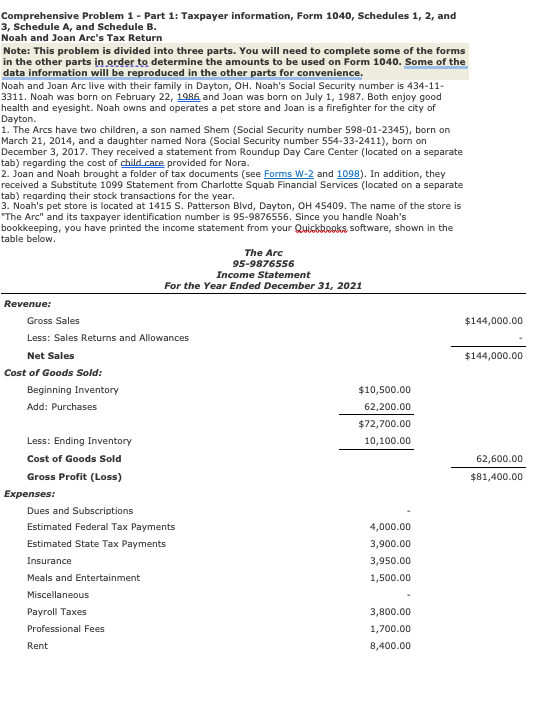

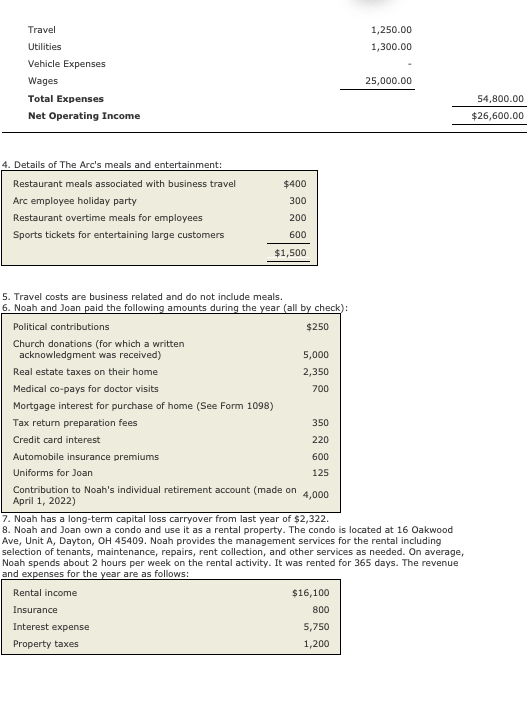

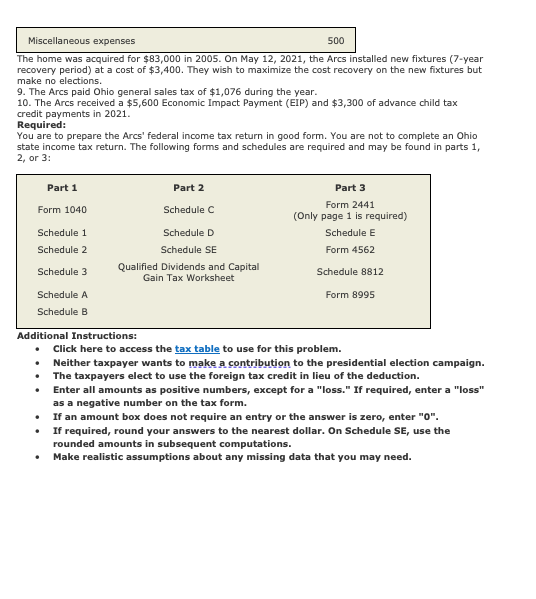

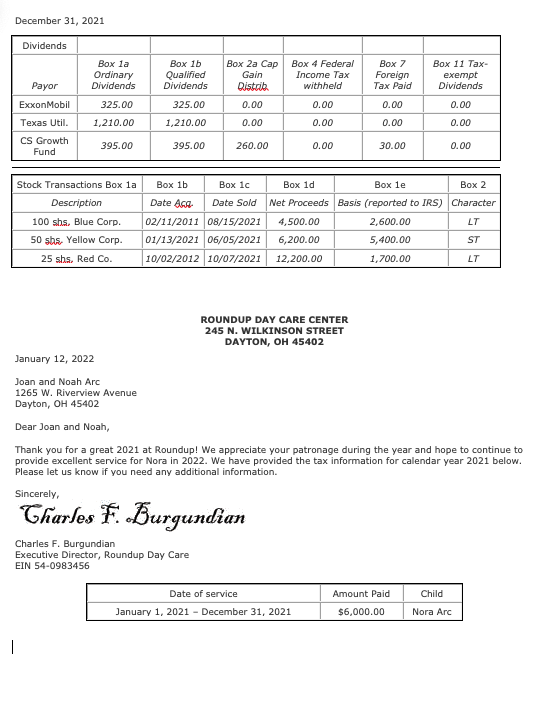

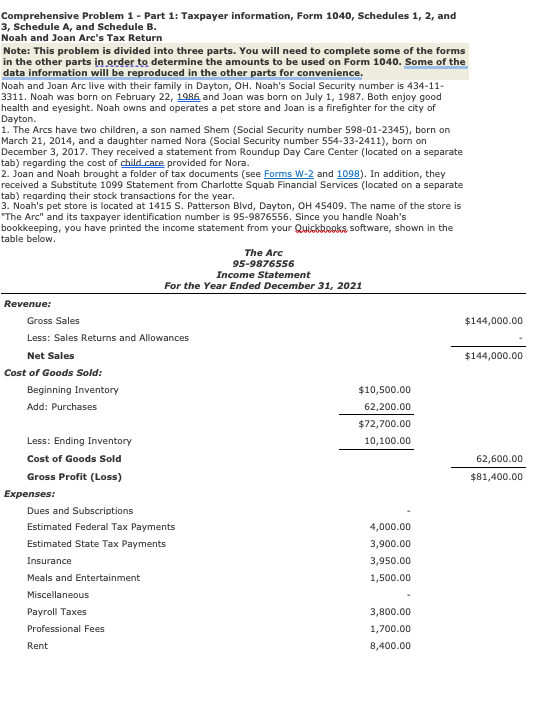

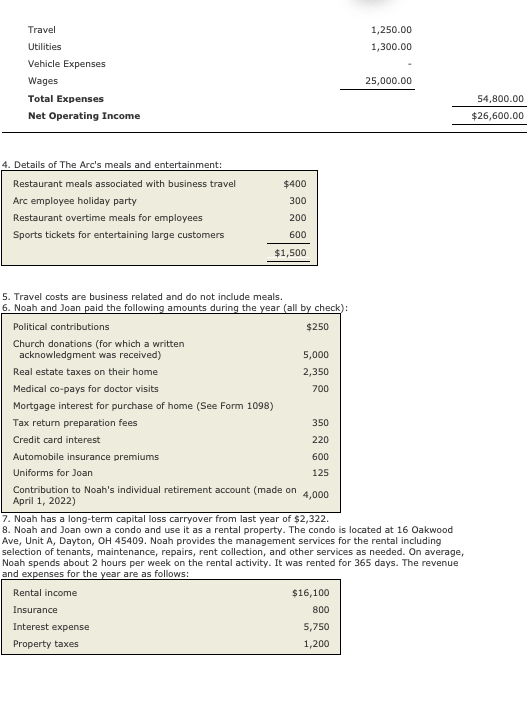

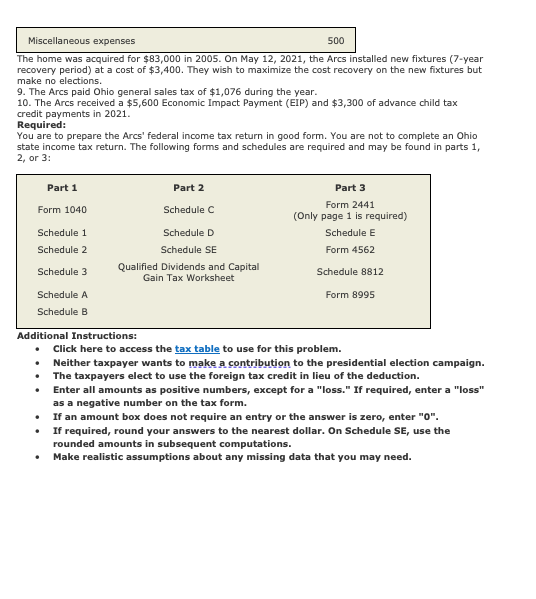

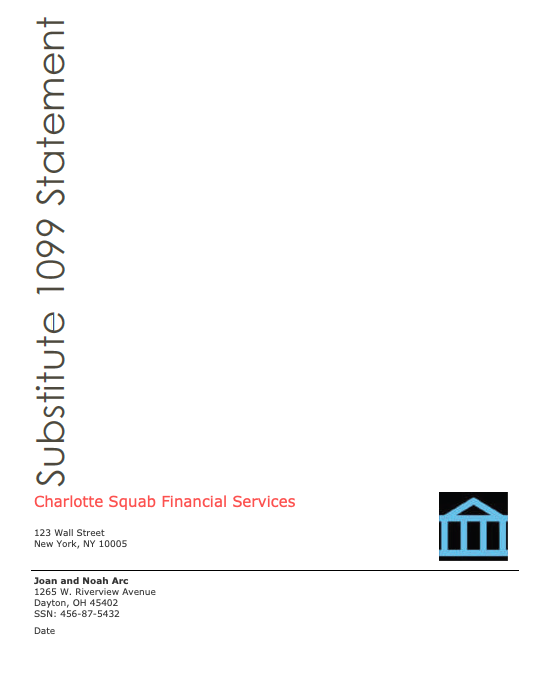

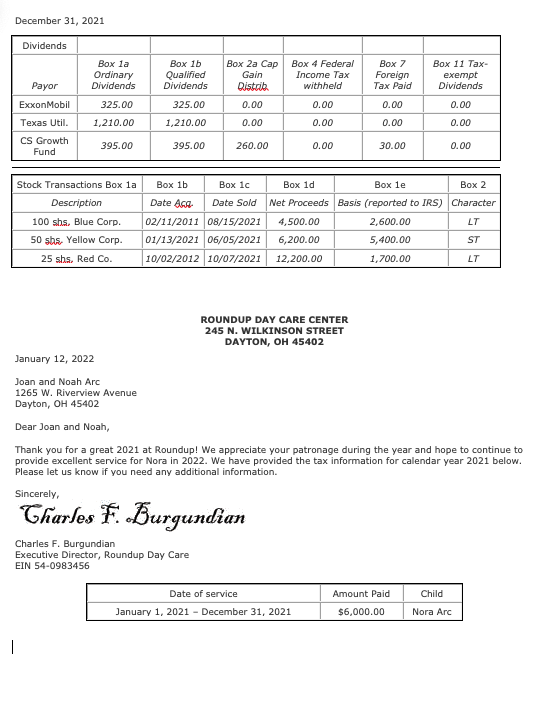

Comprehensive Problem 1 - Part 1: Taxpayer information, Form 1040, Schedules 1, 2, and 3, Schedule A, and Schedule B. Noah and Joan Arc's Tax Return Note: This problem is divided into three parts. You will need to complete some of the forms in the other parts in order to determine the amounts to be used on Form 1040. Some of the data information will be reproduced in the other parts for convenience. Noah and Joan Arc live with their family in Dayton, OH. Noah's Social Security number is 434-11- 3311. Noah was born on February 22, 1986 and Joan was born on July 1, 1987. Both enjoy good health and eyesight. Noah owns and operates a pet store and Joan is a firefighter for the city of Dayton. 1. The Arcs have two children, a son named Shem (Social Security number 598-01-2345), born on March 21, 2014, and a daughter named Nora (Social Security number 554-33-2411), born on December 3, 2017. They received a statement from Roundup Day Care Center (located on a separate tab) regarding the cost of child care provided for Nora. 2. Joan and Noah brought a folder of tax documents (see Forms W-2 and 1098). In addition, they received a Substitute 1099 Statement from Charlotte Squab Financial Services (located on a separate tab) regarding their stock transactions for the year. 3. Noah's pet store is located at 1415 S. Patterson Blvd, Dayton, OH 45409. The name of the store is "The Arc" and its taxpayer identification number is 95-9876556. Since you handle Noah's bookkeeping, you have printed the income statement from your Quickbooks software, shown in the table below. The Arc 95-9876556 Income Statement For the Year Ended December 31, 2021 Revenue: Gross Sales $144,000.00 Less: Sales Returns and Allowances Net Sales $144,000.00 Cost of Goods Sold: Beginning Inventory $10,500.00 Add: Purchases 62,200.00 $72,700.00 Less: Ending Inventory 10,100.00 Cost of Goods Sold 62,600.00 Gross