Comprehensive Problem 2 - Part 2: Schedule C, Schedule D, Schedule SE, Form 8949, and Qualified Dividends and Capital Gain Tax Worksheet.

Information regarding (1) the business which Gregory operates and (2) Lulu's stock transactions are presented below.Enter all amounts as positive numbers, except for a "loss". If required, enter a "loss" as a negative number on the tax form. If an amount box does not require an entry or the answer is zero, enter "0". On Form SE, use rounded amounts in subsequent computations.

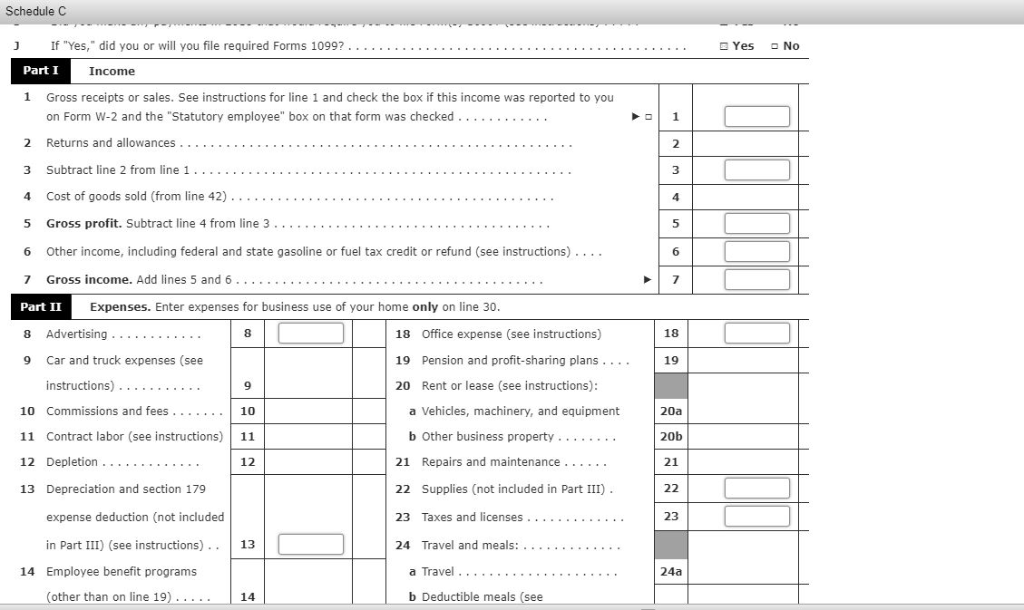

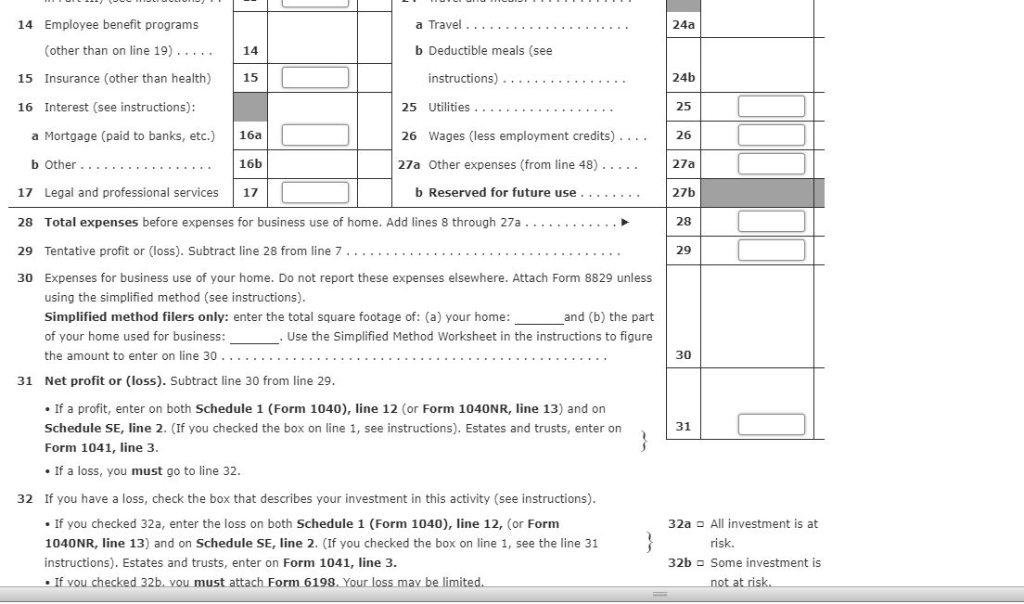

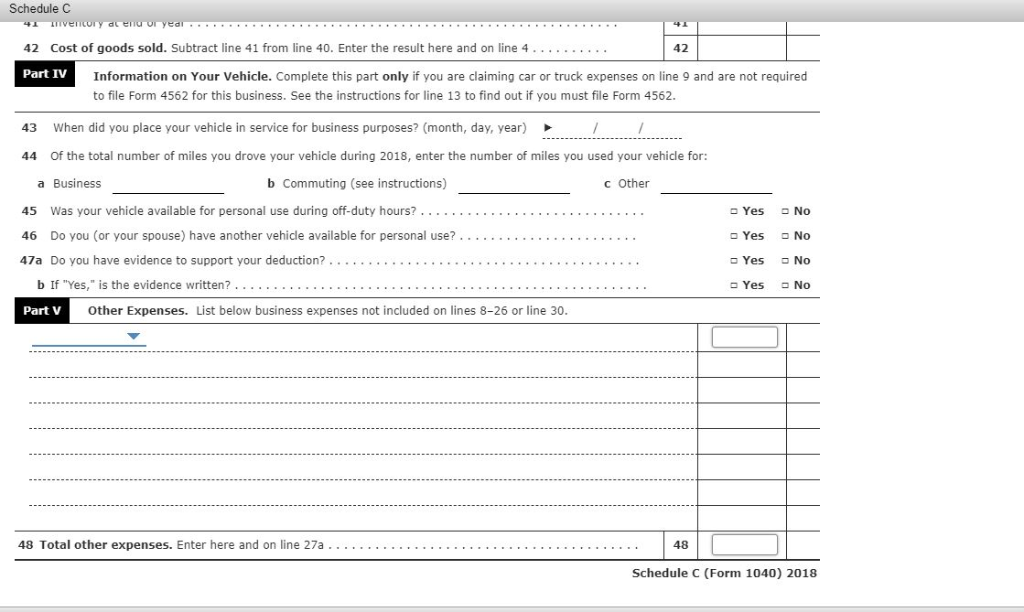

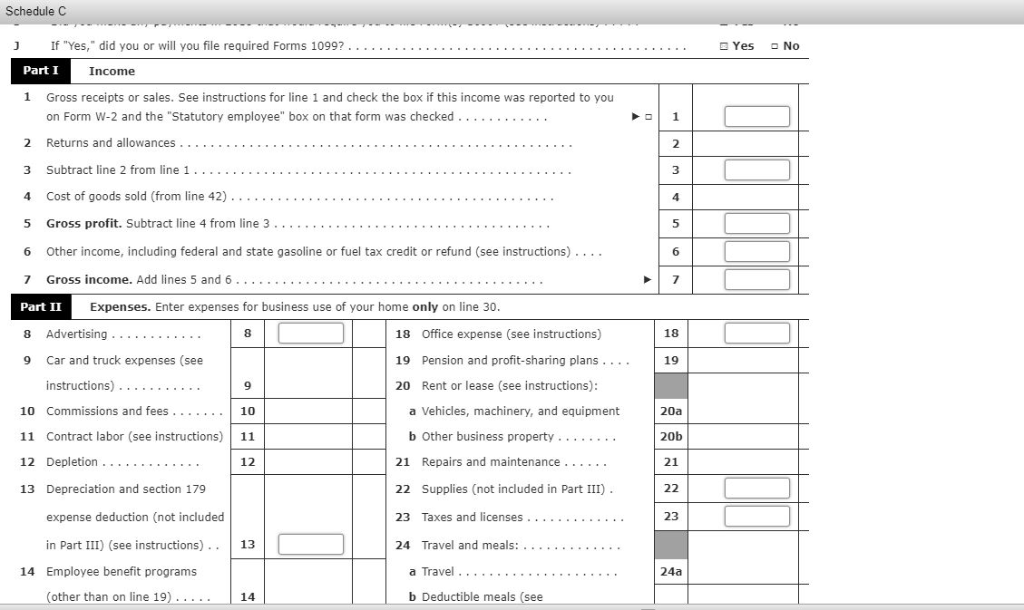

1. The Rock Glen House B&B is operated as a sole proprietorship and had the following income and expenses for the year:

| Room rental income | $138,000 | | Vending machine income | 2,100 | | Advertising expense | 4,810 | | Depreciation for book and tax purposes | 18,100 | | Mortgage interest on the B&B | 23,010 | | Wages of cleaning people | 17,540 | | Taxes and licenses | 6,420 | | Supplies consumed | 18,870 | | Business insurance | 6,300 | | Laundry expenses | 4,289 | | Accounting fees | 1,850 | | Office expenses | 2,400 | | Utilities | 6,350 | |

All of the above amounts relate to the business portion of the Bed & Breakfast; the personal portion is accounted for separately. The Rock Glen House B&B uses the cash method of accounting and has no inventory. The employer tax ID number is 95-1234567.

