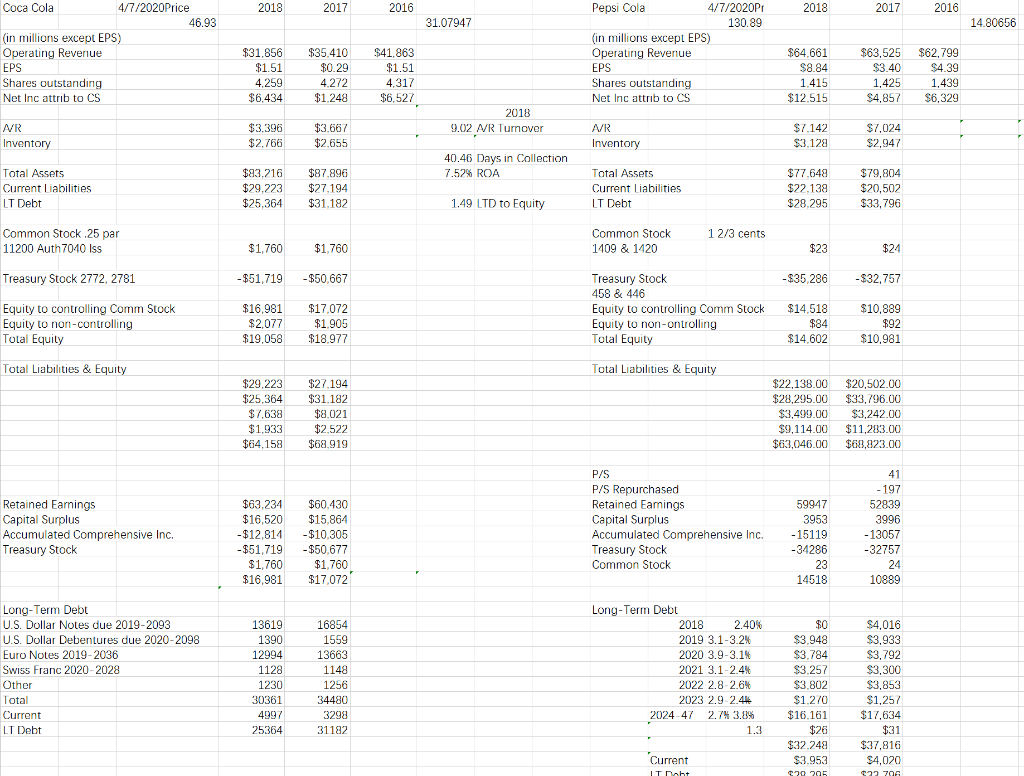

Complete word document through excel

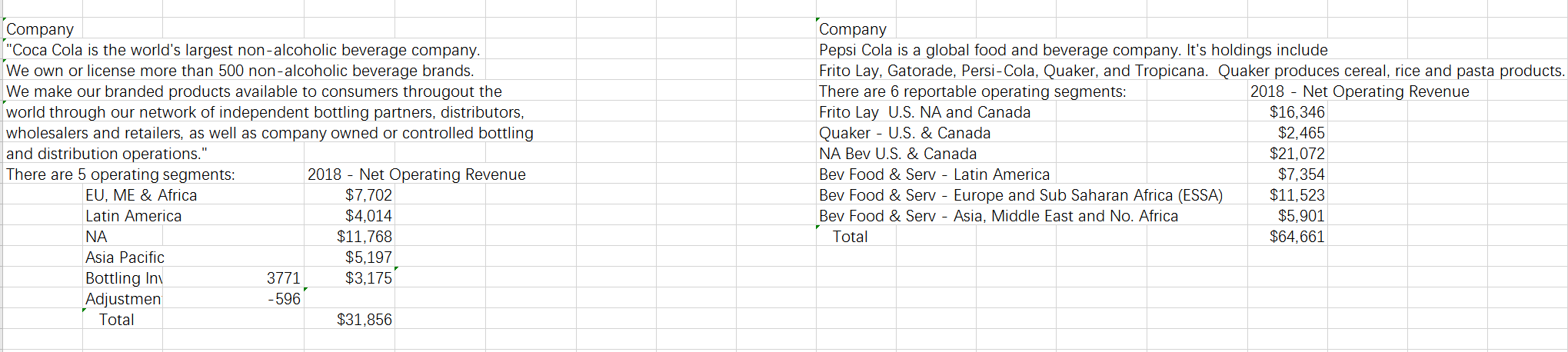

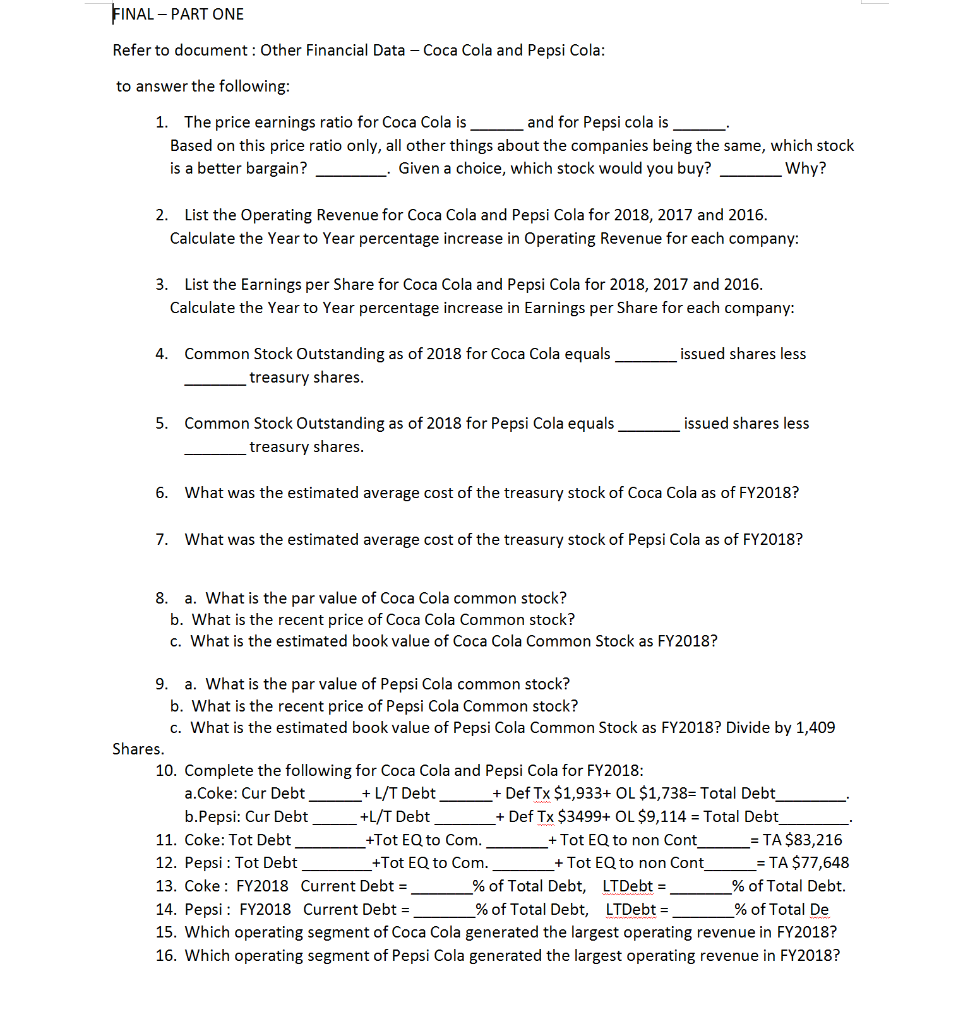

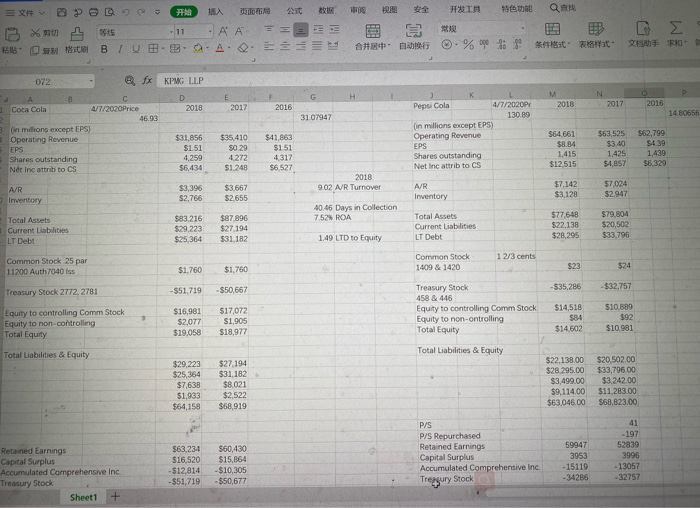

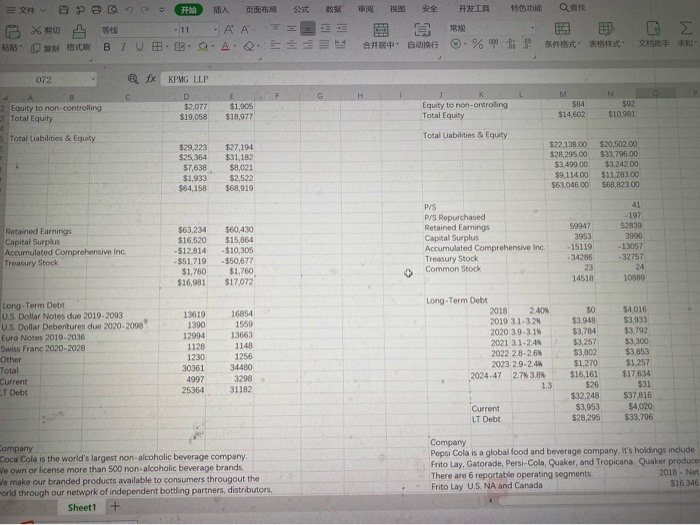

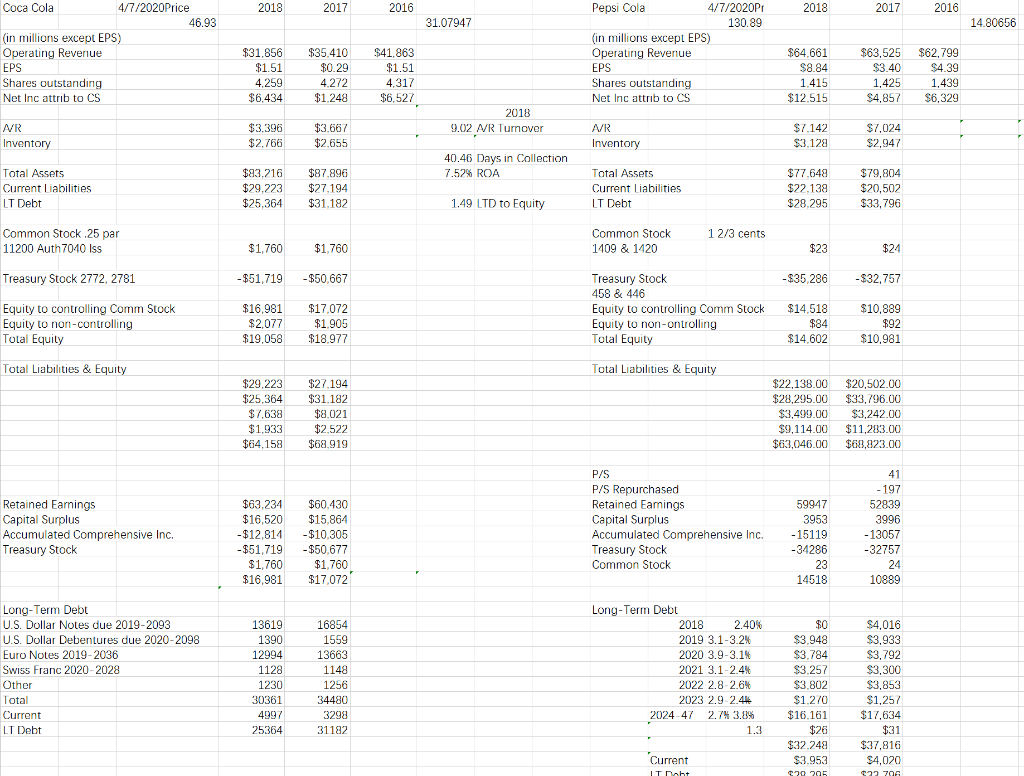

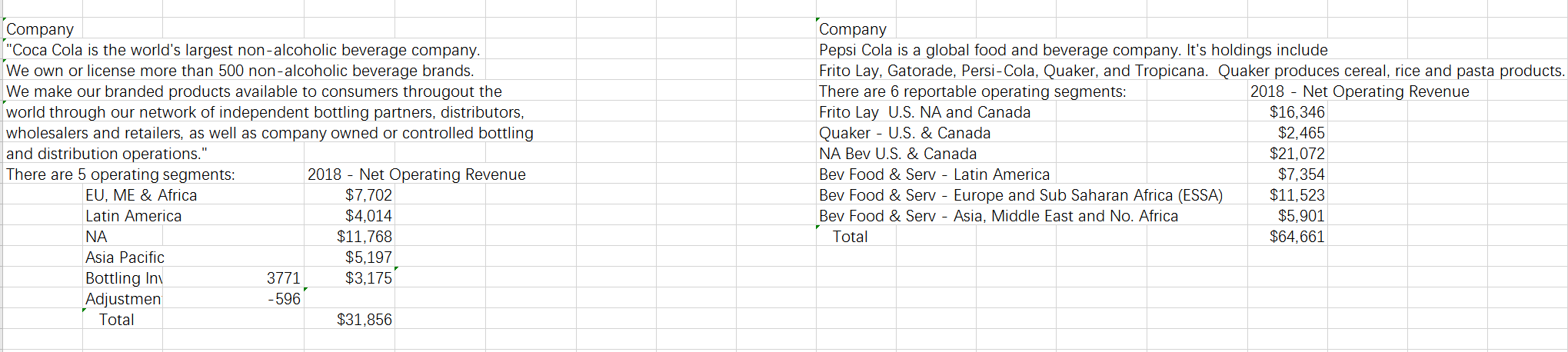

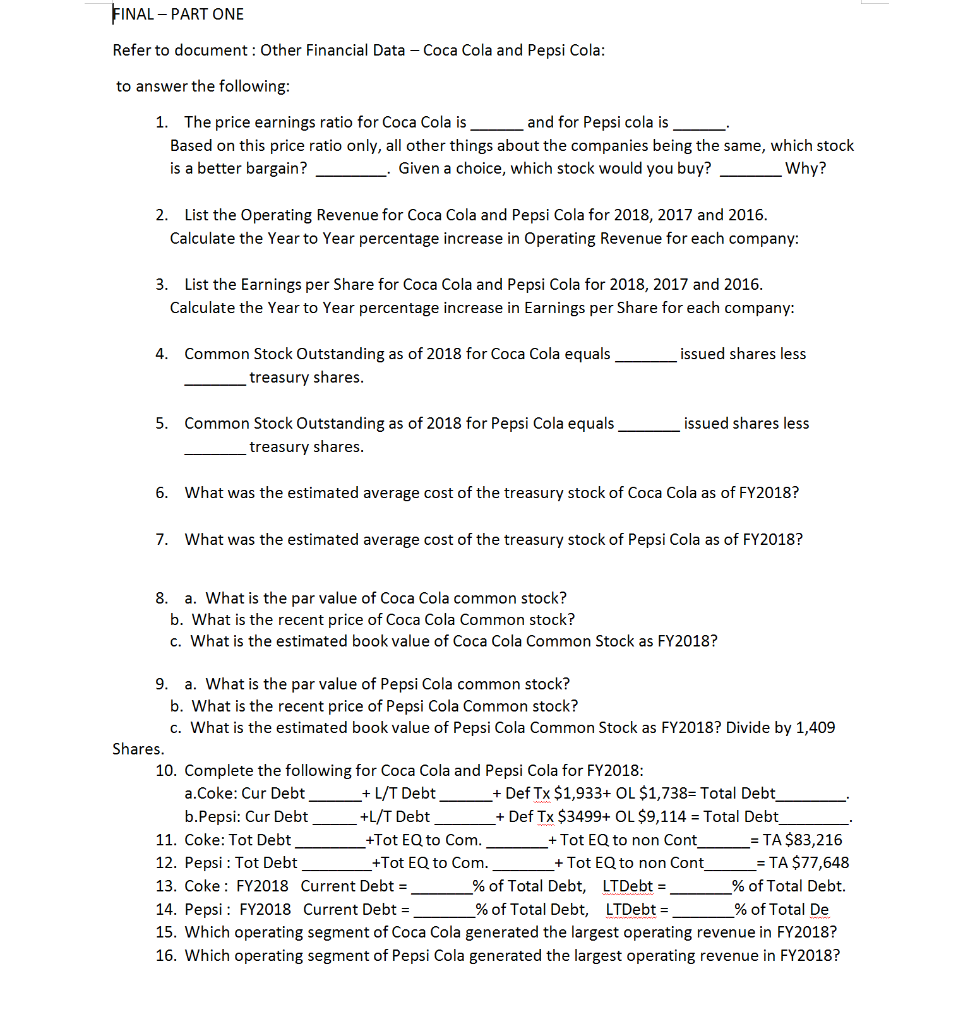

Company "Coca Cola is the world's largest non-alcoholic beverage company. We own or license more than 500 non-alcoholic beverage brands. We make our branded products available to consumers througout the world through our network of independent bottling partners, distributors, wholesalers and retailers, as well as company owned or controlled bottling and distribution operations." There are 5 operating segments: 2018 - Net Operating Revenue EU, ME & Africa $7,702 Latin America $4,014 NA $11,768 Asia Pacific $5,197 Bottling In 3771 $3,175 Adjustmen -596 Total $31,856 Company Pepsi Cola is a global food and beverage company. It's holdings include Frito Lay, Gatorade, Persi-Cola, Quaker, and Tropicana. Quaker produces cereal, rice and pasta products. There are 6 reportable operating segments: 2018 - Net Operating Revenue Frito Lay U.S. NA and Canada $16,346 Quaker - U.S. & Canada $2.465 NA Bev U.S. & Canada $21,072 Bev Food & Serv - Latin America $7,354 Bev Food & Serv - Europe and Sub Saharan Africa (ESSA) $11,523 Bev Food & Serv - Asia, Middle East and No. Africa $5,901 Total $64,661 FINAL PART ONE Refer to document: Other Financial Data - Coca Cola and Pepsi Cola: to answer the following: 1. The price earnings ratio for Coca Cola is_ and for Pepsi cola is Based on this price ratio only, all other things about the companies being the same, which