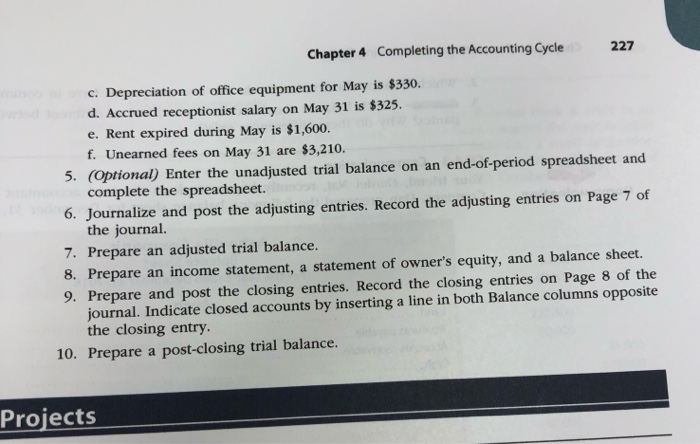

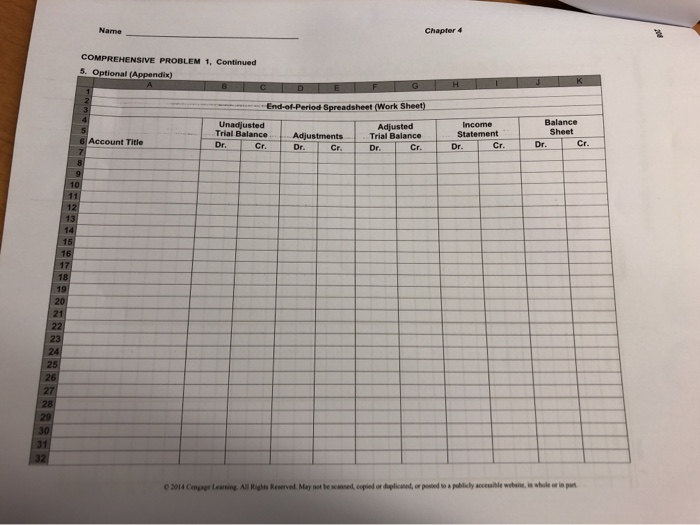

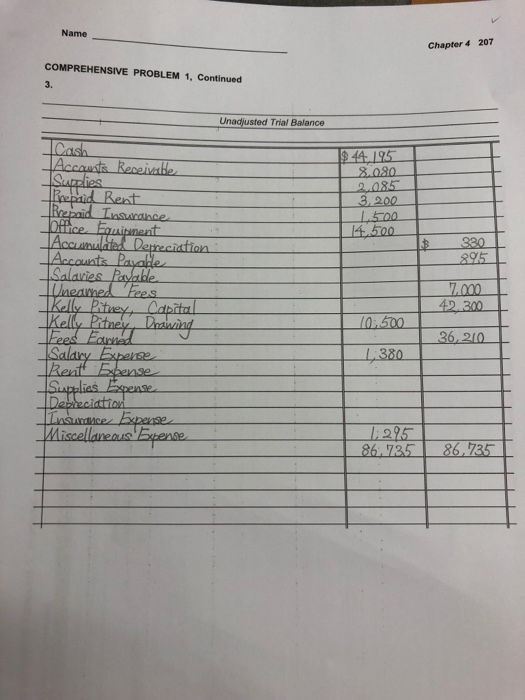

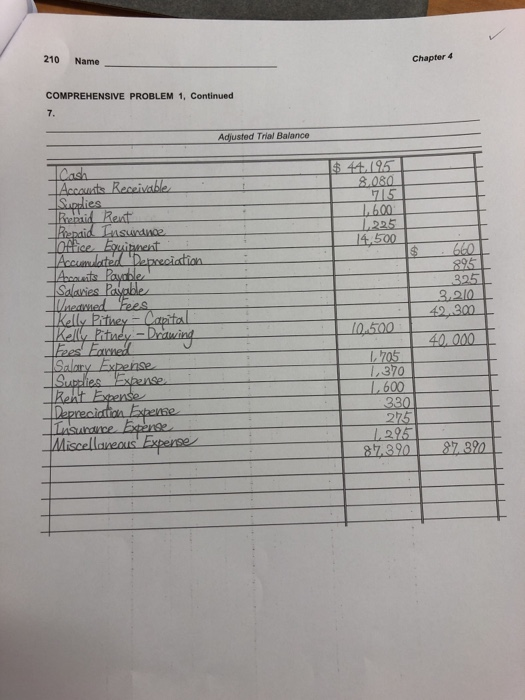

Comprehensive Problem 1 8. Net income, $33,425 Excel Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The ac- counting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $4,500. 5. Received cash from clients on account, $2,450. 9. Paid cash for a newspaper advertisement, $225. 13. Paid Office Station Co. for part of the debt incurred on April 5, $640. 15. Provided services on account for the period May 1-15, $9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, $750. 17. Received cash from cash clients for fees earned during the period May 1-16, $8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, $735. 21. Provided services on account for the period May 16-20, $4,820. 25. Received cash from cash clients for fees earned for the period May 17-23, $7.900. 27. Received cash from clients on account, $9,520. 28. Paid part-time receptionist for two weeks' salary, $750. 30. Paid telephone bill for May, $260. 31. Paid electricity bill for May, $810. 31. Received cash from cash clients for fees earned for the period May 26-31, $3,300. 31. Provided services on account for the remainder of May, $2,650. 31. Kelly withdrew $10,500 for personal use. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark (V) in the Posting Reference column. Journalize each of the May transactions in a two- column journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is $275. b. Supplies on hand on May 31 are $715. Chapter 4 Completing the Accounting Cycle 227 c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $325. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owner's equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance. Projects Name Chapter 4 COMPREHENSIVE PROBLEM 1. Continued Optional (Appendix) -End-of-Period Spreadsheet (Work Sheet) Balance Unadjusted Trial Balance Adjusted Trial Balance D r. Cr. Adjustments Dr. Gr 6 Account Title Income Statement Dr. Cr. Dr. Name Chapter 213 COMPREHENSIVE PROBLEM 1. Continued JOURNAL Closing Entre III 18 EXTENSIB I 1918 latu a te is le la la la la la la la la la 2014 Cmpage Learning. All Rights Reserved. May not be care copied or c orpored to a publicly csible website, in whole or in par 214 Name COMPREHENSIVE PROBLEM 1. Concluded Post-Closing The + CAR prest Name Chapter 6 207 COMPREHENSIVE PROBLEM 1. Continued Unadjusted Trial Balance Trash $244..195 8.080 2.085 3,200 1.500 .500 4 3801 8951 TAccounts Receivable ISHRies line paid Rent repaid Insurance Dilice. Eoinent 2 Accumulated Depreciation Accounts Payable Salaries Payable Uneamed Fees Kelly_Patrey Cobito Kelly Pitner Drawind Feed and Salary Experte Rent Shense Supplies Expense Depreciation Indundice Expanse Miscellaneous Expense 7.000 42.300 105700 36,210 380 I 295 18673586.735 210 Name Chapter 4 COMPREHENSIVE PROBLEM 1, Continued Adjusted Trial Balance 1 995 8.000 1715 1.600 T 14.500 I $ T Cash Accounts Receivable Supplies_ Renaid kent Repaid. Tusurance 10ftice Eovinent Accumulated Depreciation Acouts Payable Salaries Palable edwed Fees Kelly Pitney - Capital Helly Latures - Drawing Fres! Earned Salary Expense Supplies Expanse kent Extende Depreciation Externe Lusunde Extens Miscellaneous Experse 660 895 051 3.210 42.300 I 10.500 1705 1,370 1.600 330 2 175T 295 87.390 87 390