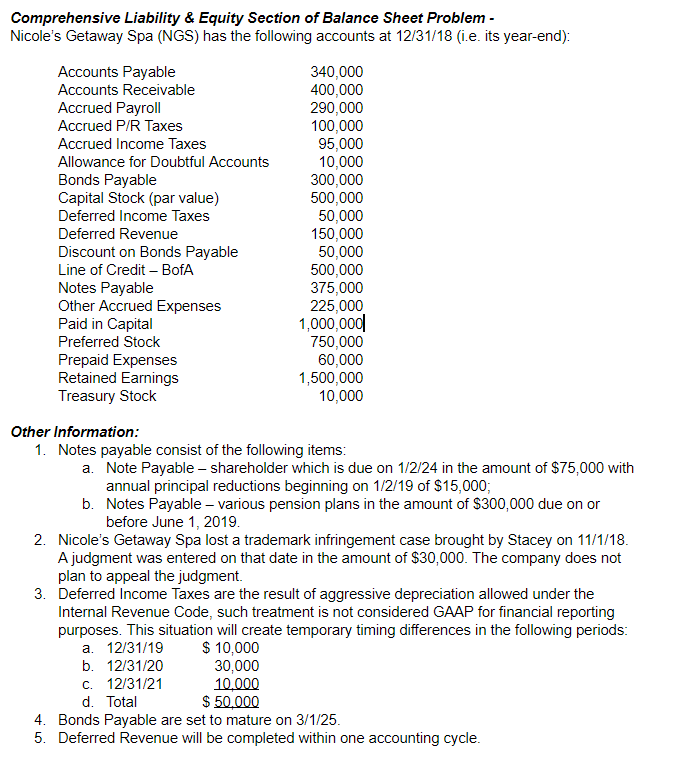

Comprehensive Liability & Equity Section of Balance Sheet Problem -

Nicoles Getaway Spa (NGS) has the following accounts at 12/31/18 (i.e. its year-end):

