Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COMPOSITION OF THE STATEMENT OF CASH FLowS FO AN ECONMICALLY SOUND COMPANY ions should be and the main source of cash. It should be large

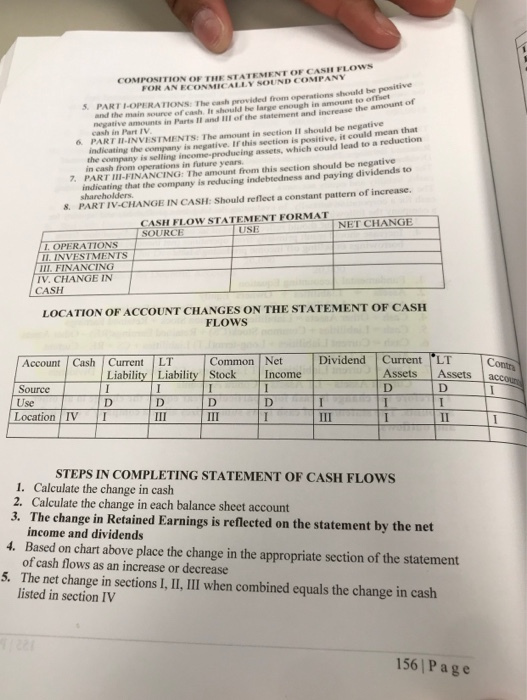

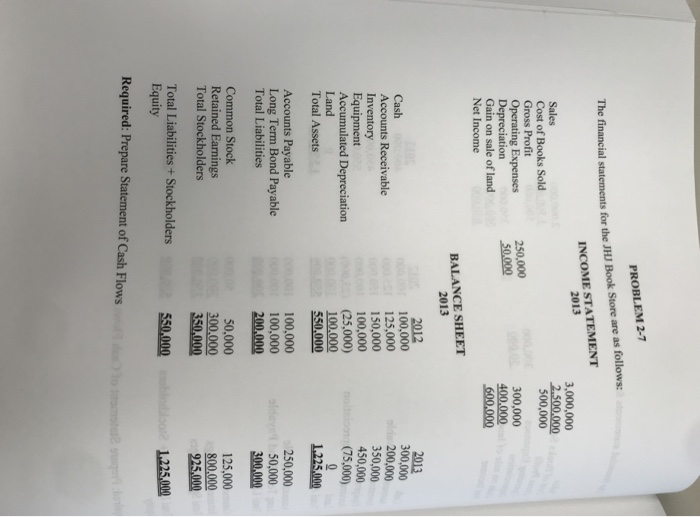

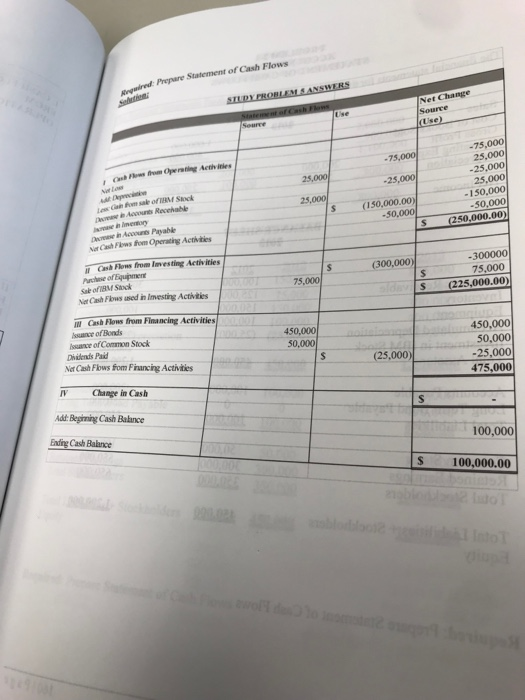

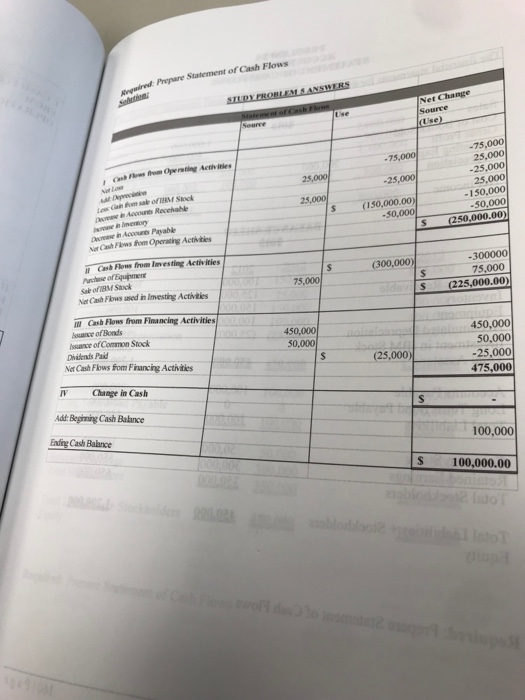

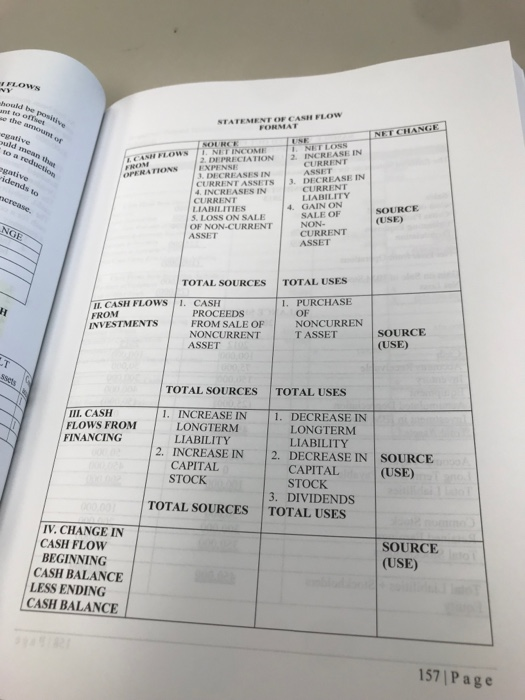

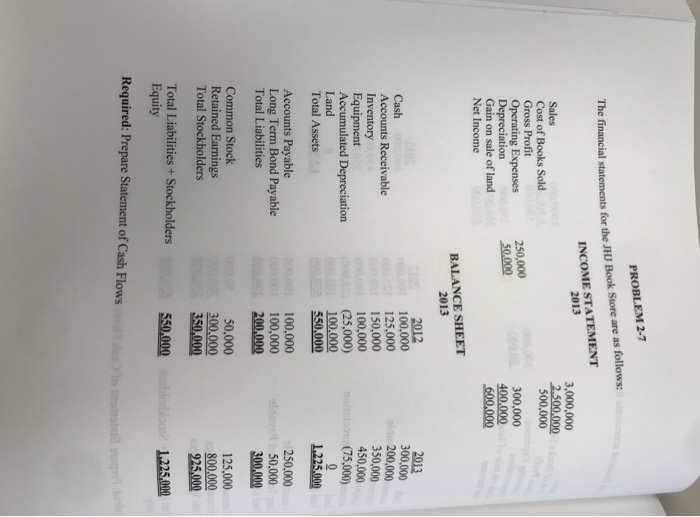

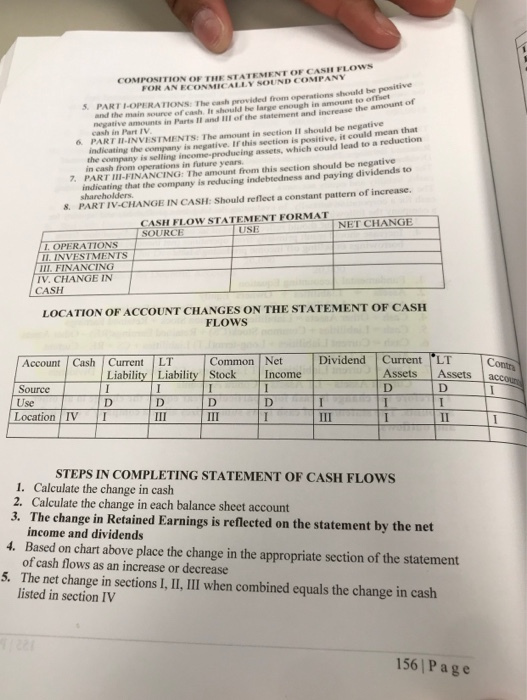

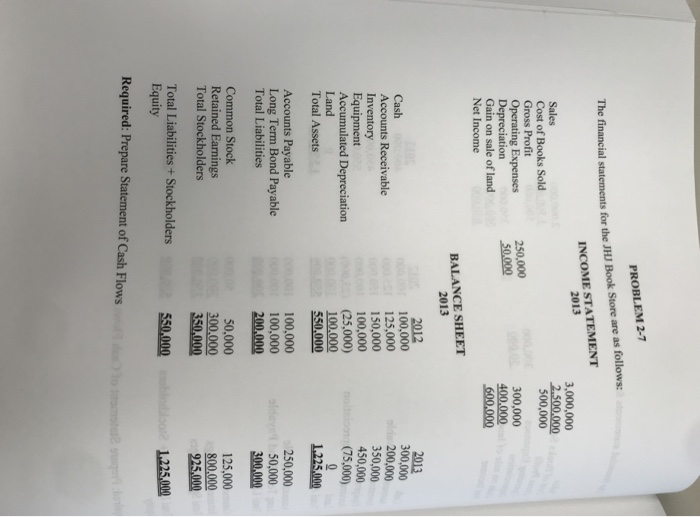

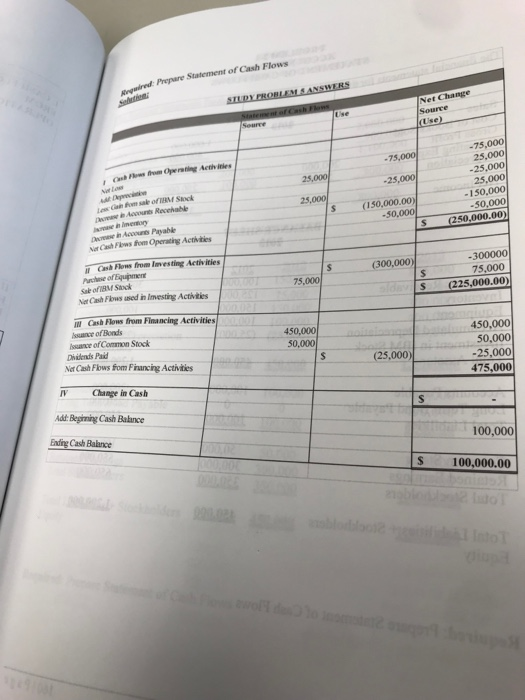

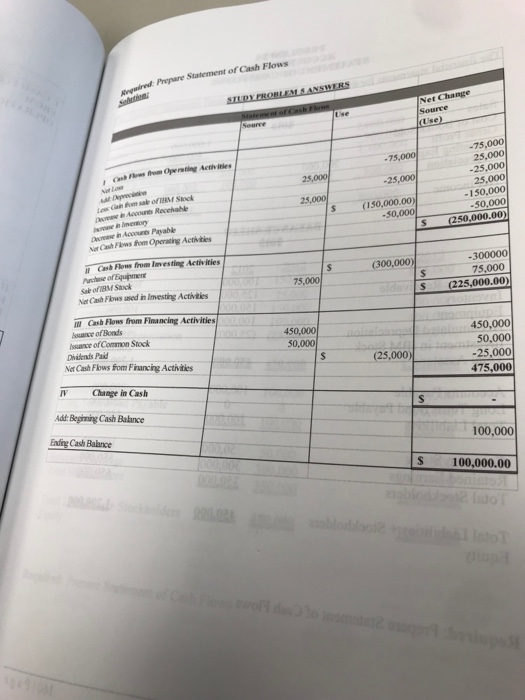

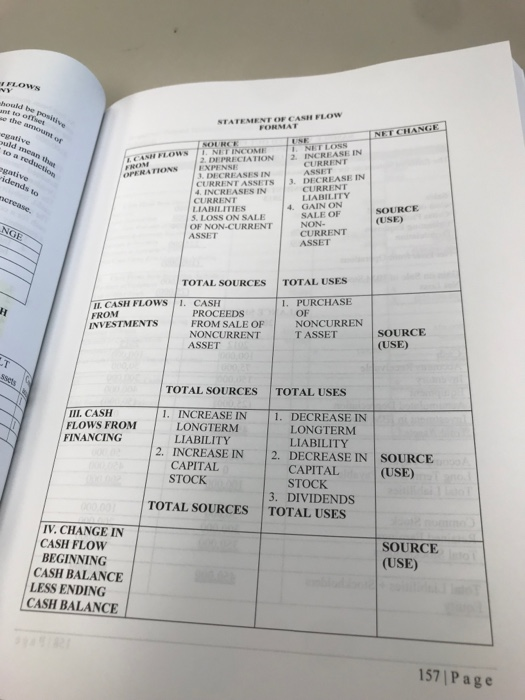

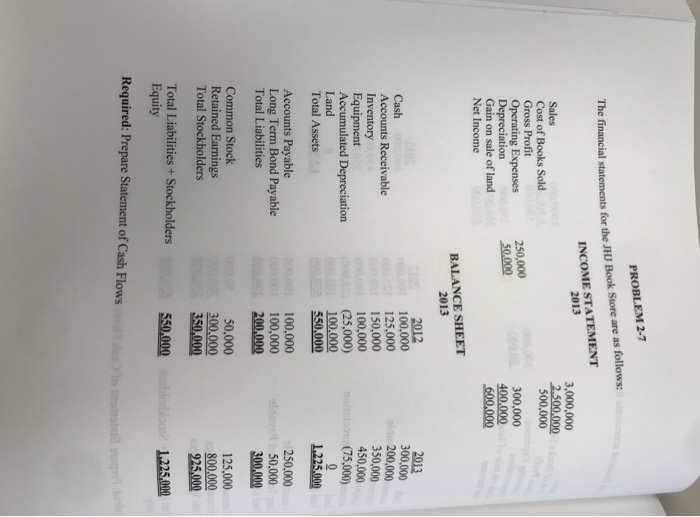

COMPOSITION OF THE STATEMENT OF CASH FLowS FO AN ECONMICALLY SOUND COMPANY ions should be and the main source of cash. It should be large enough in amount to of negative amounts in Parts II and IIl of the statement and increase the 5. PAR T 1-OPERA 0NS: The cash provided from operat amount of cash in Part IV the company is negative. If this section is positive, it could mean that ing income-producing assets, which