stock is a better bargain? . Given a choice, which stock would you buy? Why? 2. List the Operating Revenue for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Operating Revenue for each company: 3. List the Earnings per Share for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Earnings per Share for each company: 4. Common Stock Outstanding as of 2018 for Coca Cola equals - _treasury shares. issued shares less issued shares less 5. Common Stock Outstanding as of 2018 for Pepsi Cola equals ___treasury shares. 6. What was the estimated average cost of the treasury stock of Coca Cola as of FY2018? 7. What was the estimated average cost of the treasury stock of Pepsi Cola as of FY2018? 8. a. What is the par value of Coca Cola common stock? b. What is the recent price of Coca Cola Common stock? c. What is the estimated book value of Coca Cola Common Stock as FY2018? 9. a. What is the par value of Pepsi Cola common stock? b. What is the recent price of Pepsi Cola Common stock? c. What is the estimated book value of Pepsi Cola Common Stock as FY2018? Divide by 1,409 Shares. 10. Complete the following for Coca Cola and Pepsi Cola for FY2018: a.Coke: Cur Debt _+L/T Debt_ _+ Def Tx $1,933+ OL $1,738= Total Debt b.Pepsi: Cur Debt_ _ +L/T Debt + Def Tx $3499+ OL $9,114 = Total Debt 11. Coke: Tot Debt _+Tot EQ to Com. + Tot EQ to non Cont_ = TA $83,216 12. Pepsi : Tot Debt _+Tot EQ to Com._ _+ Tot EQ to non Cont_ =TA $77,648 13. Coke : FY2018 Current Debt = _ _% of Total Debt, LTDebt = _ _% of Total Debt. 14. Pepsi : FY2018 Current Debt = __ _% of Total Debt, LTDebt = _ _% of Total De 15. Which operating segment of Coca Cola generated the largest operating revenue in FY2018? 