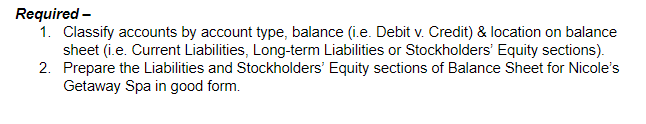

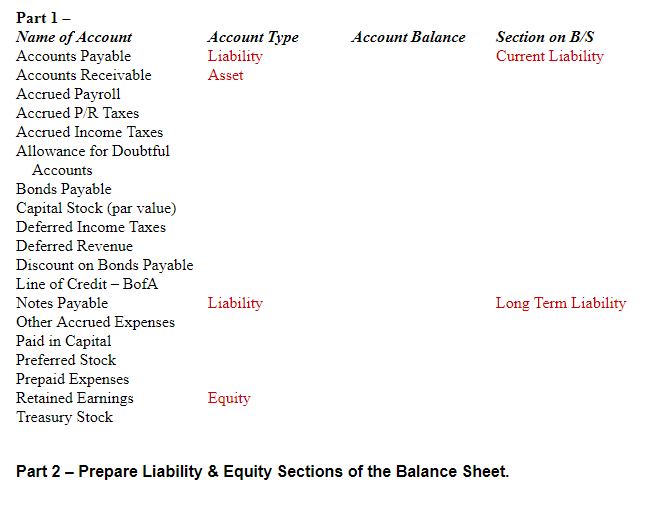

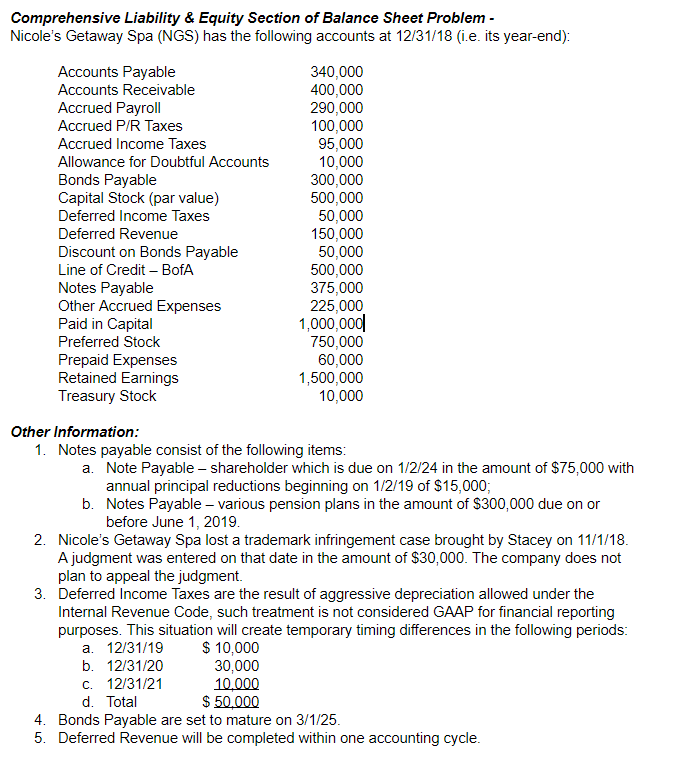

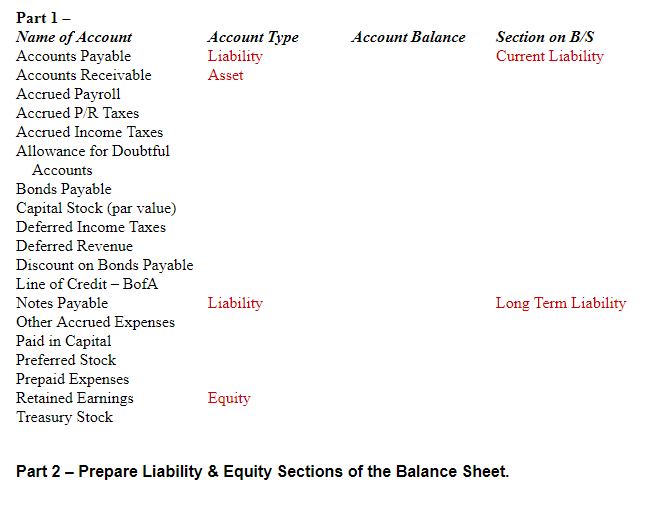

Comprehensive Liability & Equity Section of Balance Sheet Problem - Nicole's Getaway Spa (NGS) has the following accounts at 12131/18 (i.e. its year-end) Accounts Payable Accounts Receivable Accrued Payroll Accrued P/R Taxes Accrued Income Taxes Allowance for Doubtful Accounts Bonds Payable Capital Stock (par value) Deferred Income Taxes Deferred Revenue Discount on Bonds Payable Line of Credit BofA Notes Payable Other Accrued Expenses Paid in Capital Preferred Stock Prepaid Expenses Retained Earnings Treasury Stock 340,000 400,000 290,000 100,000 95,000 10,000 300,000 500,000 50,000 150,000 50,000 500,000 375,000 225,000 1,000,000 750,000 60,000 1,500,000 10,000 Other Information 1. Notes payable consist of the following items a. Note Payable shareholder which is due on 1/2/24 in the amount of $75,000 with annual principal reductions beginning on 1/2/19 of $15,000 b. Notes Payable - various pension plans in the amount of S300,000 due on or before June 1, 2019 2. Nicole's Getaway Spa lost a trademark infringement case brought by Stacey on 11/1/18 A judgment was entered on that date in the amount of S30,000. The company does not plan to appeal the judgment. Deferred Income Taxes are the result of aggressive depreciation allowed under the Internal Revenue Code, such treatment is not considered GAAP for financial reporting purposes. This situation will create temporary timing differences in the following periods 3. 10,000 30,000 10,000 S 50,000 a. 12/31/19 b. 12/31/20 C. 12/31/21 d. Total 4. Bonds Payable are set to mature on 3/1/25 5. Deferred Revenue will be completed within one accounting cycle Required- Classify accounts by account type, balance (ie, Debit V. Credit) & location on balance sheet (i.e. Current Liabilities, Long-term Liabilities or Stockholders' Equity sections). Prepare the Liabilities and Stockholders' Equity sections of Balance Sheet for Nicole's Getaway Spa in good form. 1. 2. Part 1- Name of Account Accounts Payable Accounts Receivable Accrued Payroll Accrued P/R Taxes Accrued Income Taxes Allowance for Doubtful Account Type Liability Asset Account Balance Section on B/S 1 Current Liability Accounts Bonds Payable Capital Stock (par value) Deferred Income Taxes Deferred Revenue Discount on Bonds Payable Line of Credit - BofA Notes Payable Other Accrued Expenses Paid in Capital Preferred Stock Prepaid Expenses Retained Earnings Treasury Stock 2 Liability Long Term