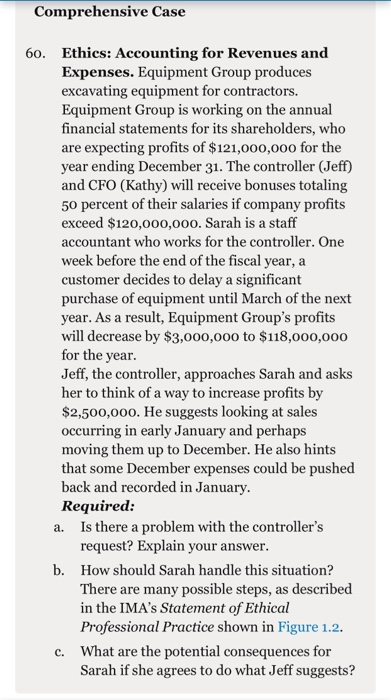

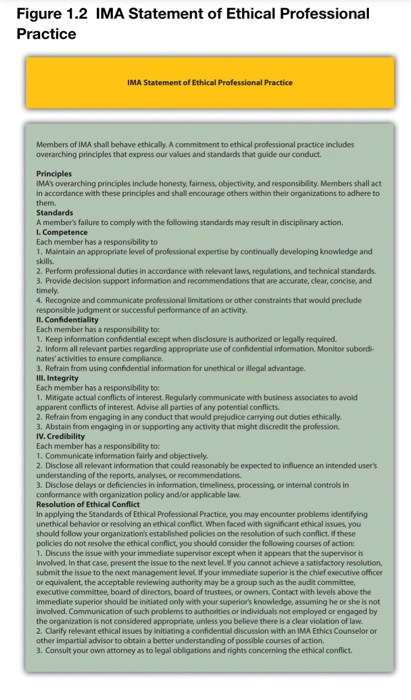

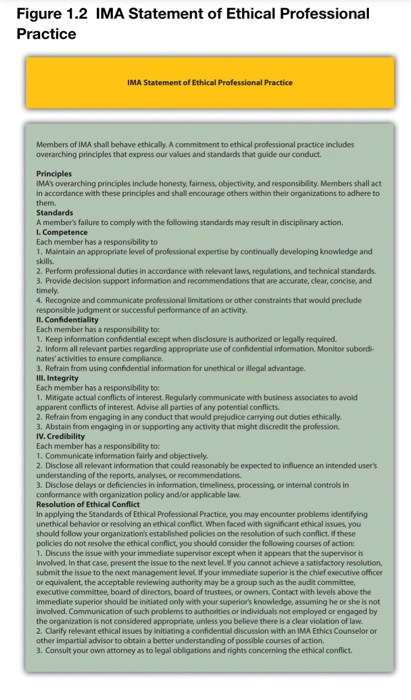

Comprehensive Case 60. Ethics: Accounting for Revenues and Expenses. Equipment Group produces excavating equipment for contractors. Equipment Group is working on the annual financial statements for its shareholders, who are expecting profits of $121,000,000 for the year ending December 31. The controller (Jeff) and CFO (Kathy) will receive bonuses totaling 50 percent of their salaries if company profits exceed $120,000,000. Sarah is a staff accountant who works for the controller. One week before the end of the fiscal year, a customer decides to delay a significant purchase of equipment until March of the next year. As a result, Equipment Group's profits will decrease by $3,000,000 to $118,000,000 for the year. Jeff, the controller, approaches Sarah and asks her to think of a way to increase profits by $2,500,000. He suggests looking at sales occurring in early January and perhaps moving them up to December. He also hints that some December expenses could be pushed back and recorded in January. Required: a. Is there a problem with the controller's request? Explain your answer. b. How should Sarah handle this situation? There are many possible steps, as described in the IMA's Statement of Ethical Professional Practice shown in Figure 1.2. c. What are the potential consequences for Sarah if she agrees to do what Jeff suggests? Figure 1.2 IMA Statement of Ethical Professional Practice IMA Statement of Ethical Professional Practice Members of IMA shall behave ethically. A commitment to ethical professional practice includes overarching principles that express our values and standards that guide our conduct Principles IMA's overarching principles include honesty, fairness, objectivity, and responsibility. Members shall act in accordance with these principles and shall encourage others within their organizations to adhere to them Standards A member's failure to comply with the following standards may result in disciplinary action. I. Competence Each member has a responsibility to 1. Maintain an appropriate level of professional expertise by continually developing knowledge and skills. 2. Perform professional duties in accordance with relevant laws, regulations, and technical standards 3. Provide decision support information and recommendations that are accurate, clear, concise, and timely 4. Recognize and communicate professional limitations or other constraints that would preclude responsible judgment or successful performance of an activity IL Confidentiality Each member has a responsibility to 1. Keep information confidential except when disclosure is authorized or legally required. 2. Inform all relevant parties regarding appropriate use of confidential information. Monitor subordi- nates'activities to ensure compliance 3. Refrain from using confidential information for unethical or illegal advantage. III. Integrity Each member has a responsibility to 1. Mitigate actual conflicts of interest. Regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts. 2. Refrain from engaging in any conduct that would prejudice carrying out duties ethically. 3. Abstain from engaging in or supporting any activity that might discredit the profession. IV. Credibility Each member has a responsibility to 1. Communicate information fairly and objectively. 2. Disclose all relevant information that could reasonably be expected to influence an intended user's understanding of the reports, analyses, or recommendations 3. Disclose delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable law. Resolution of Ethical Conflict In applying the Standards of Ethical Professional Practice, you may encounter problems identifying unethical behavior or resolving an ethical conflict. When faced with significant ethical issues, you should follow your organization's established policies on the resolution of such conflict. If these policies do not resolve the ethical conflict, you should consider the following courses of action 1. Discuss the issue with your immediate supervisor except when it appears that the supervisor is involved. In that case, present the issue to the next level. If you cannot achieve a satisfactory resolution, submit the issue to the next management level. If your immediate superior is the chief executive officer or equivalent. the acceptable reviewing authority may be a group such as the audit committee executive committee, board of directors, board of trustees, or owners. Contact with levels above the immediate superior should be initiated only with your superior's knowledge, assuming he or she is not Involved. Communication of such problems to authorities or individuals not employed or engaged by the organization is not considered appropriate, unless you believe there is a clear violation of law. 2. Clarify relevant ethical issues by initiating a confidential discussion with an IMA Ethics Counselor or other impartial advisor to obtain a better understanding of possible courses of action. 3. Consult your own attorney as to legal obligations and rights concerning the ethical conflict