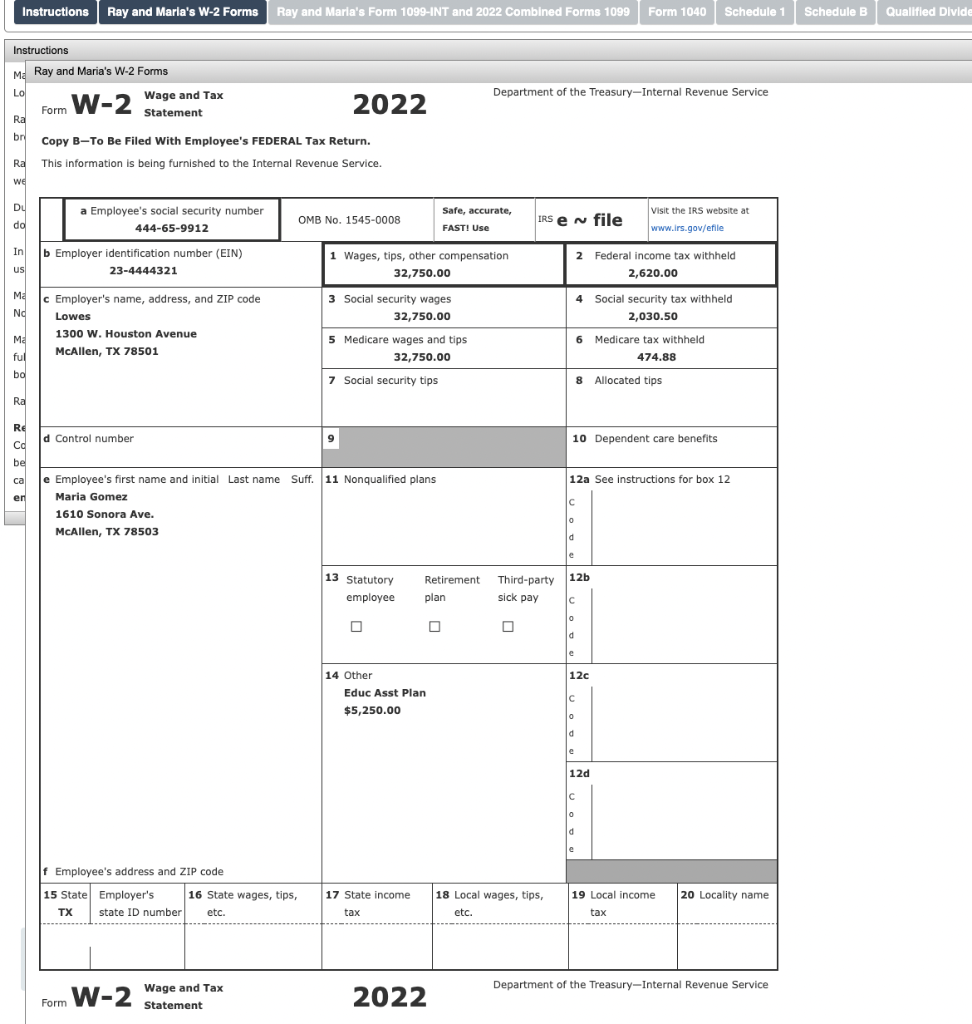

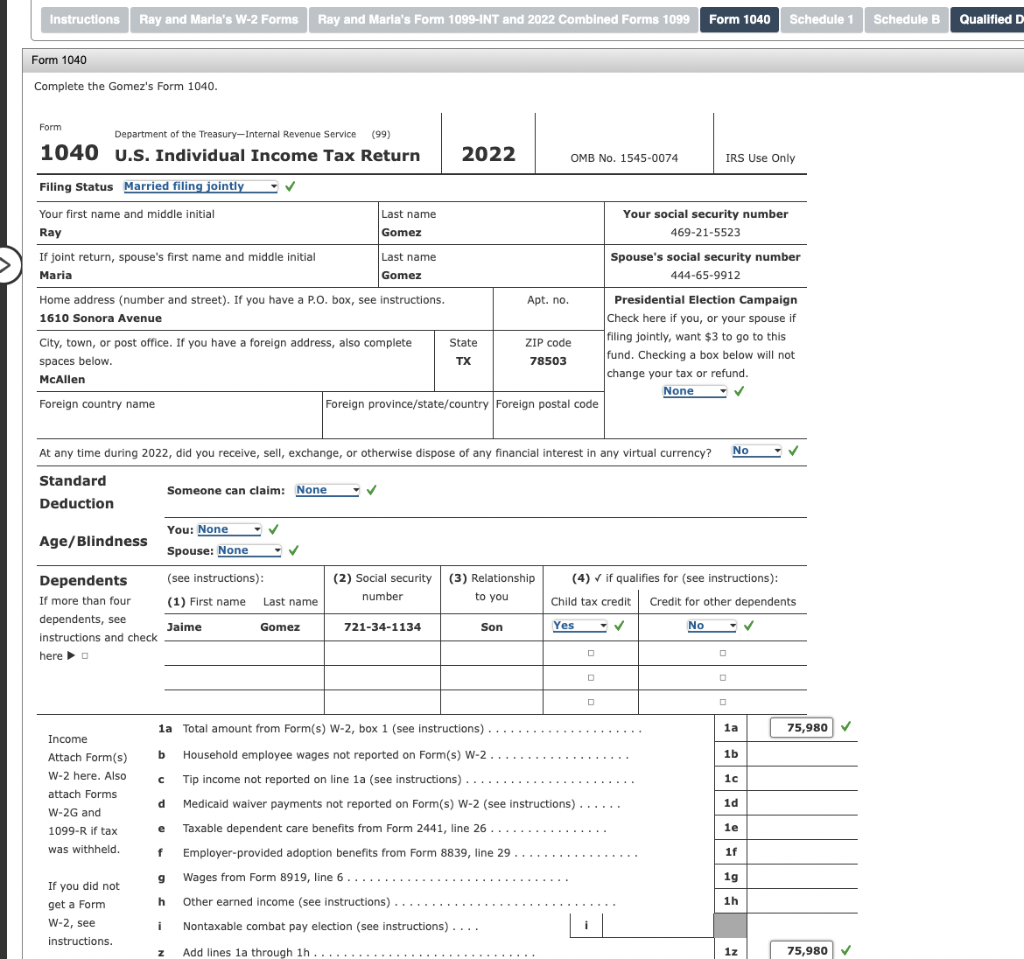

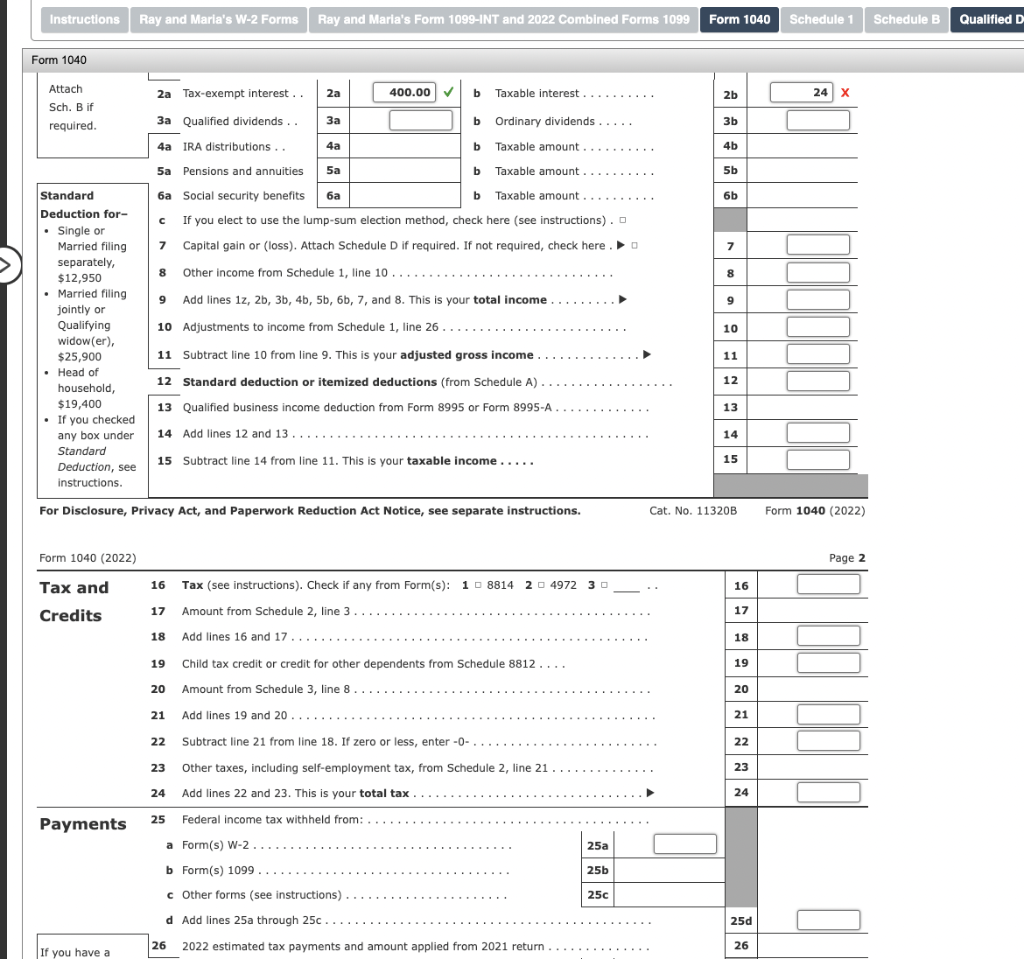

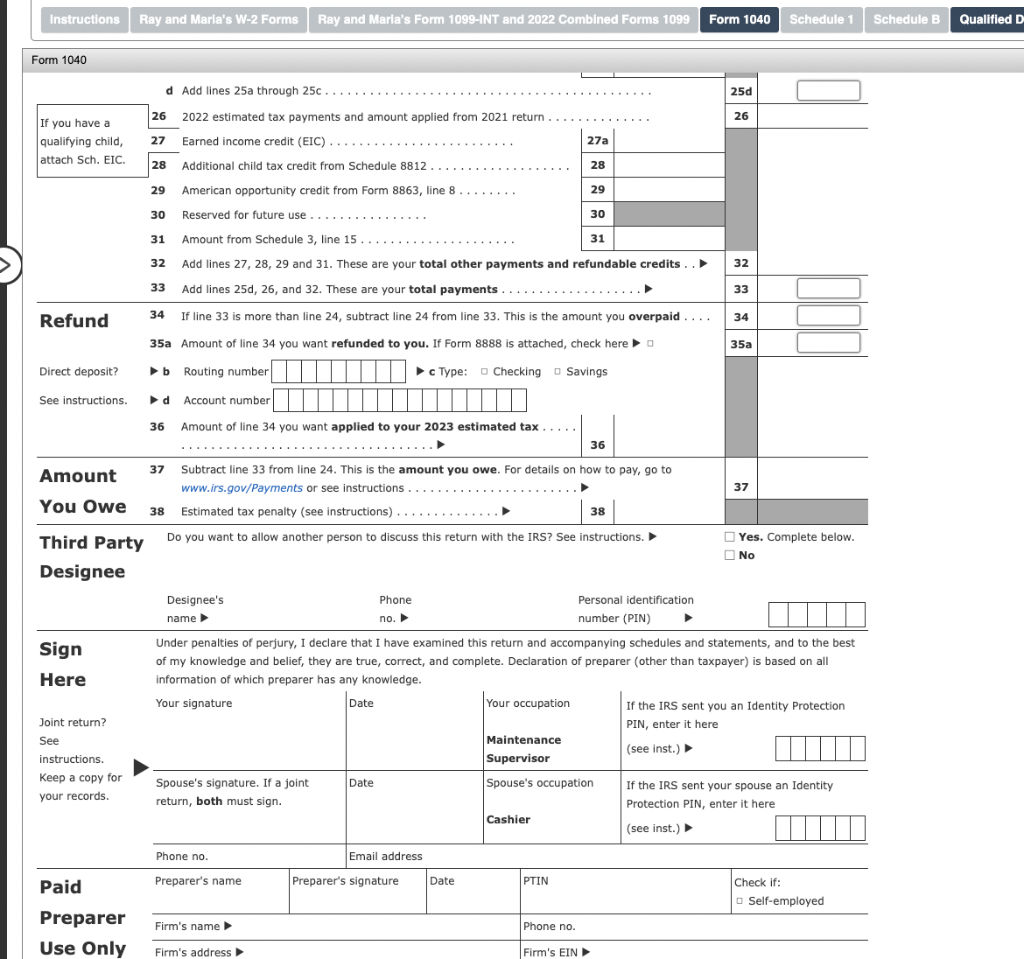

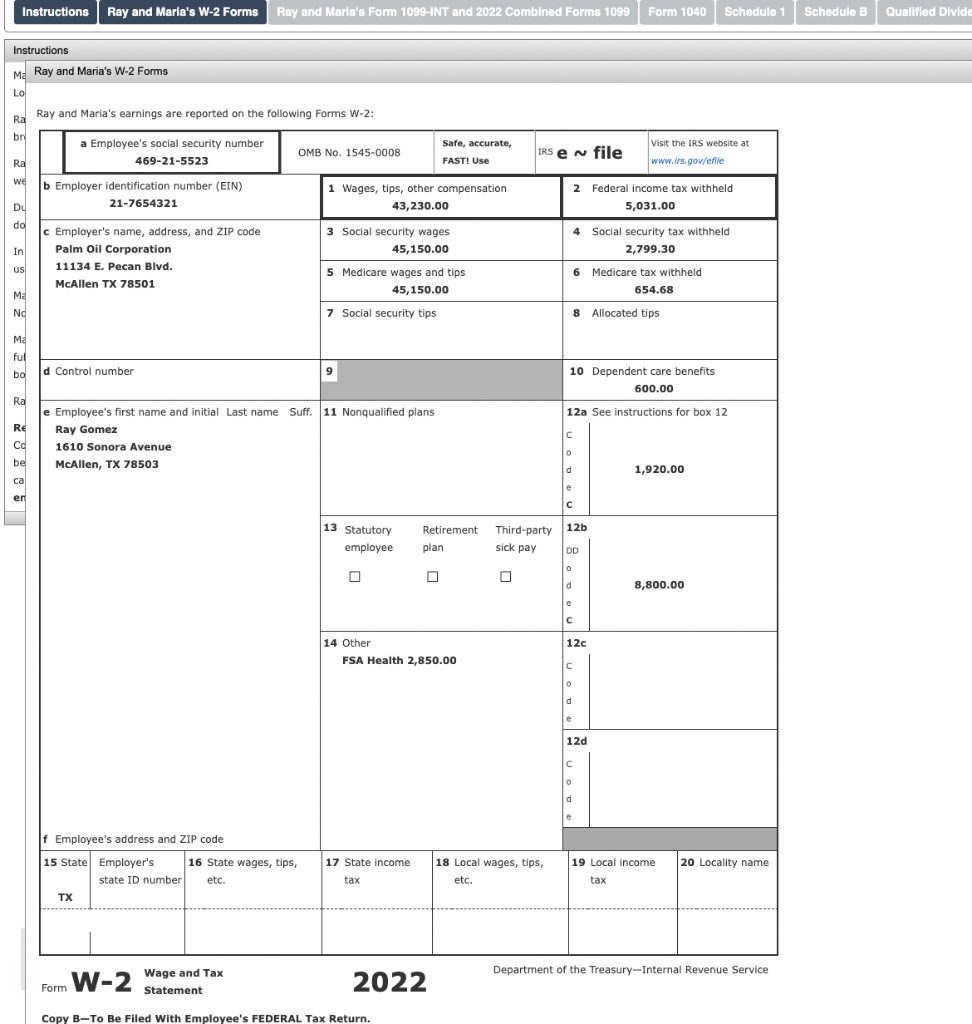

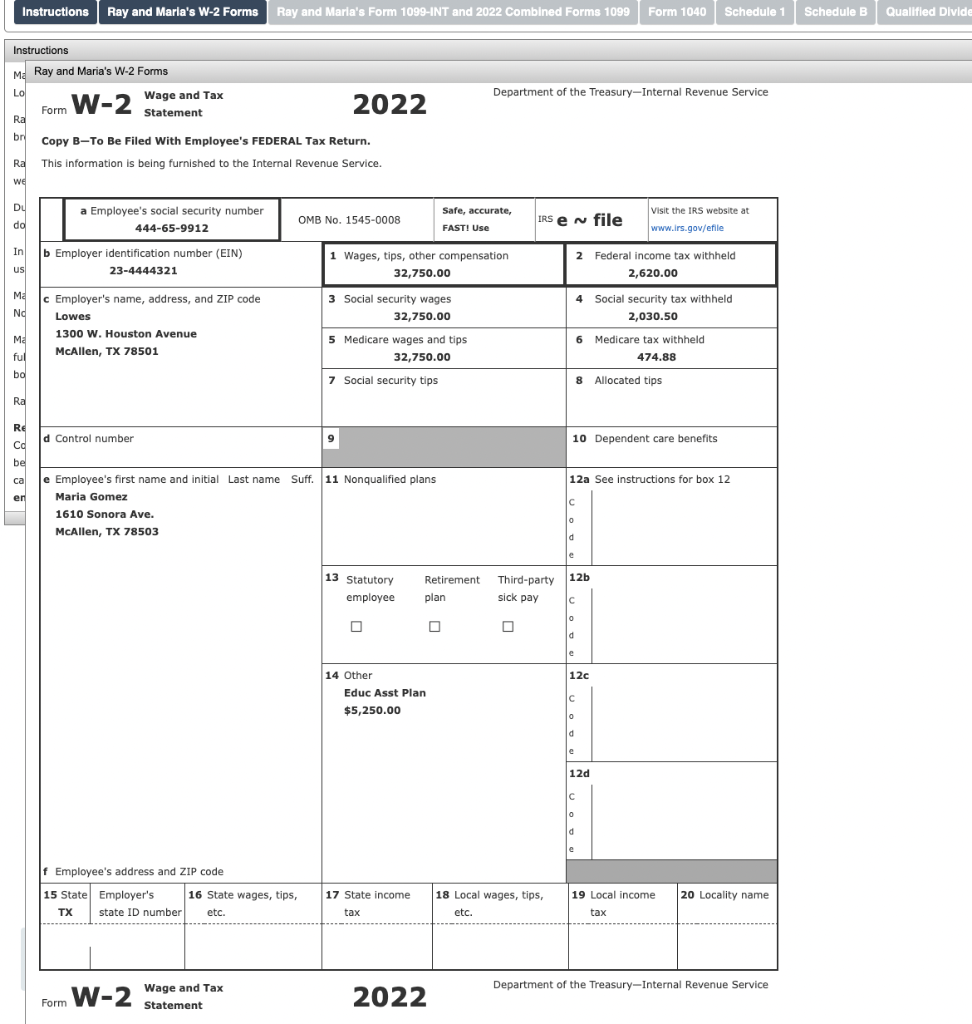

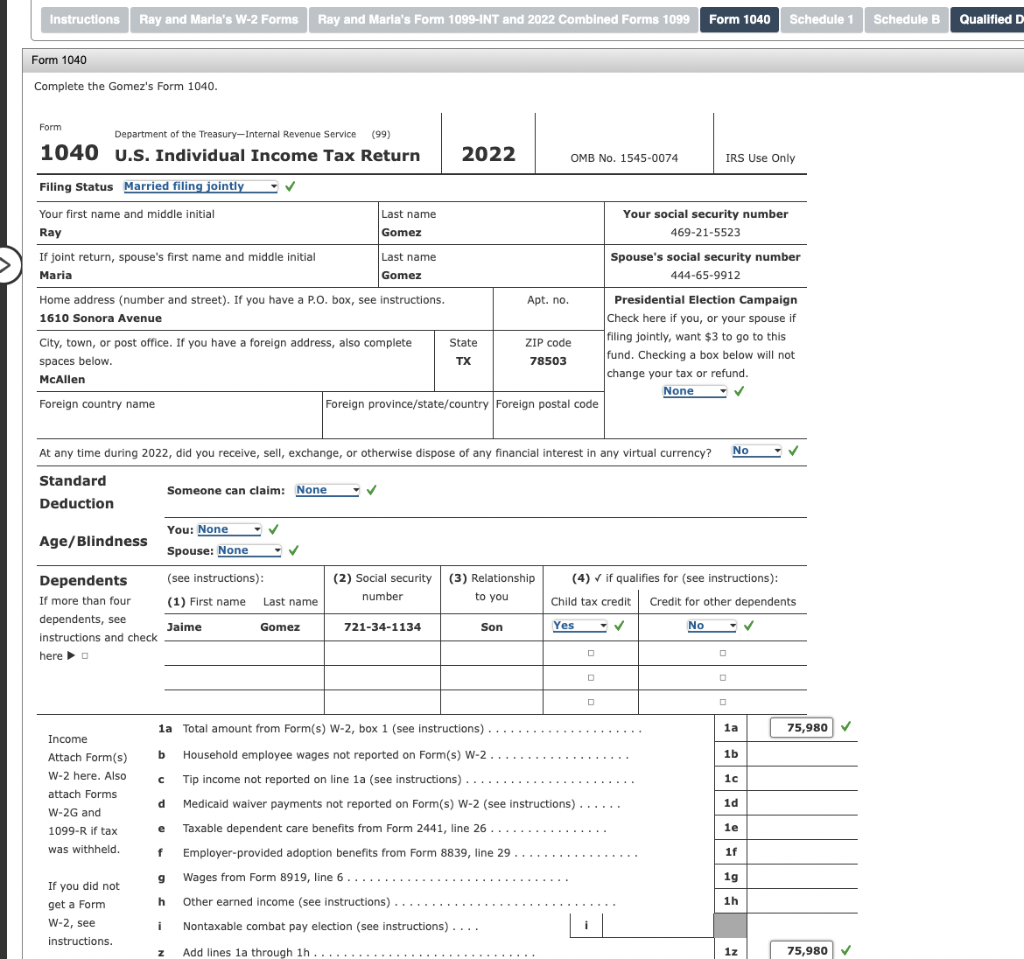

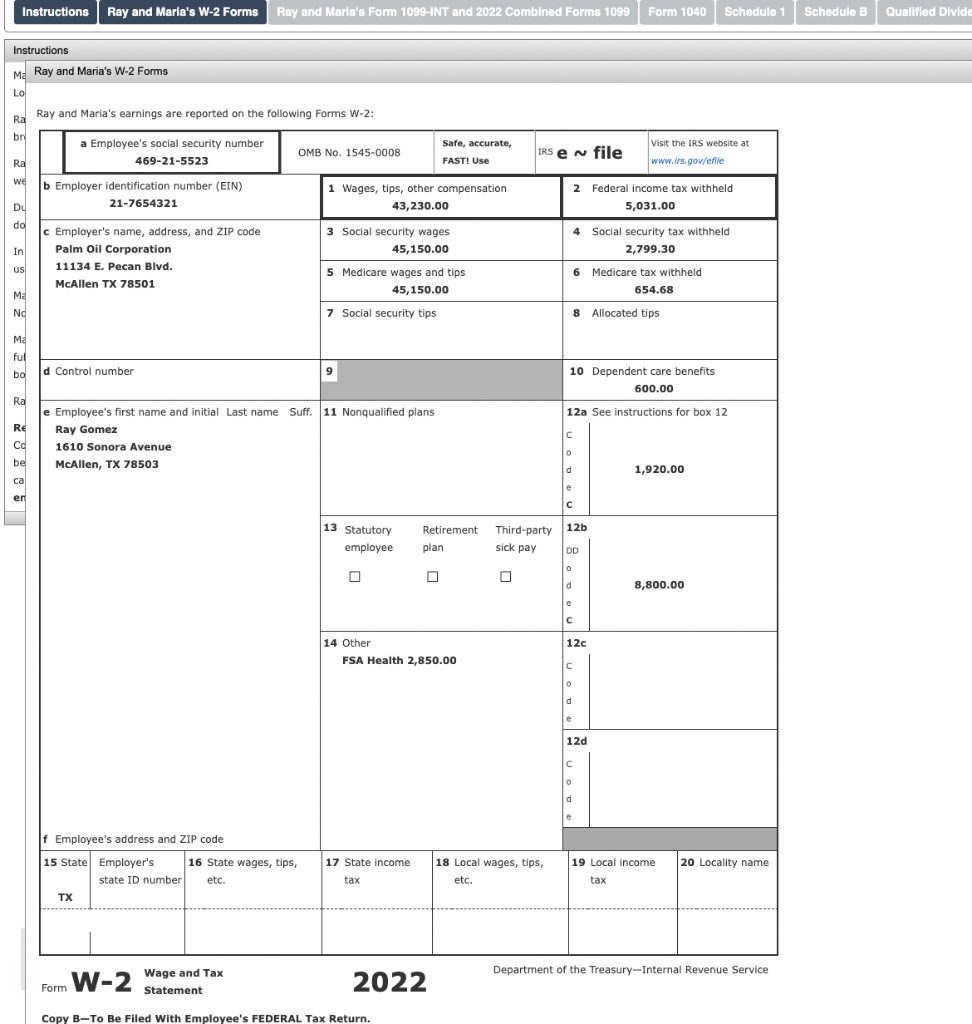

Comprehensive Problem 2-2A Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Rays birthdate is February 21, 1989, and Marias is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Marias earnings are reported each of their W-2 Form (see separate tab). Ray took advantage

Comprehensive Problem 2-2A Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Rays birthdate is February 21, 1989, and Marias is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Marias earnings are reported each of their W-2 Form (see separate tab). Ray took advantage

