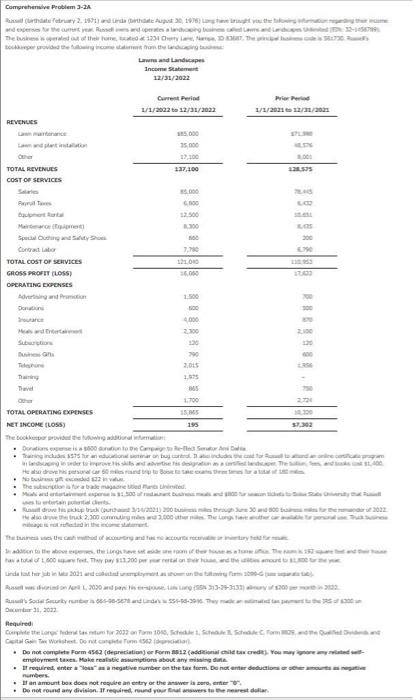

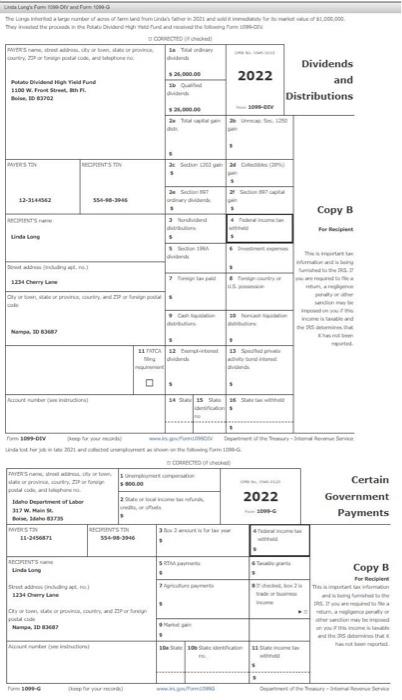

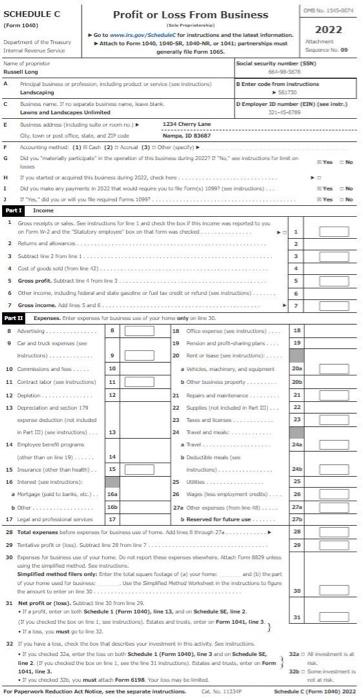

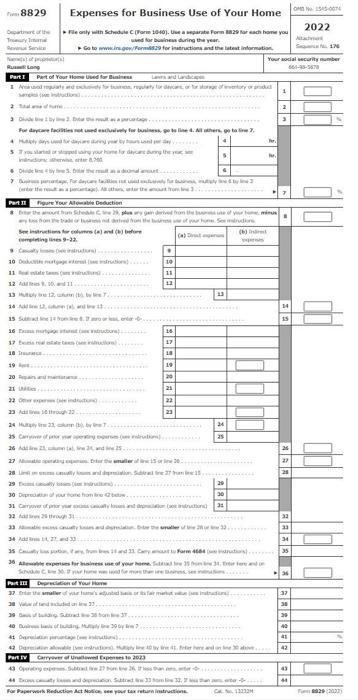

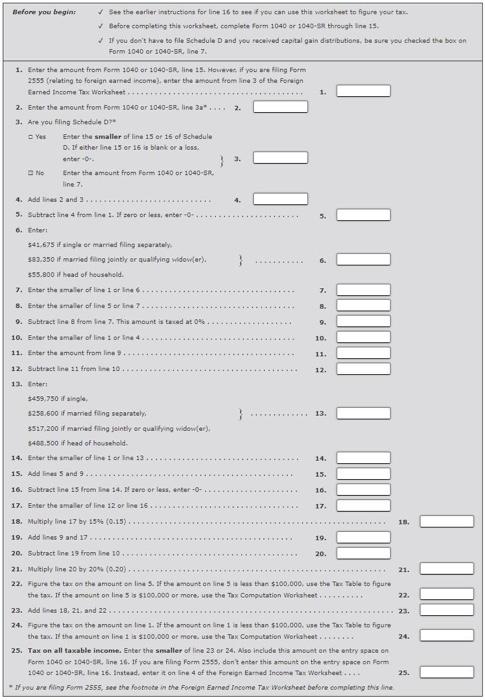

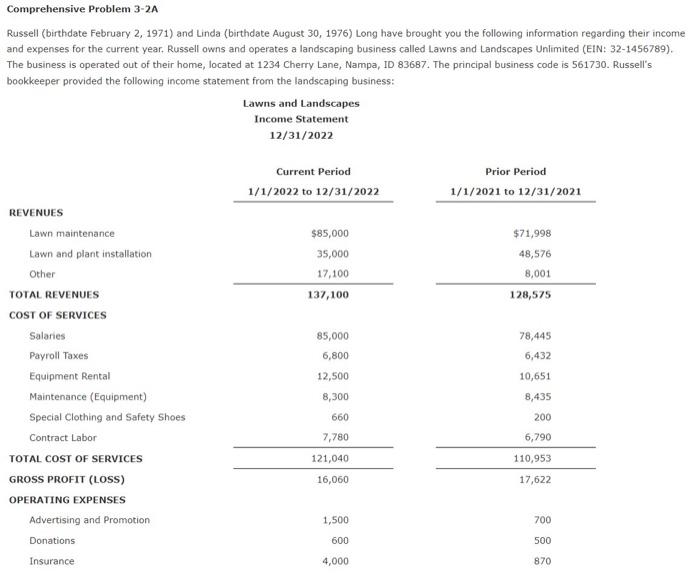

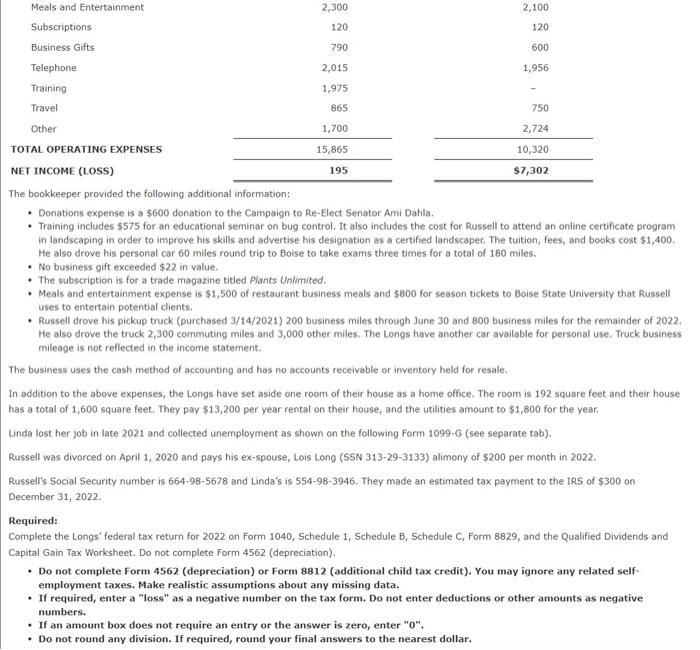

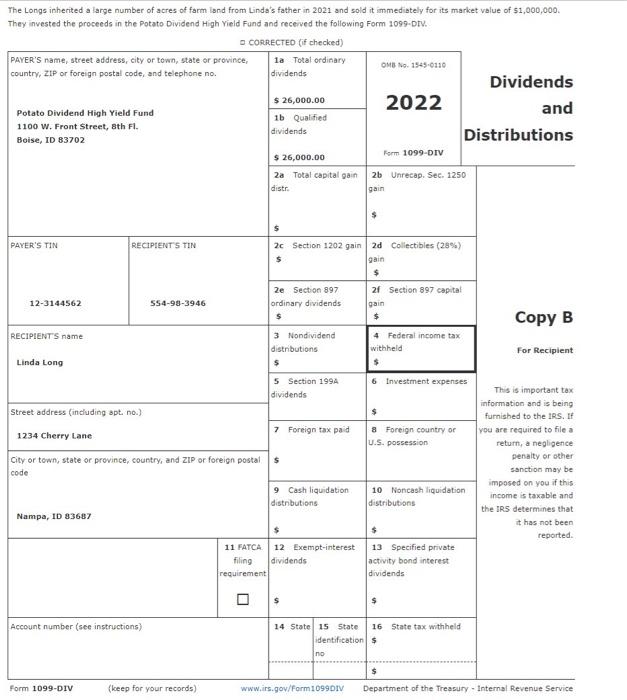

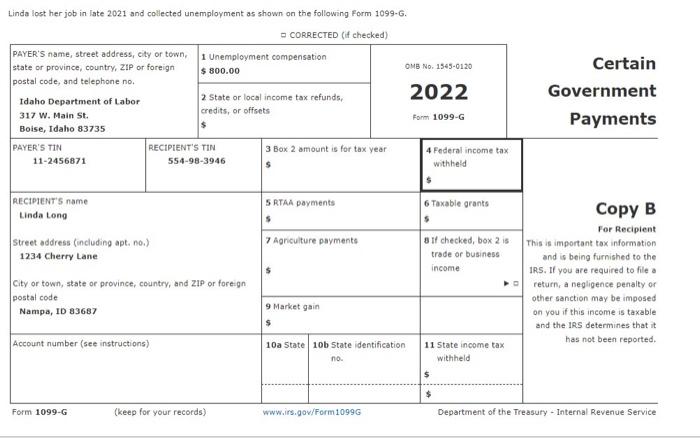

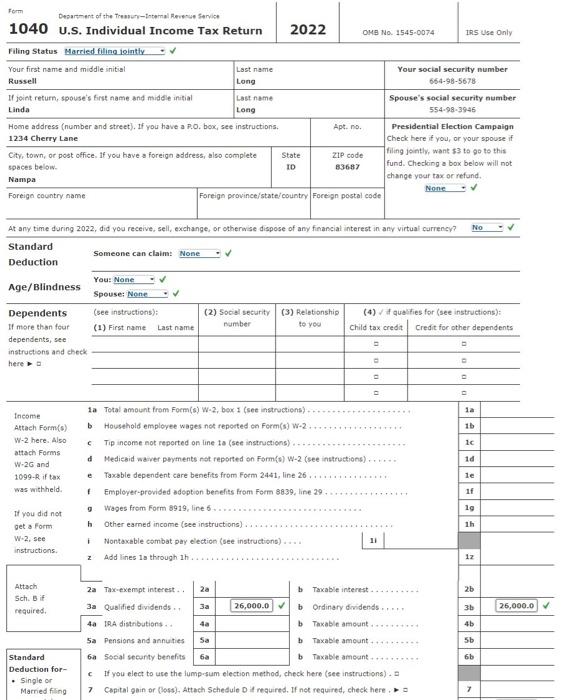

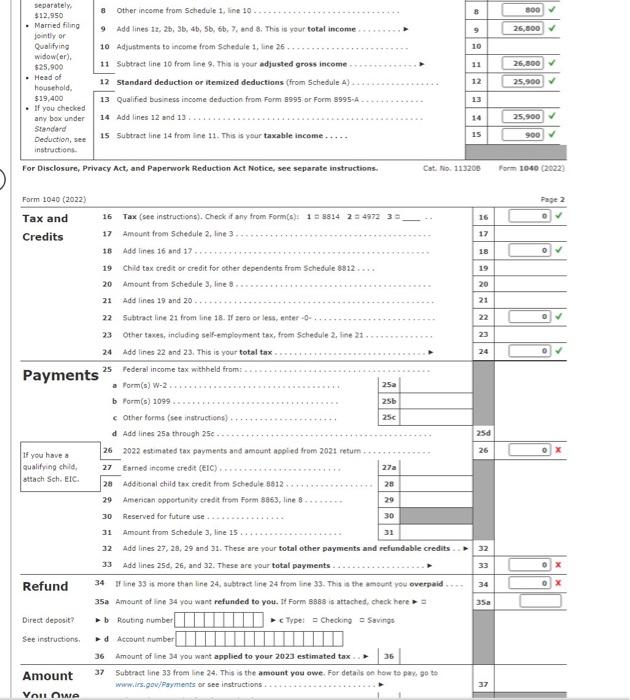

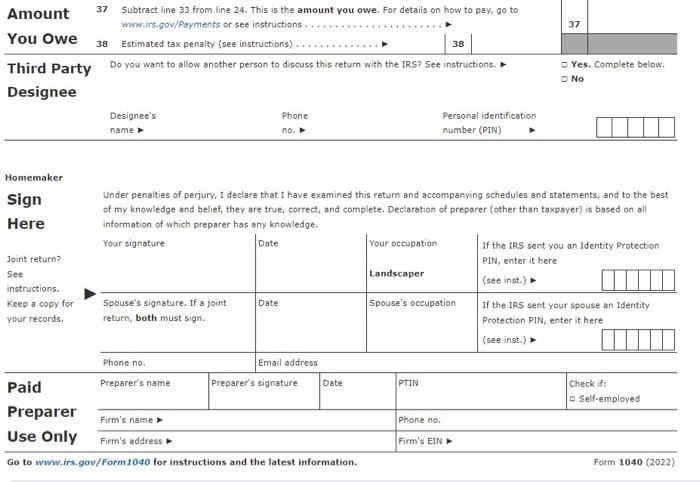

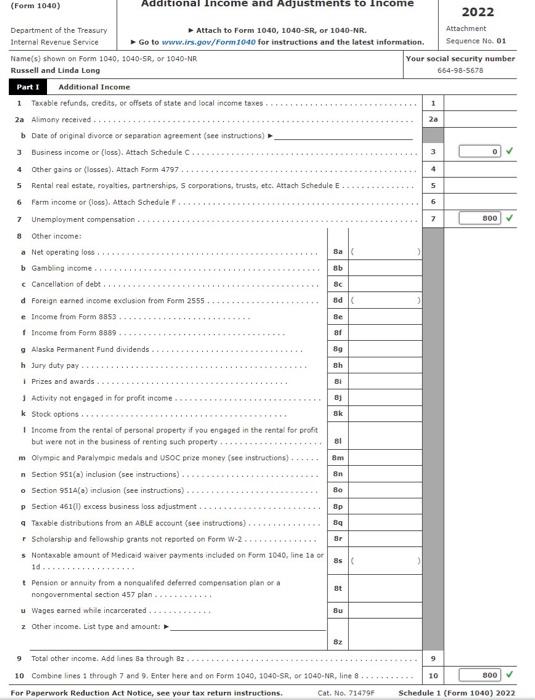

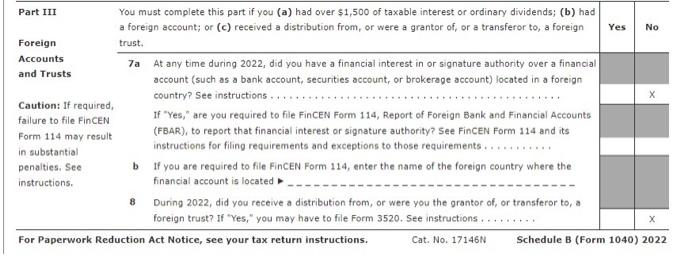

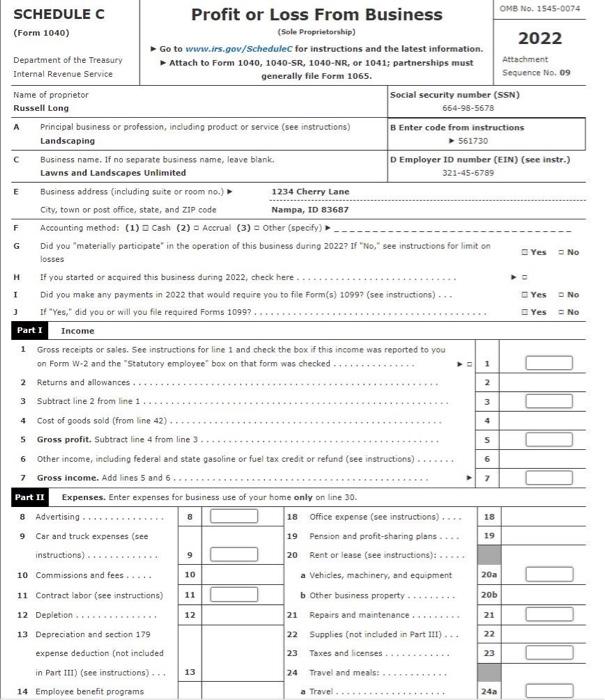

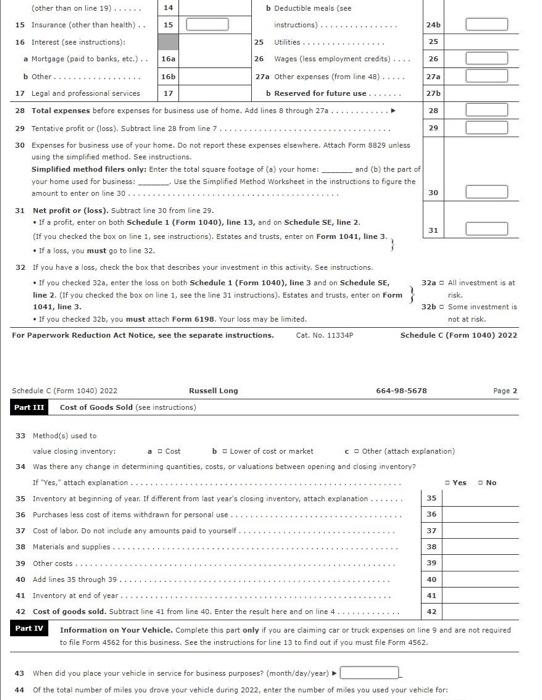

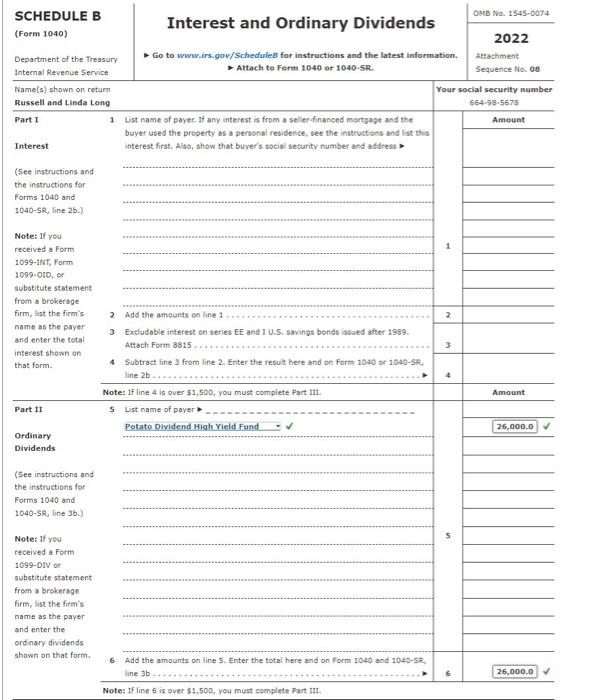

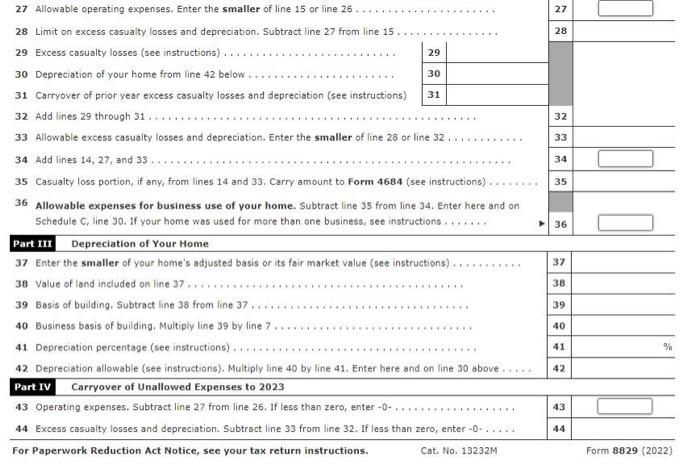

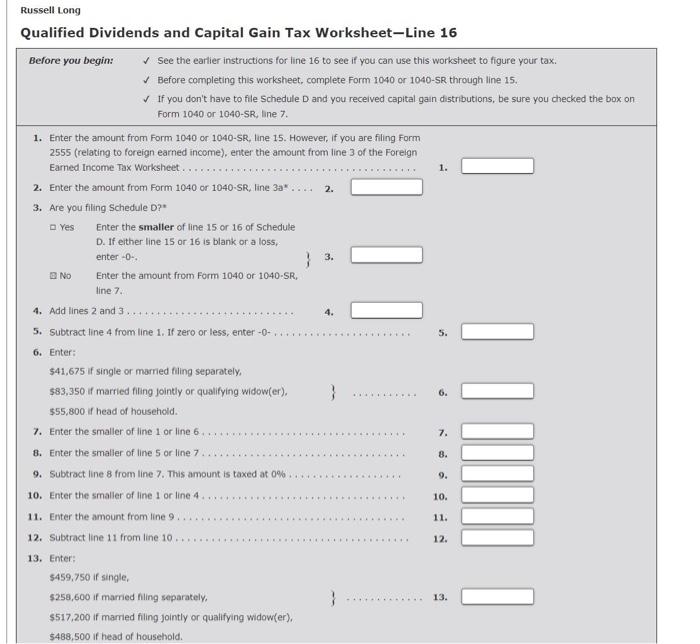

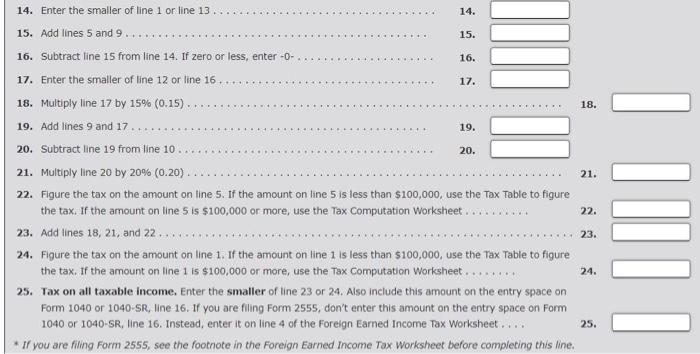

Comprehendive Problem J-2A uses la ertertan patartas diends. Dacuntar 11, 2002 . Aequired enployment taves. Make reatific mwimptiom about any misohe dina. numbers. - If an ambunt box doen not reqube an entry or the anawer in aorb, enter "P5. - Be not round any division. If regsired, reund poir fical acsowers ta ber menest dellar. (1) Before you begias. Ses the earler intructions for line 16 to set of yeo can ute this wackahaet to figure yeur tix. V Before complating thie workahedti comelote form 1040 se 1040 . Sh through line 19 . d. If yeu den't have be file Schadule D and you rectived capital gain dattibutions, be sure you chacked the bex an Form 1040 of 104058, tine 7. 1. Inter the amount from form 1040 or 1040-3N, line 15. Hounved if you are filing form 2555 (rolating to forsign aarned income), antar the atwount frem line 3 of the Forsign farned tncome Tax Workshest +,,,,. 2. Eeter the amount from Fsrm-1040 or 104058. line 3a,,2. 3. Are you fling Schedole 07 on Yes: Enter the smaller of line 15 or 15 of Sehadule Q. If ether line 15 er 15 is blank or a loss: onter - G-. 3. E No: Enter the ameunt from ferm 1040 or 104050 : line 7. 4. Add lines 2 and 3. 5. Subtrast line 4 fromi line t. If werb or last, anter - O+ b. Thtert \$41;675 if tingle or marned fling isparately. 183.350 if marnitd fing jointly or qualfying widowiar). 6. $55.800 if had of househeld. 7. Enter the smalier of line 1 or Inte 6 . 8. Foter the imallor of line 5 or Ind 7 7. 9. Subtract ine 8 frem lite 7. This amount is tawed at 0%. 8. 10. Enter the amalior of line I or Sna 4. 9. 11. E-fer the amqunt fram line 2 . 10. 12. Subtract line 11 frsm lire 10 , 11. 11. Tinteri 5459,750 if aingle. 1258.600 if mamed foing sesarately. 12. $517,200 if marriad filing jeintly er qualtying widowlar). 1400,500 if head of household. 14. feter the smallor of line 1 or Inte 18,+ 14. 15. Mdd lines 5 and 9. 15. 16. Subtrace line 15 frem line 14, If zare or less, weger 0, 16. 17. Ener the amaler of line 12 or line 16,,17. 18. Multiply line 17 by 15% \{0.15\}. 19. Add lines 9 and 17 . 20. Subtract ine 19 frem line 19 . 19. 22. Fipure the tax on the amount on line 5 . If the amount on line 5 ia leas than $100,600, use the Tre Table so figure the tax, if the amount on line 5 is $100.000 or mort, use the Tax Computation Worisheet. 22. 23. Add lines 18, 2t; and 22. 