Answered step by step

Verified Expert Solution

Question

1 Approved Answer

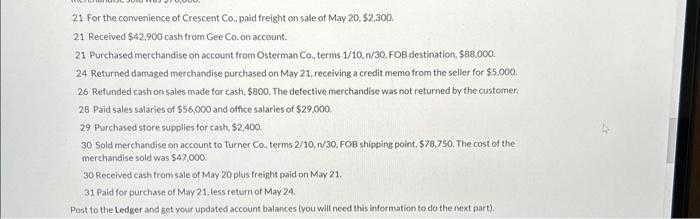

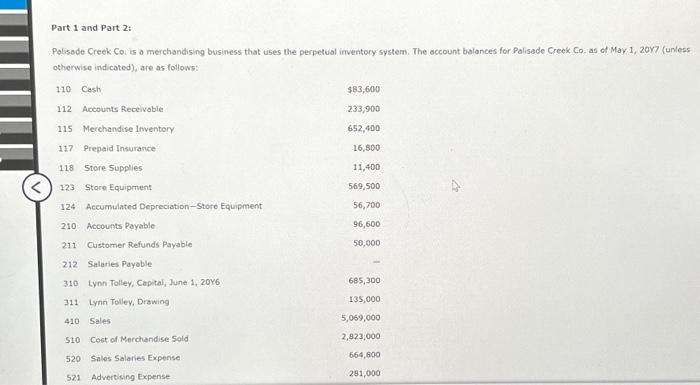

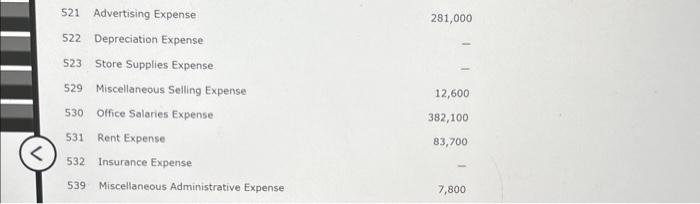

Comprehensive Problem. All instructions and ledgers included in images. Journalize please!! May 201 Paid Korman Co. a cash refund of $5,000 for damsped merchundise from