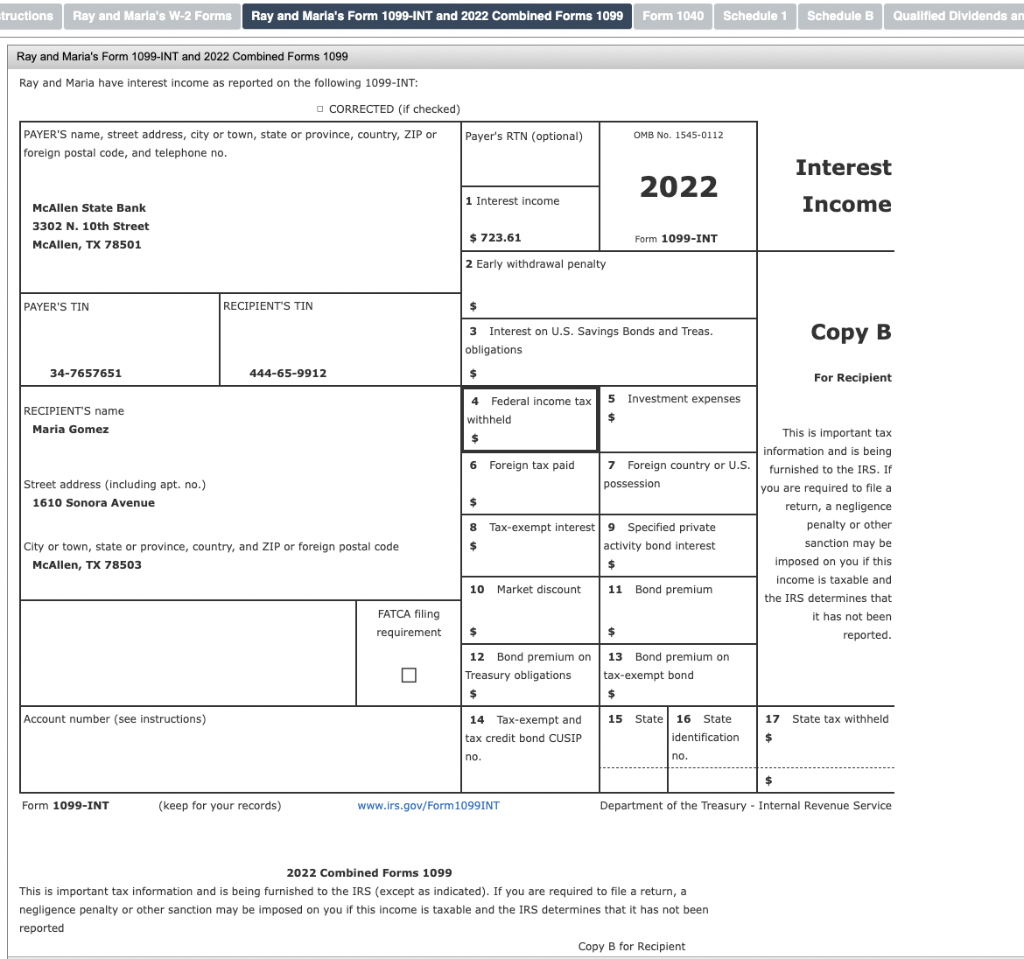

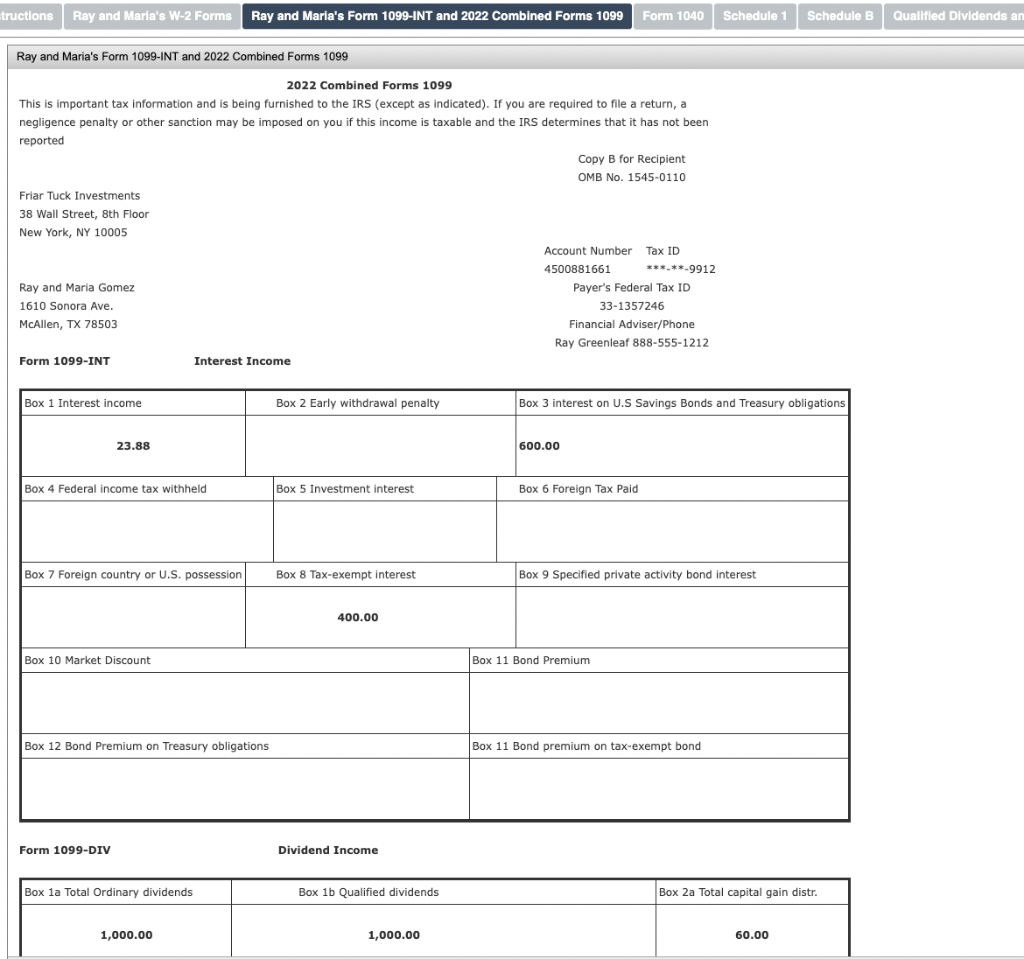

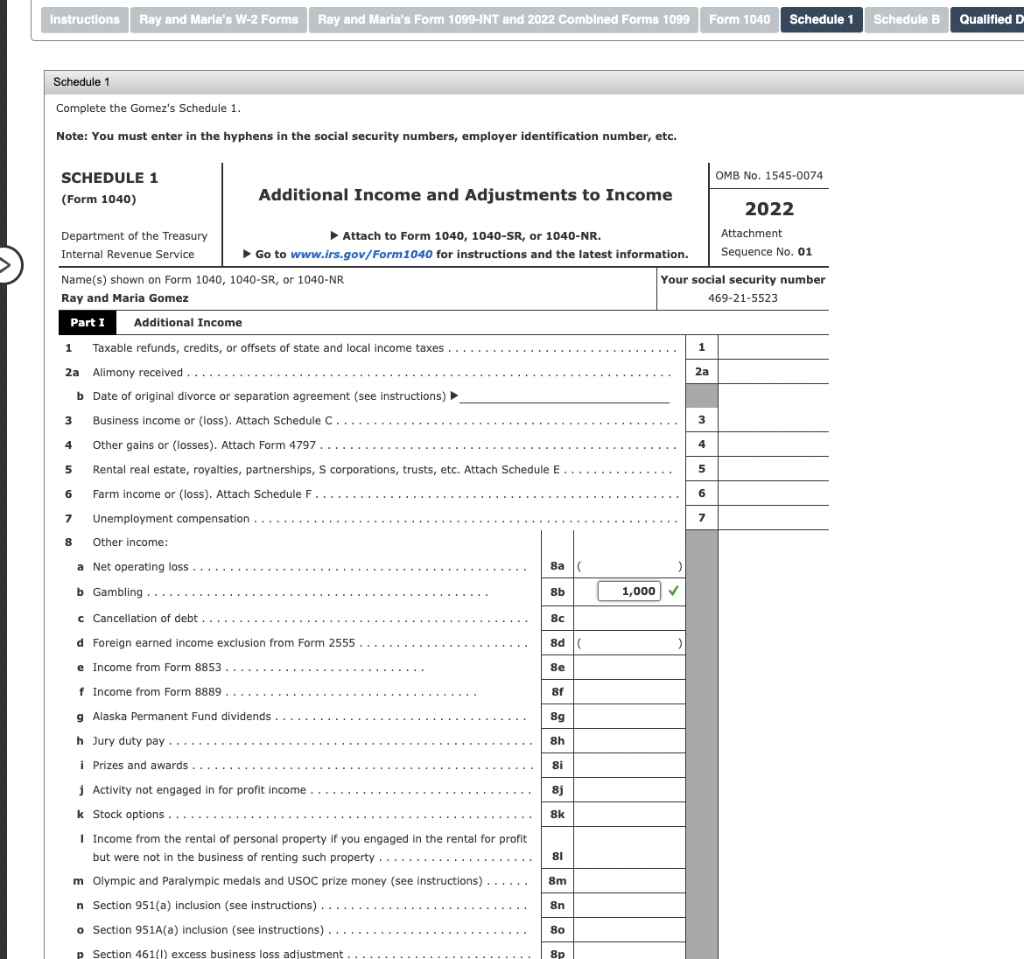

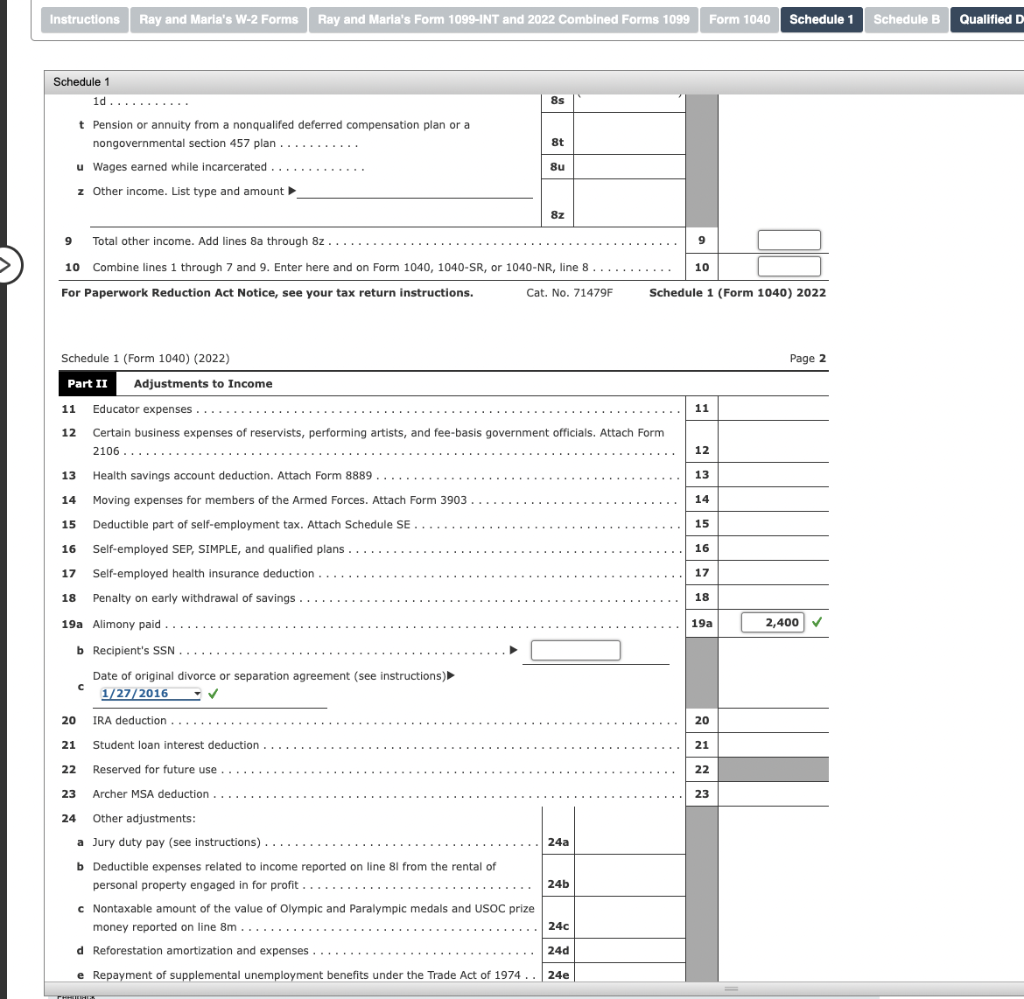

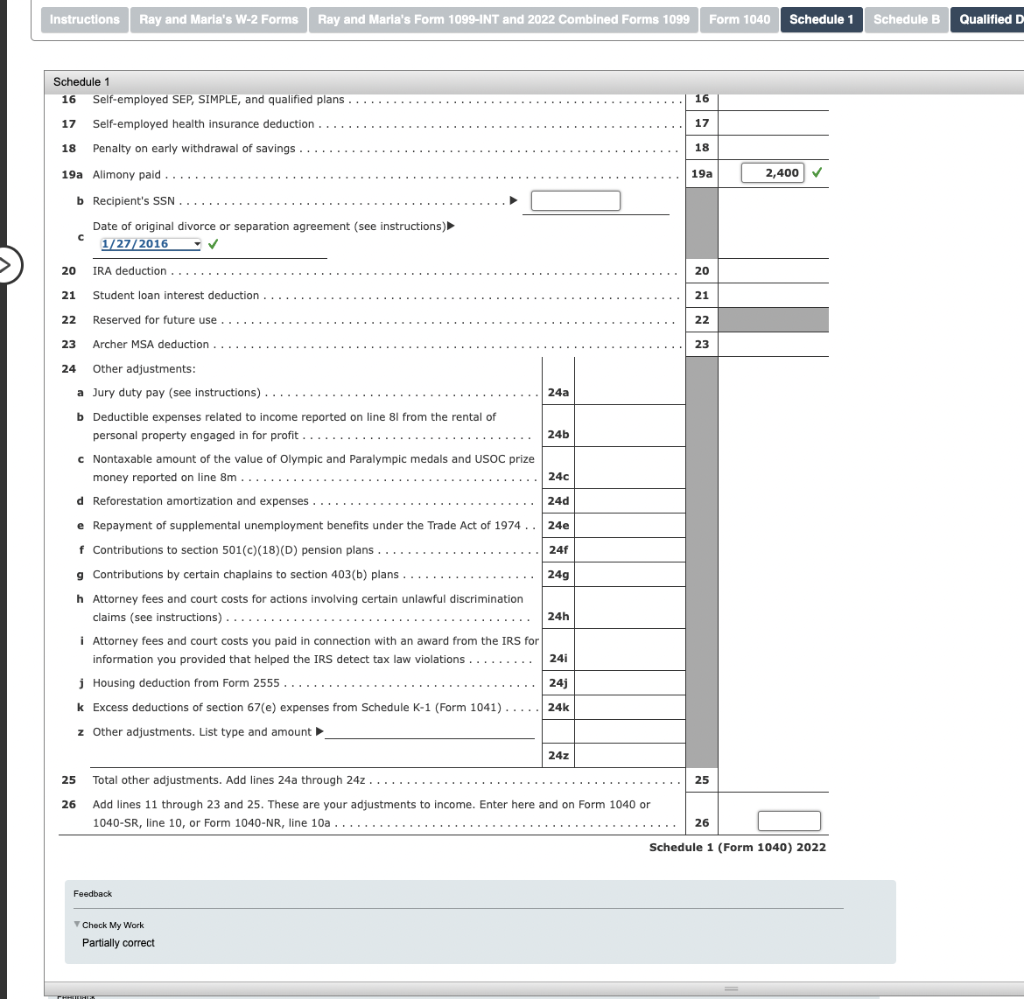

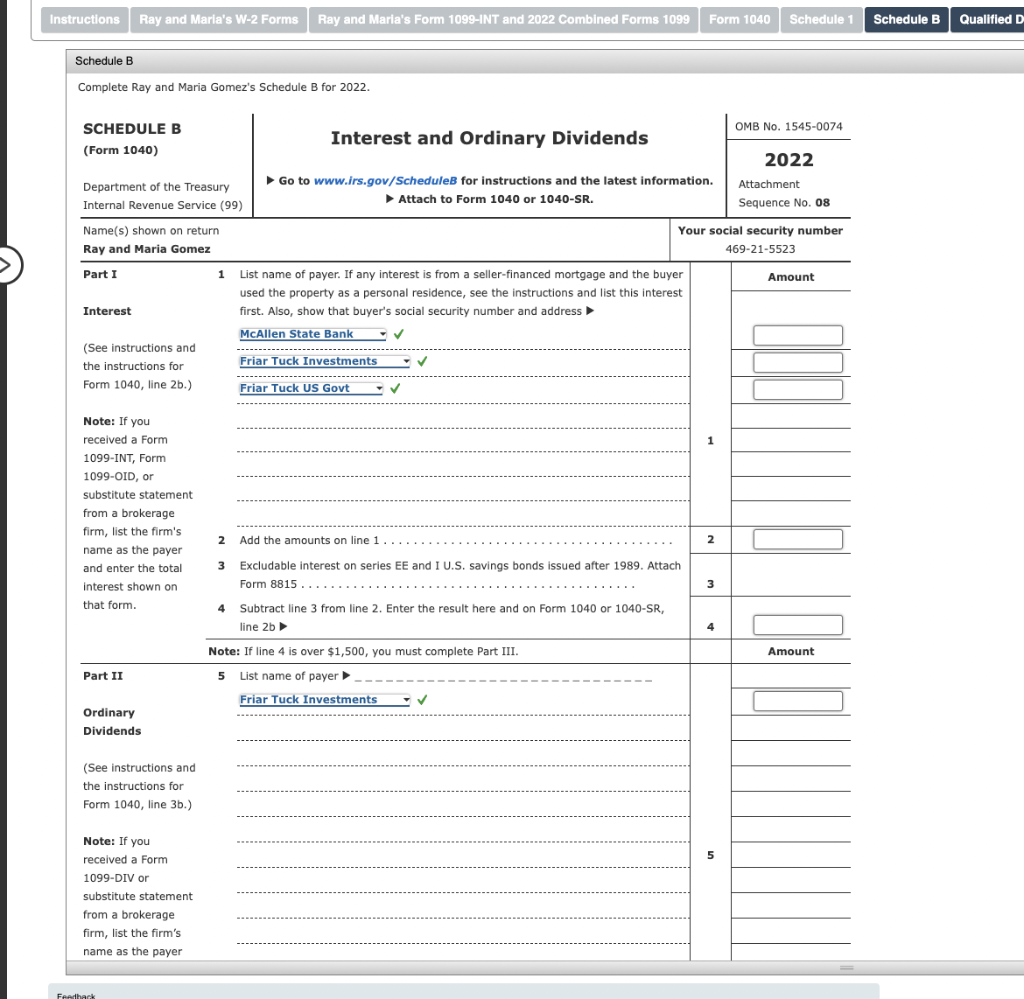

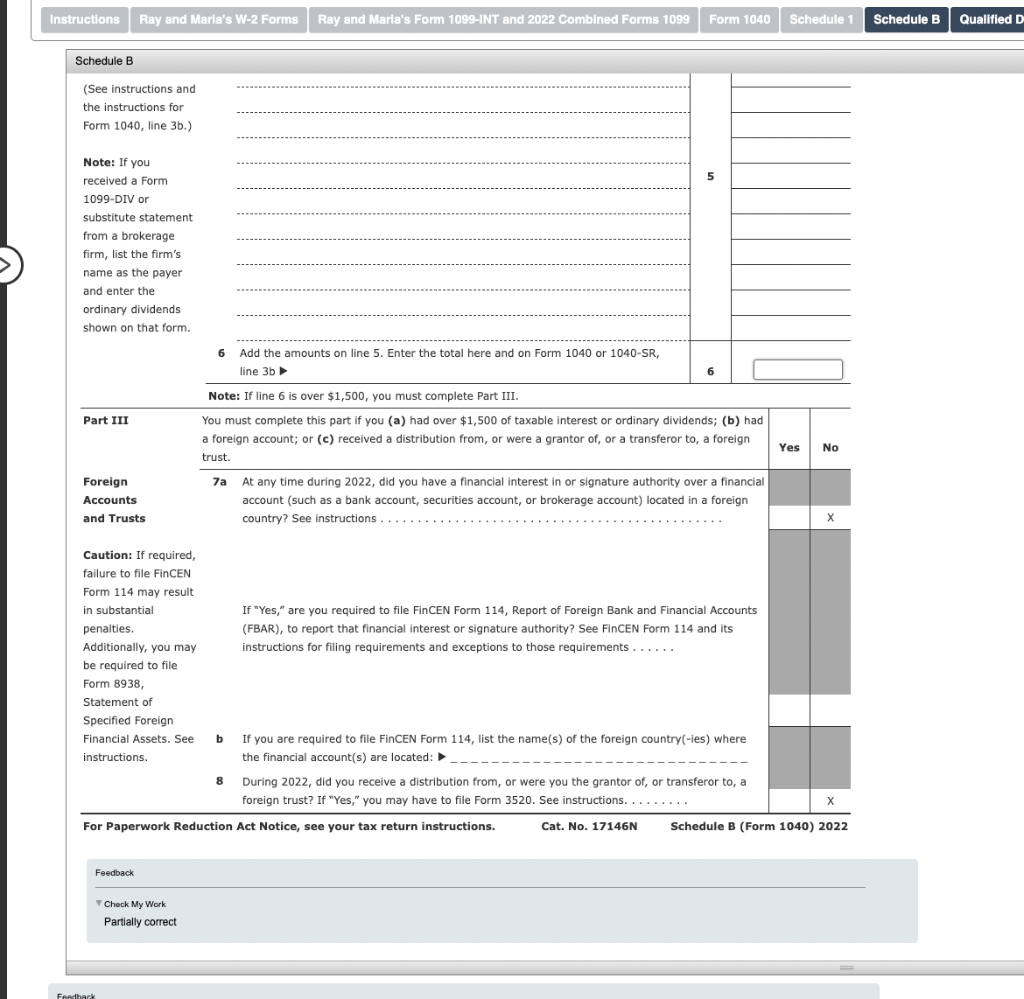

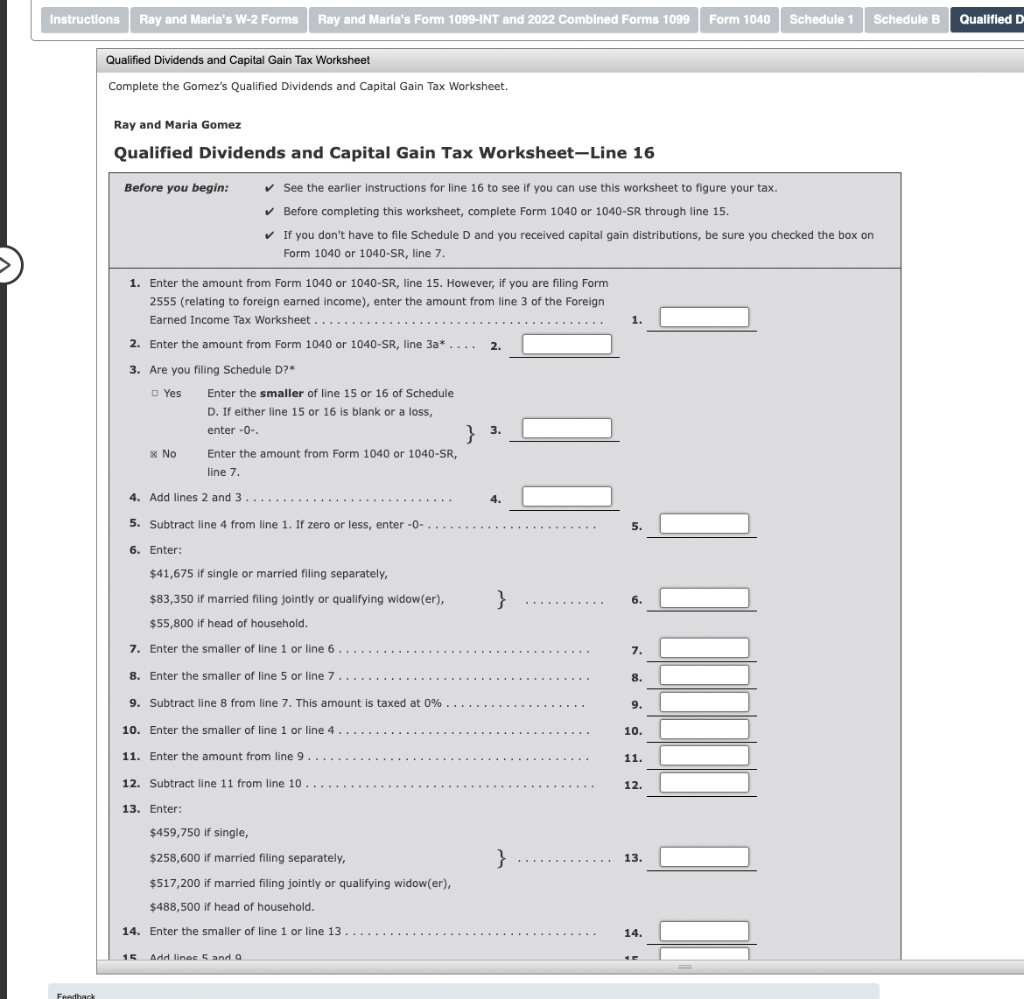

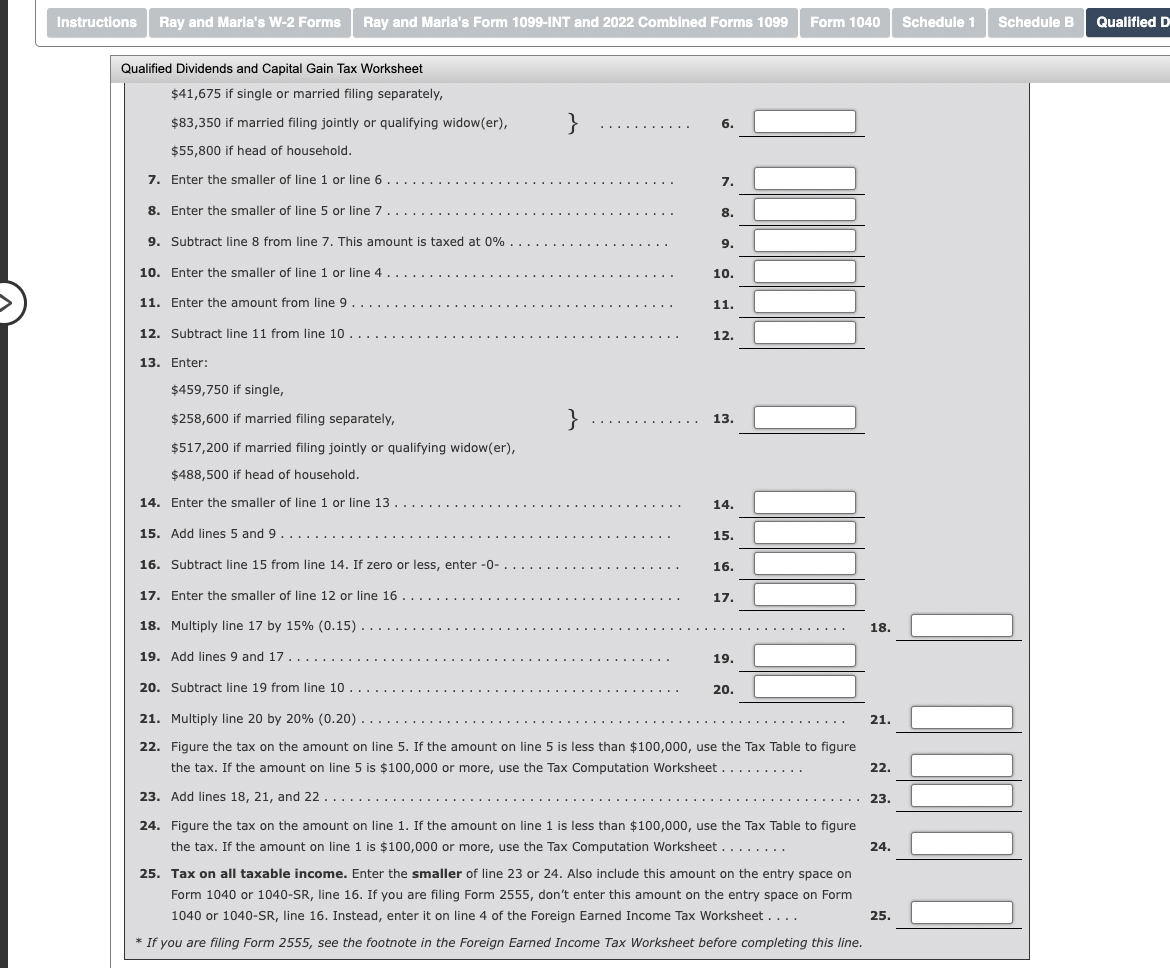

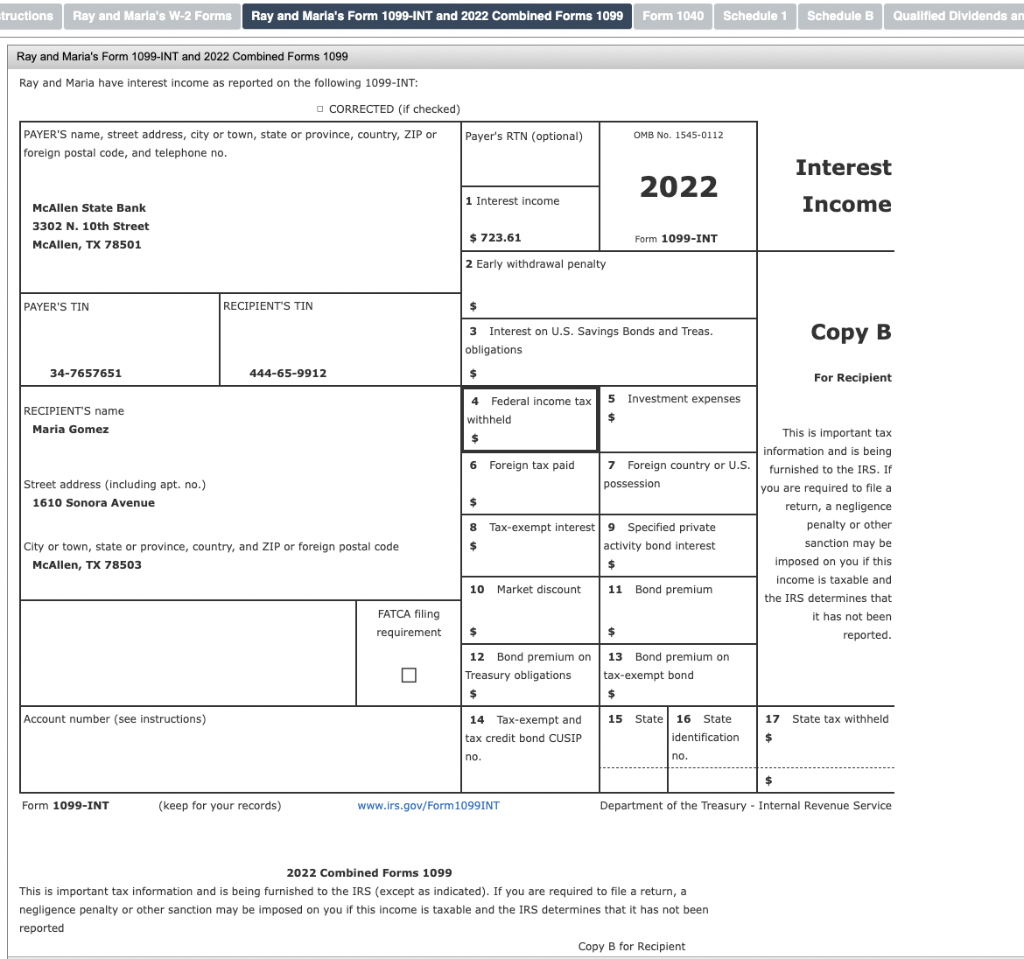

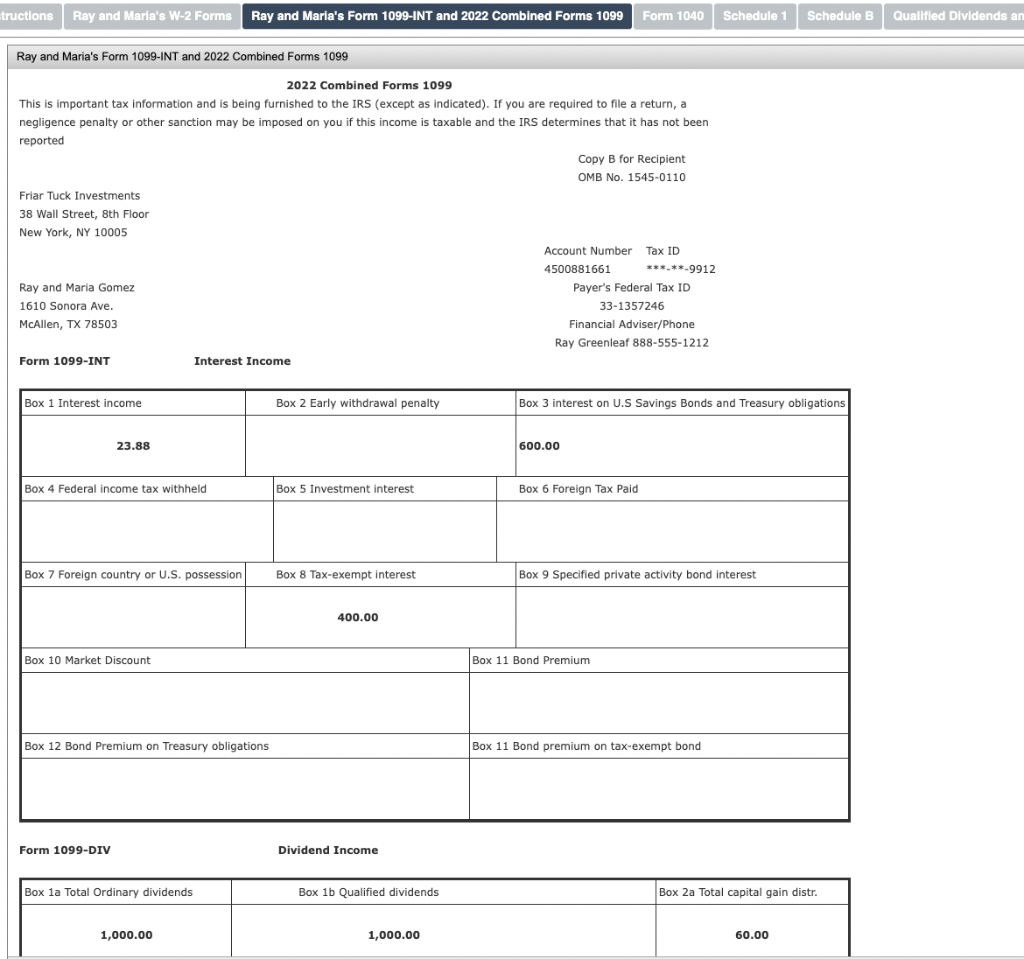

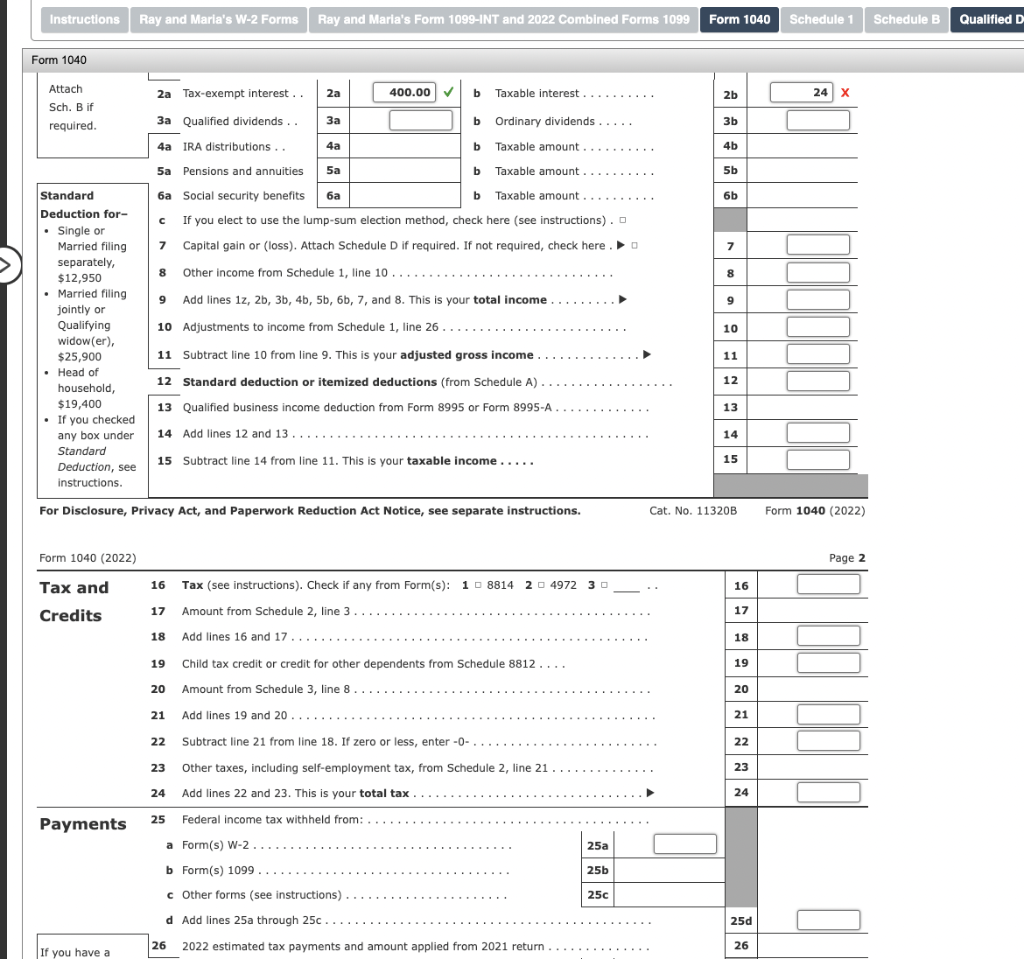

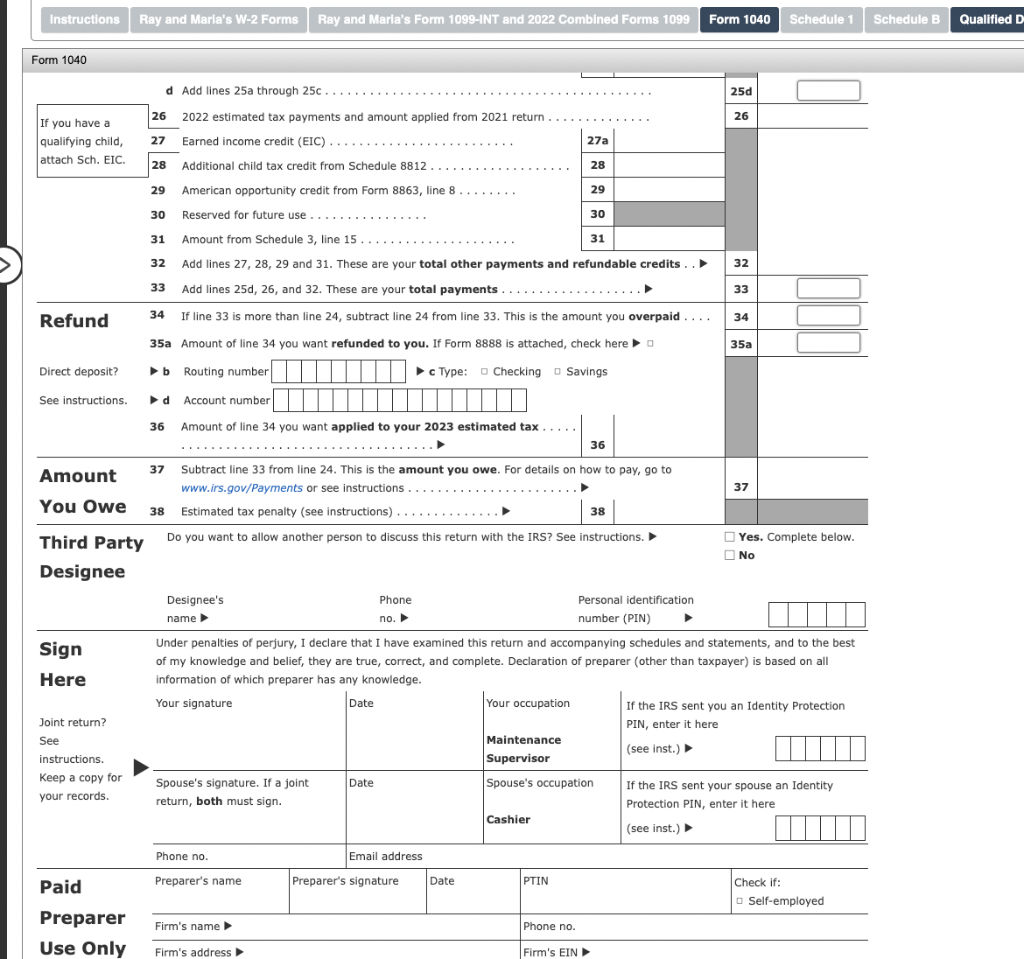

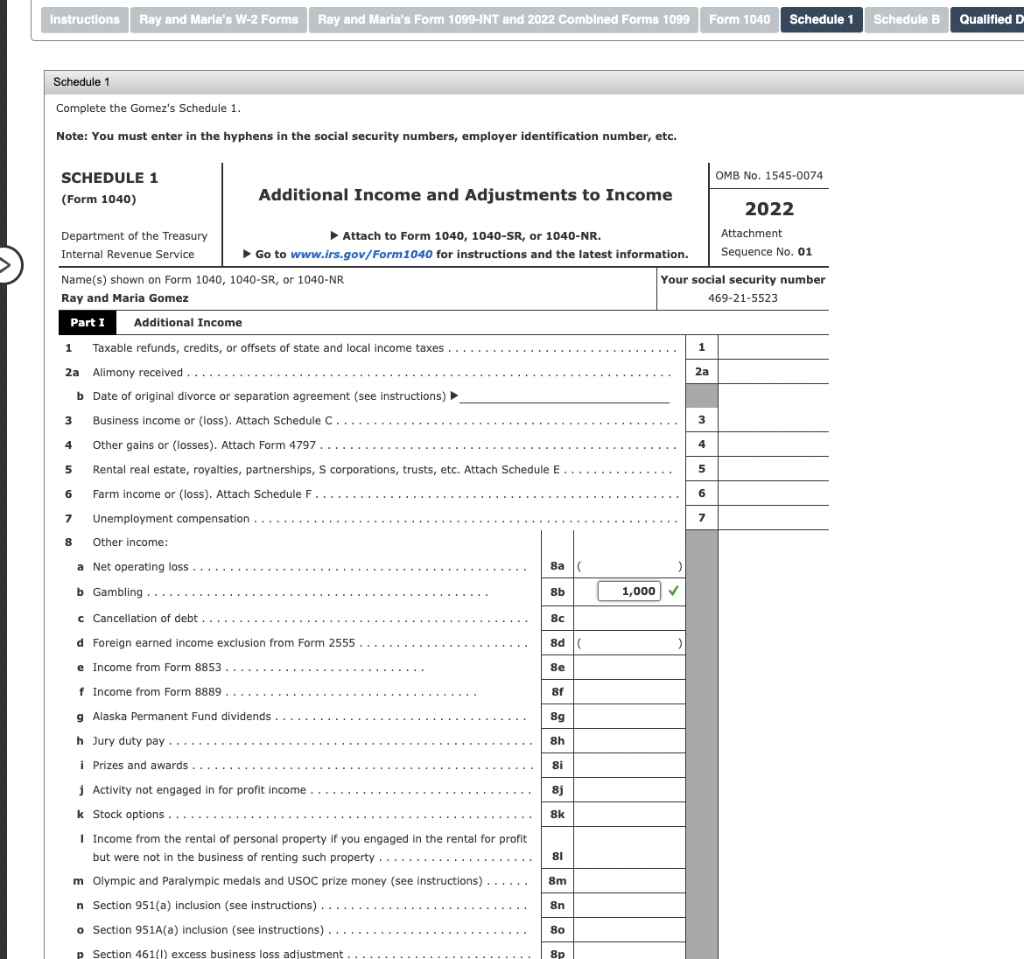

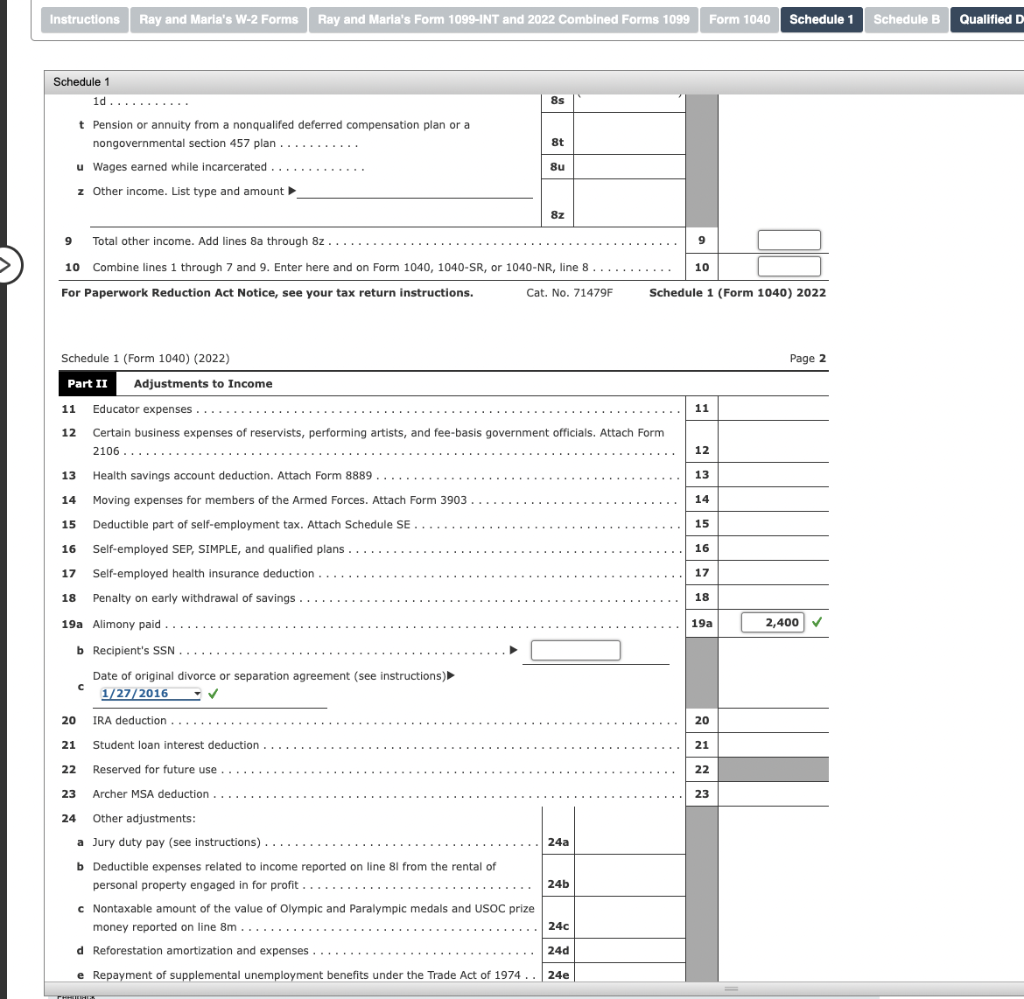

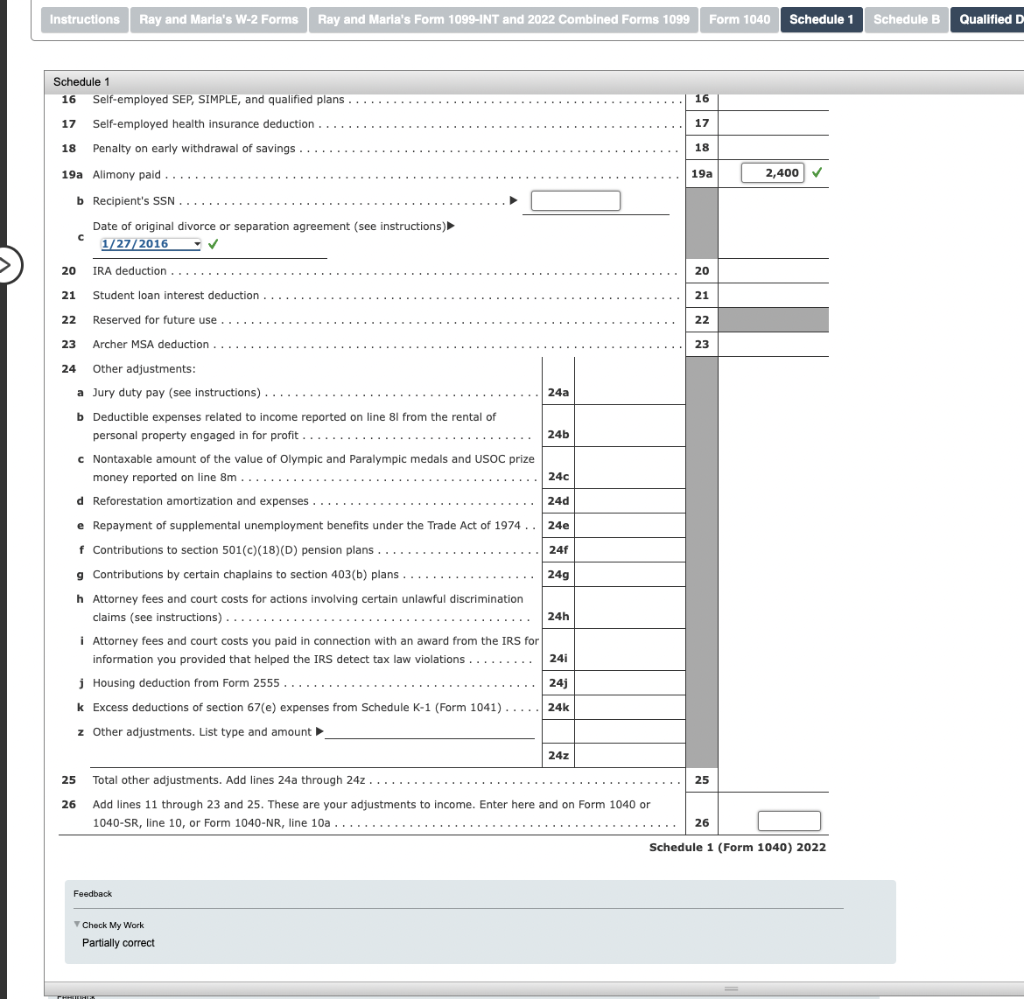

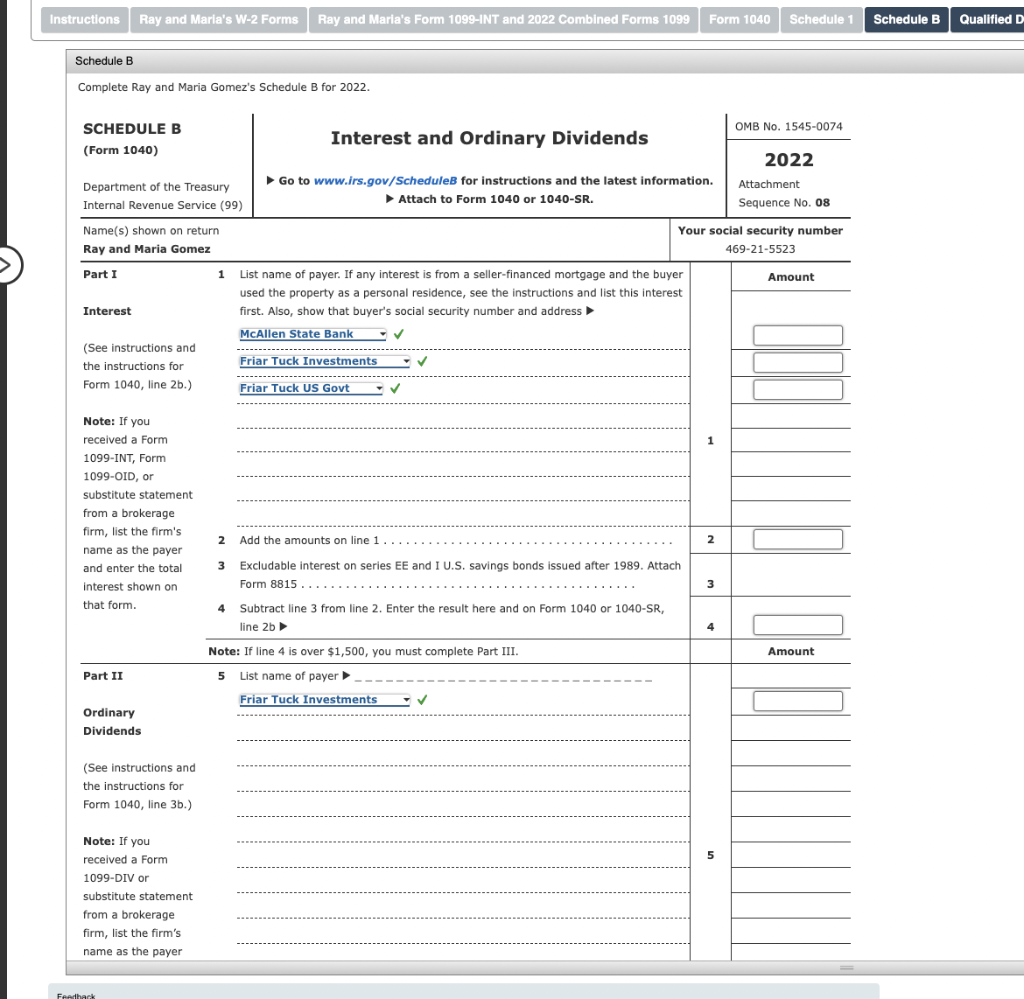

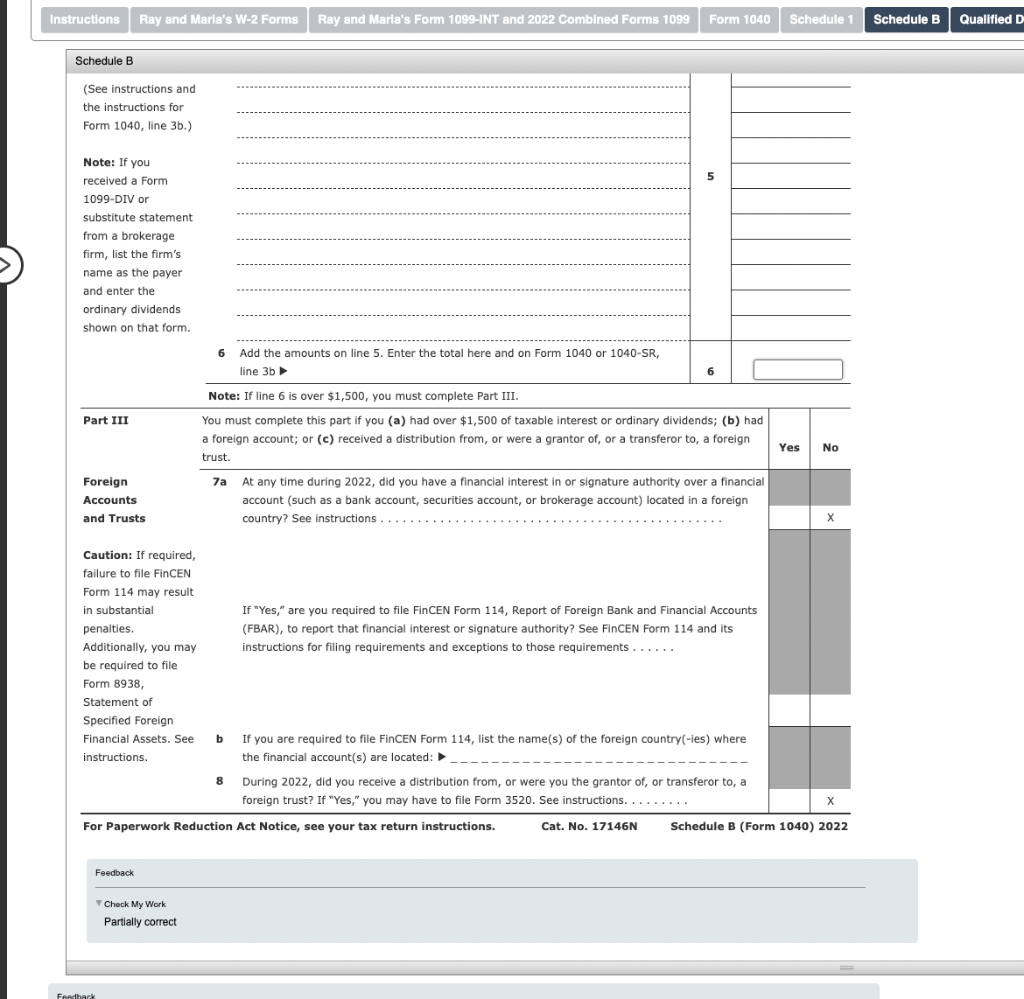

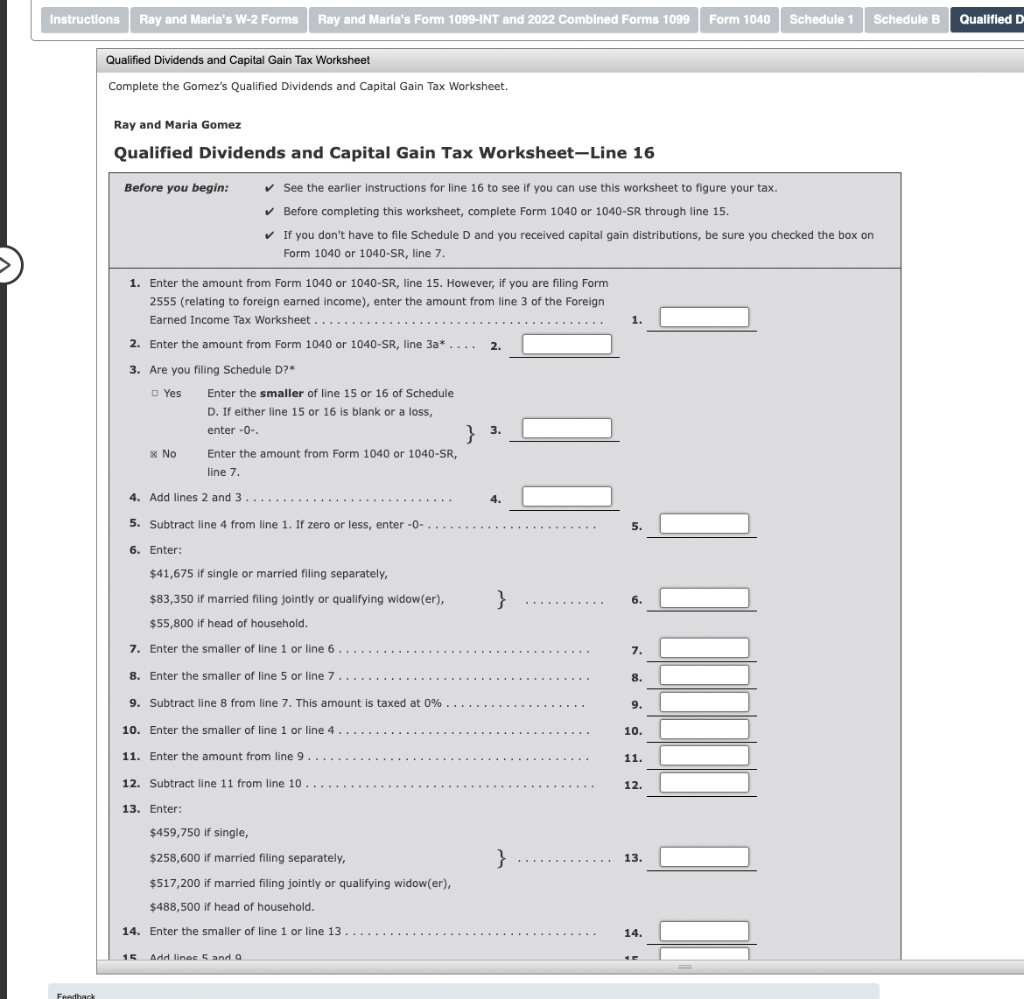

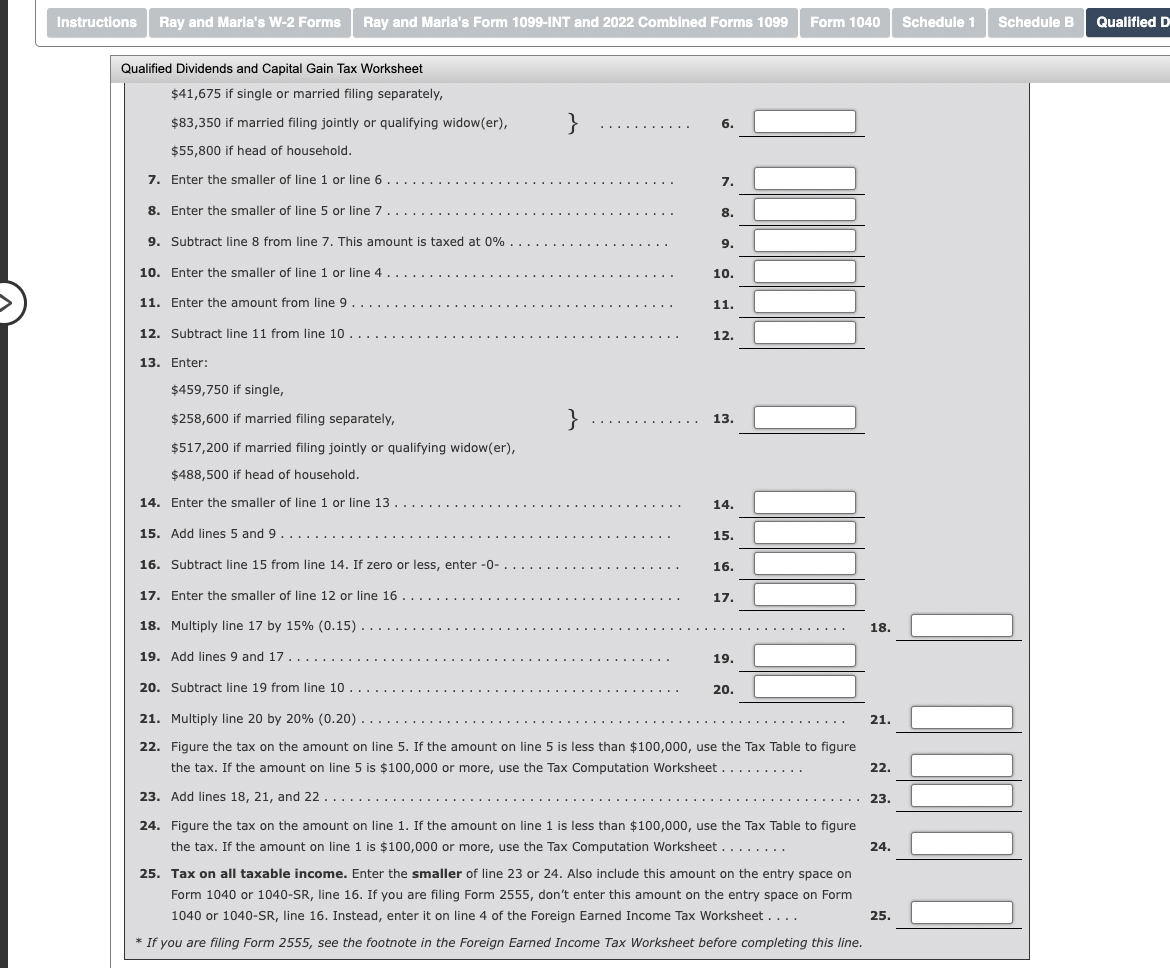

Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified Divide Instructions br Copy B-To Be Filed With Employee's FEDERAL Tax Return. Ra This information is being furnished to the Internal Revenue Service. Form YV=2 WageandTaxStatement202 2022CombinedForms1099 This is important tax information and is being furnished to the IRS (except as indicated). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported Copy B for Recipient Ray and Maria's Form 1099-INT and 2022 Combined Forms 1099 2022 Combined Forms 1099 This is important tax information and is being furnished to the IRS (except as indicated). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it heen reported Copy B for Recipient OMB No. 1545-0110 Friar Tuck Investments 38 Wall Street, 8th Floor New York, NY 10005 Account Number Tax ID 4500881661_9912 Ray and Maria Gomez Payer's Federal Tax ID 1610 Sonora Ave. 33-1357246 McAllen, TX 78503 Financial Adviser/Phone Ray Greenleaf 888-555-1212 Form 1099-INT Interest Income Form 1099-DIV Dividend Income \begin{tabular}{|c|c|} \hline Box 1a Total Ordinary dividends & Box 1b Qualified dividends \\ \hline 1,000.00 & 1,000.00 \\ \hline 60.00 \\ \hline \end{tabular} Instructions Ray and Maria's W-2 Forms Ray and Maria's Form 1099-INT and 2022 Comblned Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Form 1040 Complete the Gomez's Form 1040. Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Comblned Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Form 1040 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B 1040 (2022) Form 1040(2022) Page 2 Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-NNT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Form 1040 d Add lines 25a through 25c. 25d If you have a 262022 estimated tax payments and amount applied from 2021 return. 26 qualifying child, 27 Earned income credit (EIC). attach Sch. EIC. 28 Additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863 , line 8. 