Profit (Loss) $81,400.00 Expenses: Dues and Subscriptions Estimated Federal Tax Payments 4,000.00 Estimated State Tax Payments 3,900.00 Insurance 3,950.00 Meals and Entertainment 1,500.00 Miscellaneous Payroll Taxes 3,800.00 Professional Fees 1,700.00 Rent 8,400.00 1,250.00 1,300.00 Travel Utilities Vehicle Expenses Wages Total Expenses Net Operating Income 25,000.00 54,800.00 $26,600.00 4. Details of The Arc's meals and entertainment: Restaurant meals associated with business travel Arc employee holiday party Restaurant overtime meals for employees Sports tickets for entertaining large customers $400 300 200 600 $1,500 5. Travel costs are business related and do not include meals. 6. Noah and Joan paid the following amounts during the year (all by check): Political contributions $250 Church donations (for which a written acknowledgment was received) 5,000 Real estate taxes on their home 2,350 Medical co-pays for doctor visits 700 Mortgage interest for purchase of home (See Form 1098) Tax return preparation fees 350 Credit card interest 220 Automobile insurance premiums 600 Uniforms for Joan Contribution to Noah's individual retirement account (made on April 1, 2022) 7. Noah has a long-term capital loss carryover from last year of $2,322. 8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A, Dayton, OH 45409. Noah provides the management services for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about 2 hours per week on the rental activity. It was rented for 365 days. The revenue and expenses for the year are as follows: Rental income $16,100 Insurance 800 Interest expense 5,750 Property taxes 1,200 125 4,000 Miscellaneous expenses 500 The home was acquired for $83,000 in 2005. On May 12, 2021, the Arcs installed new fixtures (7-year recovery period) at a cost of $3,400. They wish to maximize the cost recovery on the new fixtures but make no elections. 9. The Arcs paid Ohio general sales tax of $1,076 during the year. 10. The Arcs received a $5,600 Economic Impact Payment (EIP) and $3,300 of advance child tax credit payments in 2021. Required: You are to prepare the Arcs' federal income tax return in good form. You are not to complete an Ohio state income tax return. The following forms and schedules are required and may be found