Question

Comprehensive Problem 2 - Part 1: Taxpayer information Schedule A for 2018 Gregory and Lulu Clifden's Tax Return Note: This problem is divided into four

Comprehensive Problem 2 - Part 1: Taxpayer information Schedule A for 2018

Gregory and Lulu Clifden's Tax Return

| Note: This problem is divided into four parts. You will need to complete some of the forms in the other parts in order to determine the amounts to be used on Form 1040. Some of the data information will be reproduced in the other parts for convenience. |

Gregory R. and Lulu B. Clifden live with their family at the Rock Glen House Bed & Breakfast, which Gregory operates. The Bed & Breakfast (B&B) is located at 33333 Fume Blanc Way, Temecula, CA 92591. Gregory and Lulu enjoy good health and eyesight.

1. The Clifdens have three sons. Gerald is 17 years old, Gary is 12 years old, and Glenn is 10 years old. All three boys live at home and the Clifdens provide more than 50% of their support.

2. The Rock Glen House B&B is operated as a sole proprietorship and had the following income and expenses for the year:

|

All of the above amounts relate to the business portion of the Bed & Breakfast; the personal portion is accounted for separately. The Rock Glen House B&B uses the cash method of accounting and has no inventory. The employer tax ID number is 95-1234567.

3. The Clifdens made estimated federal income tax payments of $2,000 and estimated state income tax payments of $6,000 (all made during 2018).

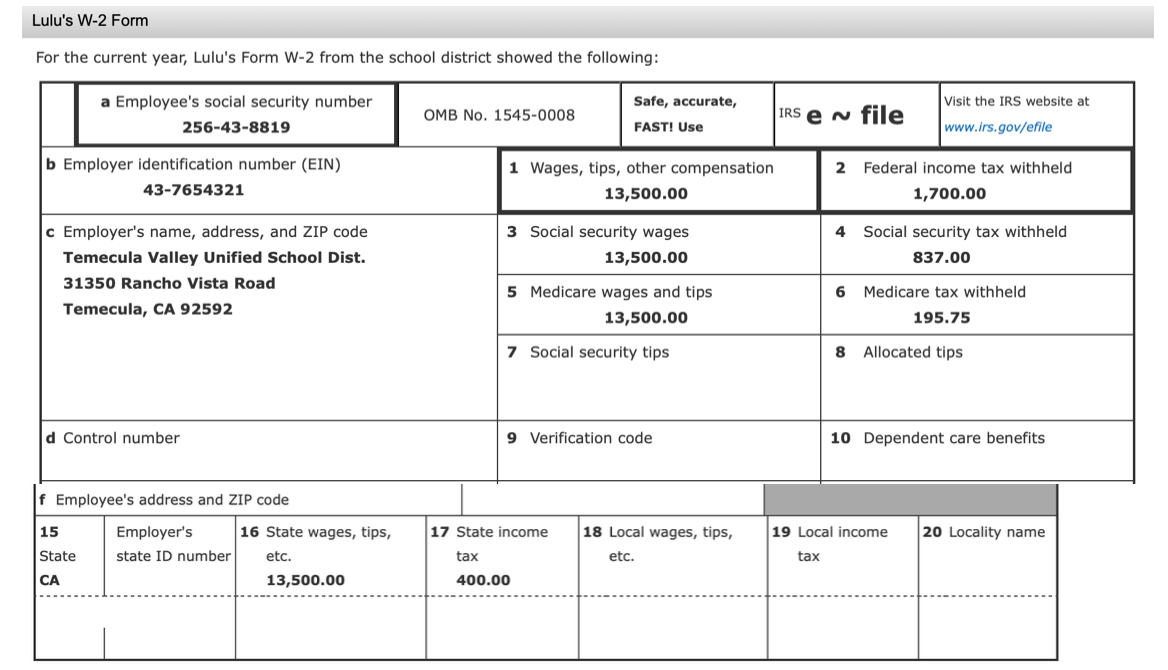

4. Lulu worked about 1,000 hours as a substitute schoolteacher with the local school district. She also spent $276 out-of-pocket for various supplies for her classroom. Lulu's Form W-2 from the school district is located on a separate tab.

