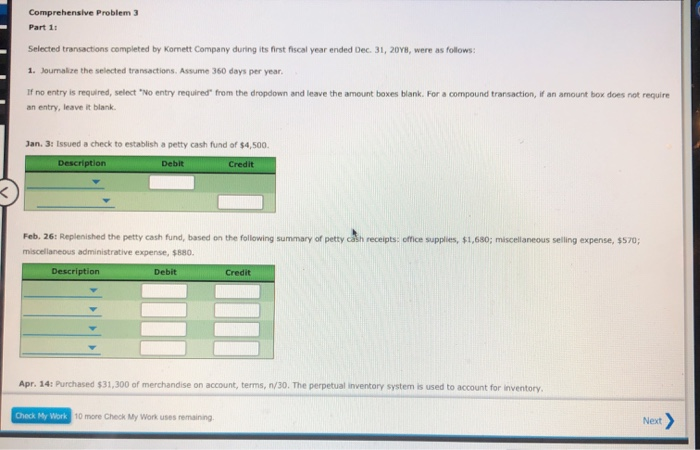

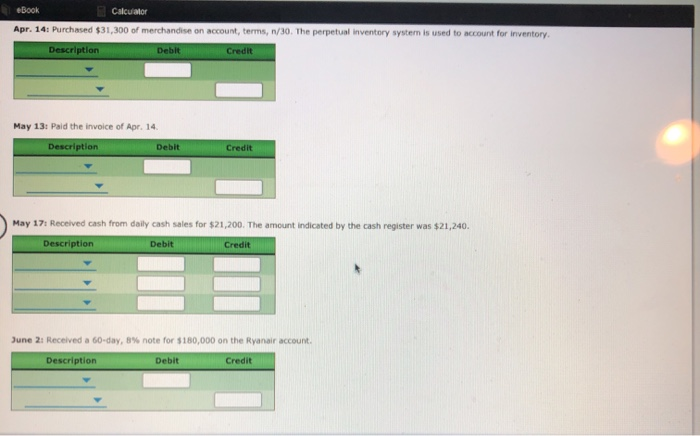

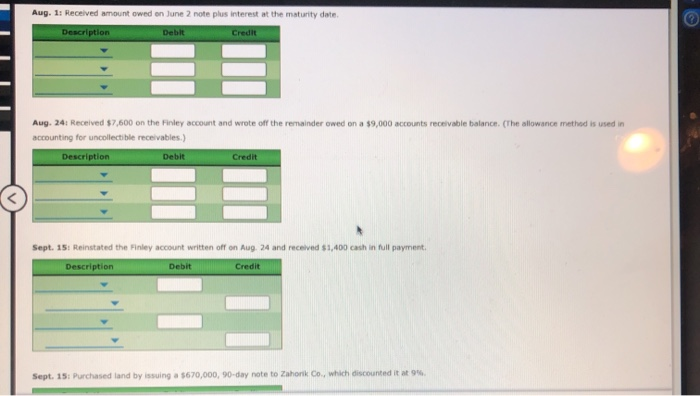

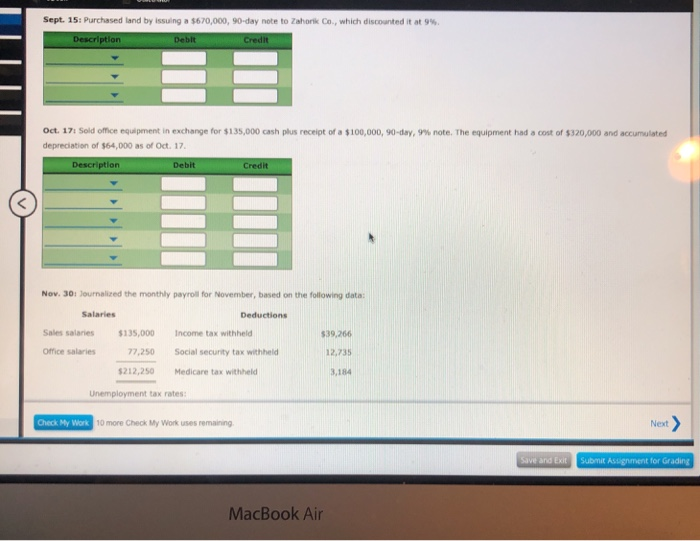

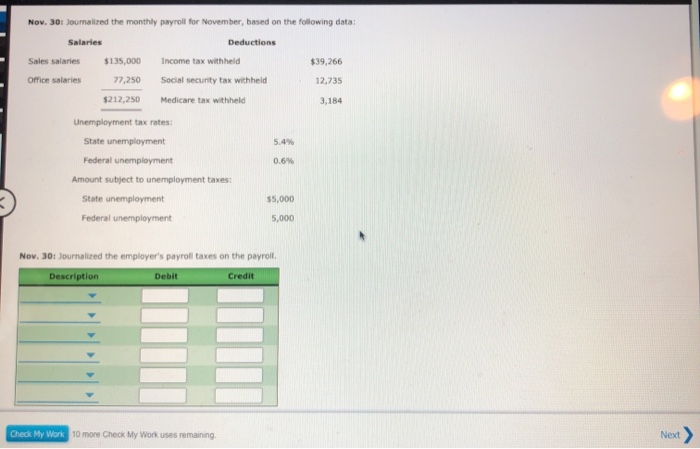

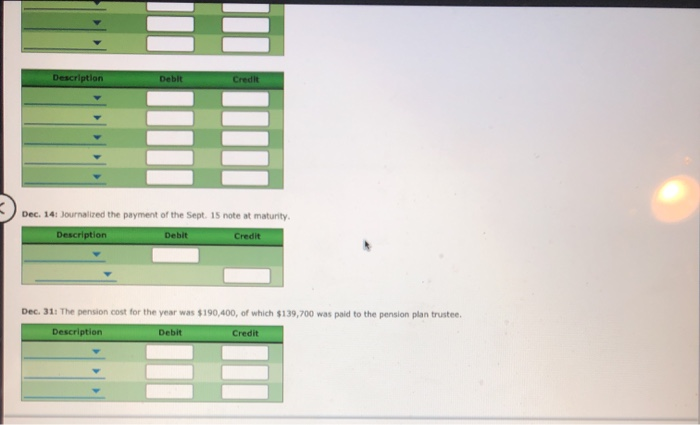

Comprehensive Problem 3 Part 11 Selected transactions completed by Komett Company during its first fiscal year ended Dec 31, 2018, were as follows: 1. Soumare the selected transactions. Assume 360 days per year. If no entry is required, select 'No entry required from the dropdown and leave the amount boxes blank. For a compound transaction, if an amount box does not require an entry, leave it blank Jan. 3: Issued a check to establish a petty cash fund of $4,500 Description Debit Credit Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $80. Description Debit Credit Apr. 14: Purchased $31,300 of merchandise on account, terms, 1/30. The perpetual inventory system is used to account for inventory Check My Work 10 more Check My Work uses remaining Next > eBook Calculator Apr. 14: Purchased $31,300 of merchandise on account, terms, /30. The perpetual inventory system is used to account for inventory. Description Debit Credit May 13: Paid the invoice of Apr. 14 Description Debit Credit May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. Description Debit Credit June 2: Received a 60-day, 8% note for $180,000 on the Ryanair account, Description Debit Credit Aug. 1: Received amount owed on June 2 note plus interest at the maturity date Description Debit Credit Aug. 24: Received $7,600 on the Finley account and wrote of the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for uncollectible receivables.) Description Debit Credit Sept. 15: Reinstated