in parts 1, 2, or 3: Part 1 Part 2 Schedule C Form 1040 Schedule 1 Schedule 2 Schedule D Schedule SE Qualified Dividends and Capital Gain Tax Worksheet Part 3 Form 2441 (Only page 1 is required) Schedule E Form 4562 Schedule 8812 Schedule 3 Schedule A Form 8995 Schedule B Additional Instructions: Click here to access the tax table to use for this problem. Neither taxpayer wants to make a contribution to the presidential election campaign. The taxpayers elect to use the foreign tax credit in lieu of the deduction. Enter all amounts as positive numbers, except for a "loss." If required, enter a "loss" as a negative number on the tax form. If an amount box does not require an entry or the answer is zero, enter "O". If required, round your answers to the nearest dollar. On Schedule SE, use the rounded amounts in subsequent computations. Make realistic assumptions about any missing data that you may need. Substitute 1099 Statement Charlotte Squab Financial Services 123 Wall Street New York, NY 10005 Joan and Noah Arc 1265 W. Riverview Avenue Dayton, OH 45402 SSN: 456-87-5432 Date December 31, 2021 Dividends Box la Ordinary Dividends Box 1b Qualified Dividends 325.00 Box 2a Cap Gain Distik 0.00 Box 4 Federal Income Tax withheld Box 7 Foreign Tax Paid Payor ExxonMobil Box 11 Tax- exempt Dividends 325.00 0.00 0.00 0.00 Texas Util. 1,210.00 1,210.00 0.00 0.00 0.00 0.00 CS Growth Fund 395.00 395.00 260.00 0.00 30.00 0.00 Stock Transactions Box la Description 100 shs. Blue Corp. 50 shs. Yellow Corp. 25 shs. Red Co. Box 1b Box 1c Box id Box le Box 2 Date Aca Date Sold Net Proceeds Basis (reported to IRS) Character 02/11/2011 08/15/2021 4,500.00 2,600.00 LT 01/13/2021 06/05/2021 6,200.00 5,400.00 ST 10/02/2012 10/07/2021 12,200.00 1,700.00 LT ROUNDUP DAY CARE CENTER 245 N. WILKINSON STREET DAYTON, OH 45402 January 12, 2022 Joan and Noah Arc 1265 W. Riverview Avenue Dayton, OH 45402 Dear Joan and Noah, Thank you for a great 2021 at Roundup! We appreciate your patronage during the year and hope to continue to provide excellent service for Nora in 2022. We have provided the tax information for calendar year 2021 below. Please let us know if you need any additional information. Sincerely, Charles F. Burgundian : Charles F. Burgundian Executive Director, Roundup