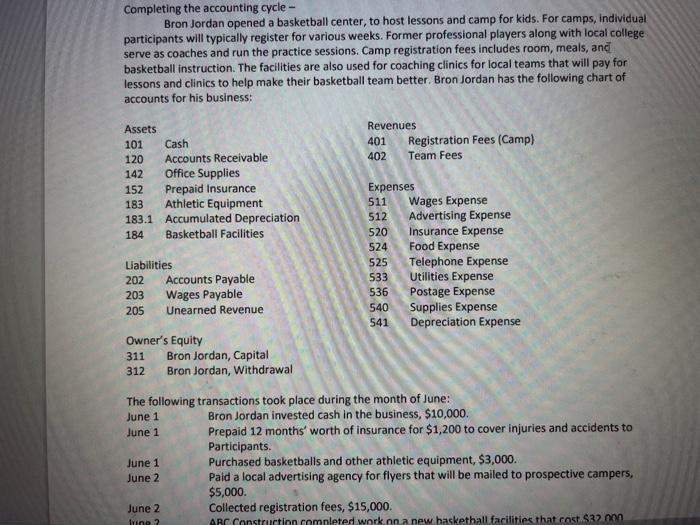

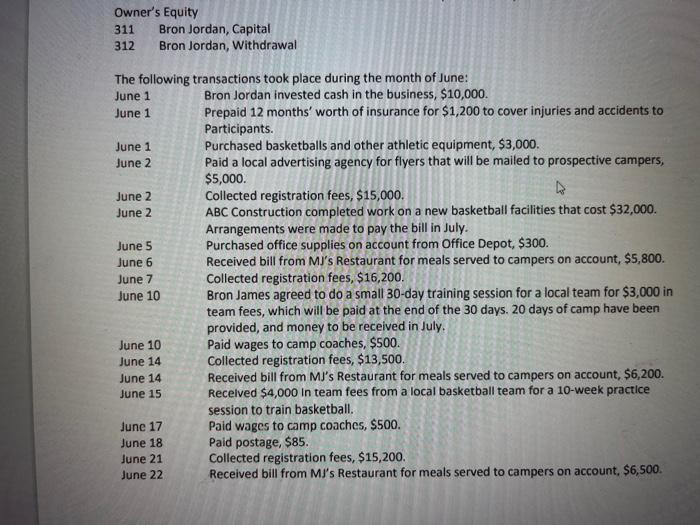

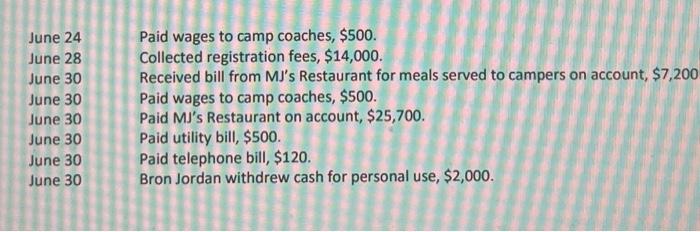

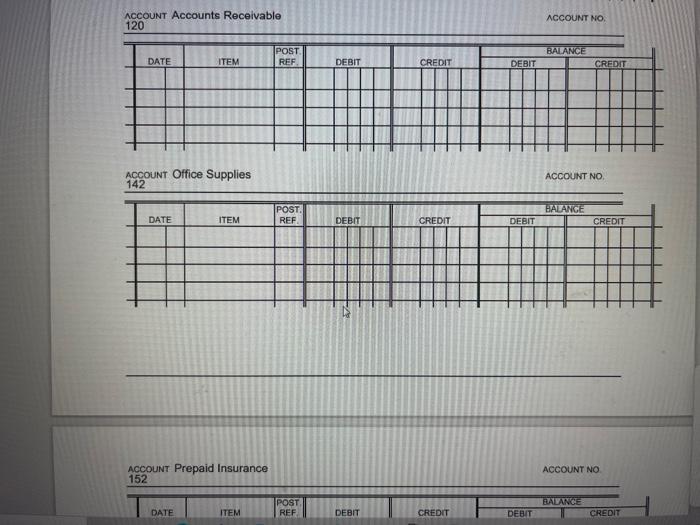

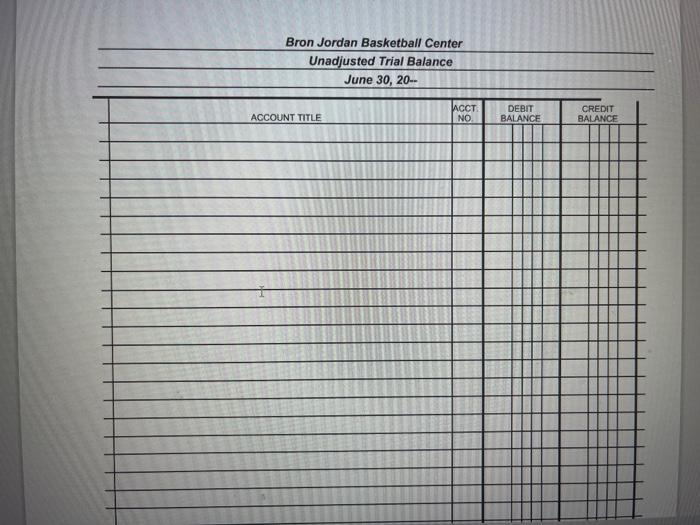

Completing the accounting cycle - Bron Jordan opened a basketball center, to host lessons and camp for kids. For camps, individual participants will typically register for various weeks. Former professional players along with local college serve as coaches and run the practice sessions. Camp registration fees includes room, meals, anc basketball instruction. The facilities are also used for coaching clinics for local teams that will pay for lessons and clinics to help make their basketball team better. Bron Jordan has the following chart of accounts for his business: 311 Bron Jordan, Capital 312 Bron Jordan, Withdrawal The following transactions took place during the month of June: June 1 Bron Jordan invested cash in the business, $10,000. June 1 Prepaid 12 months' worth of insurance for $1,200 to cover injuries and accidents to Participants. June 1 Purchased basketballs and other athletic equipment, $3,000. June 2 Paid a local advertising agency for flyers that will be mailed to prospective campers, $5,000. June 2 Collected registration fees, $15,000. 312 Bron Jordan, Withdrawal The following transactions took place during the month of June: June 1 Bron Jordan invested cash in the business, $10,000. June 1 Prepaid 12 months' worth of insurance for $1,200 to cover injuries and accidents to Participants. June 1 Purchased basketballs and other athletic equipment, $3,000. June 2 Paid a local advertising agency for flyers that will be mailed to prospective campers, $5,000. June 2 Collected registration fees, \$15,000. June2June5June6ABCConstructioncompletedworkonanewbasketballfacilitiesthatcost$32,000.ArrangementsweremadetopaythebillinJuly.PurchasedofficesuppliesonaccountfromOfficeDepot,$300. June 7 Collected registration fees, $16,200. June 10 Bron James agreed to do a small 30-day training session for a local team for $3,000 in team fees, which will be paid at the end of the 30 days. 20 days of camp have been provided, and money to be received in July. June 10 Paid wages to camp coaches, $500. June14June14Collectedregistrationfees,$13,500.ReceivedbillfromMJsRestaurantformealsservedtocampersonaccount,$6,200. June 15 Recelved $4,000 in team fees from a local basketball team for a 10-week practice session to train basketball. June 17 Paid wages to camp coaches, $500. June 18 Paid postage, $85. June 21 Collected registration fees, \$15,200. June 22 Received bill from MJ's Restaurant for meals served to campers on account, $6,500. June 24 Paid wages to camp coaches, \$500. June 28 Collected registration fees, $14,000. June 30 Received bill from MJ's Restaurant for meals served to campers on account, $7,200 June 30 Paid wages to camp coaches, $500. June 30 Paid MJ's Restaurant on account, $25,700. June 30 Paid utility bill, $500. June 30 Paid telephone bill, \$120. June 30 Bron Jordan withdrew cash for personal