24. Figure the tax on the amount an fine 1. if the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on lise 1 is 5100,000 or more. use the Tax Computition Workaheat . ........ 25. Tax on all taxable income. Enter the smaller of line 23 or 24 , Abs include this amboet en the entry apace on 1040 or 1040 - 9R. Iite 16. Instead, entar it on line 4 of the Fersign Earhed Inceme Tas Workaheet ..... 23. 24. - If you are fiing Fom 2555, see the footnote in the Forejgn Earned Inceme Tax worligheat before compieting this line Comprehensive Problem 3-2A Russell (birthdate February 2, 1971) and Linda (birthdate August 30, 1976) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landscapes Unlimited (EIN: 32 - 1456789 ). The business is operated out of their home, located at 1234 Cherry Lane, Nampa, ID 83687. The principal business code is 561730 . Russell's - Donations expense is a $600 donation to the Campaign to Re-Elect Senator Ami Daha. - Training includes $575 for an educational seminar on bug control. It also includes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified landscaper. The tuition, fees, and books cost $1,400. He also drove his personal car 60 miles round trip to Boise to take exams three times for a total of 180 miles. - No business gift exceeded $22 in value. - The subscription is for a trade magazine titled Plants Unlimited. - Meals and entertainment expense is $1,500 of restaurant business meals and $800 for season tickets to Boise State University that Russell uses to entertain potential clients. - Russell drove his pickup truck (purchased 3/14/2021) 200 business miles through June 30 and 800 business miles for the remainder of 2022. He also drove the truck 2,300 commuting miles and 3,000 other miles. The Longs have another car available for personal use. Truck business mileage is not reflected in the income statement. The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. In addition to the above expenses, the Longs have set aside one room of their house as a home office. The room is 192 square feet and their house has a total of 1,600 square feet. They pay $13,200 per year rental on their house, and the utilities amount to $1,800 for the year. Linda lost her job in late 2021 and collected unemployment as shown on the following form 1099 -G (see separate tab). Russell was divorced on April 1, 2020 and pays his ex-spouse, Lois Long (SSN 313-29-3133) alimony of $200 per month in 2022. Russell's Social Security number is 664-98-5678 and Linda's is 554-98-3946. They made an estimated tax payment to the IRS of $300 on December 31,2022. Required: Complete the Longs federal tax return for 2022 on Form 1040, Schedule 1, Schedule B, Schedule C, Form 8829 , and the Qualified Dividends and Capital Gain Tax Worksheet. Do not complete Form 4562 (depreciation). - Do not complete Form 4562 (depreciation) or Form 8812 (additional child tax credit). You may ignore any related selfemployment taxes. Make realistic assumptions about any missing data. - If required, enter a "loss" as a negative number on the tax form. Do not enter deductions or other amounts as negative numbers. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - Do not round any division. If required, round your final answers to the nearest dollar. The Longs inherited a large number of acres of farm land from Linda's father in 2021 and sold it immediately for its market value of 51,000,000. They invested the proceeds in the Potato Dividend High Vield Fund and recerved the following Form 1099-DTu. a COrRECTED (if checked) Linda lost her job in late 2021 and collected unemployment as shown on the following form 1099-G. \begin{tabular}{ll|l|l|l} 1040 & U.S. Individual Income Tax Return & 2022 & oMe Na. 1545-0074 & 1nS use Only \\ \hline \end{tabular} At any time during 2022, did you receive, sell, exchange, or otherivise dispose of any financial interest in any virtual currency? No For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. To. 113200 Form 1050 (2022). Form 1040(2022) Tax and 16 Tax (see instructions). Cheok if any from Form(s) 1=98142=49723= Credits 17 Amount froen Schedule 2 , line 3 18 Add lines 16 and 17 . 19 Child tax credit or credit for other dependents from Schedule 8:12 20 Ambunt from Sctiedule 3 , line 8 21 Add lines 19 and 20 . 22 Subtract line 21 from line 18. If aerb or less, enter 40 - . 23 Other taxes, including self-employment tax, from schedule 2 , line 21 . 24Paymentsaddlines22and23,Thisisyourtotaltax. Page 2 b Form(s) 1099 c other forms (see instructions). d Add lines 25a through 25c. Ginn Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best Part I Additional Income 1. Toxable refunds, credits, or offsets of state and local income taxes, 2a Alimony received. b Date of original divorce or separation agreement (see instructions) 3. Business income or (loss). Attach Schedule C 4 Other gains or (llosses). Attach Form 4797 5 Rental real estate, roya ties, partnershios, 5 corporabons, trusts, etc. Attach Schedule E 6 form income or (loss). Attsch Schedule f 7 Unemployment compensation . 8. Other insome: - Net operating loss. b Gambling income . c Cancellation of debt d Foreign earned income exelusion from Form 2555 e Income from Form 8853 f Income from Form 8889 g Alssks Permanent Fund dividends . h Jury duty pay. I Prizes and awards 1 Activity not engages in for profit income. k stock options . I Income from the rental of personal property if vou enguged in the rental for profit but were not in the business of renting such property m Orympic and Paralympic medals and USOC penze money (see instructions) n Section 951(a) inclusion (see instructions) . - Section 951A(a) inclusion (see instructions). p Section 451(1) excess business loss adjustment . a Taxable distributions from an ABLE accoont [see instructions] I Stholarship and fellowship grants not reported on form w-2 s Nootsxable amount of Medicaid waiver payments insluded on form 1040, line 1 a or 1d,,, t Pensien or annuity from a nonqualifed delerred compensation plan of a nongovernmental section 457 plan ............ u Wages earned while incarcerated z other income. List type and amount: \begin{tabular}{|c|c} \hline 1 & \\ \hline 2a & \\ \hline & \\ \hline 3 & \\ \hline 4 & \\ \hline 5 & \\ \hline 6 & \\ \hline 7 & \\ \hline & \\ \hline 000 \\ & \\ \hline \end{tabular} 9. Total other income. Add lines 8 through 82 10 Combine lines 1 through 7 and 9 , Enter here and on Form 1040, 1040-SR, of 1040-NR, line 8 . For Paperwork Reduction Act Notice, see your tax return instructions: Cat, No. 71479F Schedule 1 (Form 1040) 2022 Part III You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign Foreign Accounts trust. and Trusts 7a At any time during 2022, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign Caution: If required, country? See instructions . failure to file FinCEN If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts Form 114 may result (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its in substantial instructions for filing requirements and exceptions to those requirements . penalties. See b If you are required to file FinCEN Form 114, enter the name of the foreign country where the instructions. financial account is located 8 Duning 2022, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes," you may have to file Form 3520. See instructions. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 17146N Schedule B (Form 1040) 2022 Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 2 R.eturns and allowances. 3 Subtract line 2 from line 1. 4 Cost of goods sold (from line 42). 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) ...... 7 Gross income. Add lines 5 and 6 , Part II Expenses. Enter expenses for business use of your home only on line 30. Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses or line 9 and are not reauired to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4552 . 43 When did you place your vehicle in service for business purposes? (month/day/year) 44 Of the fotal number of mules you drove your vehicle dunng 2022 , enter the number of miles you used your vehicle for: 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15, 29 Excess casualty losses (see instructions) 30 Depreciation of your home from line 42 below . 31 Carryover of prior year excess casualty losses and depreciation (see instructions) 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32. 34 Add lines 14,27 , and 33 . 35 Casualty loss portion, if any, from lines 14 and 33 . Carry amount to Form 4684 (see instructions) ...... 36 Allowable expenses for business use of your home. Subtract line 35 from line 34 , Enter here and on Schedule C, line 30 . If your home was used for more than one business, see instructions Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value (see instructions) . . . . . . . . 41 Depreciation percentage (see instructions) 42 Depreciation allowable (see instructions). Multiply line 40 by line 41, Enter here and on line 30 above .... 42 . Part IV Carryover of Unallowed Expenses to 2023 43 Operating expenses. Subtract line 27 from line 26 , If less than zero, enter 0+ 44 Excess casualty losses and depreciation. Subtract line 33 from line 32 . If less than zero, enter-0- \begin{tabular}{|l|l} \hline 37 & \\ \hline 38 & \\ \hline 39 & \\ \hline 40 & \\ \hline 41 & \\ \hline 42 & \\ \hline \end{tabular} 27 28 32 33 34 36 Russell Long Oualified Dividends and Capital Gain Tax Worksheet-Line 16 1 the box on 22. Figure the tax on the amount on line 5. If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax computation Worksheet ....... 