Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comprehensive Problem 1 7 - 8 1 ( LO 1 7 - 1 , LO 1 7 - 2 , LO 1 7 - 3

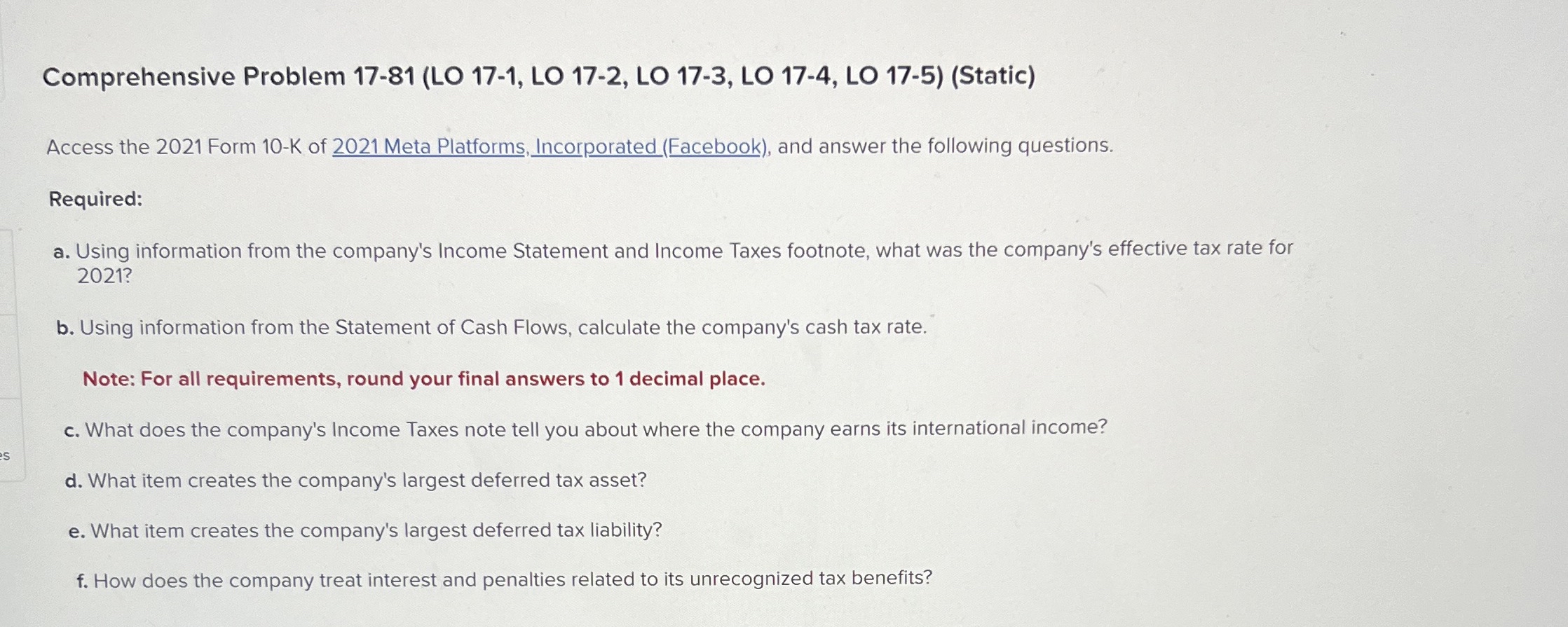

Comprehensive Problem LO LO LO LO LO Static Access the Form K of Meta Platforms Incorporated Facebook and answer the following questions Required: a Using Information from the company's Income Statement and Income Taxes footnote, what was the company's effective tax rate for b Using information from the Statement of Cash Flows, calculate the company's cash tax rate Note: For all requirements round your final answers to decimal place What does the company's Income Taxes note tell you about where the company earns its international income? d What item creates the company's largest deferred tax asset eWhat item creates the company's largest deferred tax liability? How does the company treat interest and penalties related to its unrecognized tax benefits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started