30 Reserved for future use... 31 Amount from Schedule 3 , line 15.. \begin{tabular}{|c|} \hline 27a \\ \hline 28 \\ \hline 29 \\ \hline 30 \\ \hline 31 \\ \hline \end{tabular} 32 Add lines 27, 28, 29 and 31 . These are your total other payments and refundable credits See instructions. Account number 36 Amount of line 34 you want applied to your 2023 estimated tax Third Party Do you want to allow another person to discuss this return with the IRS? See instructions. Yes. Complete below. No Designee Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best Here information of which preparer has any knowledge. Complete the Gomez's Schedule 1. Note: You must enter in the hyphens in the social security numbers, employer identification number, etc. Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule 3 Qualified D Schedule 1 1d.......... t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . u Wages earned while incarcerated z Other income. List type and amount 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2022 Schedule 1 (Form 1040) (2022) Page 2 Part II Adjustments to Income 15 Deductible part of self-employment tax. Attach Schedule SE. 16 Self-employed SEP, SIMPLE, and qualified plans. 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings. 19a Alimony paid. b Recipient's SSN Date of original divorce or separation agreement (see instructions) c 1/27/2016. 20 21 Student loan interest deduction 22 Reserved for future use. 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions). b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m. d Reforestation amortization and expenses. e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . \begin{tabular}{|l|l|l|l|l|l|} \hline Instructions & Ray and Maria's W-2 Forms & Ray and Maria's Form 1099-1NT and 2022 Combined Forms 1099 & Fohedule B \\ \hline \end{tabular} Qualified D Schedule 1 16 Self-employed SEP, SIMPLE, and qualified plans.. 17 Self-employed health insurance deduction. 18 Penalty on early withdrawal of savings. 19a Alimony paid. b Recipient's SSN \begin{tabular}{|c|r} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19a & 2,400 \\ \hline & \\ \hline \end{tabular} Date of original divorce or separation agreement (see instructions) c 1/27/2016. 20 IRA deduction . .......... 21 Student loan interest deduction 22 Reserved for future use . 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions). b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m. d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . f Contributions to section 501(c)(18)(D) pension plans . g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations . j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount 26 Add lines 11 through 23 and 25 . These are your adjustments to income. Enter here and on Form 1040 or Schedule 