Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comprehensive Problem 5 - 1 Anthony Stork ( birthdate August 2 , 1 9 7 8 ) is a single taxpayer. Anthony's earnings and withholdings

Comprehensive Problem

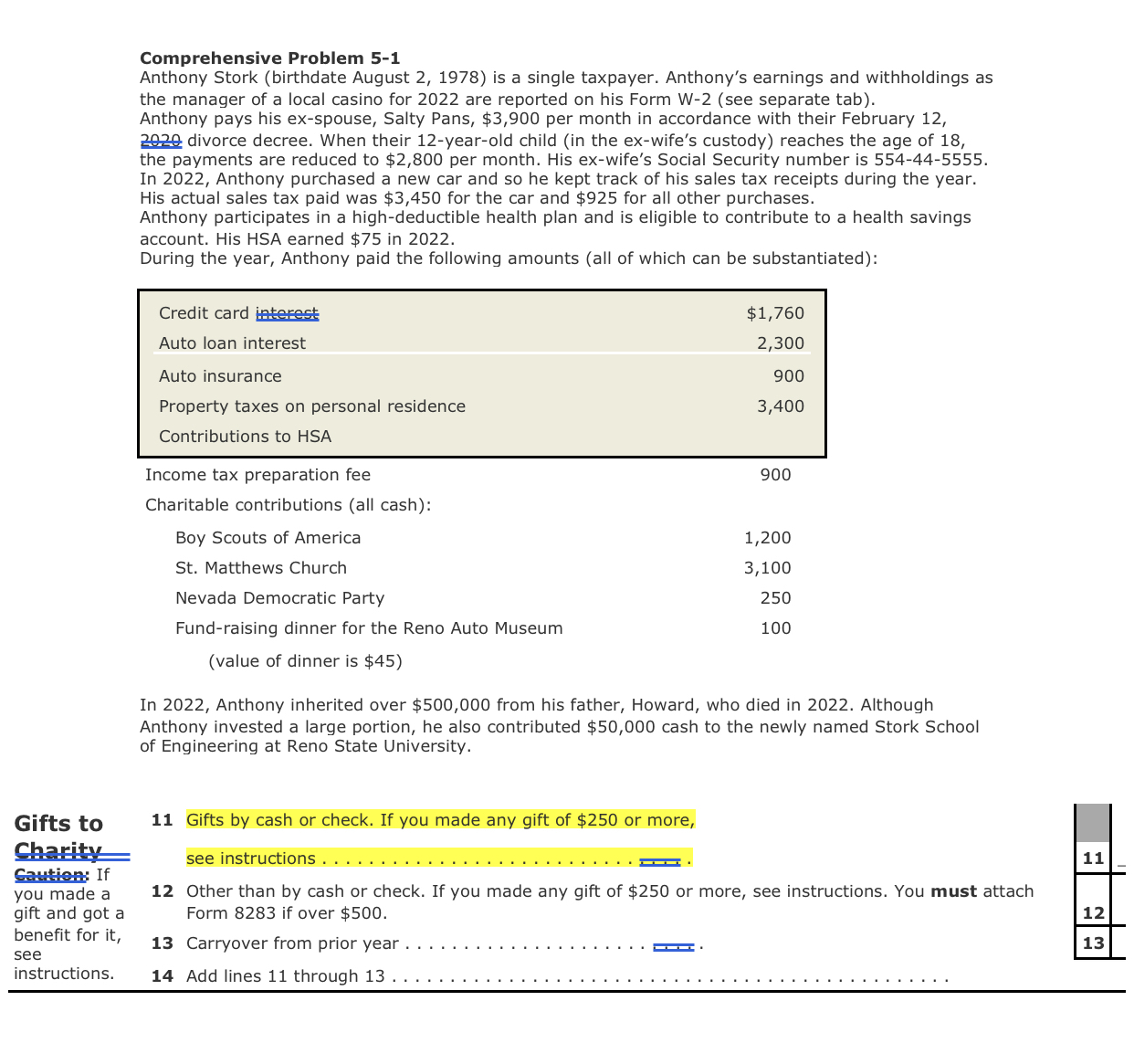

Anthony Stork birthdate August is a single taxpayer. Anthony's earnings and withholdings as the manager of a local casino for are reported on his Form Wsee separate tab

Anthony pays his exspouse, Salty Pans, $ per month in accordance with their February divorce decree. When their yearold child in the exwife's custody reaches the age of the payments are reduced to $ per month. His exwife's Social Security number is In Anthony purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid was $ for the car and $ for all other purchases.

Anthony participates in a highdeductible health plan and is eligible to contribute to a health savings account. His HSA earned $ in

During the year, Anthony paid the following amounts all of which can be substantiated:

tableCredit card interest,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started