16. Which operating segment of Pepsi Cola generated the largest operating revenue in FY2018? QAR EXPO F FIDMX 2010 3 x AA == HEM OM ONI BUBBA OE 3 IN * 19: % 911 B C E CEMO 072 - fx KPMG LLP Coca Cola DEF 2018 2017 2016 4/7/2020 Price 2018 2017 2016 46.93 3107947 in millions except EPS) Operating Revenue Pepsi Cola U/1/2020 13089 in millions except EPS) Operating Revenue $31,856 $1.51 4,259 $6.434 $35.410 90 29 4.272 $1.248 $41,863 $1 51 4317 $6527 564 661 $9.94 1,415 $12515 $63,525 $3.40 1,425 $1,657 $62,799 $4.39 1.439 36.329 Shares outstanding Net Inc attrib to CS Shares outstanding Net inc attrib to CS AR Inventory $396 52.766 $3667 $2655 2018 902 A/R Turnover $7.142 $3 128 $7,024 $2.947 Inventory 10.06 Days in Collection 752 ROA $77,548 Total Assets Current Liabilities LT Debt $83.216 529.223 $25,364 87896 $27 194 $31.182 Total Assets Current Liabilities LT Debt $79,804 $20.502 $33.796 $22.138 $28,295 1.49 LTD to Equity 1 2/3 cents Common Stock 25 par 11200 Auth7040 Iss $1,760 $1,760 Common Stock 1409 & 1420 $23 $24 Treasury Stock 2772, 2781 -$51.719 $50667 -$35,286 -$32,757 Equity to controlling Comm Stock Equity to non-controlling Total Equity $14518 $16.981 $2.077 $19.058 Treasury Stock 458 446 Equity to controlling Comm Stock Equity to non-ontrolling Total Equity $17072 $1.905 $18.977 58 $10,889 $92 $10.981 $14.502 Total Liabilities & Equity Total Liabilities & Equity $29,223 $25,364 $7,639 $1.933 $64158 $27.194 $31. 182 SR021 $2 522 $62 919 $22,138.00 $28.295.00 53 499.00 $9,114.00 $63.005.00 $20,502.00 $33,79600 $3.242.00 $11.283.00 968.823.00 - 197 59947 3953 Retained Earnings Capital Surplus Accumulated Comprehensive Inc. Treasury Stock Sheet1 + 52839 3996 P/S Repurchased Retained Earrings Capital Surplus Accumulated