Day Care EIN 54-0983456 Date of service January 1, 2021 - December 31, 2021 Amount Paid $6,000.00 Child Nora Arc Comprehensive Problem 1 - Part 1: Taxpayer information, Form 1040, Schedules 1, 2, and 3, Schedule A, and Schedule B. Noah and Joan Arc's Tax Return Note: This problem is divided into three parts. You will need to complete some of the forms in the other parts in order to determine the amounts to be used on Form 1040. Some of the data information will be reproduced in the other parts for convenience. Noah and Joan Arc live with their family in Dayton, OH. Noah's Social Security number is 434-11- 3311. Noah was born on February 22, 1986 and Joan was born on July 1, 1987. Both enjoy good health and eyesight. Noah owns and operates a pet store and Joan is a firefighter for the city of Dayton. 1. The Arcs have two children, a son named Shem (Social Security number 598-01-2345), born on March 21, 2014, and a daughter named Nora (Social Security number 554-33-2411), born on December 3, 2017. They received a statement from Roundup Day Care Center (located on a separate tab) regarding the cost of child care provided for Nora. 2. Joan and Noah brought a folder of tax documents (see Forms W-2 and 1098). In addition, they received a Substitute 1099 Statement from Charlotte Squab Financial Services (located on a separate tab) regarding their stock transactions for the year. 3. Noah's pet store is located at 1415 S. Patterson Blvd, Dayton, OH 45409. The name of the store is "The Arc" and its taxpayer identification number is 95-9876556. Since you handle Noah's bookkeeping, you have printed the income statement from your Quickbooks software, shown in the table below. The Arc 95-9876556 Income Statement For the Year Ended December 31, 2021 Revenue: Gross Sales $144,000.00 Less: Sales Returns and Allowances Net Sales $144,000.00 Cost of Goods Sold: Beginning Inventory $10,500.00 Add: Purchases 62,200.00 $72,700.00 Less: Ending Inventory 10,100.00 Cost of Goods Sold 62,600.00 Gross Profit (Loss) $81,400.00 Expenses: Dues and Subscriptions Estimated Federal Tax Payments 4,000.00 Estimated State Tax Payments 3,900.00 Insurance 3,950.00 Meals and Entertainment 1,500.00 Miscellaneous Payroll Taxes 3,800.00 Professional Fees 1,700.00 Rent 