could lead to a reduction 6, PART ll-INVESTMENTS: he armount in section ll should be negative the in cash from operations in future years 7, PART lll-FINANCNG: The anount from this section should be negative s PARTIV-CHANGE IN CASH: Should reflect a constant pattern of increase. CASH FLOW STATEMENT FORMAT indicating that the company is reducing indebtedness and paying dividends to US NET CHANGE SOURCE LOPERATIONS IL INVESTMENTS IIL FINANCING IV. CHANGE IN CASH LOCATION OF ACCOUNT CHANGES ON THE STATEMENT OF CASH FLOWS Account Cash CurrentLT Common NetDividend Current LT ICom Liability Liability Stock Income Assets Assets Source se Location IV I STEPS IN COMPLETING STATEMENT OF CASH FLOws 1. Calculate the change in cash 2. Calculate the change in each balance sheet account 3. The change in Retained Earnings is reflected on the statement by the net income and dividends Based on chart above place the change in the appropriate section of the statement of cash flows as an increase or decrease The net change in sections I, II,III when combined equals the change in cash listed in section IV 4. 5. 156 Page PROBLEM 2-7 The financial statements for the JHJ Book Store are as follows: 2013 Sales Cost of Books Sold Gross Profit Operating Expenses Depreciation Gain on sale of land Net Income 3,000,000 500,000 300,000 250,000 50.000 400,000 BALANCE SHEET 2013 2013 300,000 Cash Accounts Receivable Inventory Equipment Accumulated Depreciation 100,000 125,000 150,000 100,000 (25,000) 350,000 450,000 (75,000) Total Assets 550,000 1225,000 Accounts Payable Long Term Bond Payable Total Liabilities 100,000 100,000 50,000 Common Stock Retained Earnings Total Stockholders 50,000 125,000 Total Liabilities+ Stockholders Equity 550,000 1.225,000 Required: Prepare Statement of Cash Flows Statement of Cash Flows Net Change Source Use -75,000 25,000 -25,000 25,000 -150,000 50,000 S (250,000.00) -75,000 25,000 Gah Fom sak ofTBM Stock Accounts Recehable (150,000.00) -50,000 Nor Cash Fews fom Operating Activities Cash Flows from Iovesting Activities -300000 75,000 (300,000 Sae ofiBM Stock Nt Cash Flows ased in Imesting Activities 75,000 Cash Flows from Financing Activities ance of Bonds issance of Common Stock Dhidends Paid Net