Comprehensive Inc. Treggury Stock $63,234 $16.520 -$12,814 -$51,719 560,430 $15,864 $10,305 $50,677 -15119 - 34225 - 13057 -32757 WIR HQ OPOFFEMAS B X 4 .11AAT ROMB TUBA AOS DI ISOE 8 :% :81 fx KPMG LLP OF G H M Equity to non-controlling Total Equity $2,077 $19,058 $1,005 $18.977 Equity to non-ontrolling Total Equity 534 $14,602 $92 $10.981 Total Liabilities & Equity Total Liabilities & Equity 9223 $25,364 $7,638 $1.933 $64,158 $27.194 $31.12 $8,021 $2,522 $68,019 $2213800 $28.295.00 $3.499.00 $9.11400 563,046.00 2050200 $33.795.00 $3.242.00 $11.283.00 $60,02300 197 Retained Earnings Capital Surplus Accumulated Comprehensive Inc Treasury Stock 39 3996 $63,234 $16.520 $12.914 $51.719 $1,760 $16,981 560.430 $15.864 $10,305 $50,677 $1,760 $17,072 P/S Repurchased Retained Eags Capital Surplus Accumulated Comprehensive in Treasury Stock Common Stock 59947 395 - 15119 -34286 -13057 -32757 24 10309 14518 Long-Term Debt US Dollar Notes due 2019-2093 US Dollar Debentures due 2020-2008 Euro Notes 2019.2036 Swiss Franc 2020-2028 Other Total Current T Debt 13619 1390 12994 1128 1230 30361 4997 25364 16854 1550 13663 1148 1256 34.680 3298 LongTerm Debt 2018 20 2019 31-32 2020 3.9.3.11 2021 31-24 2022 28.2.6 2023 2.9.245 2024.47 2.7138 SO $3.948 $3,784 $3.257 $3.802 $1.270 $16.161 $26 $32.248 $3,953 $28,295 54016 53,933 $3,792 $3.300 $3,853 $1.257 $17.634 $31 $37,816 $4,020 $33.796 Current LT Debt company Coca Cola is the world's largest non-alcoholic beverage company own or license more than 500 non-alcoholic beverage brands. o make our branded products available to consumers througout the orld through our network of independent bottling partners, distributors Sheet1 + Company Pepsi Cola is a global food and beverage