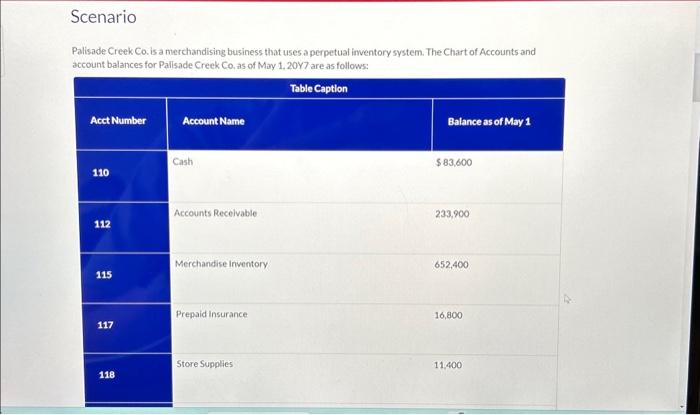

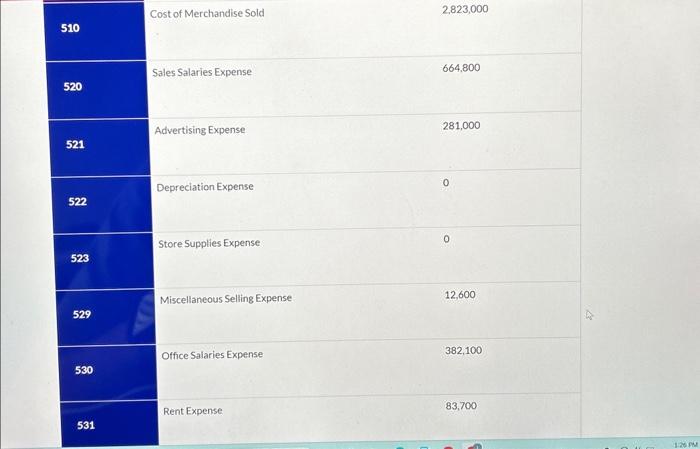

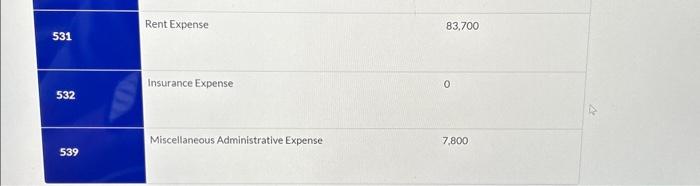

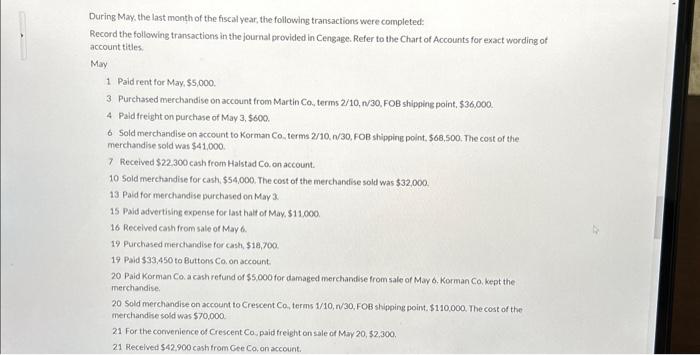

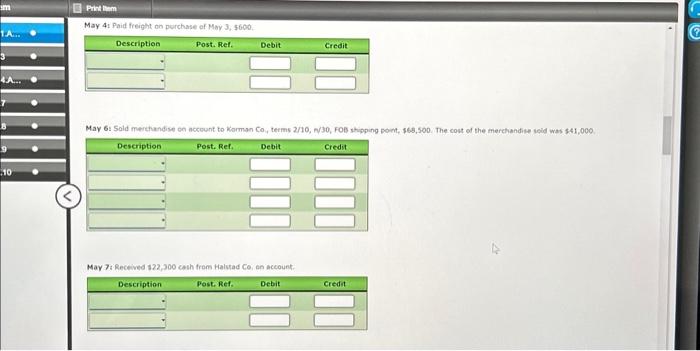