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040-5R, line 16. If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040-5R, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet ..... Comprehendive Problem J-2A uses la ertertan patartas diends. Dacuntar 11, 2002 . Aequired enployment taves. Make reatific mwimptiom about any misohe dina. numbers. - If an ambunt box doen not reqube an entry or the anawer in aorb, enter "P5. - Be not round any division. If regsired, reund poir fical acsowers ta ber menest dellar. (1) Before you begias. Ses the earler intructions for line 16 to set of yeo can ute this wackahaet to figure yeur tix. V Before complating thie workahedti comelote form 1040 se 1040 . Sh through line 19 . d. If yeu den't have be file Schadule D and you rectived capital gain dattibutions, be sure you chacked the bex an Form 1040 of 104058, tine 7. 1. Inter the amount from form 1040 or 1040-3N, line 15. Hounved if you are filing form 2555 (rolating to forsign aarned income), antar the atwount frem line 3 of the Forsign farned tncome Tax Workshest +,,,,. 2. Eeter the amount from Fsrm-1040 or 104058. line 3a,,2. 3. Are you fling Schedole 07 on Yes: Enter the smaller of line 15 or 15 of Sehadule Q. If ether line 15 er 15 is blank or a loss: onter - G-. 3. E No: Enter the ameunt from ferm 1040 or 104050 : line 7. 4. Add lines 2 and 3. 5. Subtrast line 4 fromi line t. If werb or last, anter - O+ b. Thtert \$41;675 if tingle or marned fling isparately. 183.350 if marnitd fing jointly or qualfying widowiar). 6. $55.800 if had of househeld. 7. Enter the smalier of line 1 or Inte 6 . 8. Foter the imallor of line 5 or Ind 7 7. 9. Subtract ine 8 frem lite 7. This amount is tawed at 0%. 8. 10. Enter the amalior of line I or Sna 4. 9. 11. E-fer the amqunt fram line 2 . 10. 12. Subtract line 11 frsm lire 10 , 11. 11. Tinteri 5459,750 if aingle. 1258.600 if mamed foing sesarately. 12. $517,200 if marriad filing jeintly er qualtying widowlar). 1400,500 if head of household. 14. feter the smallor of line 1 or Inte 18,+ 14. 15. Mdd lines 5 and 9. 15. 16. Subtrace line 15 frem line 14, If zare or less, weger 0, 16. 17. Ener the amaler of line 12 or line 16,,17. 18. Multiply line 17 by 15% \{0.15\}. 19. Add lines 9 and 17 . 20. Subtract ine 19 frem line 19 . 19. 22. Fipure the tax on the amount on line 5 . If the amount on line 5 ia leas than $100,600, use the Tre Table so figure the tax, if the amount on line 5 is $100.000 or mort, use the Tax Computation Worisheet. 22. 23. Add lines 18, 2t; and 22. 24. Figure the tax on the amount an fine 1. if the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on lise 1 is 5100,000 or more. use the Tax Computition Workaheat . ........ 25. Tax on all taxable income. Enter the smaller of line 23 or 24 , Abs include this amboet en the entry apace on 1040 or 1040 - 9R. Iite 16. Instead, entar it on line 4 of the Fersign Earhed Inceme Tas Workaheet ..... 23. 