company. It's holdings indude Frito Lay, Gatorade, Persi-Cola, Quaker, and Tropicana Quaker produce There are 6 reportable operating segments 2018 - Net Frito Lay U.S. NA and Canada 516 14 Company "Coca Cola is the world's largest non-alcoholic beverage company. We own or license more than 500 non-alcoholic beverage brands. We make our branded products available to consumers througout the world through our network of independent bottling partners, distributors, wholesalers and retailers, as well as company owned or controlled bottling and distribution operations." There are 5 operating segments: 2018 - Net Operating Revenue EU, ME & Africa $7,702 Latin America $4,014 NA $11,768 Asia Pacific $5,197 Bottling In 3771 $3,175 Adjustmen -596 Total $31,856 Company Pepsi Cola is a global food and beverage company. It's holdings include Frito Lay, Gatorade, Persi-Cola, Quaker, and Tropicana. Quaker produces cereal, rice and pasta products. There are 6 reportable operating segments: 2018 - Net Operating Revenue Frito Lay U.S. NA and Canada $16,346 Quaker - U.S. & Canada $2.465 NA Bev U.S. & Canada $21,072 Bev Food & Serv - Latin America $7,354 Bev Food & Serv - Europe and Sub Saharan Africa (ESSA) $11,523 Bev Food & Serv - Asia, Middle East and No. Africa $5,901 Total $64,661 FINAL PART ONE Refer to document: Other Financial Data - Coca Cola and Pepsi Cola: to answer the following: 1. The price earnings ratio for Coca Cola is_ and for Pepsi cola is Based on this price ratio only, all other things about the companies being the same, which stock is a better bargain? . Given a choice, which stock would you buy? Why? 2. List the Operating Revenue for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Operating Revenue