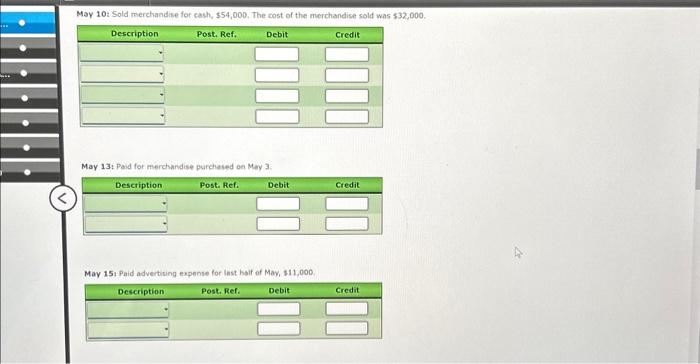

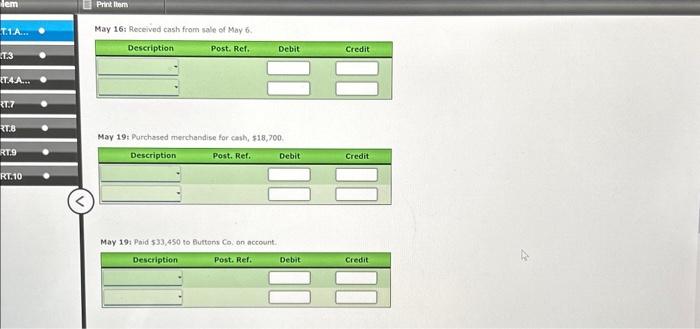

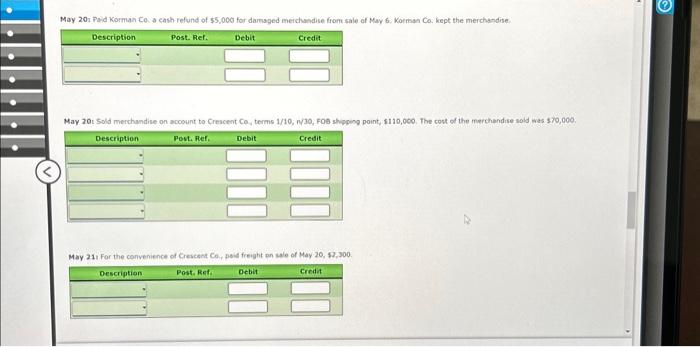

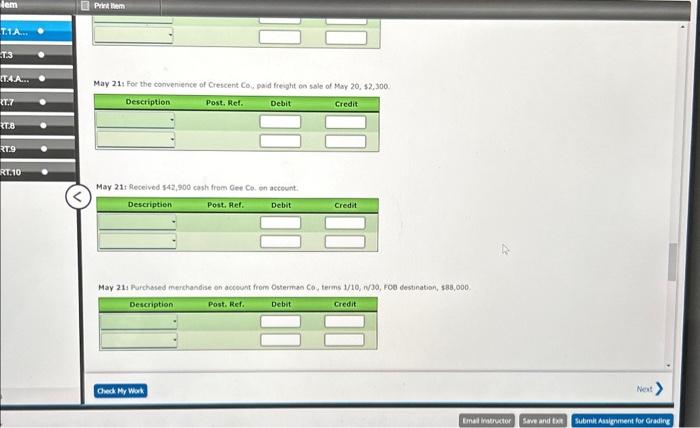

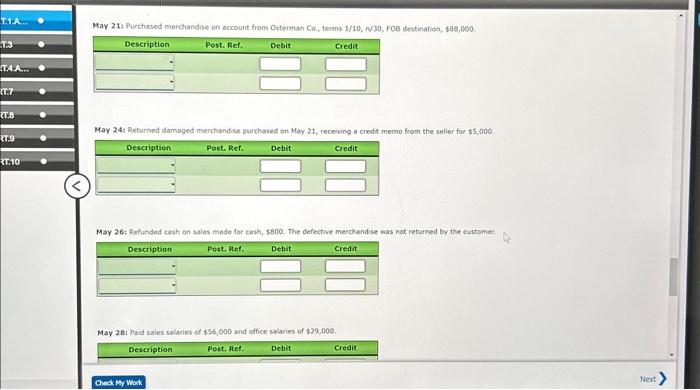

