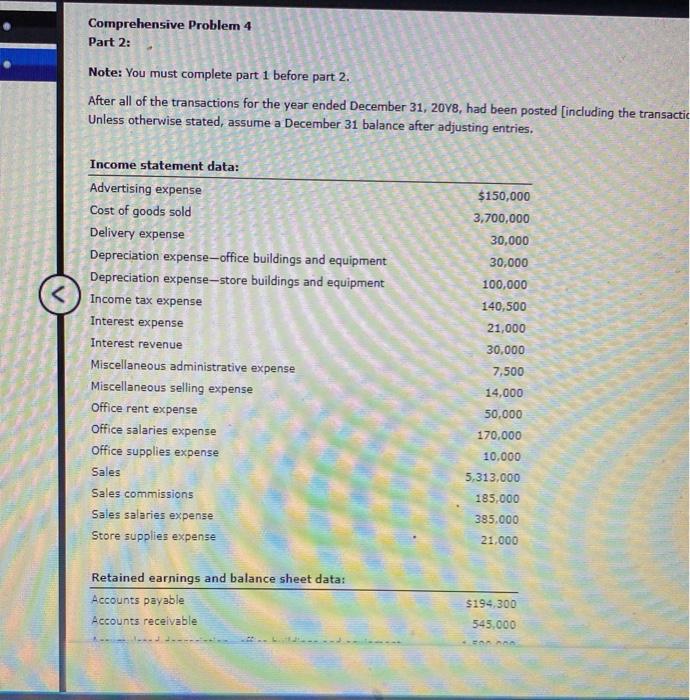

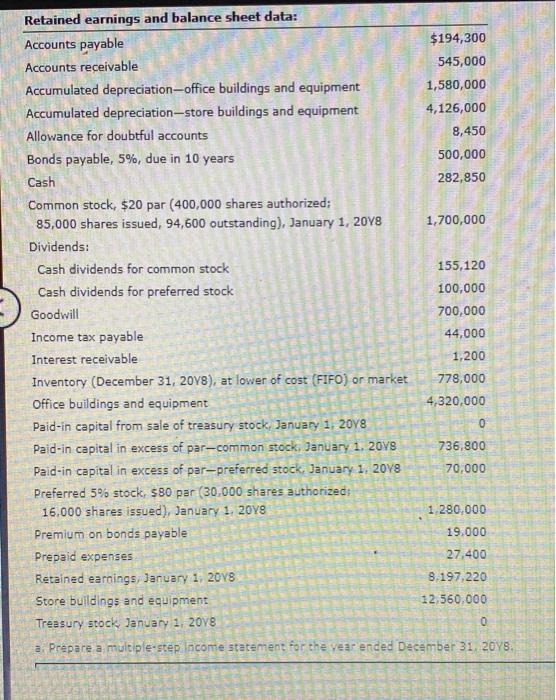

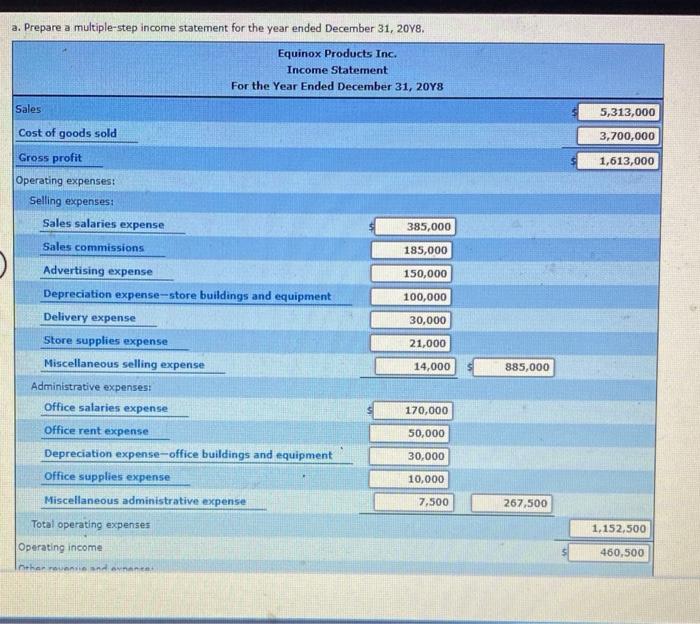

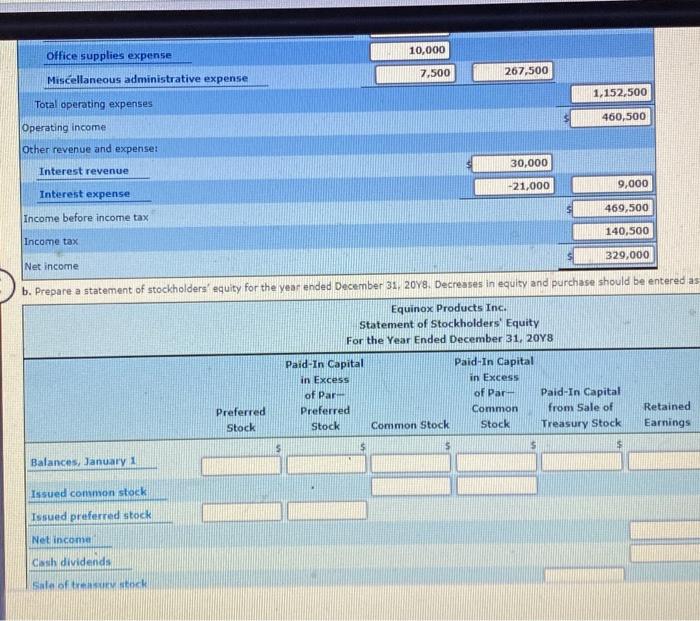

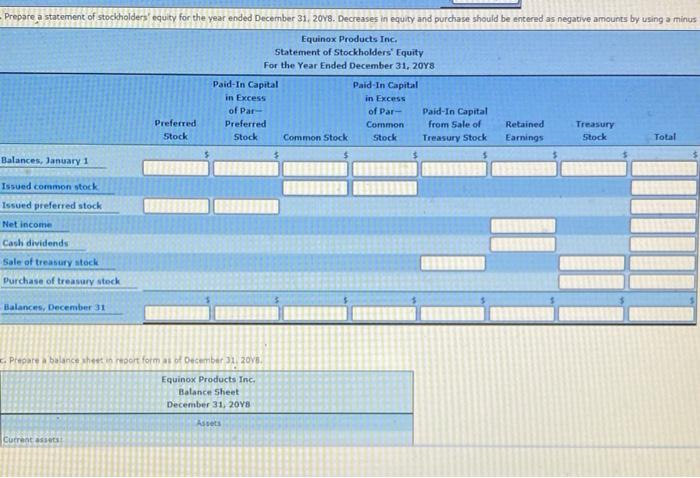

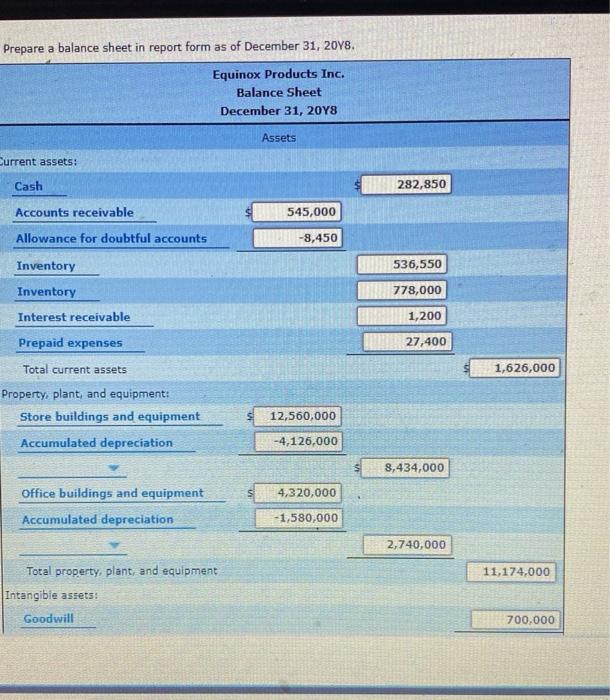

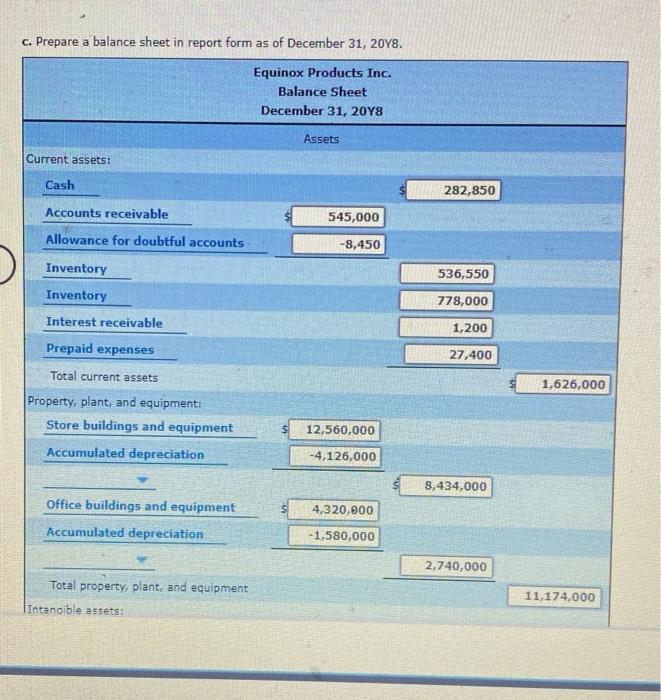

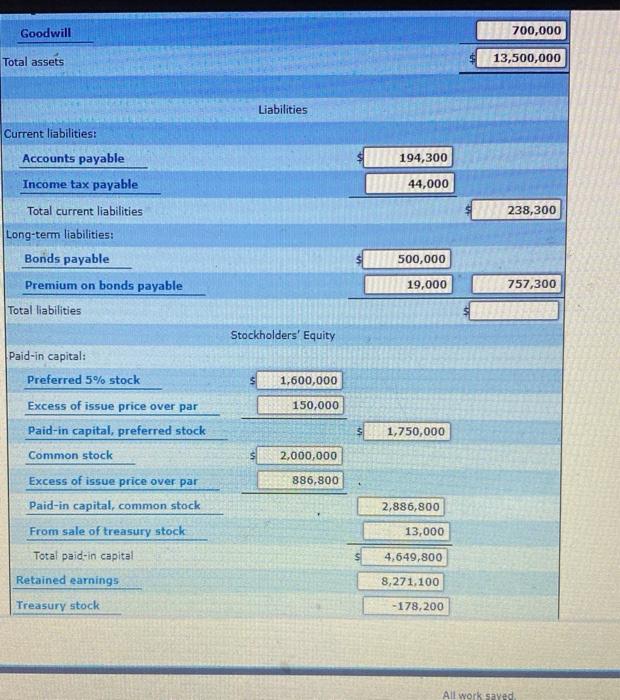

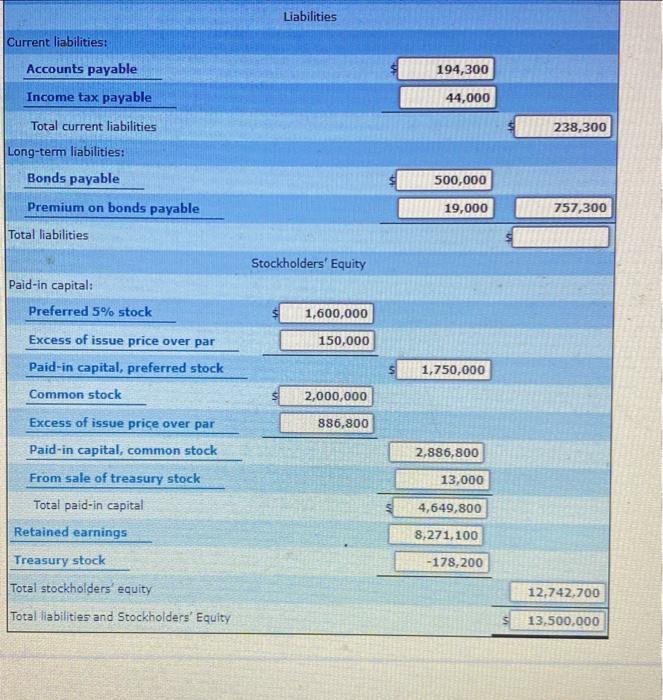

Comprehensive Problem 4 Part 2: Note: You must complete part 1 before part 2. After all of the transactions for the year ended December 31, 2018, had been posted [including the transactic Unless otherwise stated, assume a December 31 balance after adjusting entries. $150,000 3,700,000 30,000 Income statement data: Advertising expense Cost of goods sold Delivery expense Depreciation expense-office buildings and equipment Depreciation expense-store buildings and equipment Income tax expense Interest expense Interest revenue Miscellaneous administrative expense Miscellaneous selling expense Office rent expense Office salaries expense Office supplies expense Sales Sales commissions Sales salaries expense Store supplies expense 30,000 100,000 140,500 21,000 30,000 7.500 14,000 50,000 170.000 10.000 5.313.000 185.000 385.000 21.000 Retained earnings and balance sheet data: Accounts payable Accounts receivable $194,300 545.000 Retained earnings and balance sheet data: Accounts payable $194,300 Accounts receivable 545,000 Accumulated depreciation-office buildings and equipment 1,580,000 Accumulated depreciation-store buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Bonds payable, 5%, due in 10 years 500,000 Cash 282,850 Common stock, $20 par (400,000 shares authorized: 85,000 shares issued, 94,600 outstanding), January 1, 2018 1,700,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 700,000 Income tax payable 44,000 Interest receivable 1,200 Inventory (December 31, 2018), at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4,320,000 Paid-in capital from sale of treasury stock, January 1, 2018 0 Paid-in capital in excess of par--common stock, January 1, 2018 736.800 Pald-in capital in excess of par-preferred stock, January 1, 2018 70,000 Preferred 5% stock, 580 par (30.000 shares authorized 16.000 shares issued), January 1, 2018 1.280,000 Premium on bonds payable 19.000 Prepaid expenses 27,400 Retained earnings, January 1 2018 8.197,220 Store buildings and equipment 12.560,000 Treasury stock, January 1, 2018 0 a. Prepare a multiple-step income statement for the vear ended December 31, 2018 a. Prepare a multiple-step income statement for the year ended December 31, 2018. Equinox Products Inc. Income Statement For the Year Ended December 31, 2018 Sales 5,313,000 3,700,000 Cost of goods sold 1,613,000 Gross profit Operating expenses: Selling expenses: Sales salaries expense 385,000 Sales commissions 185,000 150,000 100,000 30,000 Advertising expense Depreciation expense-store buildings and equipment Delivery expense Store supplies expense Miscellaneous selling expense