Cash Flows fom Firnancing Activibies 450,000 30,000 450,000 50,000 25,000 475,000 (25,000 V Change in Cash Adt Begihning Cash Balince Ening Cash Balance 100,000 S 100,000.00 Statement of Cash Flows Net Change Source Use -75,000 25,000 -25,000 25,000 -150,000 50,000 S (250,000.00) -75,000 25,000 Gah Fom sak ofTBM Stock Accounts Recehable (150,000.00) -50,000 Nor Cash Fews fom Operating Activities Cash Flows from Iovesting Activities -300000 75,000 (300,000 Sae ofiBM Stock Nt Cash Flows ased in Imesting Activities 75,000 Cash Flows from Financing Activities ance of Bonds issance of Common Stock Dhidends Paid Net Cash Flows fom Firnancing Activibies 450,000 30,000 450,000 50,000 25,000 475,000 (25,000 V Change in Cash Adt Begihning Cash Balince Ening Cash Balance 100,000 S 100,000.00 Lows STATEMENT OF CASH FLOW FORMAT op 2 DEPRECIATION 12. INCREASE IN EXPENSE CURRENT ASSET DECREASES IN CURRENT ASSETS OPERATIONS DECREASE IN INCREASES IN CURRENT LIABILITIES 5. LOSS ON SALE OF NON-CURRENT NON- CURRENT LIABILITY SALE OF CURRENT to 4. GAIN ON SOURCE (USE) ASSET ASSET TOTAL SOURCES TOTAL USES IL. CASH FLOWSI. CASH