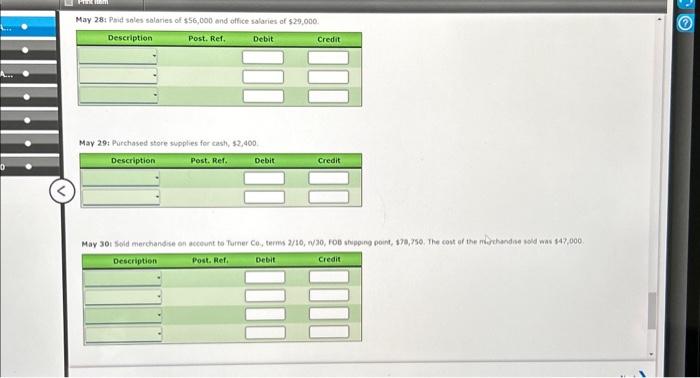

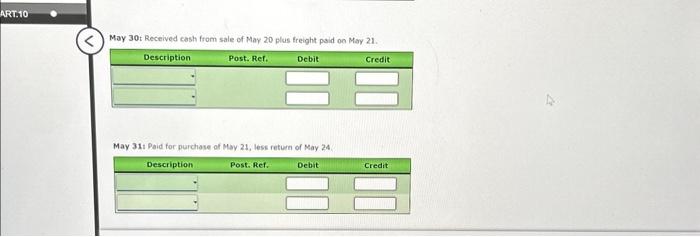

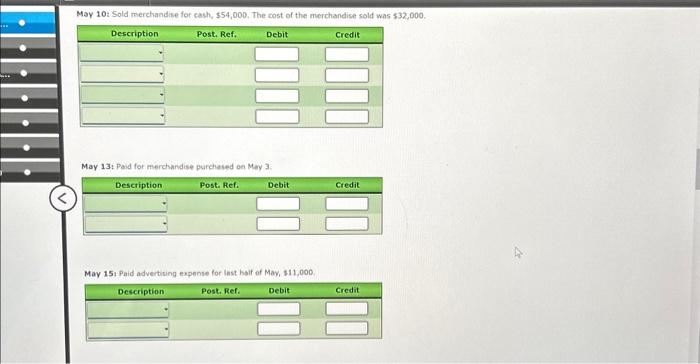

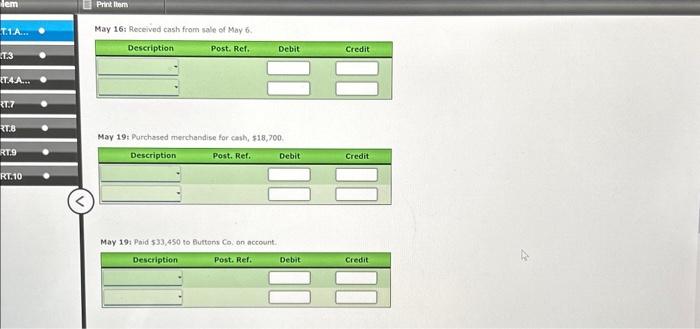

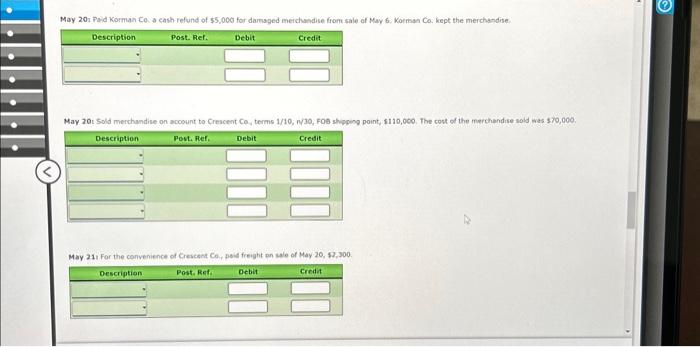

