Comprehensive problem 2 for chapter 1-4 This comprehensive problem is a continuation of comprehensive problem 1. Murphy delivery service has completed closing entries and the accounting cycle for 2018. The business is now ready to record January 2019 transactions.

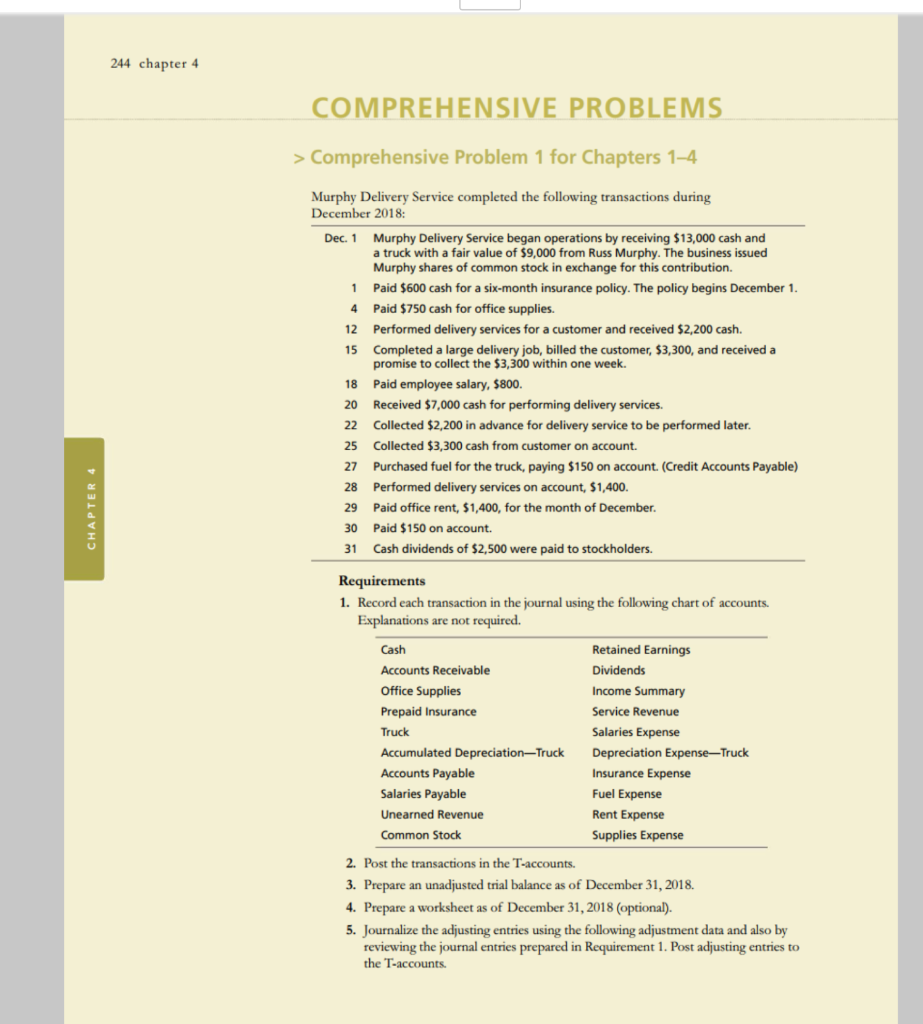

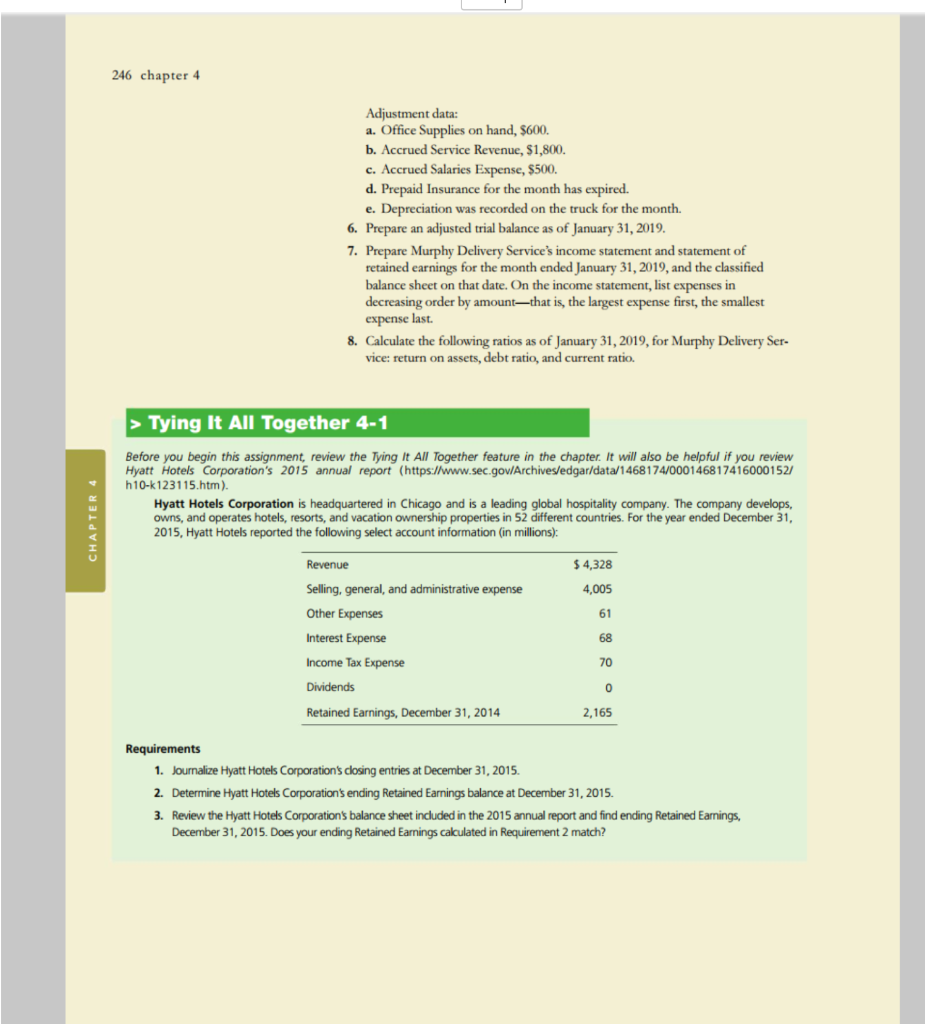

244 chapter 4 COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for Chapters 1-4 Murphy Delivery Service completed the following transactions during December 2018: Murphy Delivery Service began operations by receiving $13,000 cash and a truck with a fair value of $9,000 from Russ Murphy. The business issued Murphy shares of common stock in exchange for this contribution. Dec. 1 1 Paid $600 cash for a six-month insurance policy. The policy begins December 1. Paid $750 cash for office supplies. 4 Performed delivery services for a customer and received $2,200 cash. 12 15 Completeda large delivery job, billed the customer, $3,300, and received a promise to collect the $3,300 within one week 18 Paid employee salary, $800. Received $7,000 cash for performing delivery services. 20 22 Collected $2,200 in advance for delivery service to be performed later. Collected $3,300 cash from customer on account. 25 Purchased fuel for the truck, paying $150 on account. (Credit Accounts Payable) 27 28 Performed delivery services on account, $1,400. Paid office rent, $1,400, for the month of December 29 Paid $150 on account. 30 Cash dividends of $2,500 were paid to stockholders 31 Requirements 1. Record each transaction in the journal using the following chart of accounts. Explanations are not required. Retained Earnings Cash Accounts Receivable Dividends Office Supplies Income Summary Prepaid Insurance Service Revenue Salaries Expense Truck Depreciation Expense-Truck Accumulated Depreciation-Truck Accounts Payable Insurance Expense Salaries Payable Fuel Expense Unearned Revenue Rent Expense Common Stock Supplies Expense 2. Post the transactions in the T-accounts. 3. Prepare an unadjusted trial balance as of December 31, 2018. 