Compound Interest / Exponential growth

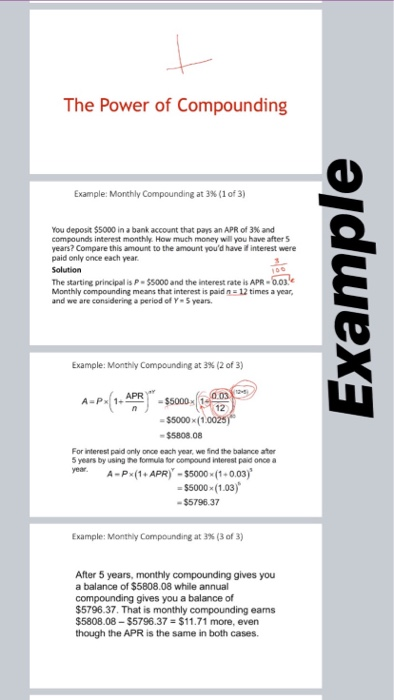

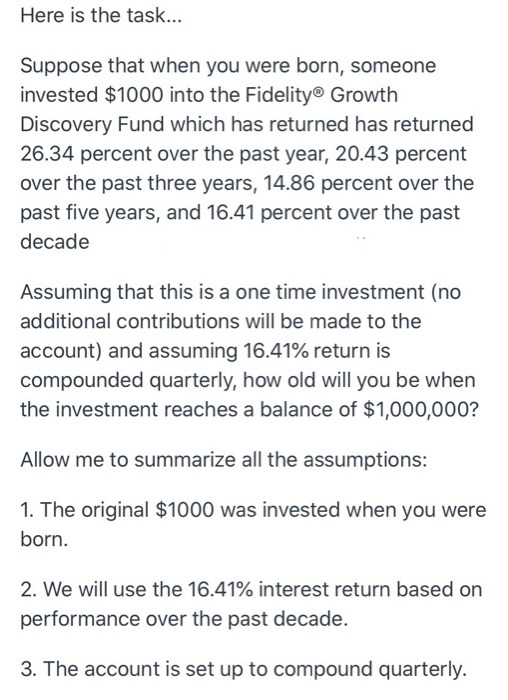

Here is the task... Suppose that when you were born, someone invested $1000 into the Fidelity Growth Discovery Fund which has returned has returned 26.34 percent over the past year, 20.43 percent over the past three years, 14.86 percent over the past five years, and 16.41 percent over the past decade Assuming that this is a one time investment (no additional contributions will be made to the account) and assuming 16.41% return is compounded quarterly, how old will you be when the investment reaches a balance of $1,000,000? Allow me to summarize all the assumptions: 1. The original $1000 was invested when you were born. 2. We will use the 16.41% interest return based on performance over the past decade. 3. The account is set up to compound quarterly. Suppose that when you were born, someone invested $1000 into the Fidelity Growth Discovery Fund which has returned has returned 26.34 percent over the past year, 20.43 percent over the past three years, 14.86 percent over the past five years, and 16.41 percent over the past decade Assuming that this is a one time investment (no additional contributions will be made to the account) and assuming 16.41% return is compounded quarterly, how old will you be when the investment reaches a balance of $1,000,000? Here is the task... Suppose that when you were born, someone invested $1000 into the Fidelity Growth Discovery Fund which has returned has returned 26.34 percent over the past year, 20.43 percent over the past three years, 14.86 percent over the past five years, and 16.41 percent over the past decade Assuming that this is a one time investment (no additional contributions will be made to the account) and assuming 16.41% return is compounded quarterly, how old will you be when the investment reaches a balance of $1,000,000? Allow me to summarize all the assumptions: 1. The original $1000 was invested when you were born. 2. We will use the 16.41% interest return based on performance over the past decade. 3. The account is set up to compound quarterly. The Power of Compounding Example: Monthly Compounding at 3% (1 of 3) You deposit $5000 in a bank account that pas an APR of 3% and compounds interest monthly. How much money will you have after 5 years? Compare this amount to the amount you'd have interest were paid only once each year. Solution The starting principalis P-55000 and the interest rate is APR-0.03. Monthly compounding means that interest is paid n = 12 times a year, and we are considering a period of Y-5 years. Example Example: Monthly Compounding at 3% (2 of 3) A-P (1-APR" - 55000=(1.93 - $5000x (1.0025) - $5808.08 For interest paid only once each year, we find the balance ater 5 years by using the formula for compound interest paid once a year A-PX(1+ APR) - $5000 (1-0.03) = $5000X (1.03) - $5796.37 Example: Monthly Compounding at 3% (3 of 3) After 5 years, monthly compounding gives you a balance of $5808.08 while annual compounding gives you a balance of $5796.37. That is monthly compounding ears $5808.08 - $5796.37 = $11.71 more, even though the APR is the same in both cases