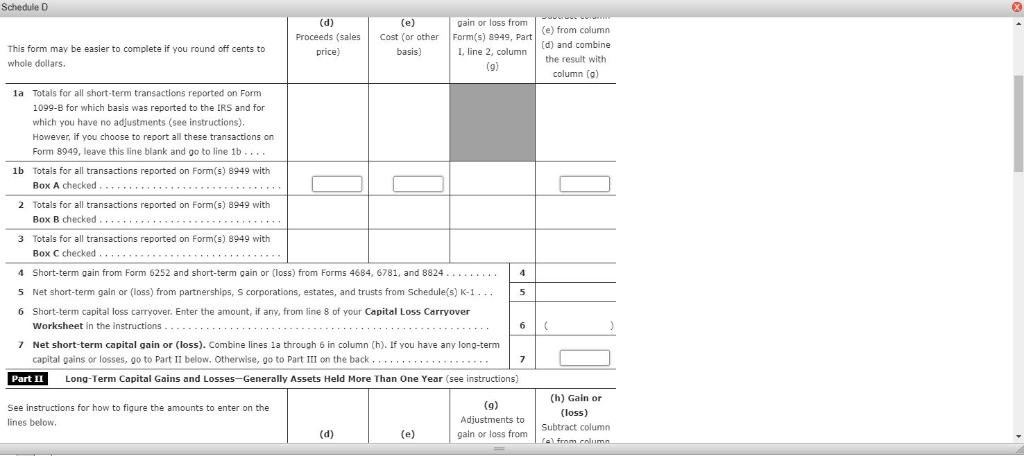

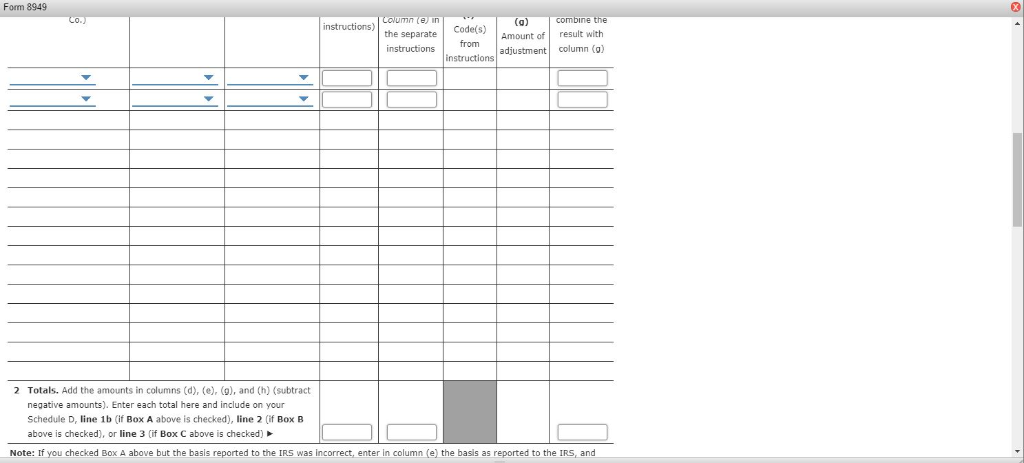

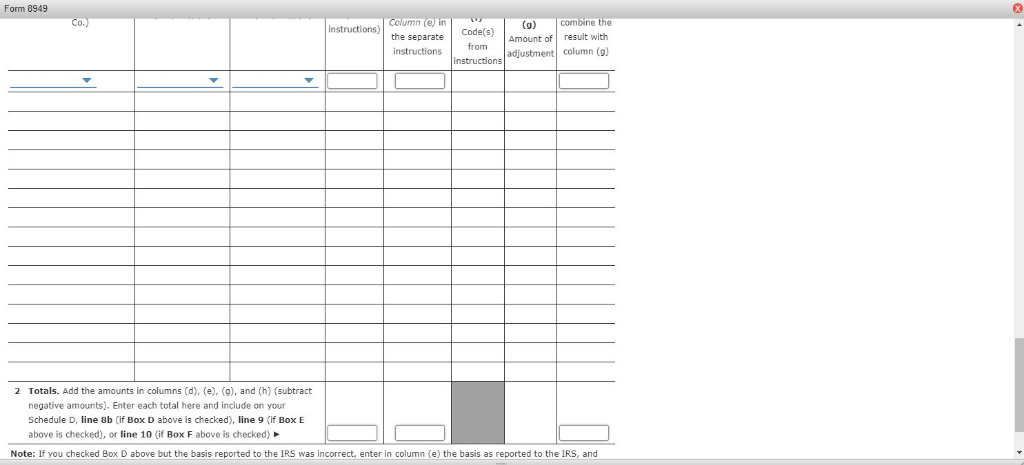

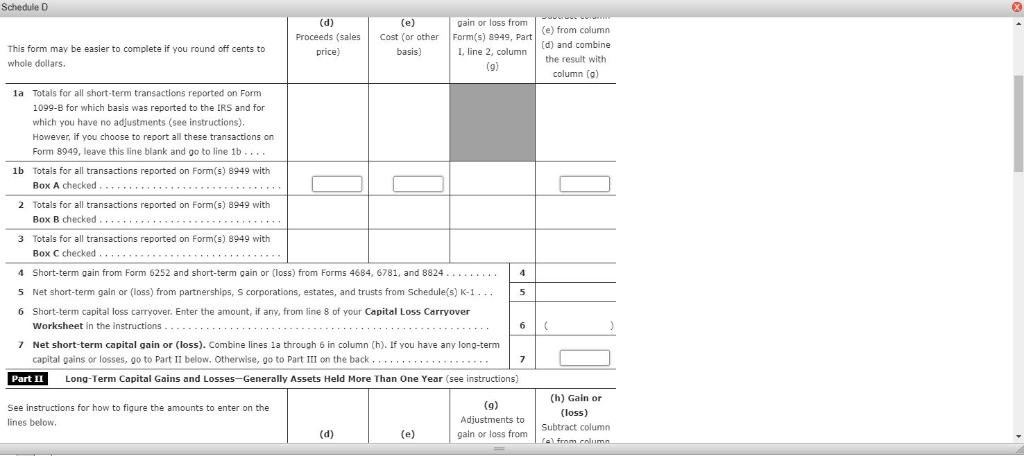

2. Lulu has a stock portfolio. During the year she sold the following stock, for which she received 1099-B Forms, as follows:

| | Orange Co. | | Gold Co. | Green Co. | | Sales price | $8,100 | | See Form | $1,450 | | Basis | 3,800 | | 1099-B | 2,575 | | Date acquired | 02/11/18 | | | 10/31/13 | | Date sold | 06/19/18 | | | 10/23/18 | |

