Question

COMPREHENSIVE EXERCISE 1 On January 1, 2013, a parent company purchased 100 percent of the stock of a subsidiary company for 277,500. The subsidiarys stockholders

COMPREHENSIVE EXERCISE 1

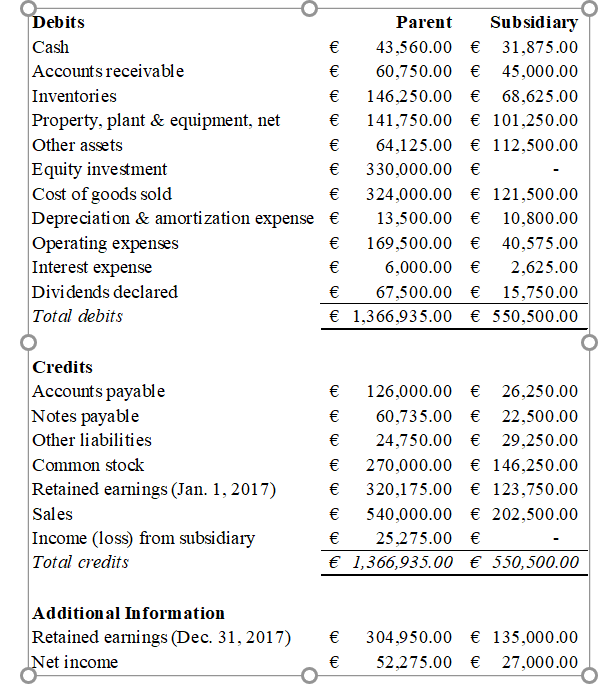

On January 1, 2013, a parent company purchased 100 percent of the stock of a subsidiary company for 277,500. The subsidiarys stockholders equity accounts at acquisition date amount to 146,250 for Common Stock, and 33,750 for Retained Earnings.

The subsidiarys recorded book values at acquisition date were equal to fair values for all items except for the following items:

- accounts receivable book value of 41,250 and a fair value of 36,000,

- property, plant & equipment, net book value of 112,500 and a fair value of 126,000,

- a previously unrecorded patent with a fair value of 22,500, and

- notes payable book value of 22,500 and a fair value of 18,750.

Both companies use the FIFO inventory method and sell all of their inventories at least once per year. The year-end net balance of accounts receivables are collected in the following year. On the acquisition date, the subsidiarys property, plant & equipment, net had a remaining useful life of 10 years, the patent had a remaining useful life of 4 years, and notes payable had a remaining term of 5 years.

On January 1, 2016, the parent' sold a building with a net book value of 41,250 to the subsidiary for 60,000. Both companies estimated that the building has a remaining life of 10 years on the intercompany sale date, with no salvage value.

Each company routinely sells merchandise to the other company, with a profit margin of 40% of selling price (regardless of the direction of the sale). During 2017, intercompany sales amount to 37,500, of which 15,000 of merchandise remains in the ending inventory of the subsidiary. On December 31, 2017, 7,500 of these intercompany sales remained unpaid. Additionally, the parents December 31, 2016 inventory includes 11,250 of merchandise purchased in the preceding year from the subsidiary. During 2016, intercompany sales amount to 30,000, and on December 31, 2016, 5,000 of these intercompany sales remained unpaid.

The parent accounts for its investment in the subsidiary using the equity method. Unconfirmed profits are allocated pro rata. The pre-closing trial balances (and additional information) for the two companies for the year ended December 31, 2017, are provided on the next page.

Required:

a. Prepare a consolidation spreadsheet using the December 31, 2017 pre-closing trial balance information for the parent and subsidiary.

b. Disaggregate and document the activity for the 100% Acquisition Accounting Premium (AAP).

c. Complete the consolidating entries according to the C-E-A-D-I sequence and explain the entries in detail.

d. Complete the consolidation and prepare the consolidated financial statements that would be published to the shareholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started