FROM . PURCHASE PROCEEDS FROM SALE OF NONCURREN NONCURRENT ASSET OF NVESTMENTS SOURCE (USE) TASSET TOTAL SOURCESTOTAL USES . INCREASE IN III. CASH FLOWS FROM FINANCING 1. DECREASE IN LONGTERM LIABILITY LONGTERM LIABILITY 2. INCREASE IN 2. DECREASE IN SOURCE CAPITAL STOCK CAPITAL STOCK (USE) 3. DIVIDENDS TOTAL SOURCESTOTAL USES IV. CHANGE IN CASH FLOW BEGINNING CASH BALANCE SOURCE (USE) LESS ENDING CASH BALANCE 157 Page PROBLEM 2-7 The financial statements for the JHJ Book Store are as follows: INCOME STATEMENT 2013 Sales Cost of Books Sold Gross Profit Operating Expenses Depreciation Gain on sale of land Net Income 3,000,000 500,000 300,000 250,000 50.000 400,000 BALANCE SHEET 2013 2013 300,000 100,000 125,000 150,000 100,000 (25,000) Cash Accounts Receivable 350,000 450,000 (75,000) Inventory Equipment Accumulated Depreciation Total Assets 550,000 225,000 Accounts Payable Long Term Bond Payable Total Liabilities 100,000 100,000 50,000 Common Stock Retained Earnings Total Stockholders 50,000 125,000 Total Liabilities+ Stockholders Equity 550,000 225,000 Required: Prepare Statement of Cash Flows

