Compose a memo to Mr. Cartwright. In the memo, you need to explain what you see as the problems with his profitable business based on your financial analysis. Included in your solution needs to be a recommendation as to the proposed loan from Northrop National Bank. Is it sufficient to meet the firms cash needs? You need to identify any issues with the company and its cash position and provide a suggested solution (and possibly some suitable alternatives) for the company.

*** The question above is the one I need answered. I have attached the entire assignment for reference. ***

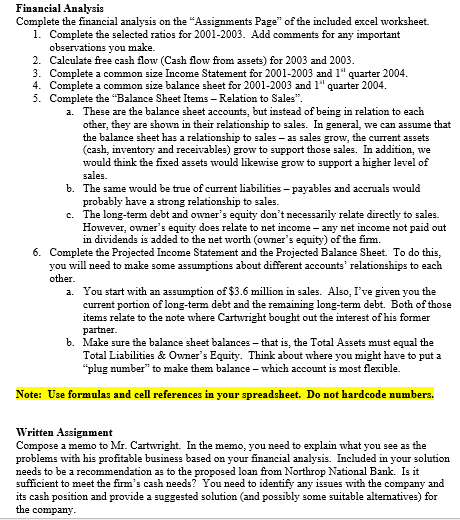

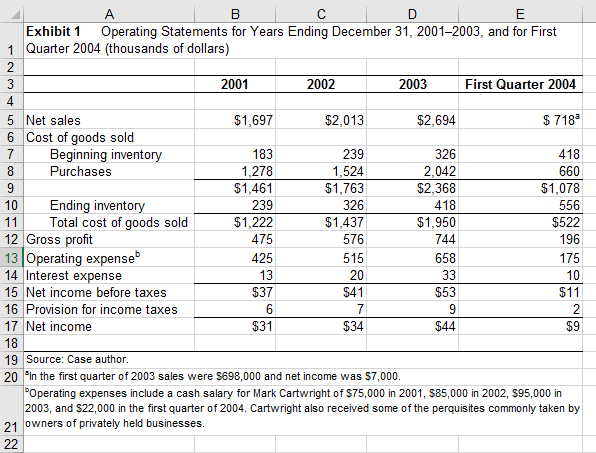

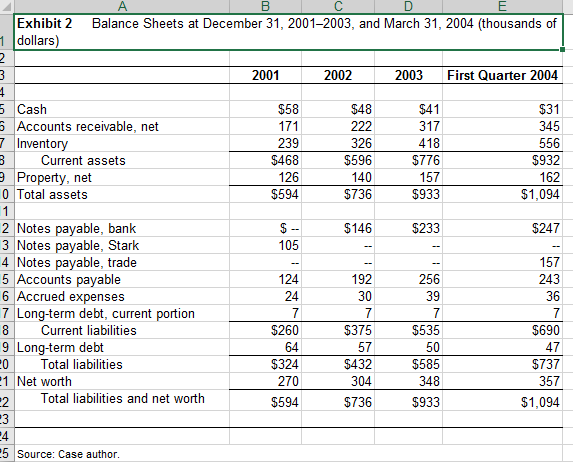

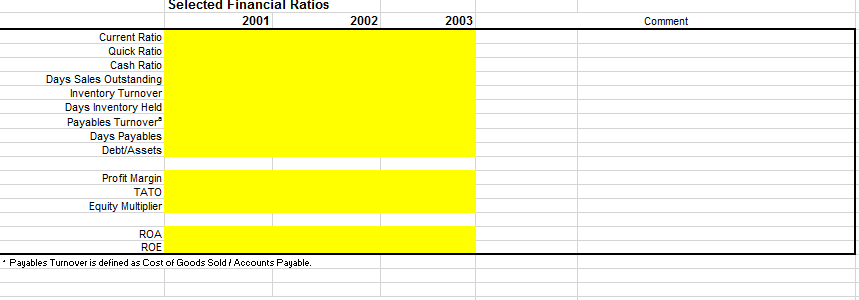

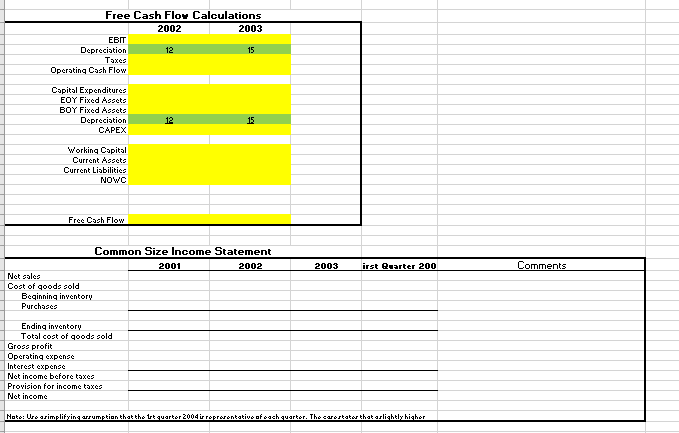

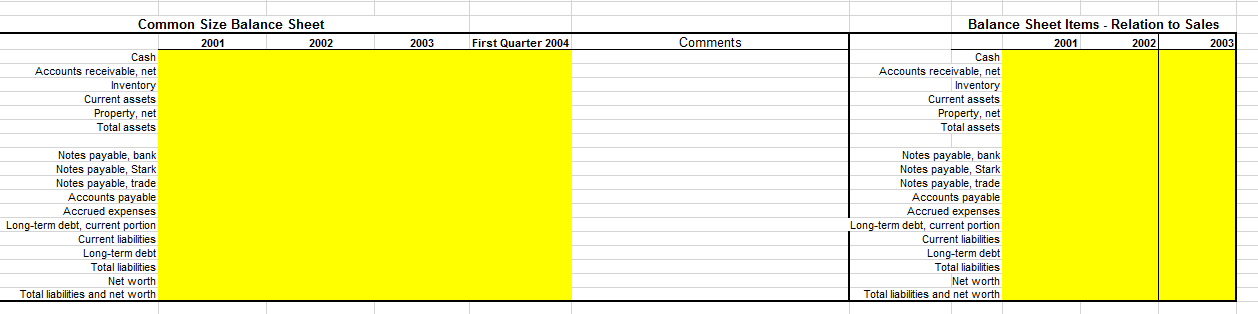

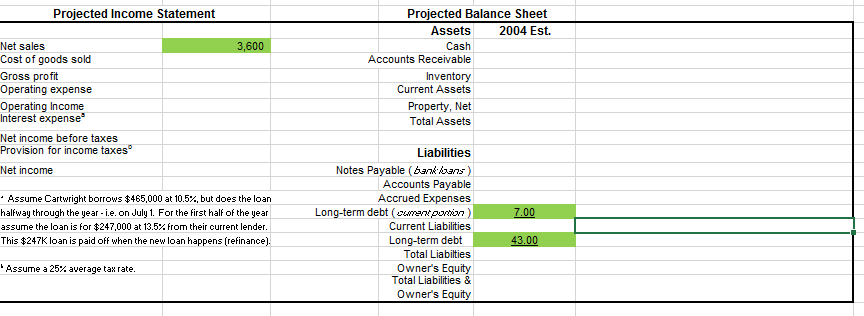

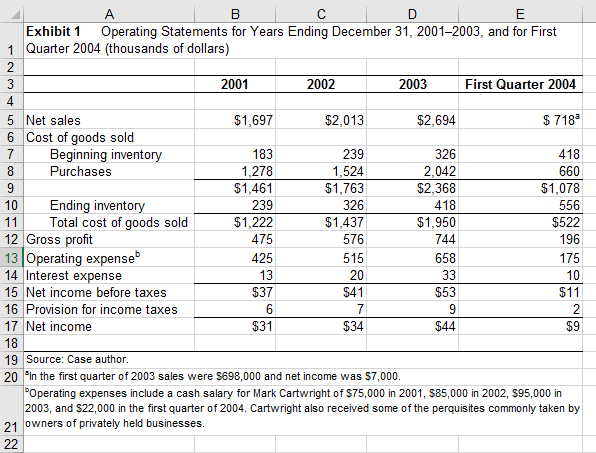

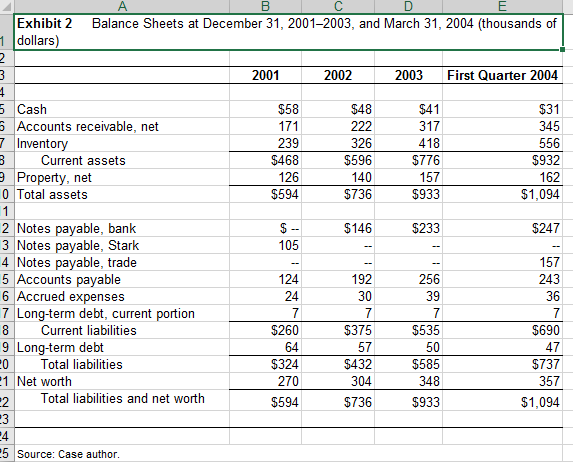

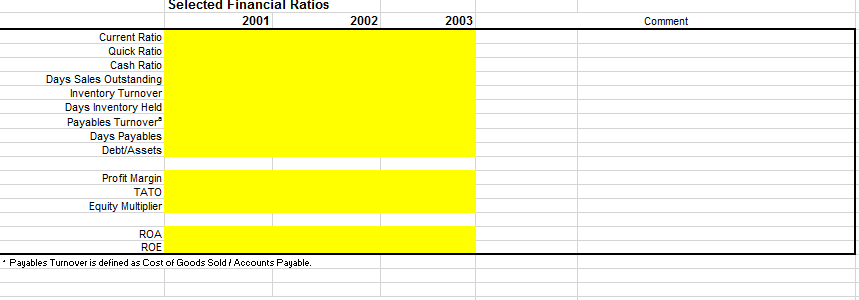

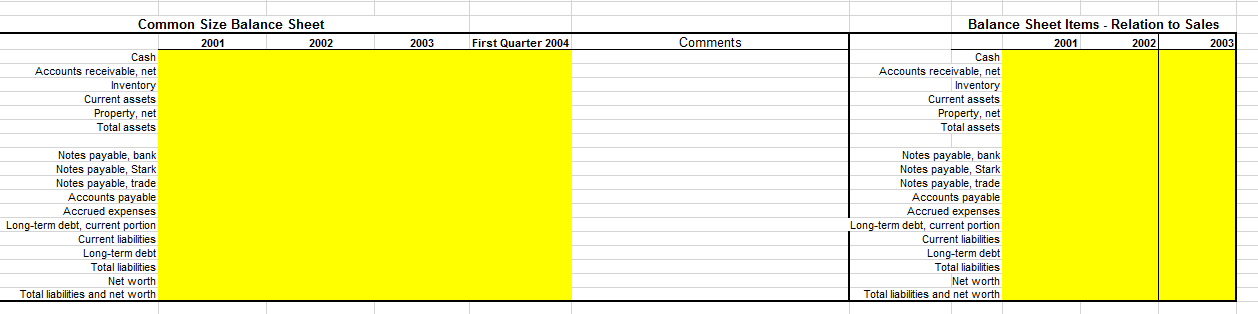

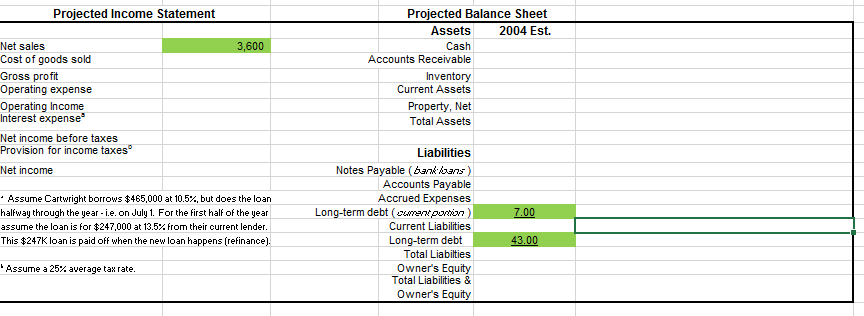