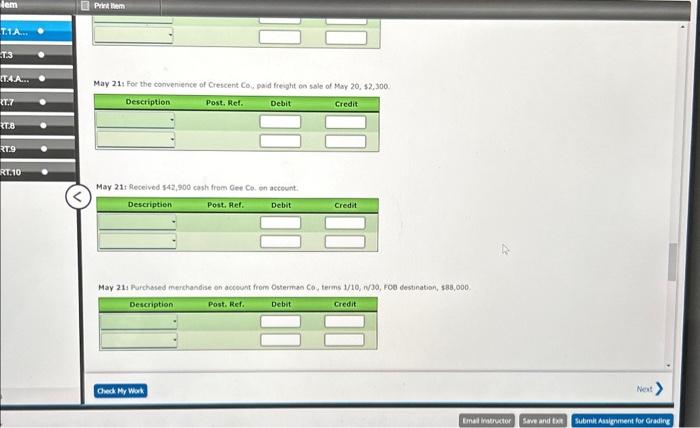

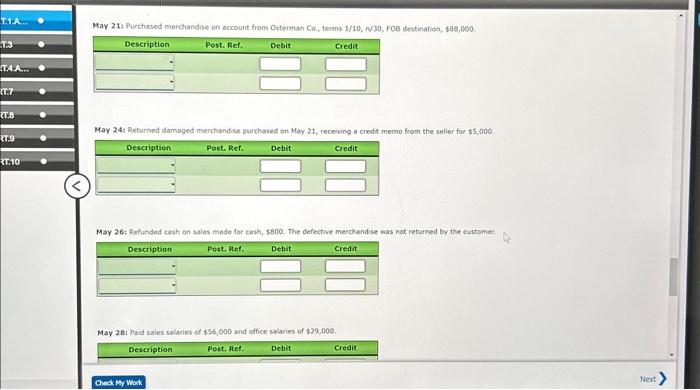

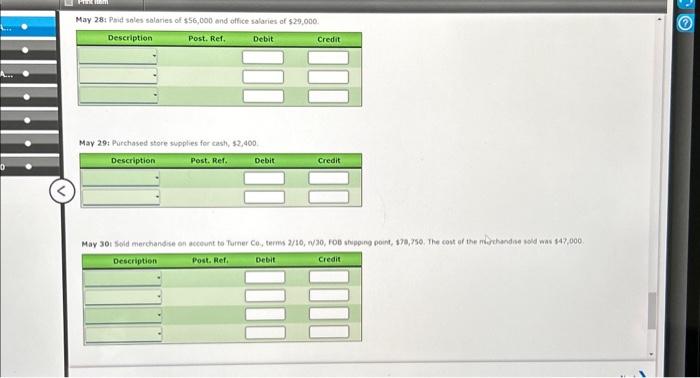

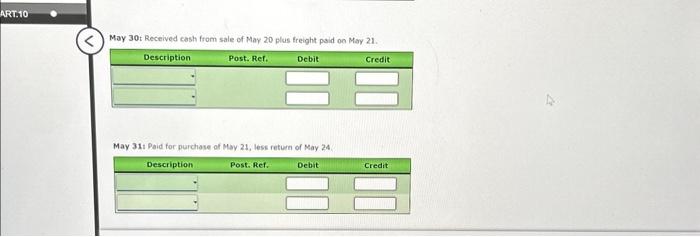

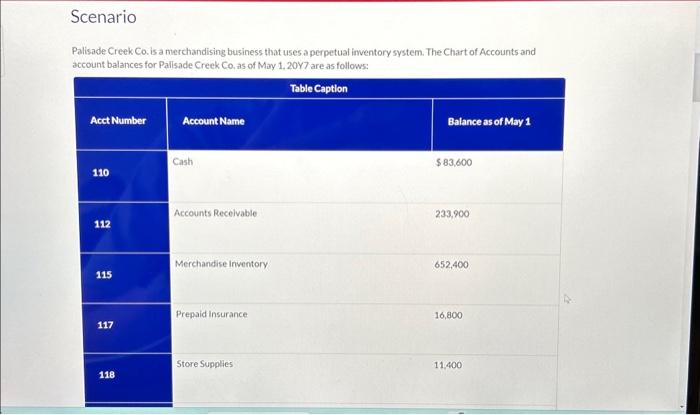

