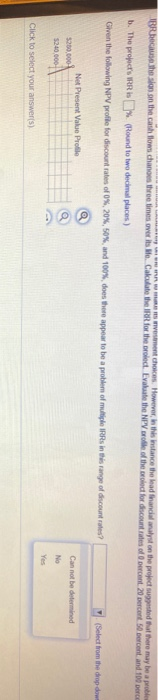

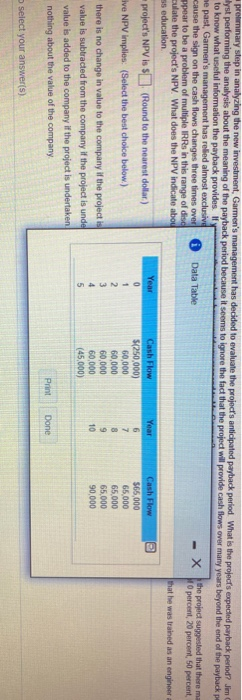

(Comprehensive problem) Carmen Technologies Inc. operates a small chain of specialty retail stores throughout the southwestern part of the US. The company markets technology based consumer products both in their stores and over the Internet, with sales split roughly equally between the two channels of dibution. The company's products range from radar detection devices and GPS mapping systems used in tomobiles to home based weather monitoring stations. The company recently began investigating the possibile acquisition of a regional warehousing facility that could be used both to stock is retail shops and to make direct shipments to the form's on the customers. The warehouse facility would require an expenditure of $250,000 for a rented space in Oklahoma Cly, Oklahoma, and would provide a source of cash fowparning the next 10 years. The estimated cash fows area The negative cash flow in year 5 reflects the cost of a planned renovation and expansion of the facility Finally, in year 10 Garmentimates some recovery of sent at the core of the lease and community higher than usual cash flow Garmentes a discount rate of 120 percent in evaluating its investments As a preliminary Mep in analyzing the new mement, Carmen's management has decided to evaluate the projects anticipated payback period. What is the project's expected payback period? Jim Garmen, CEO, goed the analyst performing the analysis about the meaning of the payback perlod because soms to ignore the fact that the project will provide cash flows over many years beyond the end of the payback period Specifically he wanted to know what Womation the payback provides you were the analyst, how would you respond to Mr Carmen b. In the past, Garmen's management has reled almost exclusively on the IRR to make its investment choices. However, in this instance the lead financial analyst on the project suppested that there may be a problem with the IRR because the son on the cash flow changes three times over Calculate the IRR for the rolect. Evaluate the NPV brofile of the role for discount rates of cercent. 20 percent. 50 cent and 100 cercnt Does a. Given the cash flow information in the table the payback period of the project is years (Round to two decimal places) The payback mothod tolls you: Select the best choice below) O A what the rate of return is for the investment OB. how much value you are adding or taking from the firm OC. how long it takes you to recover your outflows of cash OD. all of the above Remment choices. However, in this instance the lead financial analyst on the project suggested that there may be a problem IRR because the son on the cash flow changes three times over it. He Calculate the for the rolect. Evaluate the NPV role of the role for discount rates of ocent 20 percent. 50 sercent and 100 DC b. The projects IRR % (Round to two decimal places) Given the following NPV profile for discount rates of 0% 20%, 50%, and 100% does there appear to be a problem of multiple IRRs in the range of discount es? (Select from the drop dow Net Present Value Profile $200,000 5240.000 Can not be determined No Yes Click to select your answer(s) U. UULULILIULUI LUIELL CYdrudle the NPV prohle of the c. The project's NPV is $(Round to the nearest dollar.) A positive NPV implies: (Select the best choice below) O A. there is no change in value to the company if the project is undertaken. OB. value is subtracted from the company if the project is undertaken. OC. value is added to the company if the project is undertaken. OD. nothing about the value of the company. Click to select your answer(s). preminary step in analyzing the new investment, Garmen's management has decided to evaluate the project's anticipated payback period What is the project's expected payback period? Jim lyst performing the analysis about the meaning of the payback period because it seems to ignore the fact that the project will provide cash flows over many years beyond the end of the payback pe to know what useful information the payback provides. If ne past, Garmen's management has relied almost exclusive cause the sign on the cash flows changes three times over 0 Data Table - X the project suggested that there ma ppear to be a problem of multiple IRRs in this range of disc 10 percent, 20 percent, 50 percent culate the project's NPV. What does the NPV indicate aboy that he was trained as an engineer ss education Year Cash Fkw project's NPV is $ (Round to the nearest dollar) Year Cash Flow 0 $(250,000) 6 $65,000 ve NPV implies: (Select the best choice below.) 60,000 7 65,000 2 60,000 8 65.000 there is no change in value to the company if the project is 3 60 000 9 65,000 4 60,000 10 90.000 value is subtracted from the company if the project is unde 5 (45,000) value is added to the company if the project is undertaken nothing about the value of the company Print Done 1 select your answer(s)