Financial Analysis Complete the financial analysis on the "Assignments Page" of the included excel worksheet. 1. Complete the selected ratios for 2001-2003. Add comments for any important observations you make. 2. Calculate free cash flow (Cash flow from assets) for 2003 and 2003 3. Complete a common size Income Statement for 2001-2003 and 1 quarter 2004 4. Complete a common siza balance sheet for 2001-2003 and 1" quarter 2004 5. Complete the "Balance Sheet Items-Relation to Sales" These are the balance sheet accounts, but instead of being in relation to each other, they are showm in their relationship to sales. In general, we can assume that the balance sheet has a relationship to sales as sales grow, the current assets (cash, inventory and receivables) grow to support those sales. In addition, we would think the fixed assets would likewise grow to support a higher level of ales a. b. The same would be true of current liabilities payables and accruals would probably have a strong relationship to sales. The long-term debt and owmer's equity don't necessarily relate directly to sales. However, owner's equity does relate to net income any net income not paid out in dividends is added to the net worth (owner's equity) of the firm. c. 6. Complete the Projected Income Statement and the Projected Balance Sheet. To do this, you will need to make some assumptions about different accounts relationships to each other You start with an assumption of $3.6 million in sales. current portion of long-term debt and the remaining long-term debt. Both of those items relate to the note where Cartwright bought out the interest of his former partner Make sure the balance sheet balances- that is, the Total Assets must equal the Total Liabilities & Owner's Equity. Think about where you might have to put a plug number" to make them balance - which account is most flexible. a. Also, I've given you the b. Note: Use formulas and cell references in your spreadsheet. Do not hardcode numbers. Written Assignment Compose a memo to Mr. Cartwright. In the memo, you need to explain what you see as the problems with his profitable business based on your financial analysis. Included in your solution needs to be a recommendation as to the proposed loan from Northrop National Bank. Is it sufficient to meet the firm's cash needs? You need to identify any issues with the company and its cash position and provide a suggested solution (and possibly some suitable alternatives) for the company