Administrative expenses: Office salaries expense 21,000 14,000 885,000 170,000 Office rent expense 50,000 30,000 10,000 7.500 267,500 Depreciation expense-office buildings and equipment Office supplies expense Miscellaneous administrative expense Total operating expenses Operating income har runs and annat 1.152.500 460,500 10,000 Office supplies expense 7.500 267,500 Miscellaneous administrative expense 1,152,500 Total operating expenses 460,500 Operating income Other revenue and expense: 30,000 Interest revenue -21,000 9,000 Interest expense 469,500 Income before income tax 140,500 Income tax 329,000 Net income b. Prepare a statement of stockholders' equity for the year ended December 31, 2018. Decreases in equity and purchase should be entered as Equinox Products Inc. Statement of Stockholders' Equity For the Year Ended December 31, 2018 Paid-In Capital in Excess of Par Preferred Stock Paid-In Capital in Excess of Par Paid-In Capital Common from Sale of Common Stock Stock Treasury Stock Preferred Stock Retained Earnings $ S Balances, January 1 Issued common stock Issued preferred stock Net income Cash dividends Sale of Stock - Prepare a statement of stockholders' equity for the year ended December 31, 2018. Decreases in equity and purchase should be entered as negative amounts by using a minus Equinox Products Inc. Statement of Stockholders' Equity For the Year Ended December 31, 2018 Paid-In Capital Paid-In Capital in Excess in Excess of Par of Par- Paid-In Capital