4. Prepare a worksheet as of December 31, 2018 (optional) 5. Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts. CHAPTER 4 Completing the Accounting Cycle 245 Adjustment data: a. Accrued Salaries Expense, $800. b. Depreciation was recorded on the truck using the straight-line method. Assume useful life of five years and a salvage value of $3,000. c. Prepaid Insurance for the month has expired. d. Office Supplies on hand, $450. e. Unearned Revenue earned during the month, $700. f. Accrued Service Revenue, $450. 6. Prepare an adjusted trial balance as of December 31, 2018. 7. Prepare Murphy Delivery Service's income statement and statement of retained earnings for the month ended December 31, 2018, and the classified balan ce sheet on that date. On the income statement, list expenses in decreasing order by amount-that is, the largest expense first, the smallest expense last. 8. Journalize the closing entries, and post to the T-accounts 9. Prepare a post-closing trial balance as of December 31, 2018. > Comprehensive Problem 2 for Chapters 1-4 This comprehensive problem is a continuation of Comprehensive Problem 1. Murphy Delivery Service has completed closing entries and the accounting cycle for 2018. The business is now ready to record January 2019 transactions Collected $200 cash from customer on account. Jan. 3 Purchased office supplies on account, $1,000. 5 Performed delivery services for a customer and received $3,000 cash 12 Paid employee salary, including the amount owed on December 31, $4,100. 15 18 Performed delivery services on account, $1,350. Paid $300 on account 20 Purchased fuel for the truck, paying $200 cash. 24 27 Completed the remaining work due for Unearned Revenue. Paid office rent, $2,200, for the month of January. 28 Collected $3,000 in advance for delivery service to be performed later. 30 31 Cash dividends of $1,500 were paid to stockholders. Requirements 1. Record each January transaction in the journal. Explanations are not required. 2. Post the transactions in the T-accounts. Don't forget to use the December 31, 2018, ending balances as appropriate. 