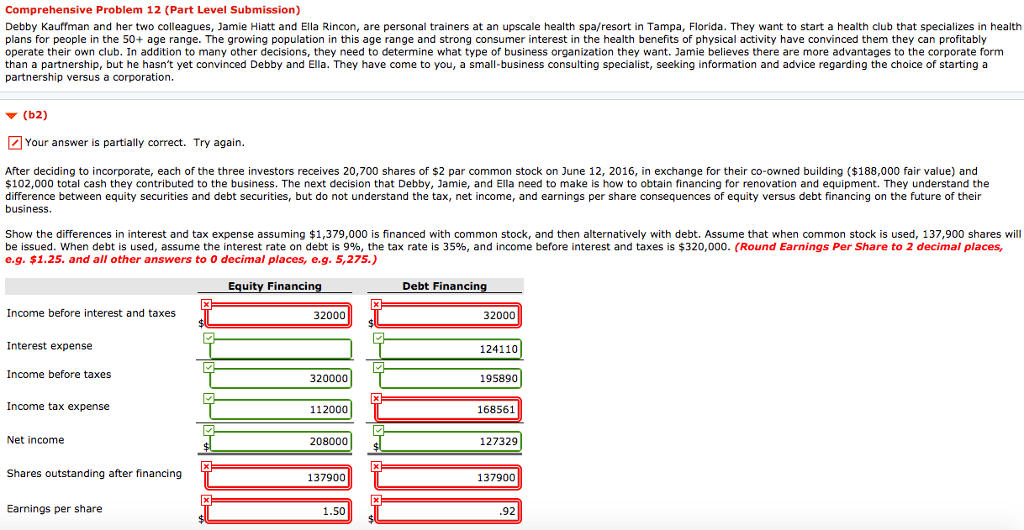

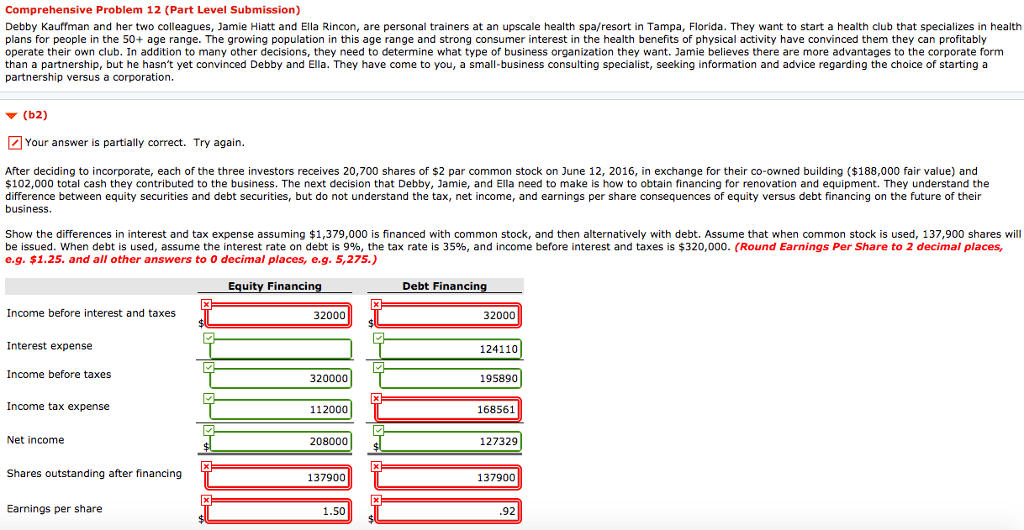

Comprehensive Problem 12 (Part Level Submission) Debby Kauffman and her two colleagues, Jamie Hiatt and Ella Rincon, are personal trainers at an upscale health spa/resort in Tampa, Florida. They want to start a health club that specializes in health plans for people in the 50+ age range. The growing population in this age range and strong consumer interest in the health benefits of physical activity have convinced them they can profitably operate their own club. In addition to many other decisions, they need to determine what type of business organization they want. Jamie believes there are more advantages to the corporate form than a partnership, but he hasn't yet convinced Debby and Ella. They have come to you, a small-business consulting specialist, seeking information and advice regarding the choice of starting a partnership versus a corporation. (b2) Your answer is partially correct. Try again After deciding to incorporate, each of the three investors receives 20,700 shares of $2 par common stock on June 12, 2016, in exchange for their co-owned building ($188,000 fair value) and $102,000 total cash they contributed to the business. The next decision that Debby, Jamie, and Ella need to make is how to obtain financing for renovation and equipment. They understand the difference between equity securities and debt securities, but do not understand the tax, net income, and earnings per share consequences of equity versus debt financing on the future of their business. Show the differences in interest and tax expense assuming $1,379,000 is financed with common stock, and then alternatively with debt. Assume that when common stock is used, 137,900 shares will be issued, when debt is used, assume the interest rate on debt is 9%, the tax rate is 35%, and income before interest and taxes is $320,000. (Round Earnings Per Share to 2 decimal places, e.g. $1.25. and all other answers to 0 decimal places, e.g. 5,275.) Equity Financin Debt Financin Income before interest and taxes 32000 32000 Interest expense 124110 Income before taxes 320000 195890 Income tax expense 112000 168561 Net income 208000 127329 Shares outstanding after financing 137900 137900 Earnings per share 1.50 92