for each company: 3. List the Earnings per Share for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Earnings per Share for each company: 4. Common Stock Outstanding as of 2018 for Coca Cola equals - _treasury shares. issued shares less issued shares less 5. Common Stock Outstanding as of 2018 for Pepsi Cola equals ___treasury shares. 6. What was the estimated average cost of the treasury stock of Coca Cola as of FY2018? 7. What was the estimated average cost of the treasury stock of Pepsi Cola as of FY2018? 8. a. What is the par value of Coca Cola common stock? b. What is the recent price of Coca Cola Common stock? c. What is the estimated book value of Coca Cola Common Stock as FY2018? 9. a. What is the par value of Pepsi Cola common stock? b. What is the recent price of Pepsi Cola Common stock? c. What is the estimated book value of Pepsi Cola Common Stock as FY2018? Divide by 1,409 Shares. 10. Complete the following for Coca Cola and Pepsi Cola for FY2018: a.Coke: Cur Debt _+L/T Debt_ _+ Def Tx $1,933+ OL $1,738= Total Debt b.Pepsi: Cur Debt_ _ +L/T Debt + Def Tx $3499+ OL $9,114 = Total Debt 11. Coke: Tot Debt _+Tot EQ to Com. + Tot EQ to non Cont_ = TA $83,216 12. Pepsi : Tot Debt _+Tot EQ to Com._ _+ Tot EQ to non Cont_ =TA $77,648 13. Coke : FY2018 Current Debt = _ _% of Total Debt, LTDebt = _ _% of Total Debt. 14. Pepsi : FY2018 Current Debt = __ _% of Total Debt, LTDebt = _ _% of Total De 15. Which operating segment of Coca Cola generated the largest operating revenue in FY2018? 