COMPOSITION OF THE STATEMENT OF CASH FLowS FO AN ECONMICALLY SOUND COMPANY ions should be and the main source of cash. It should be large enough in amount to of negative amounts in Parts II and IIl of the statement and increase the 5. PAR T 1-OPERA 0NS: The cash provided from operat amount of cash in Part IV the company is negative. If this section is positive, it could mean that ing income-producing assets, which could lead to a reduction 6, PART ll-INVESTMENTS: he armount in section ll should be negative the in cash from operations in future years 7, PART lll-FINANCNG: The anount from this section should be negative s PARTIV-CHANGE IN CASH: Should reflect a constant pattern of increase. CASH FLOW STATEMENT FORMAT indicating that the company is reducing indebtedness and paying dividends to US NET CHANGE SOURCE LOPERATIONS IL INVESTMENTS IIL FINANCING IV. CHANGE IN CASH LOCATION OF ACCOUNT CHANGES ON THE STATEMENT OF CASH FLOWS Account Cash CurrentLT Common NetDividend Current LT ICom Liability Liability Stock Income Assets Assets Source se Location IV I STEPS IN COMPLETING STATEMENT OF CASH FLOws 1. Calculate the change in cash 2. Calculate the change in each balance sheet account 3. The change in Retained Earnings is reflected on the statement by the net income and dividends Based on chart above place the change in the appropriate section of the statement of cash flows as an increase or decrease The net change in sections I, II,III when combined equals the change in cash listed in section IV 4. 5. 156 Page PROBLEM 2-7 The financial statements for the JHJ Book Store are as follows: 2013 Sales Cost of Books Sold Gross Profit Operating Expenses Depreciation Gain on sale of land Net Income 3,000,000 500,000 300,000 250,000 50.000 400,000 BALANCE SHEET 2013 2013 300,000 Cash Accounts Receivable Inventory Equipment Accumulated Depreciation 100,000 125,000 150,000 100,000 (25,000) 350,000 450,000 (75,000) Total Assets 550,000 1225,000 Accounts Payable Long Term Bond Payable Total Liabilities 100,000 100,000 50,000 Common Stock Retained Earnings Total Stockholders 50,000 125,000 Total Liabilities+ Stockholders Equity 550,000 1.225,000 Required: Prepare Statement of Cash Flows Statement of Cash Flows Net Change Source Use -75,000 25,000 -25,000 25,000 -150,000 50,000 S (250,000.00) -75,000 25,000 Gah Fom sak ofTBM Stock Accounts Recehable (150,000.00) -50,000 Nor Cash Fews fom Operating Activities Cash Flows from Iovesting Activities -300000 75,000 (300,000 Sae ofiBM Stock Nt Cash Flows ased in Imesting Activities 75,000 Cash Flows from Financing Activities ance of Bonds issance of Common Stock Dhidends Paid Net Cash Flows fom Firnancing Activibies 450,000 30,000 450,000 50,000 25,000 475,000 (25,000 V Change in Cash Adt Begihning Cash Balince Ening Cash Balance 100,000 S 100,000.00 Statement of Cash Flows Net Change Source Use -75,000 25,000 -25,000 25,000 -150,000 50,000 S (250,000.00) -75,000 25,000 Gah Fom sak ofTBM Stock Accounts Recehable (150,000.00) -50,000 Nor Cash Fews fom Operating Activities Cash Flows from Iovesting Activities -300000 75,000 (300,000 Sae ofiBM Stock Nt Cash Flows ased in Imesting Activities 75,000 Cash Flows from Financing Activities ance of Bonds issance of Common Stock Dhidends Paid Net Cash Flows fom Firnancing Activibies 450,000 30,000 450,000 50,000 25,000 475,000 (25,000 V Change in Cash Adt Begihning Cash Balince Ening Cash Balance 100,000 S 100,000.00 Lows STATEMENT OF CASH FLOW FORMAT op 2 DEPRECIATION 12. INCREASE IN EXPENSE CURRENT ASSET DECREASES IN CURRENT ASSETS OPERATIONS DECREASE IN INCREASES IN CURRENT LIABILITIES 5. LOSS ON SALE OF NON-CURRENT NON- CURRENT LIABILITY SALE OF CURRENT to 4. GAIN ON SOURCE (USE) ASSET ASSET TOTAL SOURCES TOTAL USES IL. CASH FLOWSI. CASH FROM . PURCHASE PROCEEDS FROM SALE OF NONCURREN NONCURRENT ASSET OF NVESTMENTS SOURCE (USE) TASSET TOTAL SOURCESTOTAL USES . INCREASE IN III. CASH FLOWS FROM FINANCING 1. DECREASE IN LONGTERM LIABILITY LONGTERM LIABILITY 2. INCREASE IN 2. DECREASE IN SOURCE CAPITAL STOCK CAPITAL STOCK (USE) 3. DIVIDENDS TOTAL SOURCESTOTAL USES IV. CHANGE IN CASH FLOW BEGINNING CASH BALANCE SOURCE (USE) LESS ENDING CASH BALANCE 157 Page PROBLEM 2-7 The financial statements for the JHJ Book Store are as follows: INCOME STATEMENT 2013 Sales Cost of Books Sold Gross Profit Operating Expenses Depreciation Gain on sale of land Net Income 3,000,000 500,000 300,000 250,000 50.000 400,000 BALANCE SHEET 2013 2013 300,000 100,000 125,000 150,000 100,000 (25,000) Cash Accounts Receivable 350,000 450,000 (75,000) Inventory Equipment Accumulated Depreciation Total Assets 550,000 225,000 Accounts Payable Long Term Bond Payable Total Liabilities 100,000 100,000 50,000 Common Stock Retained Earnings Total Stockholders 50,000 125,000 Total Liabilities+ Stockholders Equity 550,000 225,000 Required: Prepare Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started