Preferred Preferred Common from Sale of Retained Treasury Stock Stock Common Stock Stock Treasury Stock Earnings Stock Total Balances, January 1 Issued common stock Issued preferred stock Net Income Cash dividends Sale of treasury stock Purchase of treasury stock Balance, December 31 - Prepare a balance sheet in report forms of December 31, 2018, Equinox Products Inc. Balance Sheet December 31, 2018 Asts Current assets Prepare a balance sheet in report form as of December 31, 2018. Equinox Products Inc. Balance Sheet December 31, 2018 Assets Current assets: Cash 282,850 545,000 Accounts receivable Allowance for doubtful accounts -8,450 536,550 Inventory Inventory 778,000 Interest receivable 1,200 Prepaid expenses 27,400 Total current assets 1,626,000 Property, plant, and equipment: Store buildings and equipment Accumulated depreciation 12,560,000 -4,126,000 8,434,000 4,320,000 Office buildings and equipment Accumulated depreciation - 1,580,000 2,740,000 Total property, plant, and equipment 11,174,000 Intangible assets: Goodwill 700.000 c. Prepare a balance sheet in report form as of December 31, 2018. Equinox Products Inc. Balance Sheet December 31, 2018 Assets Current assets: Cash 282,850 Accounts receivable 545,000 Allowance for doubtful accounts -8,450 Inventory 536,550 Inventory 778,000 Interest receivable 1,200 Prepaid expenses 27,400 Total current assets 1,626,000 Property, plant, and equipment: Store buildings and equipment Accumulated depreciation 12,560,000 -4,126,000 