Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comprehensive Problem: Accounting Cycle with Subsidiary Ledgers, Part 2 I need help with the answers to this problem. I know there are a lot of

Comprehensive Problem: Accounting Cycle with Subsidiary Ledgers, Part 2

I need help with the answers to this problem. I know there are a lot of parts, but I can't seem to figure out where I messed up.

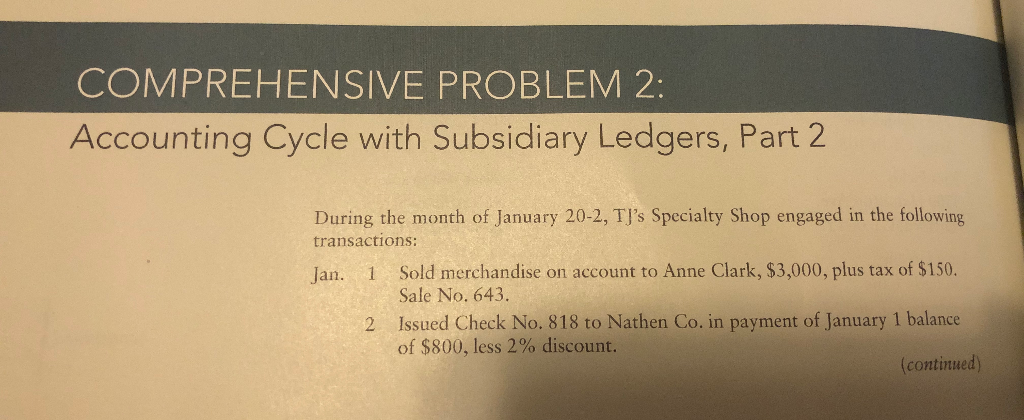

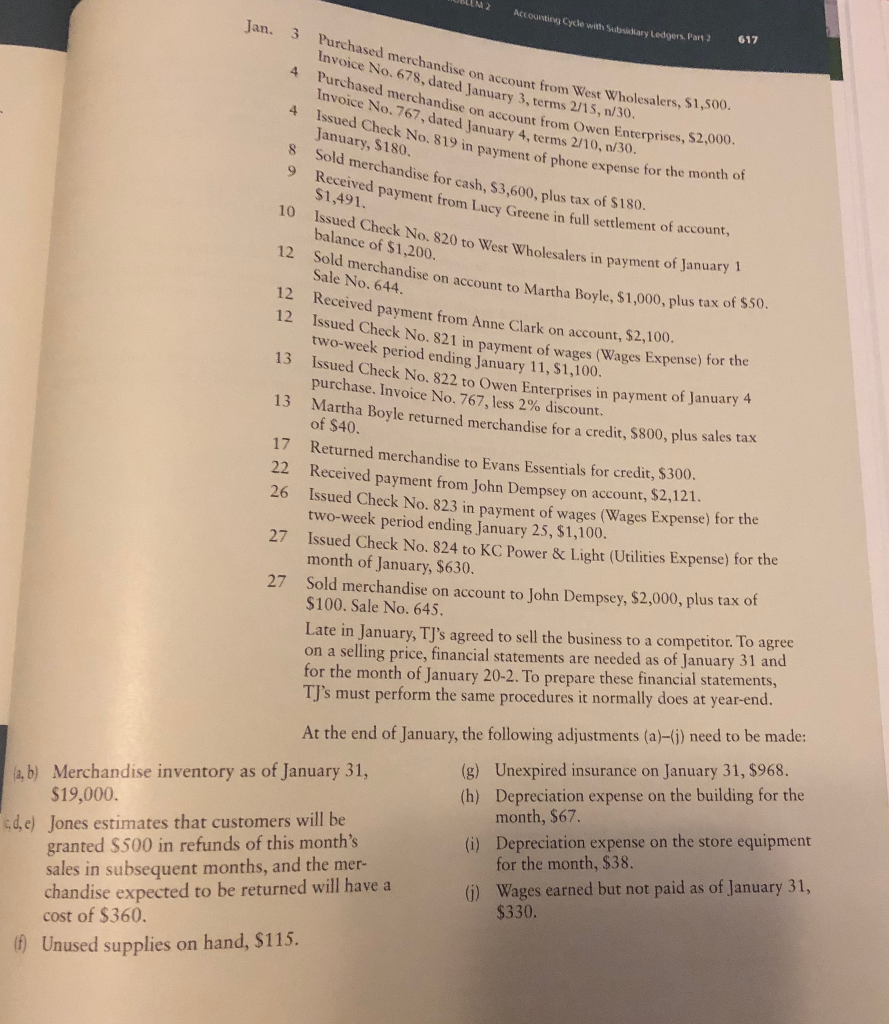

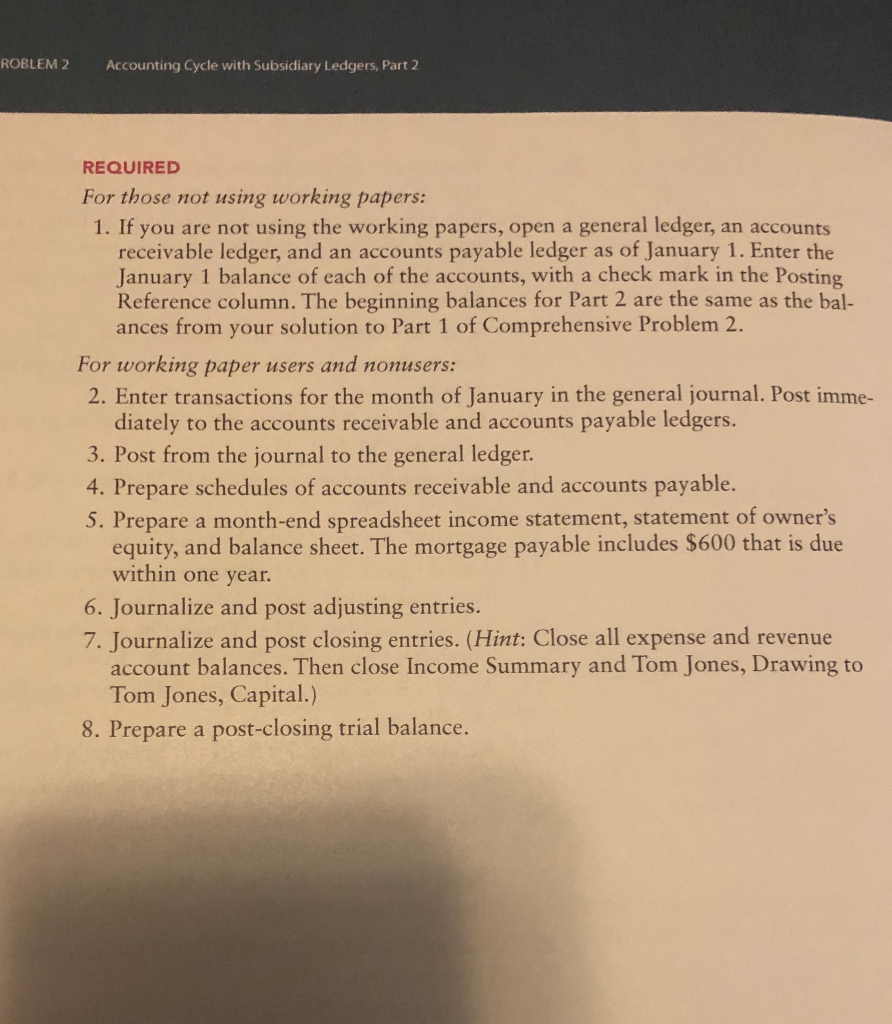

COMPREHENSIVE PROBLEM 2: Accounting Cycle with Subsidiary Ledgers, Part 2 During the month of January 20-2, TJ's Specialty Shop engaged in the following transactions: Jan. 1 Sold merchandise on account to Anne Clark, $3,000, plus tax of $150. Sale No. 643. 2 Issued Check No. 818 to Nathen Co. in payment of January 1 balance of $800, less 2% discount. (continued) LM2 Accounting Cycle with Subsidiary ledgers. Part Jan. 3 617 se on account from West Wholesalers, $1,500. Purchased merchandise on account from Invoice No. 678, dated January 3, terms 2/15, 1/30. Purchased merchandise on account from Merchandise on account from Owen Enterprises, S2,0 Invoice No.767, dated January 4, terms 2/10, 1/30. Issued Check No. 819 in payment of phone expense January, $180. Sold merchandise for cash, $3,600, plus tax of $180. 9 Received payment from Lucy Greene in full settlement $1,491. phone expense for the month of 10 Greene in full settlement of account, alers in payment of January 1 ssued Check No. 820 to West Wholesalers in payment of Janua balance of $1,200. 