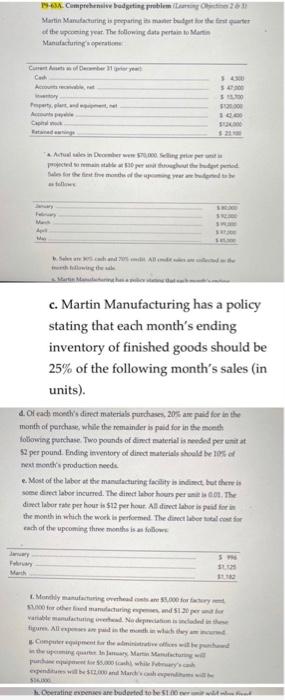

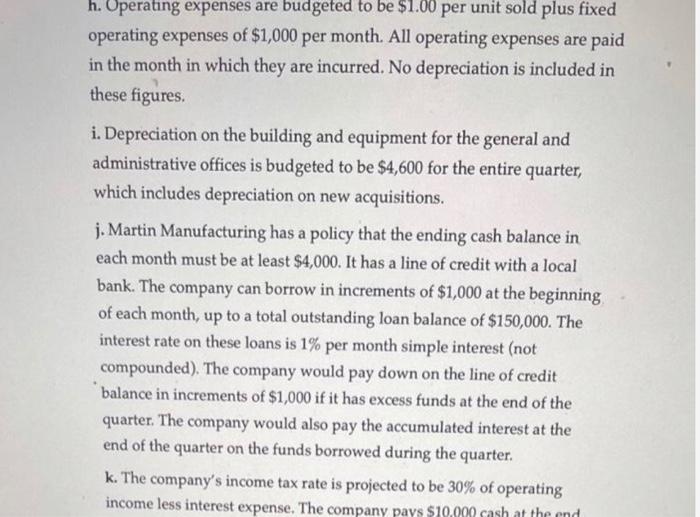

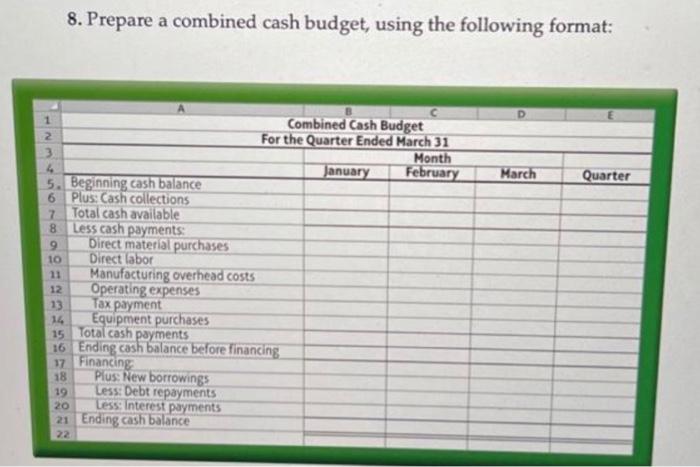

- Comprehensiv badgeting problema Martin Manufacturing preparing for the first of the wing year. The following data portanto Manalatu protes Center Cach AC 1 Cat Alles in De man perih We both in the web M AB he ch c. Martin Manufacturing has a policy stating that each month's ending inventory of finished goods should be 25% of the following month's sales (in units). d. Of each monthsdimet materials purchases 20 are paid for in the month of parchus, while the remainder is paid for in the month howing purchase. Two pounds of dimet material is needed per unit 52 per pound. Ending inventory of direct materials should be sot next month's production needs e. Most of the labor at the manufacturing facility is indirect but there is some direct labor incurred. The direct labor hours person. The direct laborale per hour 512 photAldinect laboris paid for the month in which the work to performed. The direct laboral each of the upcoming the months is as follow L. My manufacturing ant.fo for the manucuring 1.30 valacting. Nedens dadele g. All the way Computerpent for the real with in Marc praca while.com exi San Marco SH Itine e nebudete to be h. Operating expenses are budgeted to be $1.00 per unit sold plus fixed operating expenses of $1,000 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures. i. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,600 for the entire quarter, which includes depreciation on new acquisitions. j. Martin Manufacturing has a policy that the ending cash balance in each month must be at least $4,000. It has a line of credit with a local bank. The company can borrow in increments of $1,000 at the beginning of each month, up to a total outstanding loan balance of $150,000. The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay down on the line of credit balance in increments of $1,000 if it has excess funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter. k. The company's income tax rate is projected to be 30% of operating income less interest expense. The company pays $10.000 cash at the end 8. Prepare a combined cash budget, using the following format: 1 March Quarter 10 Combined Cash Budget 2 For the Quarter Ended March 31 3 Month 4 January February 5. Beginning cash balance 6 Plus: Cash collections 7 Total cash available 8 Less cash payments: 9 Direct material purchases Direct labor 11 Manufacturing overhead costs Operating expenses 13 Tax payment 14 Equipment purchases 15 Total cash payments 16 Ending cash balance before financing 17 Financing 18 Plus: New borrowings 19 Less: Debt repayments 20 Less Interest payments 21 Ending cash balance 12 22 - Comprehensiv badgeting problema Martin Manufacturing preparing for the first of the wing year. The following data portanto Manalatu protes Center Cach AC 1 Cat Alles in De man perih We both in the web M AB he ch c. Martin Manufacturing has a policy stating that each month's ending inventory of finished goods should be 25% of the following month's sales (in units). d. Of each monthsdimet materials purchases 20 are paid for in the month of parchus, while the remainder is paid for in the month howing purchase. Two pounds of dimet material is needed per unit 52 per pound. Ending inventory of direct materials should be sot next month's production needs e. Most of the labor at the manufacturing facility is indirect but there is some direct labor incurred. The direct labor hours person. The direct laborale per hour 512 photAldinect laboris paid for the month in which the work to performed. The direct laboral each of the upcoming the months is as follow L. My manufacturing ant.fo for the manucuring 1.30 valacting. Nedens dadele g. All the way Computerpent for the real with in Marc praca while.com exi San Marco SH Itine e nebudete to be h. Operating expenses are budgeted to be $1.00 per unit sold plus fixed operating expenses of $1,000 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures. i. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,600 for the entire quarter, which includes depreciation on new acquisitions. j. Martin Manufacturing has a policy that the ending cash balance in each month must be at least $4,000. It has a line of credit with a local bank. The company can borrow in increments of $1,000 at the beginning of each month, up to a total outstanding loan balance of $150,000. The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay down on the line of credit balance in increments of $1,000 if it has excess funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter. k. The company's income tax rate is projected to be 30% of operating income less interest expense. The company pays $10.000 cash at the end 8. Prepare a combined cash budget, using the following format: 1 March Quarter 10 Combined Cash Budget 2 For the Quarter Ended March 31 3 Month 4 January February 5. Beginning cash balance 6 Plus: Cash collections 7 Total cash available 8 Less cash payments: 9 Direct material purchases Direct labor 11 Manufacturing overhead costs Operating expenses 13 Tax payment 14 Equipment purchases 15 Total cash payments 16 Ending cash balance before financing 17 Financing 18 Plus: New borrowings 19 Less: Debt repayments 20 Less Interest payments 21 Ending cash balance 12 22