Answered step by step

Verified Expert Solution

Question

1 Approved Answer

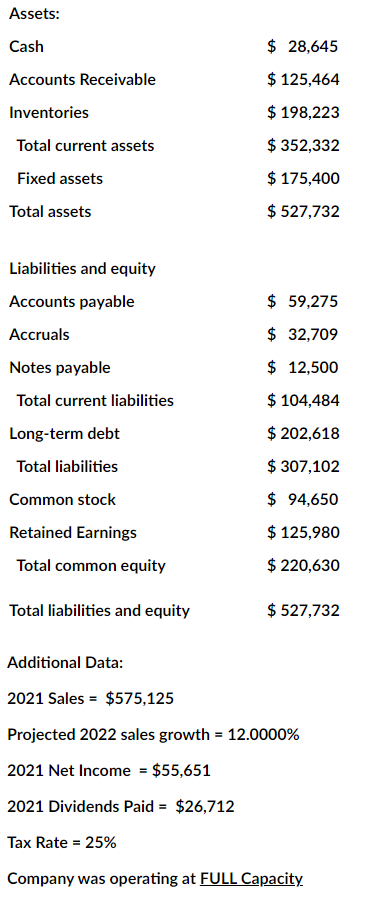

completed question Assets: CashAccountsReceivableInventoriesTotalcurrentassetsFixedassetsTotalassets$28,645$125,464$198,223$352,332$175,400$527,732 Liabilities and equity Additional Data: 2021 Sales =$575,125 Projected 2022 sales growth =12.0000% 2021 Net Income =$55,651 2021 Dividends Paid =$26,712

completed question

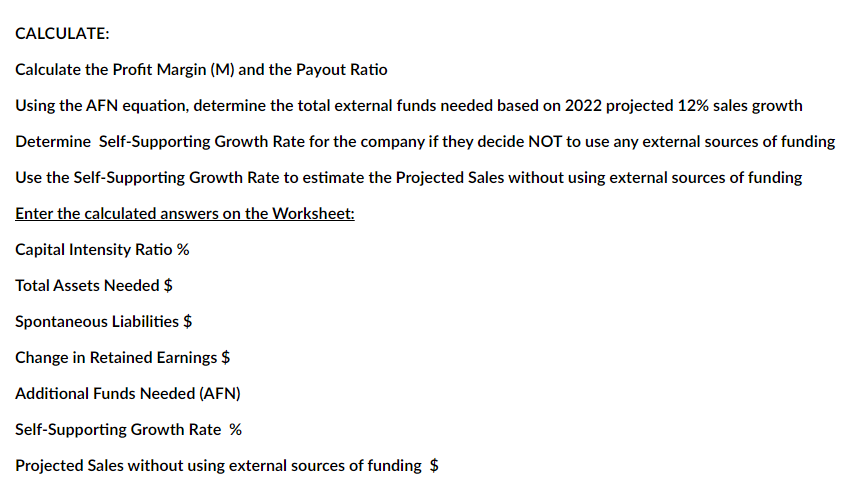

Assets: CashAccountsReceivableInventoriesTotalcurrentassetsFixedassetsTotalassets$28,645$125,464$198,223$352,332$175,400$527,732 Liabilities and equity Additional Data: 2021 Sales =$575,125 Projected 2022 sales growth =12.0000% 2021 Net Income =$55,651 2021 Dividends Paid =$26,712 Tax Rate =25% Company was operating at FULL Capacity Calculate the Profit Margin (M) and the Payout Ratio Using the AFN equation, determine the total external funds needed based on 2022 projected 12% sales growth Determine Self-Supporting Growth Rate for the company if they decide NOT to use any external sources of funding Use the Self-Supporting Growth Rate to estimate the Projected Sales without using external sources of funding Enter the calculated answers on the Worksheet: Capital Intensity Ratio \% Total Assets Needed \$ Spontaneous Liabilities $ Change in Retained Earnings \$ Additional Funds Needed (AFN) Self-Supporting Growth Rate \% Projected Sales without using external sources of funding $ Assets: CashAccountsReceivableInventoriesTotalcurrentassetsFixedassetsTotalassets$28,645$125,464$198,223$352,332$175,400$527,732 Liabilities and equity Additional Data: 2021 Sales =$575,125 Projected 2022 sales growth =12.0000% 2021 Net Income =$55,651 2021 Dividends Paid =$26,712 Tax Rate =25% Company was operating at FULL Capacity Calculate the Profit Margin (M) and the Payout Ratio Using the AFN equation, determine the total external funds needed based on 2022 projected 12% sales growth Determine Self-Supporting Growth Rate for the company if they decide NOT to use any external sources of funding Use the Self-Supporting Growth Rate to estimate the Projected Sales without using external sources of funding Enter the calculated answers on the Worksheet: Capital Intensity Ratio \% Total Assets Needed \$ Spontaneous Liabilities $ Change in Retained Earnings \$ Additional Funds Needed (AFN) Self-Supporting Growth Rate \% Projected Sales without using external sources of funding $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started