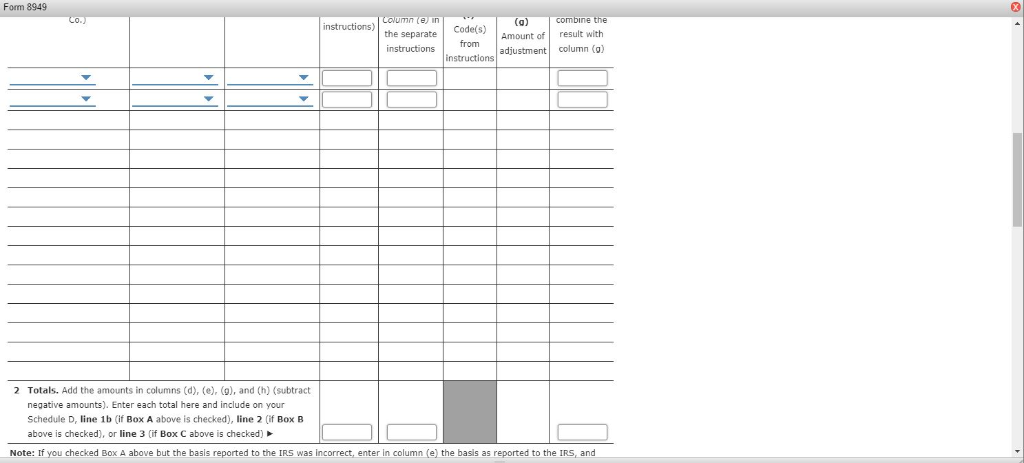

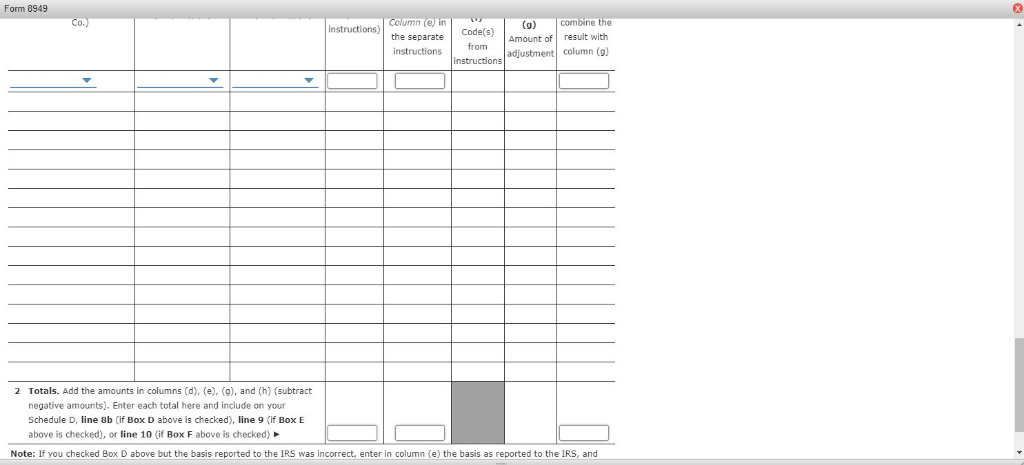

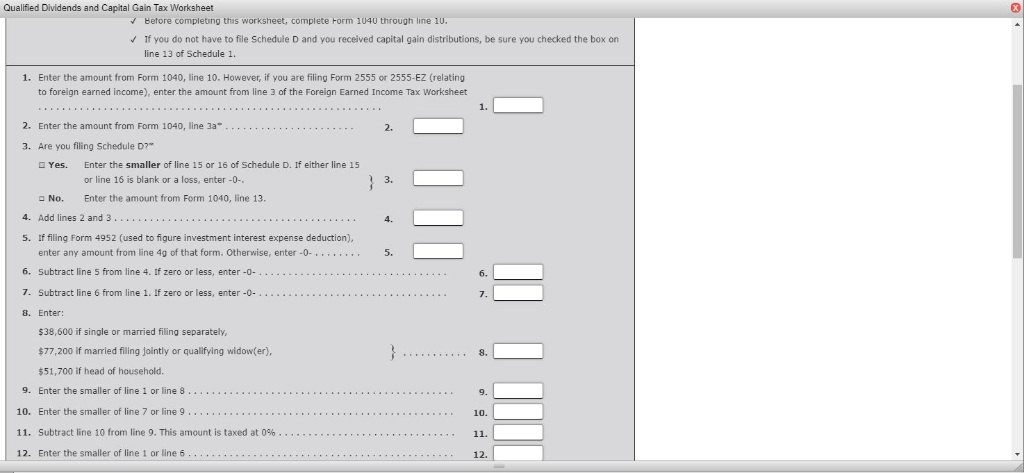

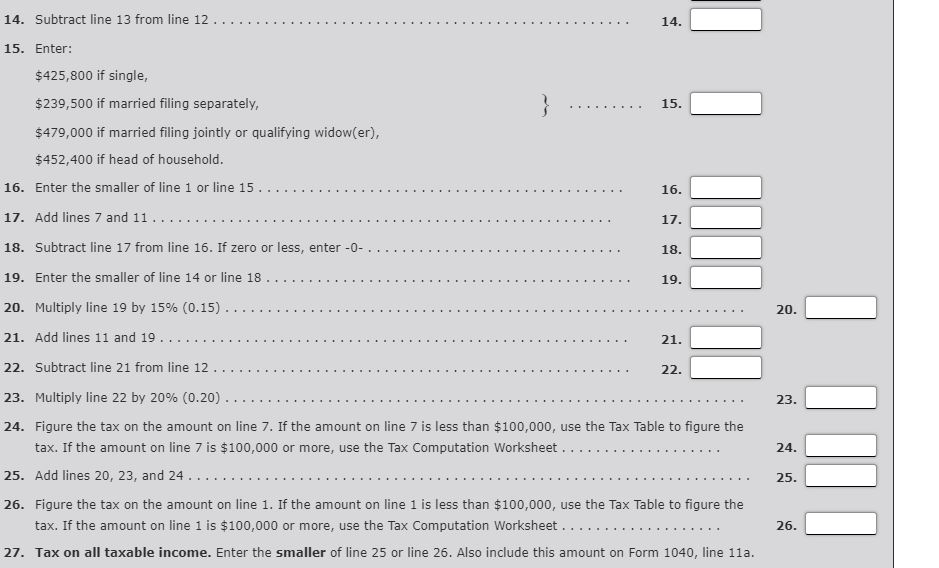

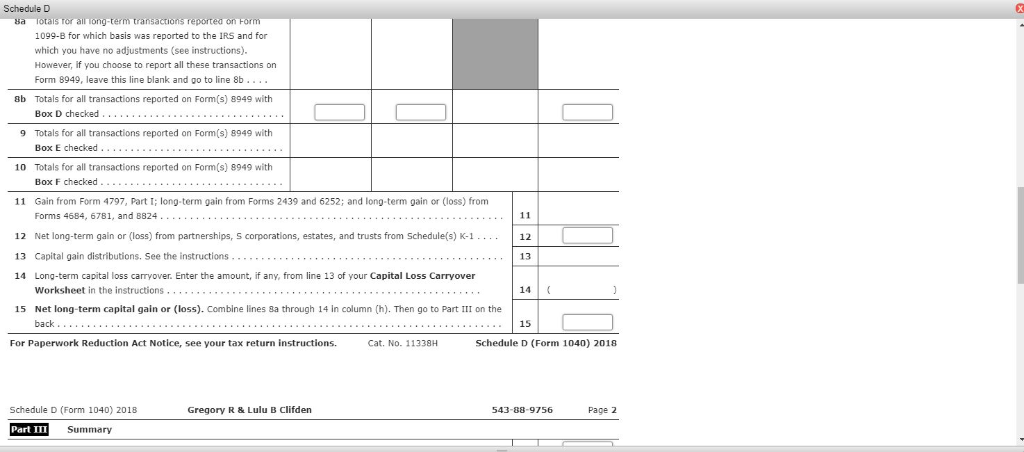

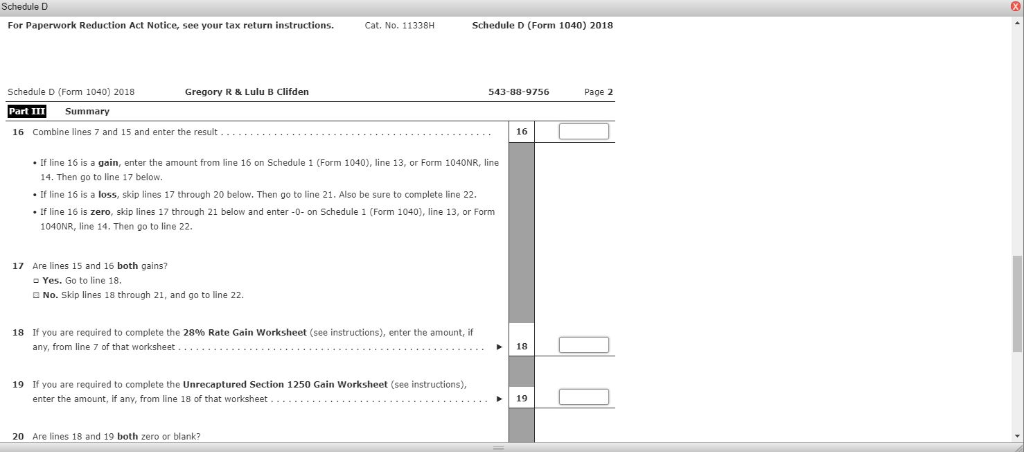

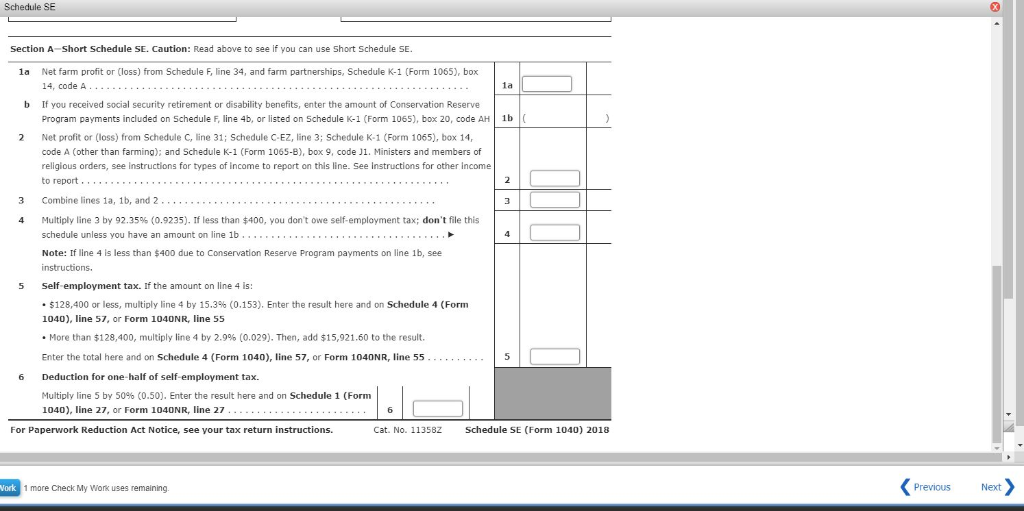

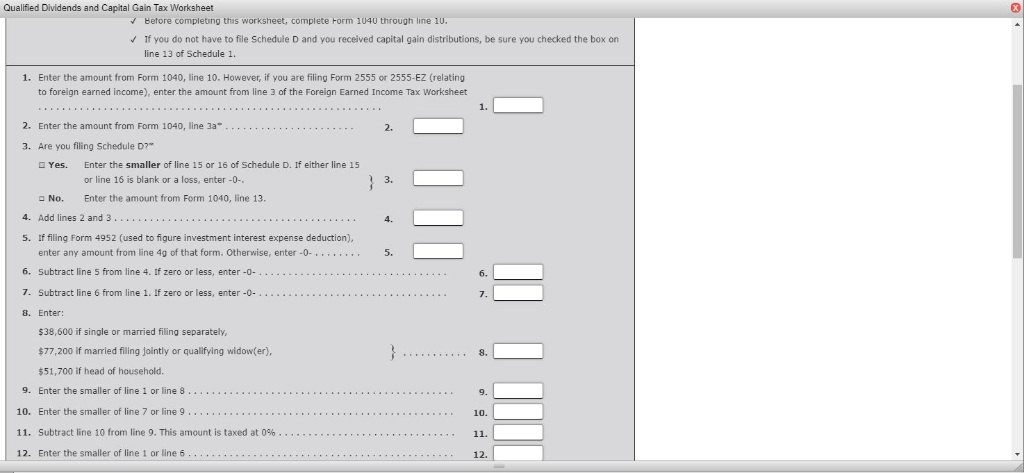

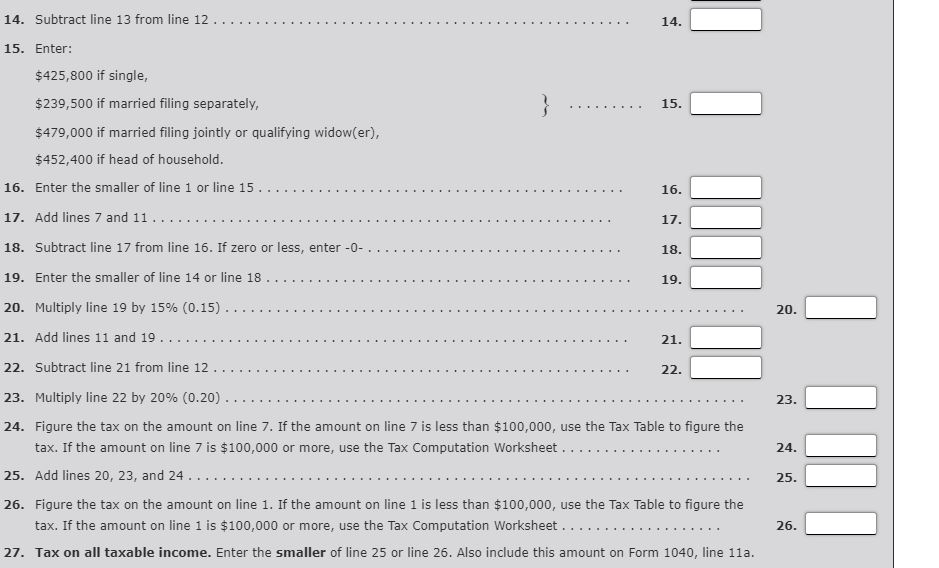

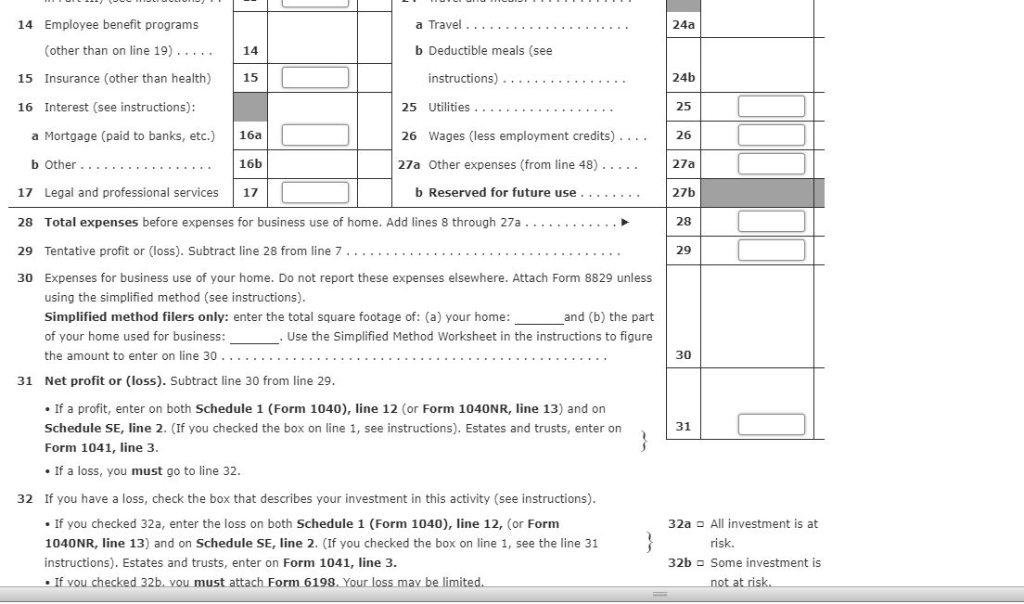

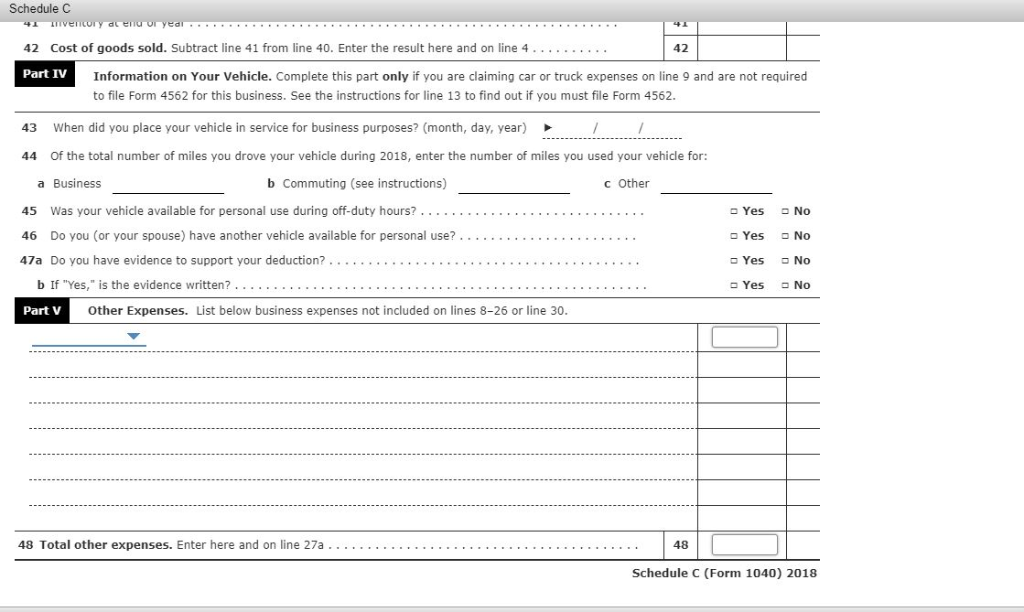

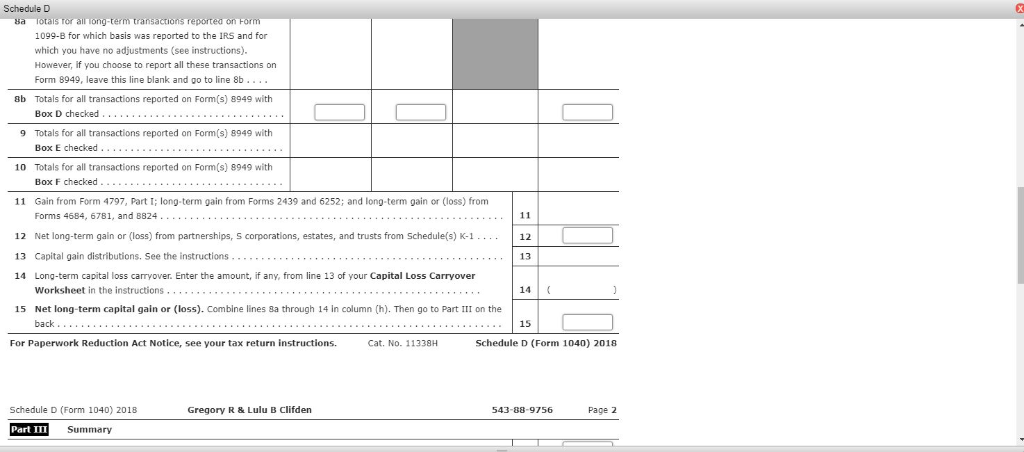

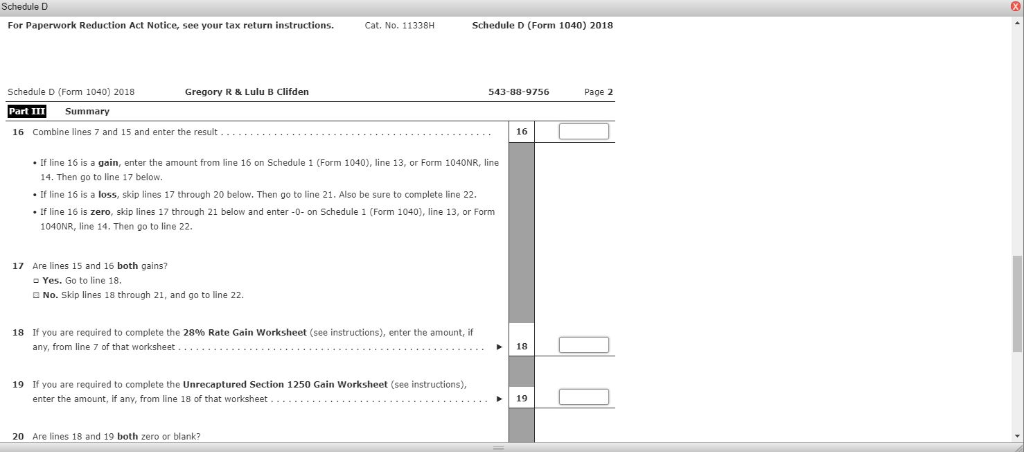

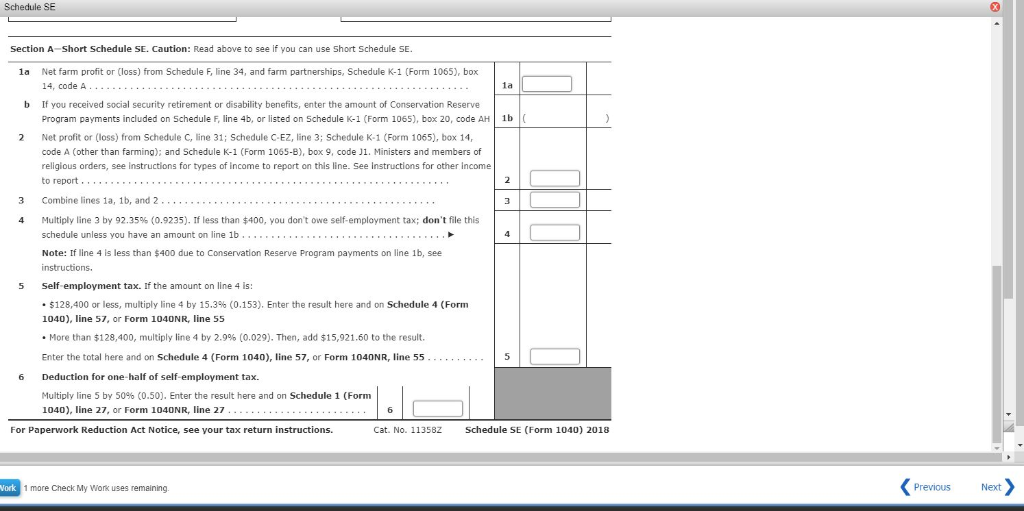

Form 8949 combine the instructions) Codes) Column (e, in the separate instructions Amount of from adjustment instructions result with column (0) 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 1b (if Box A above is checked), line 2 (if Box B above is checked), or line 3 (if Box C above is checked) Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and Form 8949 instructions) Column (ein the separate instructions (o) combine the Code(s) Amount of result with adjustment column (0) instructions from 2 Totals. Add the amounts in columns (d), (e), (9), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (if Box D above is checked), line 9 (if Box E above is checked), or line 10 (if Box F above is checked) Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and Qualified Dividends and Capital Gain Tax Worksheet before completing this worksheet, complete Form 1040 through line 10. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned Income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet 2. 2. Enter the amount from Form 1040, line 3a ........ - 3. Are you filing Schedule D?" Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or line 16 is blank or a loss, enter-O- No. Enter the amount from Form 1040, line 13. es 2 and 3......................................... 4. 5. If filing Form 4952 (used to figure investment interest expense deduction), enter any amount from line 49 of that form. Otherwise, enter-O-..... 6. Subtract line 5 from line 4. If zero or less, enter -- ........ 7. Subtract line 6 from line 1. If zero or less, enter-O-... 8. Enter: $38,600 if single or married filing separately, $77,200 if married filing jointly or qualifying widow(er), $51,700 if head of household. 9. Enter the smaller of line 1 or line 8..... 10. Enter the smaller of line 7 or line 9. . . . . . . . . . . . . . . . . 11. Subtract line 10 from line 9. This amount is taxed at 0% . . . . . . . . . 12. Enter the smaller of line 1 or line 6............. 14. Subtract line 13 from line 12 15. Enter: $425,800 if single, $239,500 if married filing separately, . ......... 15. $479,000 if married filing jointly or qualifying widow(er), $452,400 if head of household. 16. Enter the smaller of line 1 or line 15..... 17. Add lines 7 and 11 ... 18. Subtract line 17 from line 16. If zero or less, enter-0-.... 19. Enter the smaller of line 14 or line 18 ........ 20. Multiply line 19 by 15% (0.15)......... ...... 20. 21. Add lines 11 and 19........... .......... 21. 24. 