Question

Compound My Interest in 401(k)s Janelle found herself staring long and hard at the 401(k) Enrollment form provided on the first week of her employment

Compound My Interest in 401(k)s

Janelle found herself staring long and hard at the 401(k) Enrollment form provided on the first week of her employment at Atlas Healthcare. It seemed so long ago that her High School Personal Finance teacher had her complete a similar project. Still it seemed a long way off until she would need to worry about retirement savings. To get her thinking about retirement, she decided to write a few sentences to her future self about her plans.

Now, if she could only find her old notes, she would be all set, as the forms were due to the Human Resources Department by 9am Friday.

The first question Janelle needed to answer regarded whether she wished to participate and how much of her salary she wanted to set aside.

The first question on the form had the following language:

____ Yes, I request that my company defer my compensation by ________%.

____ No, I waive my right to defer any compensation at this time

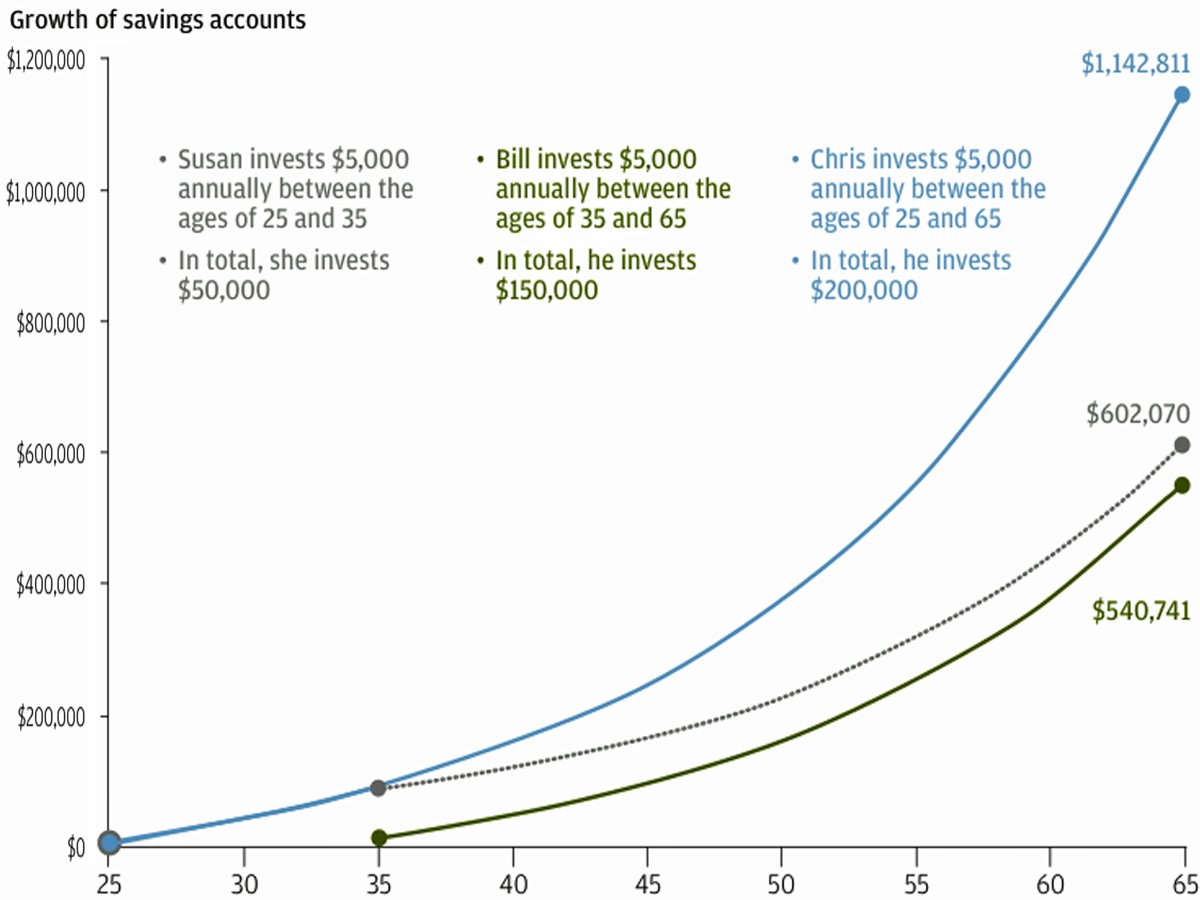

She knew that she wanted to participate (that had been seared into her memory by her high school teacher), but as for how much to set aside, that question puzzled her. She had just started her first job and didnt have a real handle on her spending habits as an independent adult with the rent, food and other assorted costs that came with it. She wished she could wait a few months to sign up for the 401(k) when she had a better budget planned for every month. However, she feared she would forget and lose the opportunity to have her contribution matched by the company. Her company had one of the more generous 401(k) match programs in that they matched 50% of every dollar she contributed up to 10% of her salary. She also came across this neat chart which provided her with additional motivation:

Exhibit 1

The next decision that Janelle needed to make was how she wanted to split her investment between stocks and bonds. While the 401(k) Enrollment form didnt include this question, she recognized that making this decision would make it that much easier for her to pick the funds that she would like to invest in. Janelle had minimal investing experience but recalled a few things her teacher had told her:

Over the long run, the returns on stocks are greater than bonds

Stocks are riskier than bonds, so they may have greater volatility in their prices

Since young people have a longer time horizon, they should have a higher percentage of stocks

You should choose an asset allocation that matches your personality, your time horizon and your goals

Many investors have trouble holding stocks when the stock market declines

Before making this decision, Janelle wanted to try out a few questionnaires developed by investment firms to see what they would recommend for her. Some of the questions they asked didnt seem to apply to her but she tried her best to complete them as accurately as possible:

She knew in the end, she needed to choose an asset allocation (the split between stocks and bonds) that would work for her based on her goals and that she would stick to over the long-term.

Answer This:

6. What should Janelles asset allocation be? Explain your answer.

Asset Allocation (must add to 100%): Stocks __________% / Bonds ____________%

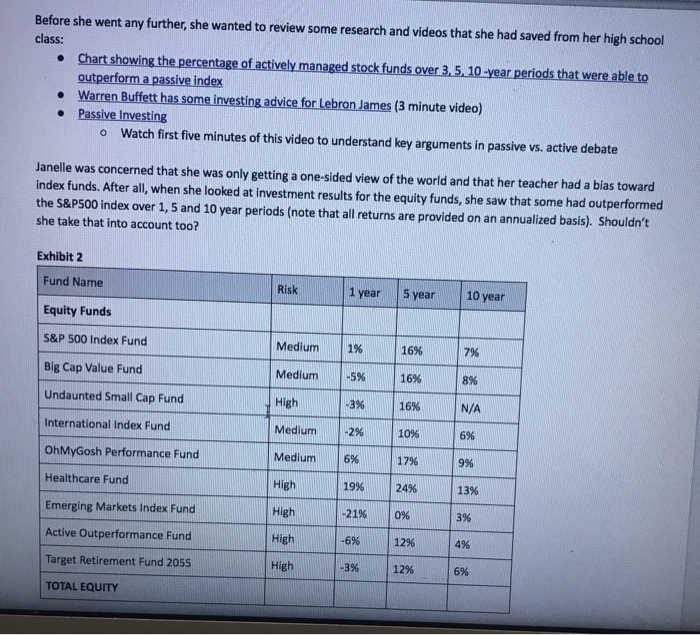

Before she went any further, she wanted to review some research and videos that she had saved from her high school class: un Warren Buffett has some investing advice for Lebron James (3 minute video) Passive Investing Watch first five minutes of this video to understand key arguments in passive vs. active debate o Janelle was concerned that she was only getting a one-sided view of the world and that her teacher had a bias toward index funds. After all, when she looked at investment results for the equity funds, she saw that some had outperformed the S&P500 index over 1, 5 and 10 year periods (note that all returns are provided on an annualized basis). Shouldn't she take that into account too? Exhibit 2 Fund Name Risk 1 year S year 10 year Equity Funds 17% 8% N/A 11% 116% S&P 500 Index Fund Big Cap Value Fund Undaunted Small Cap Fund International Index Fund OhMyGosh Performance Fund Healthcare Fund Emerging Markets Index Fund Active Outperformance Fund Medium Medium High Medium Medium High High High High 116% 15% 1-2% |19% 16% 110% | 17% 24% 10% 12% |12% 16% | 6% 9% | 13% 13% | |-21% -6% 4% Target Retirement Fund 2055 .3% 6% TOTAL EQUITY Before she went any further, she wanted to review some research and videos that she had saved from her high school class: un Warren Buffett has some investing advice for Lebron James (3 minute video) Passive Investing Watch first five minutes of this video to understand key arguments in passive vs. active debate o Janelle was concerned that she was only getting a one-sided view of the world and that her teacher had a bias toward index funds. After all, when she looked at investment results for the equity funds, she saw that some had outperformed the S&P500 index over 1, 5 and 10 year periods (note that all returns are provided on an annualized basis). Shouldn't she take that into account too? Exhibit 2 Fund Name Risk 1 year S year 10 year Equity Funds 17% 8% N/A 11% 116% S&P 500 Index Fund Big Cap Value Fund Undaunted Small Cap Fund International Index Fund OhMyGosh Performance Fund Healthcare Fund Emerging Markets Index Fund Active Outperformance Fund Medium Medium High Medium Medium High High High High 116% 15% 1-2% |19% 16% 110% | 17% 24% 10% 12% |12% 16% | 6% 9% | 13% 13% | |-21% -6% 4% Target Retirement Fund 2055 .3% 6% TOTAL EQUITYStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started