12 Sold merchandise on account to Martha Bo Sale No. 644. e on account to Martha Boyle, $1,000, plus tax of $50. 12 Received payment from Anne Clark on account, $2,100. Issued Check No. 821 in payment of wages (Wages Expense) to two-week period ending January 11, $1,100. Issued Check No. 822 to Owen Enterprises in payment of January purchase. Invoice No. 767, less 2% discount. 12 Issue 13 Issue of $40. rtha Boyle returned merchandise for a credit, $800, plus sales tax 17 Rer 26 27 Returned merchandise to Evans Essentials for credit, $300. Received payment from John Dempsey on account, $2,121. Issued Check No. 823 in payment of wages (Wages Expense) for the two-week period ending January 25, $1,100. Issued Check No. 824 to KC Power & Light (Utilities Expense) for the month of January, $630. Sold merchandise on account to John Dempsey, $2,000, plus tax of $100. Sale No. 645. Late in January, TJ's agreed to sell the business to a competitor. To agree on a selling price, financial statements are needed as of January 31 and for the month of January 20-2. To prepare these financial statements, TJ's must perform the same procedures it normally does at year-end. 27 At the end of January, the following adjustments (a)-(j) need to be made: (a,b) Merchandise inventory as of January 31, (g) Unexpired insurance on January 31, $968. $19,000. (h) Depreciation expense on the building for the c.de) Jones estimates that customers will be month, $67. granted $500 