8,400.00 1,250.00 1,300.00 Travel Utilities Vehicle Expenses Wages Total Expenses Net Operating Income 25,000.00 54,800.00 $26,600.00 4. Details of The Arc's meals and entertainment: Restaurant meals associated with business travel Arc employee holiday party Restaurant overtime meals for employees Sports tickets for entertaining large customers $400 300 200 600 $1,500 5. Travel costs are business related and do not include meals. 6. Noah and Joan paid the following amounts during the year (all by check): Political contributions $250 Church donations (for which a written acknowledgment was received) 5,000 Real estate taxes on their home 2,350 Medical co-pays for doctor visits 700 Mortgage interest for purchase of home (See Form 1098) Tax return preparation fees 350 Credit card interest 220 Automobile insurance premiums 600 Uniforms for Joan Contribution to Noah's individual retirement account (made on April 1, 2022) 7. Noah has a long-term capital loss carryover from last year of $2,322. 8. Noah and Joan own a condo and use it as a rental property. The condo is located at 16 Oakwood Ave, Unit A, Dayton, OH 45409. Noah provides the management services for the rental including selection of tenants, maintenance, repairs, rent collection, and other services as needed. On average, Noah spends about 2 hours per week on the rental activity. It was rented for 365 days. The revenue and expenses for the year are as follows: Rental income $16,100 Insurance 800 Interest expense 5,750 Property taxes 1,200 125 4,000 Miscellaneous expenses 500 The home was acquired for $83,000 in 2005. On May 12, 2021, the Arcs installed new fixtures (7-year recovery period) at a cost of $3,400. They wish to maximize the cost recovery on the new fixtures but make no elections. 9. The Arcs paid Ohio general sales tax of $1,076 during the year. 10. The Arcs received a $5,600 Economic Impact Payment (EIP) and $3,300 of advance child tax credit payments in 2021. Required: You are to prepare the Arcs' federal income tax return in good form. You are not to complete an Ohio state income tax return. The following forms and schedules are required and may be found in parts 1, 2, or 3: Part 1 Part 2 Schedule C Form 1040 Schedule 1 Schedule 2 Schedule D Schedule SE Qualified Dividends