24. - If you are fiing Fom 2555, see the footnote in the Forejgn Earned Inceme Tax worligheat before compieting this line Comprehensive Problem 3-2A Russell (birthdate February 2, 1971) and Linda (birthdate August 30, 1976) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landscapes Unlimited (EIN: 32 - 1456789 ). The business is operated out of their home, located at 1234 Cherry Lane, Nampa, ID 83687. The principal business code is 561730 . Russell's - Donations expense is a $600 donation to the Campaign to Re-Elect Senator Ami Daha. - Training includes $575 for an educational seminar on bug control. It also includes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified landscaper. The tuition, fees, and books cost $1,400. He also drove his personal car 60 miles round trip to Boise to take exams three times for a total of 180 miles. - No business gift exceeded $22 in value. - The subscription is for a trade magazine titled Plants Unlimited. - Meals and entertainment expense is $1,500 of restaurant business meals and $800 for season tickets to Boise State University that Russell uses to entertain potential clients. - Russell drove his pickup truck (purchased 3/14/2021) 200 business miles through June 30 and 800 business miles for the remainder of 2022. He also drove the truck 2,300 commuting miles and 3,000 other miles. The Longs have another car available for personal use. Truck business mileage is not reflected in the income statement. The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. In addition to the above expenses, the Longs have set aside one room of their house as a home office. The room is 192 square feet and their house has a total of 1,600 square feet. They pay $13,200 per year rental on their house, and the utilities amount to $1,800 for the year. Linda lost her job in late 2021 and collected unemployment as shown on the following form 1099 -G (see separate tab). Russell was divorced on April 1, 2020 and pays his ex-spouse, Lois Long (SSN 313-29-3133) alimony of $200 per month in 2022. Russell's Social Security number is 664-98-5678 and Linda's is 554-98-3946. They made an estimated tax payment to the IRS of $300 on December 31,2022. Required: Complete the Longs federal tax return for 2022 on Form 1040, Schedule 1, Schedule B, Schedule C, Form 8829 , and the Qualified Dividends and Capital Gain Tax Worksheet. Do not complete Form 4562 (depreciation). - Do not complete Form 4562 (depreciation) or Form 8812 (additional child tax credit). You may ignore any related selfemployment taxes. Make realistic assumptions about any missing data. - If required, enter a "loss" as a negative number on the tax form. Do not enter deductions or other amounts as negative numbers. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - Do not round any division. If required, round your final answers to the nearest dollar. The Longs inherited a large number of acres of farm land from Linda's father in 2021 and sold it immediately for its market value of 51,000,000. They invested the proceeds in the Potato Dividend High Vield Fund and recerved the following Form 1099-DTu. a COrRECTED (if checked) Linda lost her job in late 2021 and collected unemployment as shown on the following form 1099-G. \begin{tabular}{ll|l|l|l} 1040 & U.S. Individual Income Tax Return & 2022 & oMe Na. 1545-0074 & 1nS use Only \\ \hline \end{tabular} At any time during 2022, did you receive, sell, exchange, or otherivise dispose of any financial interest in any virtual currency? No For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. To. 113200 Form 1050 (2022). Form 1040(2022) Tax and 16 Tax (see instructions). Cheok if any from Form(s) 1=98142=49723= Credits 17 Amount froen Schedule 2 , line 3 18 Add lines 16 and 17 . 