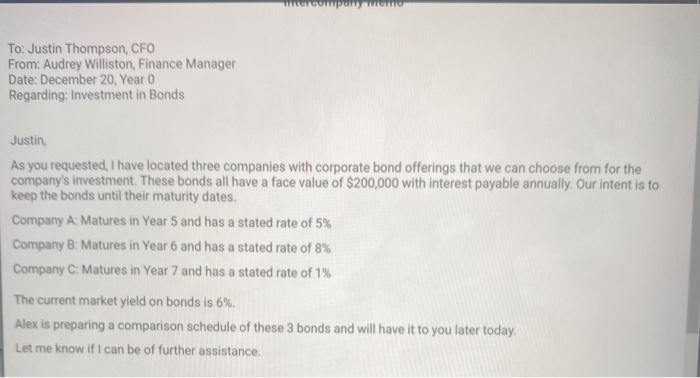

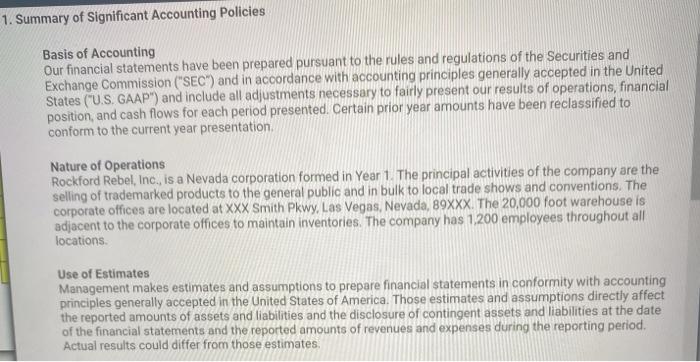

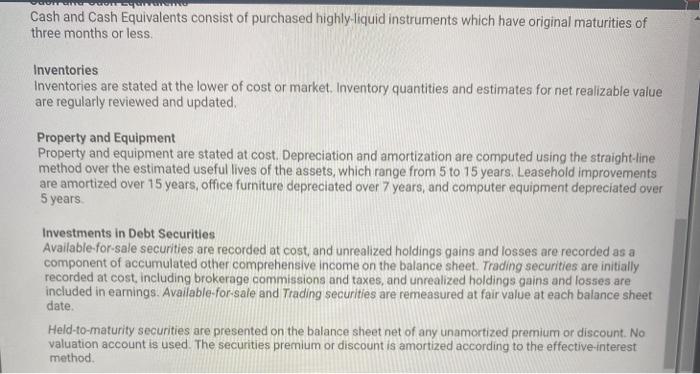

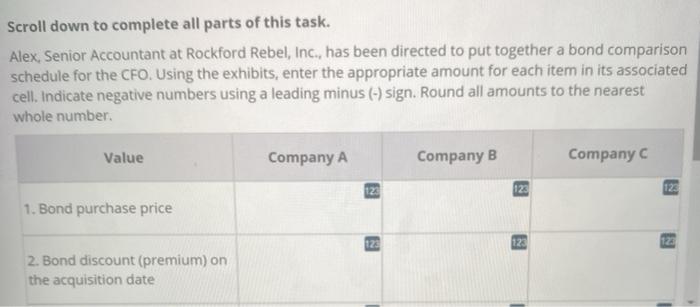

compon To: Justin Thompson, CFO From: Audrey Williston, Finance Manager Date: December 20, Year 0 Regarding: Investment in Bonds Justin As you requested, I have located three companies with corporate bond offerings that we can choose from for the company's investment. These bonds all have a face value of $200,000 with interest payable annually. Our intent is to keep the bonds until their maturity dates. Company A: Matures in Year 5 and has a stated rate of 5% Company B. Matures in Year 6 and has a stated rate of 8% Company C. Matures in Year 7 and has a stated rate of 1% The current market yield on bonds is 6% Alex is preparing a comparison schedule of these 3 bonds and will have it to you later today, Let me know if I can be of further assistance, 1. Summary of Significant Accounting Policies Basis of Accounting Our financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") and in accordance with accounting principles generally accepted in the United States (U.S. GAAP") and include all adjustments necessary to fairly present our results of operations, financial position, and cash flows for each period presented. Certain prior year amounts have been reclassified to conform to the current year presentation Nature of Operations Rockford Rebel, Inc., is a Nevada corporation formed in Year 1. The principal activities of the company are the selling of trademarked products to the general public and in bulk to local trade shows and conventions. The corporate offices are located at XXX Smith Pkwy, Las Vegas, Nevada, 89XXX. The 20,000 foot warehouse is adjacent to the corporate offices to maintain inventories. The company has 1,200 employees throughout all locations Use of Estimates Management makes estimates and assumptions to prepare financial statements in conformity with accounting principles generally accepted in the United States of America. Those estimates and assumptions directly affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates, Cash and Cash Equivalents consist of purchased highly-liquid instruments which have original maturities of three months or less Inventories Inventories are stated at the lower of cost or market. Inventory quantities and estimates for net realizable value are regularly reviewed and updated, Property and Equipment Property and equipment are stated at cost. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the assets, which range from 5 to 15 years. Leasehold improvements are amortized over 15 years, office furniture depreciated over 7 years, and computer equipment depreciated over 5 years Investments in Debt Securities Available for sale securities are recorded at cost, and unrealized holdings gains and losses are recorded as a component of accumulated other comprehensive income on the balance sheet. Trading securities are initially recorded at cost, including brokerage commissions and taxes, and unrealized holdings gains and losses are included in earnings. Available for sale and Trading securities are remeasured at fair value at each balance sheet date. Held-to-maturity securities are presented on the balance sheet net of any unamortized premium or discount. No valuation account is used. The securities premium or discount is amortized according to the effective interest method Scroll down to complete all parts of this task. Alex, Senior Accountant at Rockford Rebel, Inc., has been directed to put together a bond comparison schedule for the CFO. Using the exhibits, enter the appropriate amount for each item in its associated cell. Indicate negative numbers using a leading minus (-) sign. Round all amounts to the nearest whole number Value Company A Company B Company c 123 123 1. Bond purchase price 123 123 2. Bond discount (premium) on the acquisition date 123 123 123 3. Total annual interest received 123 123 