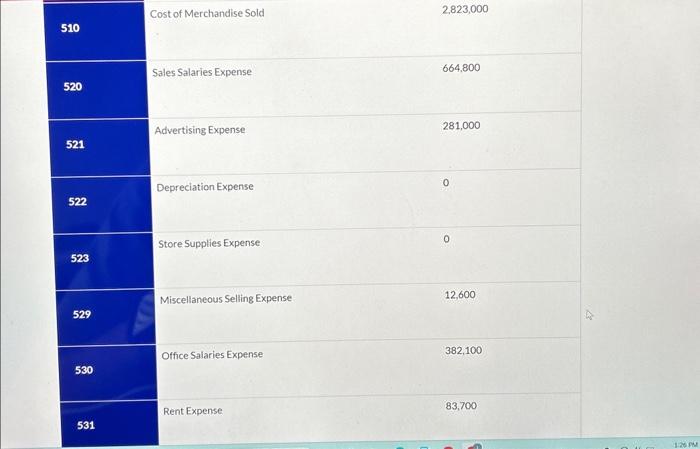

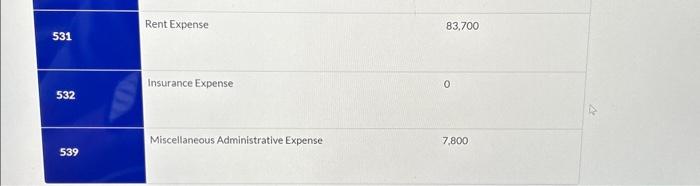

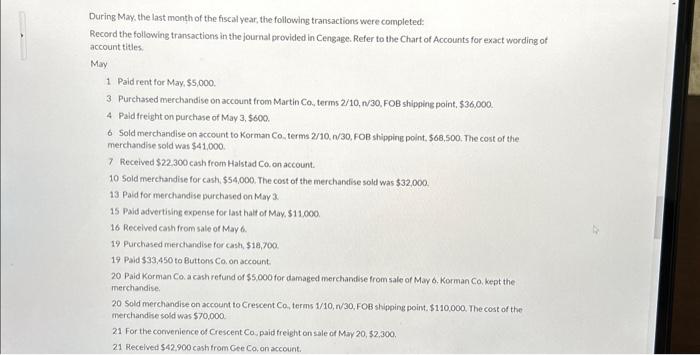

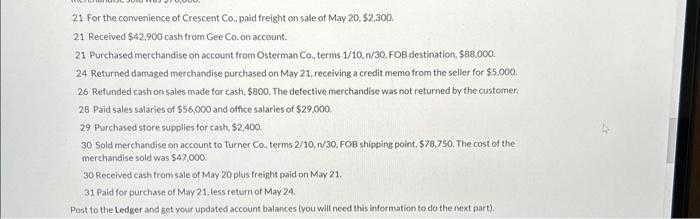

Comprehensive Problem.