19 Child tax credit or credit for other dependents from Schedule 8:12 20 Ambunt from Sctiedule 3 , line 8 21 Add lines 19 and 20 . 22 Subtract line 21 from line 18. If aerb or less, enter 40 - . 23 Other taxes, including self-employment tax, from schedule 2 , line 21 . 24Paymentsaddlines22and23,Thisisyourtotaltax. Page 2 b Form(s) 1099 c other forms (see instructions). d Add lines 25a through 25c. Ginn Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best Part I Additional Income 1. Toxable refunds, credits, or offsets of state and local income taxes, 2a Alimony received. b Date of original divorce or separation agreement (see instructions) 3. Business income or (loss). Attach Schedule C 4 Other gains or (llosses). Attach Form 4797 5 Rental real estate, roya ties, partnershios, 5 corporabons, trusts, etc. Attach Schedule E 6 form income or (loss). Attsch Schedule f 7 Unemployment compensation . 8. Other insome: - Net operating loss. b Gambling income . c Cancellation of debt d Foreign earned income exelusion from Form 2555 e Income from Form 8853 f Income from Form 8889 g Alssks Permanent Fund dividends . h Jury duty pay. I Prizes and awards 1 Activity not engages in for profit income. k stock options . I Income from the rental of personal property if vou enguged in the rental for profit but were not in the business of renting such property m Orympic and Paralympic medals and USOC penze money (see instructions) n Section 951(a) inclusion (see instructions) . - Section 951A(a) inclusion (see instructions). p Section 451(1) excess business loss adjustment . a Taxable distributions from an ABLE accoont [see instructions] I Stholarship and fellowship grants not reported on form w-2 s Nootsxable amount of Medicaid waiver payments insluded on form 1040, line 1 a or 1d,,, t Pensien or annuity from a nonqualifed delerred compensation plan of a nongovernmental section 457 plan ............ u Wages earned while incarcerated z other income. List type and amount: \begin{tabular}{|c|c} \hline 1 & \\ \hline 2a & \\ \hline & \\ \hline 3 & \\ \hline 4 & \\ \hline 5 & \\ \hline 6 & \\ \hline 7 & \\ \hline & \\ \hline 000 \\ & \\ \hline \end{tabular} 9. Total other income. Add lines 8 through 82 10 Combine lines 1 through 7 and 9 , Enter here and on Form 1040, 1040-SR, of 1040-NR, line 8 . For Paperwork Reduction Act Notice, see your tax return instructions: Cat, No. 71479F Schedule 1 (Form 1040) 2022 Part III You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends; (b) had a foreign account; or (c) received a distribution from, or were a grantor of, or a transferor to, a foreign Foreign Accounts trust. and Trusts 7a At any time during 2022, did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign Caution: If required, country? See instructions . failure to file FinCEN