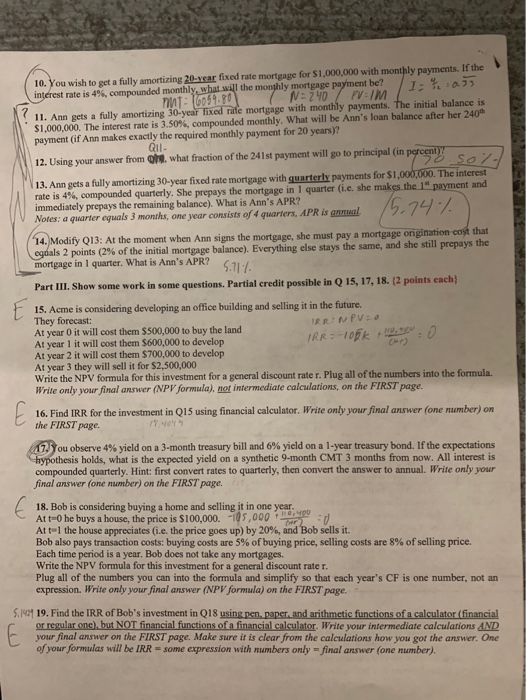

compounded monthly ( 240 mm. the initial balance is 10. You wish to act a fully amortizing 20-year fixed rate morange for $1,000,000 with monthly payments. If the interest rate is 4%, compounded monthly, what will the monthly mortgage payment be? T. 11. Ann gets a fully amortizing 30-year fixed rafe mortgage with monthly payments. The initial balance is $1,000,000. The interest rate is 3.50%, compounded monthly. What will be Ann's loan balance after her 240 payment (if Ann makes exactly the required monthly payment for 20 years)? QUL- 12. Using your answer from what fraction of the 241 st payment will go to principal (in percent 13. Ann gets a fully amortizing 30-year fixed rate mortgage with quarterly payments for $1,000,000. The interest rate is 4%, compounded quarterly. She prepays the mortgage in 1 quarter (i.e. she makes the 1" payment and immediately prepays the remaining balance). What is Ann's APR? Notes: a quarter equals 3 months, one year consists of 4 quarters, APR is annual 15.74% 14. Modify 013: At the moment when Ann signs the mortgage, she must pay a mortgage origination cost that egoals 2 points (2% of the initial mortgage balance). Everything else stays the same, and she still prepays the mortgage in 1 quarter. What is Ann's APR? 11. Part III. Show some work in some questions. Partial credit possible in Q 15, 17, 18. (2 points each) IRR = 105k to rew: 0 15. Acme is considering developing an office building and selling it in the future. They forecast: IRRINPV At year it will cost them $500,000 to buy the land At year 1 it will cost them $600,000 to develop At year 2 it will cost them $700,000 to develop At year 3 they will sell it for $2,500,000 Write the NPV formula for this investment for a general discount rater. Plug all of the numbers into the formula. Write only your final answer (NPV formula), not intermediate calculations, on the FIRST page. 16. Find IRR for the investment in Q15 using financial calculator. Write only your final answer (one number) on the FIRST page. 7 MOT 7.You observe 4% yield on a 3-month treasury bill and 6% yield on a 1-year treasury bond. If the expectations hypothesis holds, what is the expected yield on a synthetic 9-month CMT 3 months from now. All interest is compounded quarterly. Hint: first convert rates to quarterly, then convert the answer to annual. Write only your final answer (one number) on the FIRST page. 18. Bob is considering buying a home and selling it in one year. At t=0 he buys a house, the price is $100,000.-105,000 Att1 the house appreciates (i.e. the price goes up) by 20%, and Bob sells it. Bob also pays transaction costs: buying costs are 5% of buying price, selling costs are 8% of selling price. Each time period is a year. Bob does not take any mortgages. Write the NPV formula for this investment for a general discount rater. Plug all of the numbers you can into the formula and simplify so that each year's CF is one number, not an expression. Write only your final answer (NPV formula) on the FIRST page. 5.1919. Find the IRR of Bob's investment in Q18 using pen, paper, and arithmetic functions of a calculator (financial or regular one), but NOT financial functions of a financial calculator. Write your intermediate calculations AND your final answer on the FIRST page. Make sure it is clear from the calculations how you got the answer. One of your formulas will be IRR - some expression with numbers only final answer (one number)