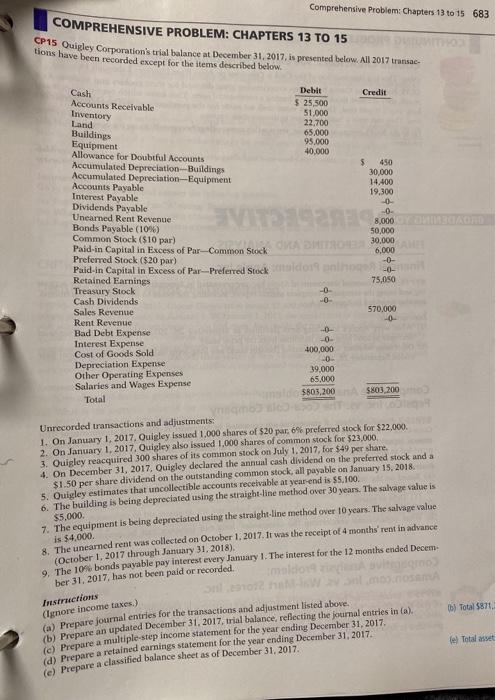

Comprehensive Problem: Chapters 13 to 15 683 COMPREHENSIVE PROBLEM: CHAPTERS 13 TO 15 CP15 Quigley Corporation's trial balance at December 31, 2017, is presented below. All 2017 transac- tions have been recorded except for the items described below. Cash Debit Credit Accounts Receivable $ 25,500 Inventory 51.000 Land 22.700 Buildings 65,000 95.000 Equipment Allowance for Doubtful Accounts 40.000 $ 450 Accumulated Depreciation-Buildings 30,000 Accumulated Depreciation-Equipment 14.400 Accounts Payable 19,300 Interest Payable -0 Dividends Payable Unearned Rent Revenue 8.000 Bonds Payable (10%) 50,000 Common Stock ($10 par) OMADURORE 30,000 Paid-in Capital in Excess of Par-Common Stock Preferred Stock ($20 par) Paid-in Capital in Excess of Par-Preferred Stock Retained Earnings 75,050 Treasury Stock 0 Cash Dividends -0 570,000 Sales Revenue Rent Revenue --0- Bad Debt Expense -0- Interest Expense 400,000 Cost of Goods Sold -0 Depreciation Expense 39.000 Other Operating Expenses Salaries and Wages Expense $803,200 $803,200 Total 6.000 65.000 Unrecorded transactions and adjustments: 1. On January 1, 2017. Ouigley issued 1.000 shares of $20 par 6% preferred stock for $22.000 2. On January 1, 2017. Quigley also issued 1,000 shares of common stock for $23.000 3. Quigley reacquired 300 shares of its common stock on July 1, 2017 for $49 per share. 4. On December 31, 2017, Quigley declared the annual cash dividend on the preferred stock and a $1.50 per share dividend on the outstanding common stock, all payable on January 15, 2018 5. Ouigley estimates that uncollectible accounts receivable at year end is 55.100 6. The building is being depreciated using the straight-line method over 30 years. The salvage value is $5,000. 7. The equipment is being depreciated using the straight-line method over 10 years. The salvage value is $4.000 8. The unearned rent was collected on October 1, 2017. It was the receipt of 4 months' rent in advance (October 1, 2017 through January 31, 2018). 9. The 10% bonds pavable pay interest every January 1. The interest for the 12 months ended Decem- ber 31, 2017, has not been paid or recorded Instructions (Ignore income taxes.) 6) Total $871 le) Total (a) Prepare journal entries for the transactions and adjustment listed above. b) Prepare an updated December 31, 2017, trial balance, reflecting the journal entries in (a), () Prepare a multiple step income statement for the year ending December 31, 2017 (a) Prepare a retained earnings statement for the year ending December 31, 2017 le) Prepare a classified balance sheet as of December 31, 2017 Comprehensive Problem: Chapters 13 to 15 683 COMPREHENSIVE PROBLEM: CHAPTERS 13 TO 15 CP15 Quigley Corporation's trial balance at December 31, 2017, is presented below. All 2017 transac- tions have been recorded except for the items described below. Cash Debit Credit Accounts Receivable $ 25,500 Inventory 51.000 Land 22.700 Buildings 65,000 95.000 Equipment Allowance for Doubtful Accounts 40.000 $ 450 Accumulated Depreciation-Buildings 30,000 Accumulated Depreciation-Equipment 14.400 Accounts Payable 19,300 Interest Payable -0 Dividends Payable Unearned Rent Revenue 8.000 Bonds Payable (10%) 50,000 Common Stock ($10 par) OMADURORE 30,000 Paid-in Capital in Excess of Par-Common Stock Preferred Stock ($20 par) Paid-in Capital in Excess of Par-Preferred Stock Retained Earnings 75,050 Treasury Stock 0 Cash Dividends -0 570,000 Sales Revenue Rent Revenue --0- Bad Debt Expense -0- Interest Expense 400,000 Cost of Goods Sold -0 Depreciation Expense 39.000 Other Operating Expenses Salaries and Wages Expense $803,200 $803,200 Total 6.000 65.000 Unrecorded transactions and adjustments: 1. On January 1, 2017. Ouigley issued 1.000 shares of $20 par 6% preferred stock for $22.000 2. On January 1, 2017. Quigley also issued 1,000 shares of common stock for $23.000 3. Quigley reacquired 300 shares of its common stock on July 1, 2017 for $49 per share. 4. On December 31, 2017, Quigley declared the annual cash dividend on the preferred stock and a $1.50 per share dividend on the outstanding common stock, all payable on January 15, 2018 5. Ouigley estimates that uncollectible accounts receivable at year end is 55.100 6. The building is being depreciated using the straight-line method over 30 years. The salvage value is $5,000. 7. The equipment is being depreciated using the straight-line method over 10 years. The salvage value is $4.000 8. The unearned rent was collected on October 1, 2017. It was the receipt of 4 months' rent in advance (October 1, 2017 through January 31, 2018). 9. The 10% bonds pavable pay interest every January 1. The interest for the 12 months ended Decem- ber 31, 2017, has not been paid or recorded Instructions (Ignore income taxes.) 6) Total $871 le) Total (a) Prepare journal entries for the transactions and adjustment listed above. b) Prepare an updated December 31, 2017, trial balance, reflecting the journal entries in (a), () Prepare a multiple step income statement for the year ending December 31, 2017 (a) Prepare a retained earnings statement for the year ending December 31, 2017 le) Prepare a classified balance sheet as of December 31, 2017