5. Gregory is retired from the U.S. Navy. His annual statement from the Navy, Form 1099-R.

6. Gregory and Lulu paid (and can substantiate) the following amounts during the year:

|

During the year, Gregory and Lulu received the following qualifying dividends and interest:

| |||||||||||||||||||

7. Also, Lulu owns Series EE U.S. savings bonds. During the year, the bond redemption value increased by $1,300. Lulu has not elected the accrual method for these bonds. There were no Irish taxes paid on the interest from the Bank of Ireland. All the above stocks, bonds, and bank accounts are community property.

8. Lulu has a stock portfolio. During the year she sold stock, for which she received 1099-B Forms, as follows (basis was provided to the IRS in all cases):

|

9. Lulu paid her ex-husband $4,800 alimony in the current year, as required under the 2014 divorce decree. Her ex-husband's name is Hector Leach and his Social Security number is 566-23-5431.

10. Gregory does all the significant work in the Bed & Breakfast and therefore he pays self-employment tax on 100 percent of the earnings from the B&B.

11. During the year, Gregory's uncle Martin died. Martin had a $50,000 life insurance policy that named Gregory as the beneficiary. Gregory received the check for the benefits payable under the policy on November 30 of the current year. Martin also left Gregory a small nonoperating farm with an appraised value of $120,000.

12. Gregory is a general partner in a partnership that owns a boutique hotel in northern California and leases the property to a hotel management company. Gregory does not materially participate in the partnership activity but the partnership activity does rise to the level of a trade or business. See Schedule K-1 from the partnership.

13. Lulu was not eligible for health care benefits due to the part-time nature of her job thus health insurance for the Clifden household was purchased by Gregory. The Clifdens are not eligible for an exemption from coverage. The Clifdens purchased health insurance through the Covered California program and received the Form 1095-A. They had no other health insurance during 2018. Assume that the self-employed health insurance deduction is $1,540. The Clifdens did not claim an advance premium credit. Click here to access the completed Form 1095-A to use when completing Form 8962.

Need help doing Schedule A for 2018

Lulu's W-2 Form For the current year, Lulu's Form W-2 from the school district showed the following: Visit the IRS website at a Employee's social security number Safe, accurate, IRS e N file OMB No. 1545-0008 www.irs.gov/efile 256-43-8819 FAST! Use b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 43-7654321 13,500.00 1,700.00 3 Social security wages c Employer's name, address, and ZIP code 4 Social security tax withheld Temecula Valley Unified School Dist. 13,500.00 837.00 31350 Rancho Vista Road 5 Medicare wages and tips Medicare tax withheld 6 Temecula, CA 92592 13,500.00 195.75 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits f Employee's address and ZIP code 15 16 State wages, tips, 18 Local wages, tips, 20 Locality name 19 Local income Employer's 17 State income State state ID number etc. tax etc. tax CA 13,500.00 400.00 Lulu's W-2 Form For the current year, Lulu's Form W-2 from the school district showed the following: Visit the IRS website at a Employee's social security number Safe, accurate, IRS e N file OMB No. 1545-0008 www.irs.gov/efile 256-43-8819 FAST! Use b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 43-7654321 13,500.00 1,700.00 3 Social security wages c Employer's name, address, and ZIP code 4 Social security tax withheld Temecula Valley Unified School Dist. 13,500.00 837.00 31350 Rancho Vista Road 5 Medicare wages and tips Medicare tax withheld 6 Temecula, CA 92592 13,500.00 195.75 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits f Employee's address and ZIP code 15 16 State wages, tips, 18 Local wages, tips, 20 Locality name 19 Local income Employer's 17 State income State state ID number etc. tax etc. tax CA 13,500.00 400.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started