and Capital Gain Tax Worksheet Part 3 Form 2441 (Only page 1 is required) Schedule E Form 4562 Schedule 8812 Schedule 3 Schedule A Form 8995 Schedule B Additional Instructions: Click here to access the tax table to use for this problem. Neither taxpayer wants to make a contribution to the presidential election campaign. The taxpayers elect to use the foreign tax credit in lieu of the deduction. Enter all amounts as positive numbers, except for a "loss." If required, enter a "loss" as a negative number on the tax form. If an amount box does not require an entry or the answer is zero, enter "O". If required, round your answers to the nearest dollar. On Schedule SE, use the rounded amounts in subsequent computations. Make realistic assumptions about any missing data that you may need. Substitute 1099 Statement Charlotte Squab Financial Services 123 Wall Street New York, NY 10005 Joan and Noah Arc 1265 W. Riverview Avenue Dayton, OH 45402 SSN: 456-87-5432 Date December 31, 2021 Dividends Box la Ordinary Dividends Box 1b Qualified Dividends 325.00 Box 2a Cap Gain Distik 0.00 Box 4 Federal Income Tax withheld Box 7 Foreign Tax Paid Payor ExxonMobil Box 11 Tax- exempt Dividends 325.00 0.00 0.00 0.00 Texas Util. 1,210.00 1,210.00 0.00 0.00 0.00 0.00 CS Growth Fund 395.00 395.00 260.00 0.00 30.00 0.00 Stock Transactions Box la Description 100 shs. Blue Corp. 50 shs. Yellow Corp. 25 shs. Red Co. Box 1b Box 1c Box id Box le Box 2 Date Aca Date Sold Net Proceeds Basis (reported to IRS) Character 02/11/2011 08/15/2021 4,500.00 2,600.00 LT 01/13/2021 06/05/2021 6,200.00 5,400.00 ST 10/02/2012 10/07/2021 12,200.00 1,700.00 LT ROUNDUP DAY CARE CENTER 245 N. WILKINSON STREET DAYTON, OH 45402 January 12, 2022 Joan and Noah Arc 1265 W. Riverview Avenue Dayton, OH 45402 Dear Joan and Noah, Thank you for a great 2021 at Roundup! We appreciate your patronage during the year and hope to continue to provide excellent service for Nora in 2022. We have provided the tax information for calendar year 2021 below. Please let us know if you need any additional information. Sincerely, Charles F. Burgundian : Charles F. Burgundian Executive Director, Roundup Day Care EIN 54-0983456 Date of service January 1, 2021 - December 31, 2021 Amount Paid $6,000.00 Child Nora Arc