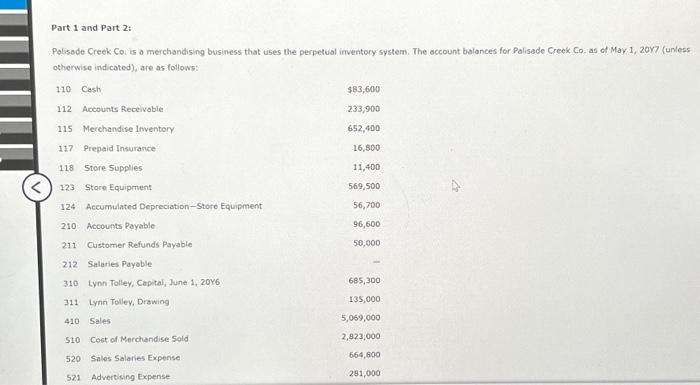

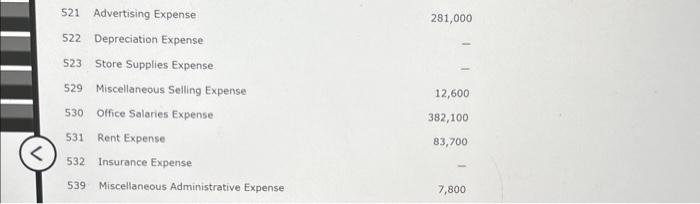

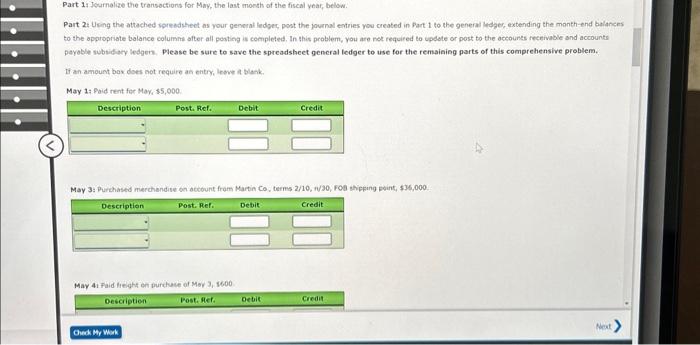

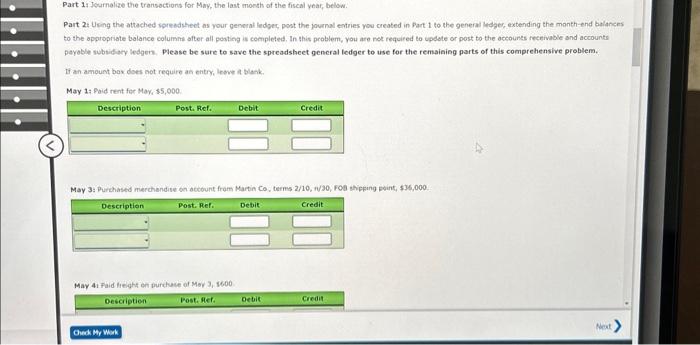

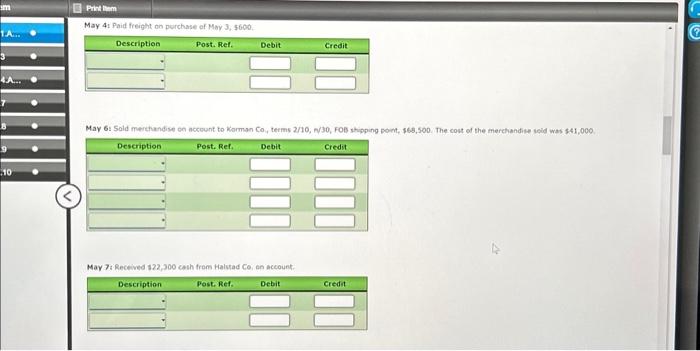

May 201 Paid Korman Co. a cash refund of $5,000 for damsped merchundise from sale of May 6 , Korman Co. kept the merchandise. May 21, For the convenience of Crescesnt Ce, poil freight an sale of May 20, $2,300 Store Equipment 569,500 123 Accumulated Depreciation-Store Equipment 56,700 124 Accounts Payable 96,600 210 Customers Refunds Payable 50,000 211 212 Salaries Payable 0 310 Lynn Tolley, Capital, June 1,2018 685,300 Lynn Tolley, Drawing 135,000 311 Sales 5,069,000 Part 1 and Part 2: Polisade Creek Co. is a merchandising business that uses the perpetual inventory system. The sccount balances for Palisade Creek Co. as of May 1,20Y7 (unless otherwise indicated), are as follows: Palisade Creek Co. is a merchandising business that uses a perpetual inventory system. The Chart of Accounts and account balances for Palisade Creek C. as of May1.20Y7 are as follows: Cost of Merchandise Sold 2,823,000 Sales Salaries Expense 664,800 520 Advertising Expense 281,000 521 Depreciation Expense 0 522 Store Supplies Expense 0 523 Miscellaneous Selling Expense 12,600 529 Office Salaries Expense 382,100 530 Rent Expense. 83,700 May 4t Paid freight an purchase of Moy 3, $600. May 6: Sald merchandise on acceunt to Karman Co, terms 2/30, N/30, FOB shipping point, $68,500. The cost of the merchandise icld was 541,000. May 7: Received 122,300 cath frem Halstad Co; an account. 521 Advertising Expense 281,000 522 Depreciation Expense 523 Store Supplies Expense. 529 Miscellaneous Selling Expense 12,600 530 Office Salaries Expense 382,100 531 Rent Expense 83,700 532 Insurance Expense 539 Miscellaneous Administrative Expense 7,800 May 16: Received cash from sale of May 6. May 19; Purchased merchandise for cash, $18,700. May 19: Paid 533,450 to Buttens Co, on accosint. 21 Received $42,900 cash from Gee Co. on account. 21 Purchased merchandise on account from Osterman Co0, terms 1/10,n/30,FOB destination, $88.000. 24 Returned damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000. 26 Refunded cash on sales made for cash, $800. The defective merchandise was not returned by the customer. 28 Paid sales salaries of $56,000 and office salaries of $29,000. 29 Purchased store supplies for cash, $2,400. 30 Sold merchandise on account to Turner Ca, terms 2/10,n/30,FOB shipping point, $78,750. The cost of the merchandise sold was $47,000. 30 Recelved cash from sale of May 20 plus freight paid on May 21. 