22. Subtract line 21 from line 12.... 22. 23. Multiply line 22 by 20% (0.20)...... 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet .. 25. Add lines 20, 23, and 24. 26. Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 27. Tax on all taxable income. Enter the smaller of line 25 or line 26. Also include this amount on Form 1040, line 11a. Schedule C Yes No If "Yes," did you or will you file required Forms 1099?. Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked.... 2 3 4 5 Returns and allowances... Subtract line 2 from line 1.... Cost of goods sold (from line 42)....... Gross profit. Subtract line 4 from line 3....... 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions).... 7 Gross income. Add lines 5 and 6........ Part II Expenses. Enter expenses for business use of your home only on line 30. | 18 19 8 Advertising 9 Car and truck expenses (see instructions) ........... 10 Commissions and fees ....... 10 11 Contract labor (see instructions) 12 Depletion.. 112 13 Depreciation and section 179 18 Office expense (see instructions) 19 Pension and profit-sharing plans .... 20 Rent or lease (see instructions): a Vehicles, machinery, and equipment b Other business property ........ 21 Repairs and maintenance ...... 22 Supplies (not included in Part III). 20a 11 20b 21 23 Taxes and licenses........ expense deduction (not included in Part III) (see instructions).. 13 24 Travel and meals: ....... a Travel 24a 14 Employee benefit programs (other than on line 19)... b Deductible meals (see Schedule C Triven cury du enu on yedi... 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4.... Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year / 1 44 Of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for: C Other 0 0 No 0 0 NO a Business b Commuting (see instructions) 45 Was your vehicle available for personal use during off-duty hours? 46 Do you (or your spouse) have another vehicle available for personal use? 47a Do you have evidence to support your deduction?... b If "Yes," is the evidence written?... Party Other Expenses. List below business expenses not included on lines 8-26 or line 30. 0 0 Yes - Yes No No 48 Total other expenses. Enter here and on line 27a .... Schedule C (Form 1040) 2018 Schedule D (d) Proceeds (sales price) (e) Cost (or other basis) This form may be easier to complete if you round off cents to whole dollars. gain or loss from Form(s) 8949, Part I line 2, column (9) (e) from column (d) and combine the result with column (al 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions), However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b.... 1b Totals for all transactions reported on Form(s) 8949 with Box A checked...................... . 2 Totals for all transactions reported on Form(s) 8949 with Box B checked ............ 3 Totals for all transactions reported on Form(s) 8949 with Box C checked .......... 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 ......... 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1... 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions ..... 