1 (Form 1040) 2022 Feedback Theck My Work Partially correct Complete Ray and Maria Gomez's Schedule B for 2022. SCHEDULE B (Form 1040) \begin{tabular}{l|l} Department of the Treasury & Go to www.irs.go \\ Internal Revenue Service (99) & \\ \hline \end{tabular} Name(s) shown on return \begin{tabular}{l|l|l|l|l|l|l} \hline Instructions & Ray and Maria's W-2 Forms & Ray and Maria's Form 1099-1NT and 2022 Combined Forms 1099 & Form 1040 & Schedule 1 D \end{tabular} Schedule B (See instructions and the instructions for Form 1040, line 3b.) Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown on that form. 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040SR, line 3b Note: If line 6 is over $1,500, you must complete Part III. Feedback T Check My Work Partially correct d the box on Instructions Ray and Maria's W-2 Forms Ray and Maria's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Qualified Dividends and Capital Gain Tax Worksheet $41,675 if single or married filing separately, $83,350 if married filing jointly or qualifying widow(er), }. $55,800 if head of household. 7. Enter the smaller of line 1 or line 6 ... 8. Enter the smaller of line 5 or line 7 8. 9. Subtract line 8 from line 7 . This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 13. Enter: $459,750 if single, $258,600 if married filing separately, }13. $517,200 if married filing jointly or qualifying widow(er), $488,500 if head of household. 14. Enter the smaller of line 1 or line 13 15. Add lines 5 and 9 16. Subtract line 15 from line 14 . If zero or less, enter 0 16. 17. Enter the smaller of line 12 or line 16 . 17. 18. Multiply line 17 by 15%(0.15). 18. 20. Subtract line 19 from line 10 22. Figure the tax on the amount on line 5 . If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . 22. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet ....... 24. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040-SR, line 16. If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040-SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet .... 25. * If you are filing Form 2555, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified Divide Instructions Ma Ray and Maria's W-2 Forms Ray and Maria's earnings are reported on the following Forms W-2: Form 1=2WageandTaxstatement202 Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified Divide Instructions br Copy B-To Be Filed With Employee's FEDERAL Tax Return. Ra This information is being furnished to the Internal Revenue Service. Form YV=2 WageandTaxStatement202 2022CombinedForms1099 This is important tax information and is being furnished to the IRS (except as indicated). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported Copy B for Recipient Ray and Maria's Form 1099-INT and 2022 Combined Forms 1099 2022 Combined Forms 1099 This is important tax information and is being furnished to the IRS (except as indicated). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it heen reported Copy B for Recipient OMB No. 1545-0110 Friar Tuck Investments 38 Wall Street, 8th Floor New York, NY 10005 Account Number Tax ID 4500881661_9912 Ray and Maria Gomez Payer's Federal Tax ID 1610 Sonora Ave. 33-1357246 McAllen, TX 78503 Financial Adviser/Phone Ray Greenleaf 888-555-1212 Form 1099-INT Interest Income Form 1099-DIV Dividend Income \begin{tabular}{|c|c|} \hline Box 1a Total Ordinary dividends & Box 1b Qualified dividends \\ \hline 1,000.00 & 1,000.00 \\ \hline 60.00 \\ \hline \end{tabular} Instructions Ray and Maria's W-2 Forms Ray and Maria's Form 1099-INT and 2022 Comblned Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Form 1040 Complete the Gomez's Form 1040. Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Comblned Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Form 1040 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B 1040 (2022) Form 1040(2022) Page 2 Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-NNT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Form 1040 d Add lines 25a through 25c. 25d If you have a 262022 estimated tax payments and amount applied from 2021 return. 26 qualifying child, 27 Earned income credit (EIC). attach Sch. EIC. 28 Additional child tax credit from Schedule 8812 29 American opportunity credit from Form 8863 , line 8. 30 Reserved for future use... 31 Amount from Schedule 3 , line 15.. \begin{tabular}{|c|} \hline 27a \\ \hline 28 \\ \hline 29 \\ \hline 30 \\ \hline 31 \\ \hline \end{tabular} 32 Add lines 27, 28, 29 and 31 . These are your total other payments and refundable credits See instructions. Account number 36 Amount of line 34 you want applied to your 2023 estimated tax Third Party Do you want to allow another person to discuss this return with the IRS? See instructions. Yes. Complete below. No Designee Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best Here information of which preparer has any knowledge. Complete the Gomez's Schedule 1. Note: You must enter in the hyphens in the social security numbers, employer identification number, etc. Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule 3 Qualified D Schedule 1 1d.......... t Pension or annuity from a nonqualifed deferred compensation plan or a nongovernmental section 457 plan . u Wages earned while incarcerated z Other income. List type and amount 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040) 2022 Schedule 1 (Form 1040) (2022) Page 2 Part II Adjustments to Income 15 Deductible part of self-employment tax. Attach Schedule SE. 16 Self-employed SEP, SIMPLE, and qualified plans. 17 Self-employed health insurance deduction 18 Penalty on early withdrawal of savings. 