Liablity Equity Part 2 - Prepare Liability & Equity Sections of the Balance Sheet. Comprehensive Liability & Equity Section of Balance Sheet Problem - Nicole's Getaway Spa (NGS) has the following accounts at 12131/18 (i.e. its year-end) Accounts Payable Accounts Receivable Accrued Payroll Accrued P/R Taxes Accrued Income Taxes Allowance for Doubtful Accounts Bonds Payable Capital Stock (par value) Deferred Income Taxes Deferred Revenue Discount on Bonds Payable Line of Credit BofA Notes Payable Other Accrued Expenses Paid in Capital Preferred Stock Prepaid Expenses Retained Earnings Treasury Stock 340,000 400,000 290,000 100,000 95,000 10,000 300,000 500,000 50,000 150,000 50,000 500,000 375,000 225,000 1,000,000 750,000 60,000 1,500,000 10,000 Other Information 1. Notes payable consist of the following items a. Note Payable shareholder which is due on 1/2/24 in the amount of $75,000 with annual principal reductions beginning on 1/2/19 of $15,000 b. Notes Payable - various pension plans in the amount of S300,000 due on or before June 1, 2019 2. Nicole's Getaway Spa lost a trademark infringement case brought by Stacey on 11/1/18 A judgment was entered on that date in the amount of S30,000. The company does not plan to appeal the judgment. Deferred Income Taxes are the result of aggressive depreciation allowed under the Internal Revenue Code, such treatment is not considered GAAP for financial reporting purposes. This situation will create temporary timing differences in the following periods 3. 10,000 30,000 10,000 S 50,000 a. 12/31/19 b. 12/31/20 C. 12/31/21 d. Total 4. Bonds Payable are set to mature on 3/1/25 5. Deferred Revenue will be completed within one accounting cycle Required- Classify accounts by account type, balance (ie, Debit V. Credit) & location on balance sheet (i.e. Current Liabilities, Long-term Liabilities or Stockholders' Equity sections). Prepare the Liabilities and Stockholders' Equity sections of Balance Sheet for Nicole's Getaway Spa in good form. 1. 2. Part 1- Name of Account Accounts Payable Accounts Receivable Accrued Payroll Accrued P/R Taxes Accrued Income Taxes Allowance for Doubtful Account Type Liability Asset Account Balance Section on B/S 1 Current Liability Accounts Bonds Payable Capital Stock (par value) Deferred Income Taxes Deferred Revenue Discount on Bonds Payable Line of Credit - BofA Notes Payable Other Accrued Expenses Paid in Capital Preferred Stock Prepaid Expenses Retained Earnings Treasury Stock 2 Liability Long Term Liablity Equity Part 2 - Prepare Liability & Equity Sections of the Balance Sheet