7 Net short-term capital gain or (loss). Combine lines la through 6 in column (h). If you have any long-term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back ................ Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. (9) Adjustments to gain or loss from (h) Gain or (loss) Subtract column L'al from column Schedule D sa Totais for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b.... 8 Totals for all transactions reported on Form(s) 8949 with Box D checked...... ............ . .... 9 Totals for all transactions reported on Form(s) 8949 with Box E checked.............................. 10 Totals for all transactions reported on Form(s) 8949 with Box F checked ......... 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from Forms 4684, 6781, and 1824..... 12 Net long-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 .... 13 Capital gain distributions. See the instructions .......... 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions ................... . 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 In column (h). Then go to Part II on the back ..................... . . .. ............ ....... ........... For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2018 Gregory R & Lulu B Clifden 543-88-9756 Page 2 Schedule D (Form 1040) 2018 Part II Summary Schedule D For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2018 Gregory R & Lulu B Clifden 543-88-9756 Page 2 Schedule D (Form 1040) 2018 Part IT Summary 16 Combine lines 7 and 15 and enter the result... . If line 16 is a gain, enter the amount from line 16 on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter -- on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet .......... 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet .......... 20 Are lines 18 and 19 both zero or blank? Schedule SE Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. la b Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A....... If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9 code J1. Ministers and members of religious orders, see instructions for types of income to report on this line. See Instructions for other income to report ......... 3 Combine lines 1a, 1b, and 2......... 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b .......... Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. Self employment tax. If the amount on line 4 is: $128,400 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 . More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921,60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 .......... Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27........................ For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 1135BZ Schedule SE (Form 1040) 2018 Work 1 more Check My Work uses remaining. Previous Next > Form 8949 combine the instructions) Codes) Column (e, in the separate instructions Amount of from adjustment instructions result with column (0) 2 Totals. Add the amounts in columns (d), (e), (g), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 1b (if Box A above is checked), line 2 (if Box B above is checked), or line 3 (if Box C above is checked) Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and Form 8949 instructions) Column (ein the separate instructions (o) combine the Code(s) Amount of result with adjustment column (0) instructions from 2 Totals. Add the amounts in columns (d), (e), (9), and (h) (subtract negative amounts). Enter each total here and include on your Schedule D, line 8b (if Box D above is checked), line 9 (if Box E above is checked), or line 10 (if Box F above is checked) Note: If you checked Box D above but the basis reported to the IRS was incorrect, enter in column (e) the basis as reported to the IRS, and Qualified Dividends and Capital Gain Tax Worksheet before completing this worksheet, complete Form 1040 through line 10. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned Income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet 2. 2. Enter the amount from Form 1040, line 3a ........ - 3. Are you filing Schedule D?" Yes. Enter the smaller of line 15 or 16 of Schedule D. If either line 15 or line 16 is blank or a loss, enter-O- No. Enter the amount from Form 1040, line 13. es 2 and 3......................................... 4. 5. If filing Form 4952 (used to figure investment interest expense deduction), enter any amount from line 49 of that form. Otherwise, enter-O-..... 6. Subtract line 5 from line 4. If zero or less, enter -- ........ 7. Subtract line 6 from line 1. If zero or less, enter-O-... 8. Enter: $38,600 if single or married filing separately, $77,200 if married filing jointly or qualifying widow(er), $51,700 if head of household. 9. Enter the smaller of line 1 or line 8..... 10. Enter the smaller of line 7 or line 9. . . . . . . . . . . . . . . . . 11. Subtract line 10 from line 9. This amount is taxed at 0% . . . . . . . . . 12. Enter the smaller of line 1 or line 6............. 14. Subtract line 13 from line 12 15. Enter: $425,800 if single, $239,500 if married filing separately, . ......... 15. $479,000 if married filing jointly or qualifying widow(er), $452,400 if head of household. 16. Enter the smaller of line 1 or line 15..... 17. Add lines 7 and 11 ... 18. Subtract line 17 from line 16. If zero or less, enter-0-.... 19. Enter the smaller of line 14 or line 18 ........ 20. Multiply line 19 by 15% (0.15)......... ...... 20. 21. Add lines 11 and 19........... .......... 21. 24. 22. Subtract line 21 from line 12.... 22. 23. Multiply line 22 by 20% (0.20)...... 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet .. 25. Add lines 20, 23, and 24. 26. Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet. 27. Tax on all taxable income. Enter the smaller of line 25 or line 26. Also include this amount on Form 1040, line 11a. Schedule C Yes No If "Yes," did you or will you file required Forms 1099?. Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked.... 2 3 4 5 Returns and allowances... Subtract line 2 from line 1.... Cost of goods sold (from line 42)....... Gross profit. Subtract line 4 from line 3....... 