use, $2,000. Account Accounts Receivable 120 Account Office Supplies 142 Account Prepaid Insurance 152 Completing the accounting cycle - Bron Jordan opened a basketball center, to host lessons and camp for kids. For camps, individual participants will typically register for various weeks. Former professional players along with local college serve as coaches and run the practice sessions. Camp registration fees includes room, meals, anc basketball instruction. The facilities are also used for coaching clinics for local teams that will pay for lessons and clinics to help make their basketball team better. Bron Jordan has the following chart of accounts for his business: 311 Bron Jordan, Capital 312 Bron Jordan, Withdrawal The following transactions took place during the month of June: June 1 Bron Jordan invested cash in the business, $10,000. June 1 Prepaid 12 months' worth of insurance for $1,200 to cover injuries and accidents to Participants. June 1 Purchased basketballs and other athletic equipment, $3,000. June 2 Paid a local advertising agency for flyers that will be mailed to prospective campers, $5,000. June 2 Collected registration fees, $15,000. 312 Bron Jordan, Withdrawal The following transactions took place during the month of June: June 1 Bron Jordan invested cash in the business, $10,000. June 1 Prepaid 12 months' worth of insurance for $1,200 to cover injuries and accidents to Participants. June 1 Purchased basketballs and other athletic equipment, $3,000. June 2 Paid a local advertising agency for flyers that will be mailed to prospective campers, $5,000. June 2 Collected registration fees, \$15,000. June2June5June6ABCConstructioncompletedworkonanewbasketballfacilitiesthatcost$32,000.ArrangementsweremadetopaythebillinJuly.PurchasedofficesuppliesonaccountfromOfficeDepot,$300. June 7 Collected registration fees, $16,200. June 10 Bron James agreed to do a small 30-day training session for a local team for $3,000 in team fees, which will be paid at the end of the 30 days. 20 days of camp have been provided, and money to be received in July. June 10 Paid wages to camp coaches, $500. June14June14Collectedregistrationfees,$13,500.ReceivedbillfromMJsRestaurantformealsservedtocampersonaccount,$6,200. June 15 Recelved $4,000 in team fees from a local basketball team for a 10-week practice session to train basketball. June 17 Paid wages to camp coaches, $500. June 18 Paid postage, $85. June 21 Collected registration fees, \$15,200. June 22 Received bill from MJ's Restaurant for meals served to campers on account, $6,500. June 24 Paid wages to camp coaches, \$500. June 28 Collected registration fees, $14,000. June 30 Received bill from MJ's Restaurant for meals served to campers on account, $7,200 June 30 Paid wages to camp coaches, $500. June 30 Paid MJ's Restaurant on account, $25,700. June 30 Paid utility bill, $500. June 30 Paid telephone bill, \$120. June 30 Bron Jordan withdrew cash for personal use, $2,000. Account Accounts Receivable 120 Account Office Supplies 142 Account Prepaid Insurance 152