31 Pald for purchase of May 21, less return of May 24. Post to the Ledger and get your updated account balances (you will need this information to do the next part). May 30t Received cash from sale of May 20 plus freight paid on May 21. May 311 Paid for purchose of May 21, less return of May 24 Part 1: Jesmalize the transocfions for Mary, the last month of the fiscal year, below. Part 2: Uning the attached spreadshect as vour general ledgec, post the journal evtries vou created in Part 1 to the general lebger, extending the manth-end balances to the oppropriate balance column after all posting is completed. In this problem, you are not required to updote or post to the accounts recenivale and accounts payoble subsidacy ledgen, please be sure to save the spreadsheet general ledger to use for the remaiaing parts of this comprehensive problem. If an amount box does not require an entry, leove a blank. May 1: Foid rent far May, $5,000 May 3: Purchased merchandise on actourt fram Martin Co, terms 2/10, rv/30, FOe shipping point, $36,000 Mar 41 Faid lieght en purcluace of Mor 3, 1600 May 13: Paid for merchandise purchased on May 3 May 15: Paid advertising expense for last haif of May, $11,000 Rent Expense 83,700 Insurance Expense 0 Miscellaneous Administrative Expense 7,800 During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions in the journal provided in Cengage. Refer to the Chart of Accounts for exact wording of account titles. Mary 1 Paid rent for May, \$5,000. 3 Purchased merchandise on account from Martin Co, terms 2/10,n/30,FOB shipping point, $36,000. 4 Paid freight on purchase of May 3,$600. 6 Sold merchandise on account to Korman Co, terms 2/10,n/30, FOB shippine point, 568,500 , The cost of the merchandise sold was $41,000. 7 Received $22,300 cash from Haistad Co, on account. 10 Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000. 13 Paid for merchandise purchased on May 3 15 Paid advertising expense for last half of May. $11.000. 16 Recelved cash from sale of May 6. 19 Purchased merchundise for cash, $18,700. 19 Paid $33,450 to Buttons Co. on account: 20 Paid Korman Co. a cash refund of $5,000 for damaged merchandise from sale of May 6. Korman Co, kept the merchandise. 20 Sold merchandise on account to Crescent Co, terms 1/10,n/30, FOB shipping point. $110,000. The cost of the merchandise sold was 570,000 21 For the corvenience of Crescent Co, paid freight on sale of May 20, $2,300. 21 Received $42,900 cash from Gee C a, on account. May 21: Purchased merchandse on account from Osterman Co, terms 1/10, nV30, FOe ifestination, $88,000. May 24: Returned damaged merchandise purchated an May. 21, receiving a credit memo from the seller for $5,000. May 26: Hefunded cash on sales made for cash, $800, The defective merchandise was not returned by the customer. May 28: Paid sales selaries of $56,000 and office salaries of $29,000. May 284 Pand soles solaries of $56,000 and affice solaries of $29,000. May 29: Purchased store supplies for cash, $2,400 May 21: For the cocrvenience of Crescent Co, paid freight on sale of Hay 20, $2,300. May 21t Received 542,900 cashifrem Gee Ce, en acceunt. May 214 Rurchased merchandise an account from Ostermen Co, terms 1/10, nJ30, Foe destination, 388,000 All instructions and ledgers included in images.

Journalize please!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started