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions).... 7 Gross income. Add lines 5 and 6........ Part II Expenses. Enter expenses for business use of your home only on line 30. | 18 19 8 Advertising 9 Car and truck expenses (see instructions) ........... 10 Commissions and fees ....... 10 11 Contract labor (see instructions) 12 Depletion.. 112 13 Depreciation and section 179 18 Office expense (see instructions) 19 Pension and profit-sharing plans .... 20 Rent or lease (see instructions): a Vehicles, machinery, and equipment b Other business property ........ 21 Repairs and maintenance ...... 22 Supplies (not included in Part III). 20a 11 20b 21 23 Taxes and licenses........ expense deduction (not included in Part III) (see instructions).. 13 24 Travel and meals: ....... a Travel 24a 14 Employee benefit programs (other than on line 19)... b Deductible meals (see Schedule C Triven cury du enu on yedi... 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4.... Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year / 1 44 Of the total number of miles you drove your vehicle during 2018, enter the number of miles you used your vehicle for: C Other 0 0 No 0 0 NO a Business b Commuting (see instructions) 45 Was your vehicle available for personal use during off-duty hours? 46 Do you (or your spouse) have another vehicle available for personal use? 47a Do you have evidence to support your deduction?... b If "Yes," is the evidence written?... Party Other Expenses. List below business expenses not included on lines 8-26 or line 30. 0 0 Yes - Yes No No 48 Total other expenses. Enter here and on line 27a .... Schedule C (Form 1040) 2018 Schedule D (d) Proceeds (sales price) (e) Cost (or other basis) This form may be easier to complete if you round off cents to whole dollars. gain or loss from Form(s) 8949, Part I line 2, column (9) (e) from column (d) and combine the result with column (al 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions), However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b.... 1b Totals for all transactions reported on Form(s) 8949 with Box A checked...................... . 2 Totals for all transactions reported on Form(s) 8949 with Box B checked ............ 3 Totals for all transactions reported on Form(s) 8949 with Box C checked .......... 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824 ......... 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1... 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions ..... 7 Net short-term capital gain or (loss). Combine lines la through 6 in column (h). If you have any long-term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back ................ Part II Long-Term Capital Gains and Losses-Generally Assets Held More Than One Year (see instructions) See instructions for how to figure the amounts to enter on the lines below. (9) Adjustments to gain or loss from (h) Gain or (loss) Subtract column L'al from column Schedule D sa Totais for all long-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 8b.... 8 Totals for all transactions reported on Form(s) 8949 with Box D checked...... ............ . .... 9 Totals for all transactions reported on Form(s) 8949 with Box E checked.............................. 10 Totals for all transactions reported on Form(s) 8949 with Box F checked ......... 11 Gain from Form 4797, Part 1; long-term gain from Forms 2439 and 6252; and long-term gain or (loss) from Forms 4684, 6781, and 1824..... 12 Net long-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 .... 13 Capital gain distributions. See the instructions .......... 14 Long-term capital loss carryover. Enter the amount, if any, from line 13 of your Capital Loss Carryover Worksheet in the instructions ................... . 14 15 Net long-term capital gain or (loss). Combine lines 8a through 14 In column (h). Then go to Part II on the back ..................... . . .. ............ ....... ........... For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2018 Gregory R & Lulu B Clifden 543-88-9756 Page 2 Schedule D (Form 1040) 2018 Part II Summary Schedule D For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11338H Schedule D (Form 1040) 2018 Gregory R & Lulu B Clifden 543-88-9756 Page 2 Schedule D (Form 1040) 2018 Part IT Summary 16 Combine lines 7 and 15 and enter the result... . If line 16 is a gain, enter the amount from line 16 on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 17 below. If line 16 is a loss, skip lines 17 through 20 below. Then go to line 21. Also be sure to complete line 22. If line 16 is zero, skip lines 17 through 21 below and enter -- on Schedule 1 (Form 1040), line 13, or Form 1040NR, line 14. Then go to line 22. 17 Are lines 15 and 16 both gains? Yes. Go to line 18. No. Skip lines 18 through 21, and go to line 22. 18 If you are required to complete the 28% Rate Gain Worksheet (see instructions), enter the amount, if any, from line 7 of that worksheet .......... 19 If you are required to complete the Unrecaptured Section 1250 Gain Worksheet (see instructions), enter the amount, if any, from line 18 of that worksheet .......... 20 Are lines 18 and 19 both zero or blank? Schedule SE Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. la b Net farm profit or loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A....... If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9 code J1. Ministers and members of religious orders, see instructions for types of income to report on this line. See Instructions for other income to report ......... 3 Combine lines 1a, 1b, and 2......... 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b .......... Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. Self employment tax. If the amount on line 4 is: $128,400 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 . More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921,60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 .......... Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27........................ For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 1135BZ Schedule SE (Form 1040) 2018 Work 1 more Check My Work uses remaining. Previous Next >