8,434,000 4,320,000 Office buildings and equipment Accumulated depreciation -1,580,000 2.740,000 Total property, plant, and equipment Intangible assets: 11,174,000 Goodwill 700,000 Total assets 13,500,000 Liabilities Current liabilities: Accounts payable 194,300 Income tax payable 44,000 238,300 Total current liabilities Long-term liabilities: Bonds payable 500,000 Premium on bonds payable 19,000 757,300 Total liabilities Stockholders' Equity Paid-in capital: Preferred 5% stock 1,600,000 Excess of issue price over par 150,000 Paid-in capital, preferred stock 1,750,000 Common stock 2,000,000 Excess of issue price over par 886,800 2,886,800 13,000 Paid-in capital, common stock From sale of treasury stock Total paid-in capital Retained earnings Treasury stock 4.649,800 8,271.100 -178,200 All work sayed Liabilities Current liabilities: Accounts payable 194,300 Income tax payable 44,000 238,300 Total current liabilities Long-term liabilities: Bonds payable 500,000 Premium on bonds payable 19,000 757,300 Total liabilities Stockholders' Equity Paid-in capital: Preferred 5% stock 1,600,000 150,000 Excess of issue price over par Paid-in capital, preferred stock 1,750,000 Common stock 2,000,000 Excess of issue price over par 886,800 Paid-in capital, common stock 2,886,800 From sale of treasury stock 13,000 Total paid-in capital 4,649,800 Retained earnings 8,271,100 -178,200 Treasury stock Total stockholders' equity Total liabilities and Stockholders' Equity 12,742,700 13,500,000