19a Alimony paid. b Recipient's SSN Date of original divorce or separation agreement (see instructions) c 1/27/2016. 20 21 Student loan interest deduction 22 Reserved for future use. 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions). b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m. d Reforestation amortization and expenses. e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . \begin{tabular}{|l|l|l|l|l|l|} \hline Instructions & Ray and Maria's W-2 Forms & Ray and Maria's Form 1099-1NT and 2022 Combined Forms 1099 & Fohedule B \\ \hline \end{tabular} Qualified D Schedule 1 16 Self-employed SEP, SIMPLE, and qualified plans.. 17 Self-employed health insurance deduction. 18 Penalty on early withdrawal of savings. 19a Alimony paid. b Recipient's SSN \begin{tabular}{|c|r} \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline 19a & 2,400 \\ \hline & \\ \hline \end{tabular} Date of original divorce or separation agreement (see instructions) c 1/27/2016. 20 IRA deduction . .......... 21 Student loan interest deduction 22 Reserved for future use . 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions). b Deductible expenses related to income reported on line 81 from the rental of personal property engaged in for profit . c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8m. d Reforestation amortization and expenses e Repayment of supplemental unemployment benefits under the Trade Act of 1974 . f Contributions to section 501(c)(18)(D) pension plans . g Contributions by certain chaplains to section 403 (b) plans h Attorney fees and court costs for actions involving certain unlawful discrimination i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations . j Housing deduction from Form 2555 k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) z Other adjustments. List type and amount 26 Add lines 11 through 23 and 25 . These are your adjustments to income. Enter here and on Form 1040 or Schedule 1 (Form 1040) 2022 Feedback Theck My Work Partially correct Complete Ray and Maria Gomez's Schedule B for 2022. SCHEDULE B (Form 1040) \begin{tabular}{l|l} Department of the Treasury & Go to www.irs.go \\ Internal Revenue Service (99) & \\ \hline \end{tabular} Name(s) shown on return \begin{tabular}{l|l|l|l|l|l|l} \hline Instructions & Ray and Maria's W-2 Forms & Ray and Maria's Form 1099-1NT and 2022 Combined Forms 1099 & Form 1040 & Schedule 1 D \end{tabular} Schedule B (See instructions and the instructions for Form 1040, line 3b.) Note: If you received a Form 1099-DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown on that form. 