16. Which operating segment of Pepsi Cola generated the largest operating revenue in FY2018? QAR EXPO F FIDMX 2010 3 x AA == HEM OM ONI BUBBA OE 3 IN * 19: % 911 B C E CEMO 072 - fx KPMG LLP Coca Cola DEF 2018 2017 2016 4/7/2020 Price 2018 2017 2016 46.93 3107947 in millions except EPS) Operating Revenue Pepsi Cola U/1/2020 13089 in millions except EPS) Operating Revenue $31,856 $1.51 4,259 $6.434 $35.410 90 29 4.272 $1.248 $41,863 $1 51 4317 $6527 564 661 $9.94 1,415 $12515 $63,525 $3.40 1,425 $1,657 $62,799 $4.39 1.439 36.329 Shares outstanding Net Inc attrib to CS Shares outstanding Net inc attrib to CS AR Inventory $396 52.766 $3667 $2655 2018 902 A/R Turnover $7.142 $3 128 $7,024 $2.947 Inventory 10.06 Days in Collection 752 ROA $77,548 Total Assets Current Liabilities LT Debt $83.216 529.223 $25,364 87896 $27 194 $31.182 Total Assets Current Liabilities LT Debt $79,804 $20.502 $33.796 $22.138 $28,295 1.49 LTD to Equity 1 2/3 cents Common Stock 25 par 11200 Auth7040 Iss $1,760 $1,760 Common Stock 1409 & 1420 $23 $24 Treasury Stock 2772, 2781 -$51.719 $50667 -$35,286 -$32,757 Equity to controlling Comm Stock Equity to non-controlling Total Equity $14518 $16.981 $2.077 $19.058 Treasury Stock 458 446 Equity to controlling Comm Stock Equity to non-ontrolling Total Equity $17072 $1.905 $18.977 58 $10,889 $92 $10.981 $14.502 Total Liabilities & Equity Total Liabilities & Equity $29,223 $25,364 $7,639 $1.933 $64158 $27.194 $31. 182 SR021 $2 522 $62 919 $22,138.00 $28.295.00 53 499.00 $9,114.00 $63.005.00 $20,502.00 $33,79600 $3.242.00 $11.283.00 968.823.00 - 197 59947 3953 Retained Earnings Capital Surplus Accumulated Comprehensive Inc. Treasury Stock Sheet1 + 52839 3996 P/S Repurchased Retained Earrings Capital Surplus Accumulated Comprehensive Inc. Treggury Stock $63,234 $16.520 -$12,814 -$51,719 560,430 $15,864 $10,305 $50,677 -15119 - 34225 - 13057 -32757 WIR HQ OPOFFEMAS B X 4 .11AAT ROMB TUBA AOS DI ISOE 8 :% :81 