in refunds of this month's (i) Depreciation expense on the store equipment sales in subsequent months, and the mer- for the month, $38. chandise expected to be returned will have a 6) Wages earned but not paid as of January 31, cost of $360. $330. (1) Unused supplies on hand, $115. ROBLEM 2 Accounting Cycle with Subsidiary Ledgers, Part 2 REQUIRED For those not using working papers: 1. If you are not using the working papers, open a general ledger, an accounts receivable ledger, and an accounts payable ledger as of January 1. Enter the January 1 balance of each of the accounts, with a check mark in the Posting Reference column. The beginning balances for Part 2 are the same as the bal- ances from your solution to Part 1 of Comprehensive Problem 2. For working paper users and nonusers: 2. Enter transactions for the month of January in the general journal. Post imme- diately to the accounts receivable and accounts payable ledgers. 3. Post from the journal to the general ledger. 4. Prepare schedules of accounts receivable and accounts payable. 5. Prepare a month-end spreadsheet income statement, statement of owner's equity, and balance sheet. The mortgage payable includes $600 that is due within one year. 6. Journalize and post adjusting entries. 7. Journalize and post closing entries. (Hint: Close all expense and revenue account balances. Then close Income Summary and Tom Jones, Drawing to Tom Jones, Capital.) 8. Prepare a post-closing trial balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started