123 4. Total interest revenue over the term of the bond compon To: Justin Thompson, CFO From: Audrey Williston, Finance Manager Date: December 20, Year 0 Regarding: Investment in Bonds Justin As you requested, I have located three companies with corporate bond offerings that we can choose from for the company's investment. These bonds all have a face value of $200,000 with interest payable annually. Our intent is to keep the bonds until their maturity dates. Company A: Matures in Year 5 and has a stated rate of 5% Company B. Matures in Year 6 and has a stated rate of 8% Company C. Matures in Year 7 and has a stated rate of 1% The current market yield on bonds is 6% Alex is preparing a comparison schedule of these 3 bonds and will have it to you later today, Let me know if I can be of further assistance, 1. Summary of Significant Accounting Policies Basis of Accounting Our financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") and in accordance with accounting principles generally accepted in the United States (U.S. GAAP") and include all adjustments necessary to fairly present our results of operations, financial position, and cash flows for each period presented. Certain prior year amounts have been reclassified to conform to the current year presentation Nature of Operations Rockford Rebel, Inc., is a Nevada corporation formed in Year 1. The principal activities of the company are the selling of trademarked products to the general public and in bulk to local trade shows and conventions. The corporate offices are located at XXX Smith Pkwy, Las Vegas, Nevada, 89XXX. The 20,000 foot warehouse is adjacent to the corporate offices to maintain inventories. The company has 1,200 employees throughout all locations Use of Estimates Management makes estimates and assumptions to prepare financial statements in conformity with accounting principles generally accepted in the United States of America. Those estimates and assumptions directly affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates, Cash and Cash Equivalents consist of purchased highly-liquid instruments which have original maturities of three months or less Inventories Inventories are stated at the lower of cost or market. Inventory quantities and estimates for net realizable value are regularly reviewed and updated, Property and Equipment Property and equipment are stated at cost. Depreciation and amortization are computed using the straight-line method over the estimated useful lives of the assets, which range from 5 to 15 years. Leasehold improvements are amortized over 15 years, office furniture depreciated over 7 years, and computer equipment depreciated over 5 years Investments in Debt Securities Available for sale securities are recorded at cost, and unrealized holdings gains and losses are recorded as a component of accumulated other comprehensive income on the balance sheet. Trading securities are initially recorded at cost, including brokerage commissions and taxes, and unrealized holdings gains and losses are included in earnings. Available for sale and Trading securities are remeasured at fair value at each balance sheet date. Held-to-maturity securities are presented on the balance sheet net of any unamortized premium or discount. No valuation account is used. The securities premium or discount is amortized according to the effective interest method Scroll down to complete all parts of this task. Alex, Senior Accountant at Rockford Rebel, Inc., has been directed to put together a bond comparison schedule for the CFO. Using the exhibits, enter the appropriate amount for each item in its associated cell. Indicate negative numbers using a leading minus (-) sign. Round all amounts to the nearest whole number Value Company A Company B Company c 123 123 1. Bond purchase price 123 123 2. Bond discount (premium) on the acquisition date 123 123 123 3. Total annual interest received 123 123 123 4. Total interest revenue over the term of the bond