fx KPMG LLP OF G H M Equity to non-controlling Total Equity $2,077 $19,058 $1,005 $18.977 Equity to non-ontrolling Total Equity 534 $14,602 $92 $10.981 Total Liabilities & Equity Total Liabilities & Equity 9223 $25,364 $7,638 $1.933 $64,158 $27.194 $31.12 $8,021 $2,522 $68,019 $2213800 $28.295.00 $3.499.00 $9.11400 563,046.00 2050200 $33.795.00 $3.242.00 $11.283.00 $60,02300 197 Retained Earnings Capital Surplus Accumulated Comprehensive Inc Treasury Stock 39 3996 $63,234 $16.520 $12.914 $51.719 $1,760 $16,981 560.430 $15.864 $10,305 $50,677 $1,760 $17,072 P/S Repurchased Retained Eags Capital Surplus Accumulated Comprehensive in Treasury Stock Common Stock 59947 395 - 15119 -34286 -13057 -32757 24 10309 14518 Long-Term Debt US Dollar Notes due 2019-2093 US Dollar Debentures due 2020-2008 Euro Notes 2019.2036 Swiss Franc 2020-2028 Other Total Current T Debt 13619 1390 12994 1128 1230 30361 4997 25364 16854 1550 13663 1148 1256 34.680 3298 LongTerm Debt 2018 20 2019 31-32 2020 3.9.3.11 2021 31-24 2022 28.2.6 2023 2.9.245 2024.47 2.7138 SO $3.948 $3,784 $3.257 $3.802 $1.270 $16.161 $26 $32.248 $3,953 $28,295 54016 53,933 $3,792 $3.300 $3,853 $1.257 $17.634 $31 $37,816 $4,020 $33.796 Current LT Debt company Coca Cola is the world's largest non-alcoholic beverage company own or license more than 500 non-alcoholic beverage brands. o make our branded products available to consumers througout the orld through our network of independent bottling partners, distributors Sheet1 + Company Pepsi Cola is a global food and beverage company. It's holdings indude Frito Lay, Gatorade, Persi-Cola, Quaker, and Tropicana Quaker produce There are 6 reportable operating segments 2018 - Net Frito Lay U.S. NA and Canada 516 14