the Finley account written off on Aug. 24 and received $1,400 cash in full payment Description Debit Credit Sept. 15: Purchased land by issuing a $670,000, 90-day note to Zahorik Co., which discounted it at 96 Sept. 15: Purchased and by issuing a 5670,000, 90-day note to Zahork Co., which discounted it Description Debat Credit note. The equipment had a cost of $320,000 and accumulated Oct. 17: Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000, 90-day, 9 depreciation of $64,000 as of Oct. 17. Description Debit Credit Nov. 301 Journalized the monthly payroll for November, based on the following data: Salaries Sales salaries Deductions Income tax withheld Social security tax withheld $135,000 77,250 $39.266 Office salaries 12,735 5212,250 Medicare tax withheld 3,184 Unemployment tax rates: Check My Work 10 more Check My Work uses remaining Next > Save and Submit Assignment for Grading MacBook Air Nov. 30: Journalized the monthly payroll for November, based on the following data: Deductions Salaries Sales salaries $135,000 Office salaries 77,250 $39,266 Income tax withheld Social security tax withheld 12,735 $212,250 Medicare tax withheld 3,184 Unemployment tax rates: State unemployment 5.4% Federal unemployment 0.6% Amount subject to unemployment taxes: State unemployment $5,000 Federal unemployment 5,000 Nov. 30: Journalized the employer's payroll taxes on the payroll Description Debit Credit Check My Work 10 more Check My Work uses remaining Next > Description Debit Credit Dec. 14: Journalized the payment of the Sept. 15 note at maturity Description Debit Credit Dec. 31. The pension cost for the year was $190,400, of which $139,700 was paid to the pension plan trustee. Description Debit Credit