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040SR, line 3b Note: If line 6 is over $1,500, you must complete Part III. Feedback T Check My Work Partially correct d the box on Instructions Ray and Maria's W-2 Forms Ray and Maria's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified D Qualified Dividends and Capital Gain Tax Worksheet $41,675 if single or married filing separately, $83,350 if married filing jointly or qualifying widow(er), }. $55,800 if head of household. 7. Enter the smaller of line 1 or line 6 ... 8. Enter the smaller of line 5 or line 7 8. 9. Subtract line 8 from line 7 . This amount is taxed at 0% 9. 10. Enter the smaller of line 1 or line 4 10. 11. Enter the amount from line 9 11. 12. Subtract line 11 from line 10 13. Enter: $459,750 if single, $258,600 if married filing separately, }13. $517,200 if married filing jointly or qualifying widow(er), $488,500 if head of household. 14. Enter the smaller of line 1 or line 13 15. Add lines 5 and 9 16. Subtract line 15 from line 14 . If zero or less, enter 0 16. 17. Enter the smaller of line 12 or line 16 . 17. 18. Multiply line 17 by 15%(0.15). 18. 20. Subtract line 19 from line 10 22. Figure the tax on the amount on line 5 . If the amount on line 5 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 5 is $100,000 or more, use the Tax Computation Worksheet . 22. 24. Figure the tax on the amount on line 1 . If the amount on line 1 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet ....... 24. 25. Tax on all taxable income. Enter the smaller of line 23 or 24 . Also include this amount on the entry space on Form 1040 or 1040-SR, line 16. If you are filing Form 2555, don't enter this amount on the entry space on Form 1040 or 1040-SR, line 16. Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet .... 25. * If you are filing Form 2555, see the footnote in the Foreign Earned Income Tax Worksheet before completing this line. Instructions Ray and Maria's W-2 Forms Ray and Marla's Form 1099-INT and 2022 Combined Forms 1099 Form 1040 Schedule 1 Schedule B Qualified Divide Instructions Ma Ray and Maria's W-2 Forms Ray and Maria's earnings are reported on the following Forms W-2: Form 1=2WageandTaxstatement202

Comprehensive Problem 2-2A Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Rays birthdate is February 21, 1989, and Marias is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Marias earnings are reported each of their W-2 Form (see separate tab). Ray took advantage

Comprehensive Problem 2-2A Ray and Maria Gomez have been married for eight years. Ray is an oil rig maintenance supervisor for Palm Oil Corporation and Maria works as a cashier for Lowes. Rays birthdate is February 21, 1989, and Marias is December 30, 1991. Ray and Maria have a 9-year-old son named Jaime Gomez, born on 3/22/2013 (Social Security number 721-34-1134). Ray and Marias earnings are reported each of their W-2 Form (see separate tab). Ray took advantage