso believes that if it maintains the same price in Brazilian reais as a permanent policy, volume wil increase at 10% per annum through year six, cosis will not change. At the end of sax year5, HP's patent exples and it will no longer export to Brazil. Aler the reais is devalued to BRL.4.20= USD1.00, no further devaluaton is expected. If HP raises the price in reais so as to maintain its dollar price, volume will increase at only 2% per annum through year six, starting from the lower infial base of 44,000 units. Again, dollar costs will not change, and at the end of six yoars, HP will stop exporting to Brazi. HP's weighted average cost of capital is 13%. Given these considerations, what do you recormmend for HP's pricing policy? Justify your recortimendstion. CASE. the saies, or $2100.60=$126. Calculate the gross profits for years 1 through 6 in the following table: (Found to the nearest doliar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started