3. Prepare an unadjusted trial balance as of January 31, 2019 4. Prepare a worksheet as of January 31, 2019 (optional). 5. Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts CHAF PTER 4 246 chapter 4 Adjustment data: a. Office Supplies on hand, $600. b. Accrued Service Revenue, $1,800. c. Accrued Salaries Expense, $500. d. Prepaid Insurance for the month has expired. e. Depreciation was recorded on the truck for the month. 6. Prepare an adjusted trial balance as of January 31, 2019. 7. Prepare Murphy Delivery Service's income statement and statement of retained earnings for the month ended January 31, 2019, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount-that is, the largest expense first, the smallest expense last. 8. Calculate the following ratios as of January 31, 2019, for Murphy Delivery Ser vice: return on assets, debt ratio, and current ratio, Tying It All Together 4-1 Before you begin this assignment, review the Tying It All Together feature in the chap ter. It will also be helpful if you review Hyatt Hotels Corporation's 2015 annual report (https://www.sec.gov/Archives/edgar/data/1468174/000146817416000152 h10-k123115.htm ). Hyatt Hotels Corporation is headquartered in Chicago and is a leading global hospitality company. The company develops, owns, and operates hotels, resorts, and vacation ownership properties in 52 different countries. For the year ended December 31, 2015, Hyatt Hotels reported the following select account information (in millions) $ 4,328 Revenue Selling, general, and administrative expense 4,005 61 Other Expenses Interest Expense 68 Income Tax Expense 70 Dividends 2.165 Retained Earnings, December 31, 2014 Requirements Jounalize Hyatt Hotels Corporation's closing entries at December 31, 2015 1. Determine Hyatt Hotels Corporation 's ending Retained Earnings balance at December 31, 2015. 2. Review the Hyatt Hotels Corporation's balance sheet included in the 2015 annual report and find ending Retained Earnings, December 31, 2015. Does your ending Retained Earnings calculated in Requirement 2 match? 3. CHAPTER