Answered step by step

Verified Expert Solution

Question

1 Approved Answer

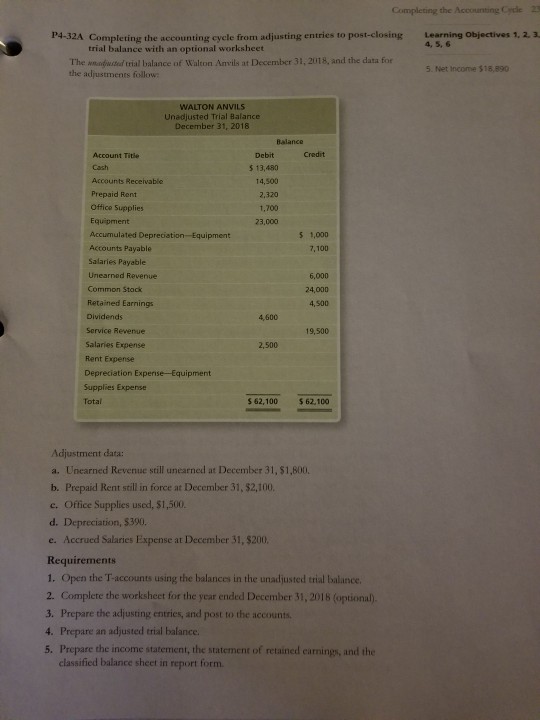

Completing the Accounting Cydle 2 P4-32A Completing the accounting cyele from adjusting entries to post-closing Learning Objectives 1,2.3 4, 5, 6 trial balance with an

Completing the Accounting Cydle 2 P4-32A Completing the accounting cyele from adjusting entries to post-closing Learning Objectives 1,2.3 4, 5, 6 trial balance with an optional worksheet The madusted trial balance of Walton Anvils at December 31, 2018, and the data for the adjustmenrs follow 5. Net income $18,890 WALTON ANVILS Unadjusted Trial Balance December 31, 2018 Balance Credit Account Title Cash Accounts Receivable Prepaid Rent Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Service Revenue Debit s 13,480 14,500 2,320 1,700 23,000 $ 1,000 6,000 24,000 4, 500 4,600 19,500 Salaries Expense 2,500 Rent Expense Depreciation Expenise-Equipment Supplies Expense Total 362 100$62,100 Adjustment data: a. Unearned Revenue still unearned at December 31, $1,800. b. Prepaid Rent still in force at December 31, $2,100, c. Office Supplies used, $1,500. d. Depreciation, $390. e. Accrued Salaries Expense at December 31, $200, Requirements 1. Open the T-accounts using the balances in the unadjusted trial balance 2. Complere the worksheet for the year ended December 31, 2018 (optional). 3. Prepare the adjusting entries, and post to the accounts 4. Prepare an adjusted trial balance. 5. Prepare the income statement, the statement of retained carnings, and the classified balance sheet in report form

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started