If "Yes," are you required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts Form 114 may result (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 and its in substantial instructions for filing requirements and exceptions to those requirements . penalties. See b If you are required to file FinCEN Form 114, enter the name of the foreign country where the instructions. financial account is located 8 Duning 2022, did you receive a distribution from, or were you the grantor of, or transferor to, a foreign trust? If "Yes," you may have to file Form 3520. See instructions. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 17146N Schedule B (Form 1040) 2022 Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 2 R.eturns and allowances. 3 Subtract line 2 from line 1. 4 Cost of goods sold (from line 42). 5 Gross profit. Subtract line 4 from line 3 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) ...... 7 Gross income. Add lines 5 and 6 , Part II Expenses. Enter expenses for business use of your home only on line 30. Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses or line 9 and are not reauired to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4552 . 43 When did you place your vehicle in service for business purposes? (month/day/year) 44 Of the fotal number of mules you drove your vehicle dunng 2022 , enter the number of miles you used your vehicle for: 28 Limit on excess casualty losses and depreciation. Subtract line 27 from line 15, 29 Excess casualty losses (see instructions) 30 Depreciation of your home from line 42 below . 31 Carryover of prior year excess casualty losses and depreciation (see instructions) 33 Allowable excess casualty losses and depreciation. Enter the smaller of line 28 or line 32. 34 Add lines 14,27 , and 33 . 35 Casualty loss portion, if any, from lines 14 and 33 . Carry amount to Form 4684 (see instructions) ...... 36 Allowable expenses for business use of your home. Subtract line 35 from line 34 , Enter here and on Schedule C, line 30 . If your home was used for more than one business, see instructions Part III Depreciation of Your Home 37 Enter the smaller of your home's adjusted basis or its fair market value (see instructions) . . . . . . . . 41 Depreciation percentage (see instructions) 42 Depreciation allowable (see instructions). Multiply line 40 by line 41, Enter here and on line 30 above .... 42 . Part IV Carryover of Unallowed Expenses to 2023 43 Operating expenses. Subtract line 27 from line 26 , If less than zero, enter 0+ 44 Excess casualty losses and depreciation. Subtract line 33 from line 32 . If less than zero, enter-0- \begin{tabular}{|l|l} \hline 37 & \\ \hline 38 & \\ \hline 39 & \\ \hline 40 & \\ \hline 41 & \\ \hline 42 & \\ \hline \end{tabular} 27 28 32 33 34 36 Russell Long Oualified Dividends and Capital Gain Tax Worksheet-Line 16 1 the box on 22. Figure the tax on the amount on line 5. If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax computation Worksheet ....... 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040-5R, line 16. If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040-5R, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet